-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Much Of Post-NFP Gains

- Biden Economic Advisor BRAINARD: ECONOMY IS COMING TO POINT OF SUSTAINABLE GROWTH .. MOST FORECASTERS TAKING RECESSION CALLS OFF THE TABLE, Bbg

- BOE'S HUW PILL: `QUITE A SHARP FURTHER FALL' IN OCT. INFLATION .. RATES POLICY REMAINS `RESTRICTIVE' FOR UK, Bbg

- Finland says Russian Baltic Sea telecoms cable also damaged, Reuters

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Unwinding Post-NFP Rally, SLOOS Credit Less Tight Than Estimated

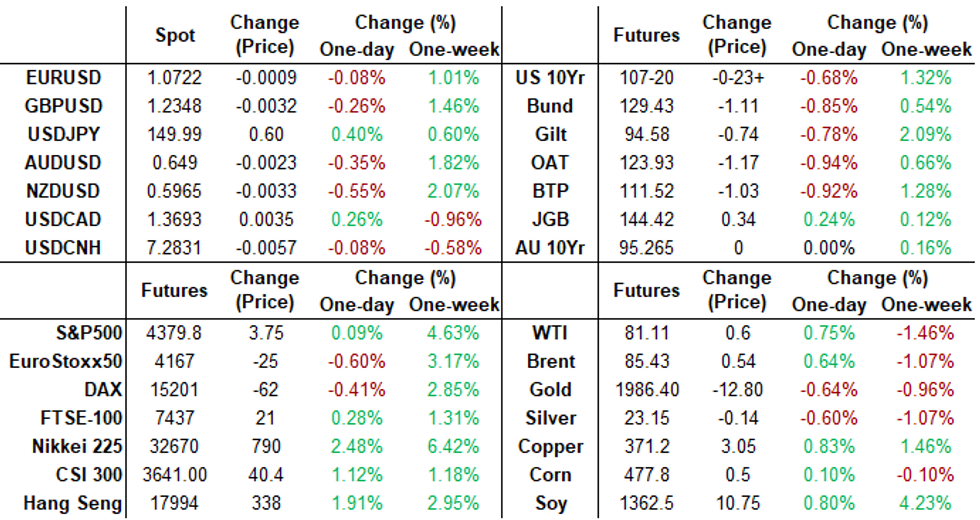

- Treasury futures are holding just above late session lows after both Tsy and SOFR futures nearly unwound all of Friday's post-NFP rally.

- A confluence of less tighter credit conditions reported by the Fed's latest Sr Loan Advisor Survey (SLOOS) for Q3, and heavy corporate supply at nearly $27B weighed on rates due to rate lock hedges after $6B RTX Corp 5-tranche and $5.5 Roche 5-tranche issuance surprised to the upside.

- The SLOOS report has had little impact on pricing for near-term FOMC meetings (which are still seen with essentially an end to the hiking cycle) but has trimmed cuts later into 2024.

- Fed Funds futures still show the first cut in June but with a cumulative 33bp of cuts vs 36bp pre SLOOS (and 27bps before payrolls), building to a cumulative 91bp of cuts by end-2024 vs 94bp pre SLOOS (and 84bp before payrolls).

- Cross asset: Stocks are having a mildly rocky morning, S&P Eminis bounced off marginal lows at the same time as Tsys, have since scaled back support to near steady at 4376.00.

- Tuesday Data Calendar: Multiple Fed Speakers and 3Y Note Sale

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00168 to 5.32344 (-0.00236 total last wk)

- 3M -0.01211 to 5.36806 (-0.00304 total last wk)

- 6M -0.02770 to 5.39819 (-0.01744 total last wk)

- 12M -0.06312 to 5.26278 (-0.04705 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $246B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.579T

- Broad General Collateral Rate (BGCR): 5.30%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $575B

- (rate, volume levels reflect prior session)

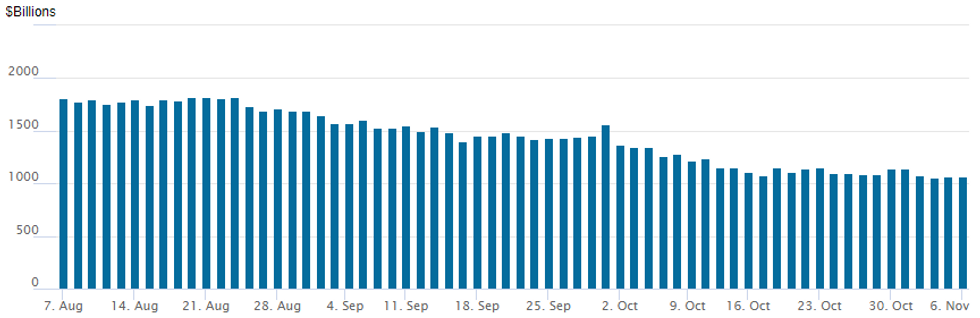

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage inches up to $1,062.878B w/101 counterparties vs. $1,071.139B in the prior session, compares to $1,054,986B on November 2 -- lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Better SOFR put option volume carried over from overnight, underlying futures unwinding a large portion of last Friday's post-jobs miss rally. Projected rate cut chance into early 2024 have moderated: December holds at 2.4bp at 5.347%, January 2024 cumulative 4.4bp at 5.368%, while March 2024 pricing in -27.1% chance of a rate cut (-30.9% this morning) with cumulative at -2.4bp at 5.300%, May 2024 cumulative -14.0bp vs. -16.5bp earlier at 5.184%. Fed terminal at 5.365% in Feb'24.- SOFR Options:

- Block, 15,000 0QZ3 95.37/95.50 put spds 6.0 ref 95.59

- Block, 10,000 SFRH4 94.25/94.34/94.81/95.56 broken call condors ref 94.75

- Block, +35,000 SFRM4 93.62/94.12 put spds, 2.5 ref 95.01

- Block, 15,000 SFRF4 93.87/94.37 put spds, 1.5 ref 94.755

- +7,500 SFRH4 94.25/94.37/94.50 put trees, 0.5 net 1-leg over

- +4,000 SFRH4 95.00/95.25 call spds 0.5 over 94.12/94.37 put spds

- 18,000 SFRG4 94.25/94.37 put spds ref 94.755

- 1,000 SFRF4 94.62/94.81/95.00 1x3x2 call flys ref 94.76

- over 10,200 SFRF4 94.25 puts, cab ref 94.76

- Block, 10,000 SFRF4 94.12/94.25 put spds, cab ref 94.76

- 5,000 SFRF4 94.00/94.25/94.37 broken put flys

- Block, 3,750 SFRH4 93.62/94.00 put spds, 0.75 ref 94.765

- 6,000 0QZ3 95.00/95.31/95.56 broken put flys ref 95.62

- 4,000 0QZ3 95.31 puts, ref 95.62

- 6,500 0QF4 95.12/95.43/95.75 put flys ref 95.865

- 3,000 SFRF4 94.43/94.56/94.68 put flys ref 94.75

- 2,000 0QZ3 95.06/95.43/95.75 2x3x1 broken put flys ref 95.605

- Treasury Options:

- +9,000 TYF4 111/112.5 call spds 4 over TYZ3 111 calls

- 2,000 TYF4 110/111.5 1x2 call spds ref 108-16.5

- 1,000 TYZ3 109.5/110/110.5 call flys, 5 ref 108-04

- 2,000 TYZ3 105.5 puts, 5 ref 108-03

EGBs-GILTS CASH CLOSE: Yields Close Near The Highs

Core European FI retreated sharply Monday following last week's rally, with both the UK and German curves bear steepening.

- In a session light on data flow, fixed income markets appeared to reassess Friday's post-US employment gains, with steady losses throughout most of the day for both Bunds and Gilts.

- Yields closed on the highs as the US dollar regained ground and equities pulled back in the European afternoon, with 10Y Bund breaching Friday's pre-payrolls levels, with Gilt finishing just below.

- Periphery spreads widened, with BTPs underperforming - 10Y/Bund spreads erased the post-payrolls tightening and then some but closed about 0.5bp narrower vs last Friday's open.

- BoE's Pill said after the cash close that inflation may have fallen sharply below 5% in October (data's out next week).

- On the data front, Services PMIs were mixed (mostly Finals, little market reaction), while September German factory orders surprised to the upside, but the details and downward revisions made for a weak report ahead of Tuesday's industrial production data.

- Among other releases Tuesday we get Spanish industrial production data, along with an appearance by ECB's Nagel (who is also due to speak after hours Monday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 3.023%, 5-Yr is up 8.5bps at 2.627%, 10-Yr is up 9.4bps at 2.739%, and 30-Yr is up 8.7bps at 3.006%.

- UK: The 2-Yr yield is up 4.4bps at 4.721%, 5-Yr is up 6.5bps at 4.329%, 10-Yr is up 8.9bps at 4.377%, and 30-Yr is up 8bps at 4.852%.

- Italian BTP spread up 3.7bps at 190.5bps / Spanish up 1.9bps at 105.8bps

EGB Options: Mixed Trade To Open The Week

Monday's Europe rates / bond options flow included:

- ERH4 96.00/96.12/96.37 broken call fly paper paid 2.5 on 5.25K

- ERM4 96.25/96.12ps sold at 5 in 19k

- 0RM4 97.12/96.75/96.25p fly, bought for 5 and 5.25 in 8.5k

- RXZ3 132.00/133.50cs 1x1.5, bought for 13 in 2k

- RXF4 125p, bought for 22 in 3.9k

FOREX Greenback On Slightly Firmer Footing As Treasury Yields Reverse Higher

- Ongoing pressure on treasuries throughout Monday’s session has provided a late relief bid for the USD on Monday. While US yields have reversed almost the entirety of the post-NFP move, the greenback has only moderately recovered, with the USD index still way off the pre-data levels from Friday.

- Marginal downward pressure for equities leaves AUD and NZD as two of the worst performers, pulling back just under half a percent on the session. Additionally, the Japanese Yen has struggled, prompting USDJPY to pull higher towards 150.00 once more.

- To emphasise the narrow ranges for G10 FX on Monday, EURUSD has traded within a thirty-pip range and although a touch lower to start the week, the pair is broadly consolidating last week’s impressive move higher, back above the 1.07 handle.

- Key short-term resistance at 1.0694, the Oct 24 high has been cleared. The break of this hurdle strengthens a bullish case and signals scope for a stronger short-term correction. Attention is on 1.0764, a Fibonacci retracement. Initial support is at 1.0652, the 50-day EMA.

- As noted earlier, an overnight AUD/USD straddle breaks even on a 45pip (vs. 3m average ~20-25pips) swing in the pair ahead of the RBA rate decision in APAC on Tuesday. This is the widest break-even pricing for the pair since Sep13 as markets awaited the August Australian jobs report. Such a move in the pair might bring expiries layered between 0.6460-80 into play, across which A$584mln is set to roll off.

- Additionally on Tuesday, markets will receive the latest trade data from China. Over the weekend, China Premier Li Qiang stated that the authorities will expand market access and boost imports, which have fallen this year.

Expiries for Nov07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0490-00(E2.1bln), $1.0575(E510mln), $1.0650(E1.8bln), $1.0695-00(E556mln)

- USD/JPY: Y149.00($765mln), Y149.50($583mln), Y150.00($882mln), Y150.50($570mln)

- GBP/USD: $1.2168-85(Gbp530mln)

EQUITIES

E-MINI S&P TECHS: (Z3) Trades Through The 50-Day EMA

- RES 4: 4508.00 High Sep 20

- RES 3: 4445.62 Trendline resistance drawn from the Jul 27 high

- RES 2: 4430.50 High Oct 12

- RES 1: 4391.75 Intraday high

- PRICE: 4383.00 @ 14:28 GMT Nov 6

- SUP 1: 4157.75/4122.25 Low Nov 3 / Low Oct 27 and the bear trigger

- SUP 2: 4100.00 Round number support 4124.19

- SUP 3: 4090.35 1.764 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4049.00 Low Mar 28

S&P e-minis traded higher last week and the contract remains firm. The latest recovery still appears to be a correction, however, price has cleared the 20- and 50-day EMAs. The break of the 50-day average - a key short-term pivot level - has strengthened bullish conditions. Sights are on 4430.50, the Oct 12 high. Key support and the bear trigger has been defined at 4122.25, the Oct 27 low.

COMMODITIES Modest Crude Gains With Saudi/Russia Voluntary Output Cuts

- Crude oil prices are trading higher on the day, driven by a continuation of Saudi Arabia and Russia’s voluntary output cuts. They have however relinquished most of their intraday gains following a late pullback in prices during US hours, seemingly helped by headlines that President Biden has discussed potential for tactical pauses with Israel’s Netanyahu.

- The decline came before a jump higher in Treasury yields on the Fed’s Senior Loan Officer survey, but has continued since then.

- Saudi Arabia and Russia have reaffirmed intention to keep output cuts in place until the end of the year. Saudi will review the output next month and consider “extending the cut, deepening the cut, or increasing production,” according to the Saudi Press Agency.

- Saudi Aramco maintained its OSP to Asia for Arab Light and Super light in December but adjusted other grades to Asia as prices to Europe where cut and to North America were left unchanged.

- Despite eased US sanctions last month, TankerTrackers still identifies 41 dark fleet tankers waiting off Venezuela with hidden AIS outside the San Jose terminal – drawing questions about the possibility of the latest deal reversing.

- WTI is +0.7% at $81.05 having pulled back from a high of $82.24, nudging closer but clearly not testing resistance at $85.90 (Oct 27 high). Key support at $80.10 (Nov 3 low) remains intact for now.

- Brent is +0.65% at $85.43 off a high of $86.46 for a step closer to resistance at $89.49 (Oct 24 high). It lifts off support at $84.09 (Oct 11 low).

- Gold is -0.6% at $1980.02 having declined through the session. The trend outlook appears bullish and it’s not close to testing support at $1957.5 (20-day EMA).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/11/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 07/11/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/11/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2023 | 0835/0935 |  | EU | ECB's de Guindos fireside organised by Deloitte | |

| 07/11/2023 | 1000/1100 | ** |  | EU | PPI |

| 07/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/11/2023 | - | *** |  | CN | Trade |

| 07/11/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/11/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/11/2023 | 1345/0845 |  | CA | BOC Governor Macklem conference opening remarks | |

| 07/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/11/2023 | 1415/0915 |  | US | Fed Vice Chair Michael Barr | |

| 07/11/2023 | 1450/0950 |  | US | Kansas City Fed's Jeff Schmid | |

| 07/11/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/11/2023 | 1500/1000 |  | US | Fed Governor Christopher Waller | |

| 07/11/2023 | 1600/1100 |  | CA | BOC Deputy Kozicki opening remarks for lecture by IMF's Pierre-Olivier Gourinchas | |

| 07/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/11/2023 | 1700/1200 |  | US | New York Fed's John Williams | |

| 07/11/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/11/2023 | 1825/1325 |  | US | Dallas Fed's Lorie Logan | |

| 07/11/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.