-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Upside Inflation Risk Fed Minutes

- MNI: MOST OF FOMC SEES UPSIDE RISK TO INFLATION

- MNI: UPSIDE INFLATION RISK COULD NEED MORE TIGHTENING

- SWISS CHANCELLOR WALTER THURNHERR TO RESIGN: TAGESANZEIGER, Bbg

- CHINA VOWS TO MEET ANNUAL ECONOMIC TARGETS .. VOWS TO BOOST INVESTMENT, CONSUMPTION: RADIO

Key Links: MNI: Upside Inflation Risk Could Require More Tightening -Fed

July Minutes More Hawkish Than Anticipated

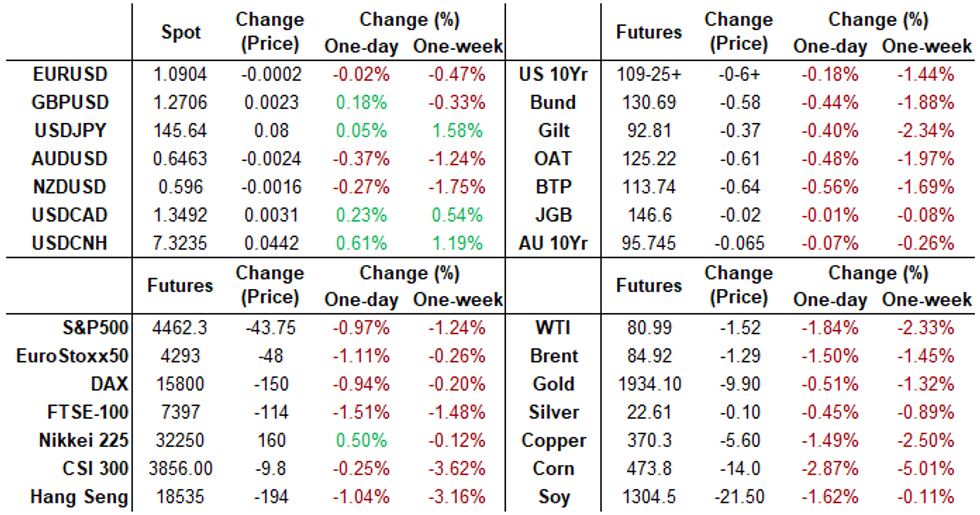

- US rates markets finishing broadly lower/near lows as participants continued to digest the more hawkish than anticipated FOMC minutes as most policymakers see upside risk to inflation.

- “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy” However, two officials favored holding rates steady (or could have supported such a proposal) and “several” saw a need to consider the risk of overtightening financial conditions.

- Sporadic buying reported, however, while WSJ economist Timiraos writes "Some Fed Officials Are Turning Cautious about Raising Rates Too High".

- Treasury futures started the day on the back foot: see-sawing around pre-data lows, weaker Building Permits (1.442M vs. 1.468M est; MoM (0.1% vs. 1.5% est), stronger Housing Starts (1.452M vs 1.450M est; MoM (3.9% vs. 1.1% est). Treasury futures extend lows after strong IP driven by autos and utilities.

- Front month Sep'23 10Y futures mark 109-13.5 low (-11), near initial technical support at 109-11.5 (Low Aug 15), followed by 109-10.5 (Low Nov 4 2022, cont). Below that, major technical support at 108-26. (Low Oct 21 2022, cont).

- Curves maintain steeper profiles with short end rates outperforming, 3M10Y curve +6.382 at -118.489, 2Y10Y +3.566 at -71.193.

- Rate hike projections through year end are steady to mildly higher, Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.6bp at 5.435, December cumulative of 9.1bp at 5.420%. Fed terminal holds at 5.43% in Nov'23.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00181 to 5.31195 (+.00147/k)

- 3M +0.00275 to 5.37923 (+0.01466/wk)

- 6M -0.00286 to 5.44186 (+0.02678/wk)

- 12M +0.00358 to 5.38554 (+0.07972/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $268B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.413T

- Broad General Collateral Rate (BGCR): 5.29%, $558B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $541B

- (rate, volume levels reflect prior session)

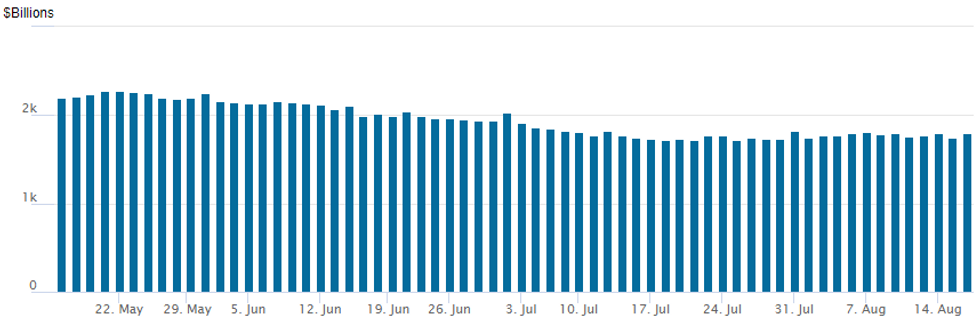

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operations continue to see-saw around 1.75-1.80T: the latest bounces to to $1,796.725B, w/105 counterparties, compared to $1,743.784B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

FI option trade segued from mixed to better downside puts Wednesday as underlying futures traded weaker after July FOMC minutes deemed more hawkish than anticipated. Rate hike projections through year end are steady to mildly higher, Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.6bp at 5.435, December cumulative of 9.1bp at 5.420%. Fed terminal holds at 5.43% in Nov'23.

- Treasury Options:

- 3,900 USV3 112/114/116/118 put condors, 28 net ref 119-23

- Update, over 18,800 TYU3 108.5 puts, 9-10 last ref 109-19

- over 13,600 wk3 TY 109 puts, 4 ref 109-21.5

- 4,000 USV3 112/116 put spds ref 119-31

- 5,000 USV3 114 puts, 24 ref 120-05

- over 11,200 FVU3 107 calls, 5 last ref 106-00.75

- 15,000 FVV3 106.5/107.25/107.75 broken call trees ref 106-21.25

- over 6,800 FVV3 107.5 calls, 26

- over 5,300 FVV3 106.5 calls, 48 last

- over 5,900 TYU3 109.5 puts, 17 last

- 2,600 TYU3 112 calls, 4 ref 110-02.5

- 4,000 TYX3 113 calls, 35

- SOFR Options:

- 19,664 0QZ3 97.06/97.31 call spds ref 95.72

- Block, 20,000 SFRV3 94.31/94.43 put spds, 2.25-2.50 ref 94.585

- over 8,500 SFRZ3 98.25 calls, .75 ref 94.605

- over 6,100 TYV3 110 puts, 54 last ref 110-08 to -08.5

- +4,000 SFRH4 97.00 calls, 5.0 vs. 94.78/0.06%

- 22,000 SFRZ3 94.31/94.37/94.38/94.43 put condors ref 94.615

- 4,000 SFRV3 95.25 calls, ref 94.625

- 2,900 SFRZ4 94.25 puts ref 95.82 to -.825

EGBs-GILTS CASH CLOSE: More Hawkish UK Data Sees Gilts Underperform

Gilts weakened and underperformed global peers Wednesday - including Bunds, which strengthened. This followed another hawkish UK data release in the form of July inflation, as core CPI surprised to the upside driven by services prices.

- The immediate reaction wasn't as big as Tuesday's following strong wage data, but UK yields continued to drift higher for most of the session and closed on the highs (yesterday they lost momentum and closed near their open levels).

- In contrast to Gilts, Bund yields drifted lower all day, benefiting from a solid long-end auction, and taking a risk-off cue from Chinese economic concerns.

- The UK curve bear flattened overall, with slight bull steepening in Germany.

- Periphery spreads closed mostly wider, with BTPs again underperforming.

- A relatively quiet data schedule awaits Thursday with Dutch unemployment before the open and Eurozone trade. The Norges Bank decision will garner most attention in the morning, with French and Finnish bond supply later on.

- Germany: The 2-Yr yield is down 2.5bps at 3.085%, 5-Yr is down 2.4bps at 2.663%, 10-Yr is down 2.2bps at 2.65%, and 30-Yr is down 1.8bps at 2.729%.

- UK: The 2-Yr yield is up 6.6bps at 5.203%, 5-Yr is up 6.9bps at 4.664%, 10-Yr is up 5.7bps at 4.646%, and 30-Yr is up 5.6bps at 4.834%.

- Italian BTP spread up 1.8bps at 170.2bps / Spanish up 1.4bps at 105bps

EGB Options: Mainly Sonia Structures Midweek

Wednesday's Europe rates / bond options flow included:

- ERM4 98.00/99.00/100.00 call fly paper paid 2 on 4K

- SFIZ3 94.25/94.00/93.75 put ladder paper paid 2.25 & 2.50 on 7.5K all day

- SFIZ3 94.15/94.30/94.40/94.55 call condor bought for 3.25 in 12k

FOREX USDJPY Extends Gains Above 146, EURGBP At Support

- The greenback staged a late rally on Wednesday ahead of the FOMC minutes, which was consolidated in the aftermath of the release which showed most Fed “participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy”. The USD index matched the weeks highs and resides close to six-week highs around 103.45 approaching the APAC crossover.

- USDJPY has breached the 146 handle and is extending the day’s gains to around 0.45% on the session amid the broader rebound for the USD index and ongoing Yen weakness.

- The overall uptrend for the pair resumed following the break of key resistance at 145.07, Jun 30 high. Moving average studies are in a bull mode condition, and the focus is now on 146.38, a Fibonacci projection. Above here, the notable target levels are 146.59, the Nov 10 2022 high, and 147.49, a Fibonacci projection level.

- Today’s resilient services CPI data in the UK has kept GBP moderately bid, with the most notable strength against both he Japanese yen and the Euro. EURGBP weakness has narrowed the gap to support at 0.8544, the Jul 27 low and clearance of this level would expose 0.8504, the Jul 11 low and a bear trigger.

- Australian employment data will be the focus overnight on Thursday before US jobless claims and Philly Fed manufacturing data later in the session.

FX Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0895-00(E553mln), $1.0920-25(E509mln), $1.0930-40(E1.9bln), $1.0950(E1.8bln), $1.0985-00(E2.0bln)

- USD/JPY: Y142.00($1.4bln), Y142.50-65($1.0bln), Y143.00($1.3bln), Y145.00($900mln), Y145.50($784mln), Y146.00($521mln)

- GBP/USD: $1.2700(Gbp701mln)

- EUR/GBP: Gbp0.8600-05(E540mln), Gbp0.8750(E1.1bln)

- EUR/JPY: Y160.00(E1.2bln)

- AUD/USD: $0.6550(A$1.5bln)

- AUD/NZD: N$1.0850(A$985mln), N$1.1073(A$1.1bln)

- USD/CAD: C$1.3210($866mln), C$1.3490($956mln)

- USD/CNY: Cny7.3015($734mln), Cny7.3250($1.6bln)

Late Equity Roundup: Post FOMC Minutes Weakness

- Equity indexes saw moderate two-way trade following the release of FOMC minutes for the July meeting. Markets still digesting what at first appeared to be a more hawkish than anticipated.

- At the moment, DJIA shares are down -60.91 points (-0.17%) at 34883.02, S&P E-Mini futures down 16 points (-0.36%) at 4437.25, Nasdaq down 92.9 points (-0.7%) at 13536.82.

- Leading gainers: Utilities, Consumer Staples and Financial sectors led late in the session. Independent power and renewable energy shares buoyed Utilities with AES +3.1%, Public Service Ent +1.7, Consolidated Edison +1.65%.

- Distribution and retail names continued to support Consumer Staples sector: Target trading +3.5% (vs. +11% pre-open) after beating profit estimates this morning, net income of $835M, $1.80 a share, from $183M prior. Sysco climbed 1.7%, Dollar General +1.65%. Financials firmed up late, led by insurance names: Progressive +8.45%, Allstate +4.52%, Brown & Brown +2.45%.

- Laggers: Real Estate, and Communication Services continued to underperform in late trade. Retail, Residential and Industrial REITs weighed on Real Estate: SBA -3.45%, American Tower -3.3%, Kimco -2.15%. Media and entertainment subsectors weighed on Comm Services: Paramount -2.1% led laggers, Meta -1.6, Netflix -1.4%

E-MINI S&P TECHS: (U3) Channel Breakout

- RES 4: 4634.50 High Jul 27 and the bull trigger

- RES 3: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 2: 4560.75 High Aug 4

- RES 1: 4515.45 20-day EMA

- PRICE: 4425.00@ 1535 ET Aug 16

- SUP 1: 4421.00 Aug 16 intraday low

- SUP 2: 4411.25 Low Jul 10

- SUP 3: 4400.00 Round number support

- SUP 4: 4368.50 Low Jun 26

A bearish theme in the E-mini S&P contract remains intact and this week’s move lower has reinforced current conditions. The contract is through the 50-day EMA and has breached channel support drawn from the Mar 13 low - the channel base is at 4461.67. A clear breakout would signal scope for a continuation lower and open 4411.25, the Jul 10 low. Initial resistance to watch is at the 20-day EMA - at 4515.45.

COMMODITIES Dollar Uptick Weighs On Crude, Sees Gold Approach Bear Trigger

- Crude markets were relatively constrained through Asian and London sessions and the first half of the NY session before slipping, with some attributing to China demand concerns but certainly not helped by a resurgent US dollar with the USD index pushing back to early July levels.

- Earlier, a larger than expected US crude inventories draw (-5.96M vs -2.40M), driven by higher than expected exports (rising 1.684mbbls), had little upward traction.

- A total of 673kbbls of open September 23 options positions on CME and ICE are due to expire against the September future close tomorrow. Current aggregate OI is 344k calls and 328k puts. OI across all WTI options on both exchanges is currently 1.69m calls and 1.26m puts. The most significant open position at nearby strikes is just below the current market prices at the 80$/bbl strike prices with OI of about 22k of calls and 18.5k of puts. Above the current market another 11k of OI sits at the 84$/bbl strike and 15k at 85$/bbl.

- UBS has increased their year end Brent price forecast from 90$/bbl to 95$/bbl.

- WTI is -2.0% at $79.37, plumbing session lows and pushing towards support at $78.69 (Aug 3 low) after which lies $77.18 (50-day EMA).

- Brent is -1.7% at $83.42, also pushing lows and nearing support at $82.36 (Aug 3 low) after which lies $81.05 (50-day EMA).

- Gold is -0.4% at $1895.02, sliding with latest USD strength to clear $1896.5 (Aug 15 low) and eyeing the bear trigger at $1893.1 (Jun 29 low). Clearance could open $1885.8 (Mar 15 low).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/08/2023 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 17/08/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 17/08/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 17/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 17/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/08/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 17/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.