-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: US CPI Inflation Data Ahead

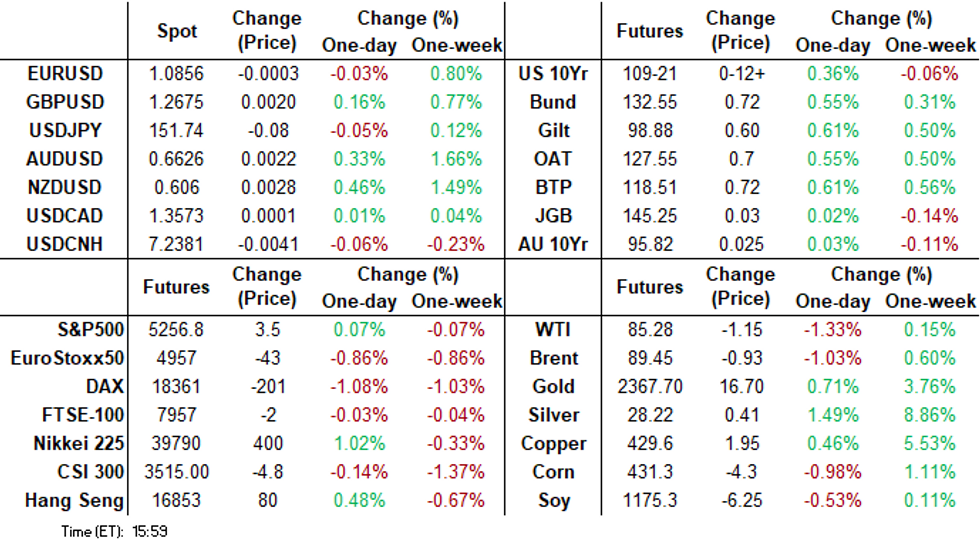

- Treasuries climbed steadily off early week lows Tuesday, shorts pared ahead Wednesday's CPI, FOMC Minutes.

- Stocks recovered lost ground in late trade, SPX and Nasdaq back near steady ahead Wednesday's event risk.

- Spot gold tested new highs on Tuesday as demand remained strong ahead of the US CPI inflation report

US TSYS Off Lows Ahead US CPI inflation Report

- Treasuries climbed steadily off early week lows Tuesday, shorts pared ahead Wednesday's CPI, FOMC Minutes.

- Consensus puts core CPI inflation at 0.3% M/M in March with some skew towards a ‘low’ 0.3 reading. Most of the usual drivers are seen exerting downward pressure after a stronger than expected 0.36% M/M in Feb, most notably used car prices after their surprise increase.

- Tsys pared gains briefly after weak $58B 3Y note auction (91282CKJ9) tailed: 4.548% high yield vs. 4.527% WI; 2.50x bid-to-cover vs. 2.60x prior month. After the bell, Jun'24 10Y futures trade +12.5 at 109-21 vs. 109-22.5 high, 10Y yield -0.581 at 4.3616%.

- A downtrend in Treasuries remains intact despite the bounce posted across the Tuesday session. An overriding bear trend remains intact. The contract has cleared support at 109-09+, the Apr 3 low, confirming a resumption of this year's downtrend.

- Projected rate cut pricing firmer vs. late Monday levels: May 2024 at -6.7% vs. -4.7bp late Monday w/ cumulative -1.7bp at 5.312%; June 2024 at -53.4% vs. -48.8% w/ cumulative rate cut -15bp at 5.179%. July'24 cumulative at -24.6bp vs -22.1bp, Sep'24 cumulative -41bp vs. -38.2bp.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00323 to 5.32065 (+0.00219/wk)

- 3M +0.00863 to 5.30586 (+0.01247/wk)

- 6M +0.01844 to 5.24930 (+0.02896/wk)

- 12M +0.03511 to 5.08765 (+0.05658/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.807T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $700B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $688B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

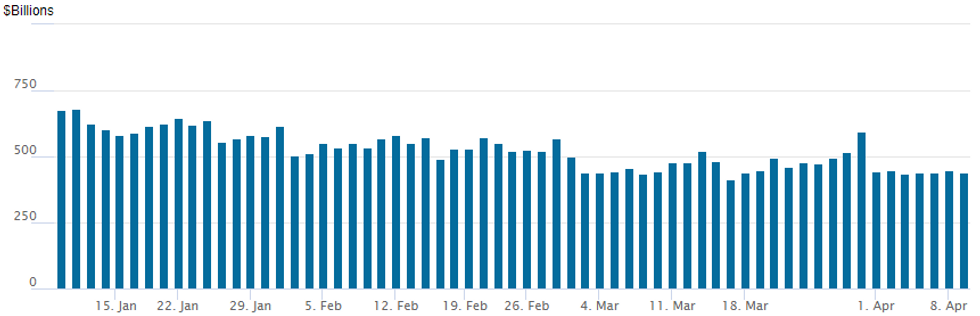

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches recedes to $441.792B vs $448.597B on Monday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 73 vs. 74 Monday.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options look mixed with slightly better upside call trade Tuesday. Underlying futures climbing steadily off overnight lows through the NY session, finishing near highs as markets square up ahead of Wednesday's CPI and March FOMC minutes. Projected rate cut pricing firmer vs. late Monday levels: May 2024 at -6.7% vs. -4.7bp late Monday w/ cumulative -1.7bp at 5.312%; June 2024 at -53.4% vs. -48.8% w/ cumulative rate cut -15bp at 5.179%. July'24 cumulative at -24.6bp vs -22.1bp, Sep'24 cumulative -41bp vs. -38.2bp. Salient trade:- SFOR Options:

- +10,000 SRZ4 96.25/96.50 vs 0QZ4 97.12/97.37 call spd/spd 1.0

- +4,000 0QJ4 95.62/95.87 put over risk reversal, 0.0 vs. 95.75/0.50%

- +5,000 SRU4 94.68/94.81 2x1 put spd 0.0

- +3,000 SRM4 94.62/94.68 2x1 put spd 1x2 0.0

- -4,000 SRZ5 96.37 calls vs. 96.015/0.38%

- +4,000 0QM4 96.00 calls, 1.0 vs. 95.79/0.05%

- -4,000 SRU4 94.68/94.75 2x1 put spds 1.75 ref 95.085

- +30,000 SRU4 94.62 puts 2.25-2.5 ref 95.08

- +2,500 SRZ4 95.37/95.62 call spds x2 vs 0QZ4 96.50/97.12 call spd 1.5

- +10,000 0QK4 96.00 calls, 6.0 ref 95.73

- +5,000 SRJ4 94.87/94.93 call spds 0.75 vs. 9483.5/0.15%

- -7,000 SRM4 94.87 calls vs 0QM4 96.50 calls, 2.5

- +5,000 0QK4 96.00 calls 6.0 ref 9574

- +4,000 SRM4 94.81/94.87/94.93/95.00 call condor 2.25, ref 9483

- +5,000 SRK4 94.87/95.00 1x2 call spds 0.5 vs. 94.81/0.10%

- +10,000 SFRJ4 94.81/94.87/94.93 call flys, 1.5

- Treasury Options:

- -10,300 TYM4 109 puts, 43-42 ref 109-20.5

- 2,000 FVM4/FVK4 105.75 put spds

- 2,000 USK4 115/119 strangles, 61 ref 118-1

- 5,000 TYM4 116/117/118/119 call condors

- +8,500 TYK4 111.5/116 call spds 5 vs. 109-21/0.05%

- +10,000 TYK4 111/111.5 call spds 4

- -10,000 TYK4 111 calls 8 ref 109-16/0.08%

- 2,000 FVK4 105.5/106 put spds 11

- 3,000 TYM4 108/108.5/109.5 put trees, 0.0 ref 109-15

EGBs-GILTS CASH CLOSE: Bunds See Support From Sell-off In Risk, Shy of Resistance

Core/semi-core EGBs and Gilts have continued to move higher following the latest sell-off in risk. As noted above, no specific headline to drive the move which began in the equity space, with a sizeable sell program at 1530BST noted.

FOREX USD Index Remains Close To Unchanged As US Inflation Data Awaited

- The USD had been trending a touch lower in early trade on Tuesday, although price action remained subdued given the lack of data/speakers and the close proximity to key US inflation data tomorrow.

- However, as equities underwent a sharp bout of weakness, putting the e-mini S&P at new pullback lows, the broad USD index received a near 30 pip boost to trade close to opening levels on the session.

- AUD and NZD are rising once again with the recent bounce in AUDUSD cementing the break of resistance around the 50-day EMA. As mentioned, this marks a bullish development and confirms the recent bout of weakness between Mar 8 - Apr 1 has been a correction. NZDUSD is up 0.36% which extends the April recovery back above 0.6050 ahead of the overnight RBNZ decision.

- USDJPY had a brief push lower to 151.57 as equities dropped, however the pair remains well within range of the key 152.00 level. The yen’s sensitivity to major US data points has remained a key theme for global markets in recent months, however, USDJPY’s proximity to multi-decade resistance and the potential threat of MOF intervention is placing the Yen’s tradability into question at current levels.

- We highlight some key topside levels for USDJPY and the crosses ahead of the US CPI release and the potential downside targets should market sentiment prompt a yen recovery: https://roar-assets-auto.rbl.ms/files/60797/FX%20Market%20Analysis%20-%20JPY%2009-04.pdf

- Both the RBNZ and the BOC are widely expected to hold rates on Wednesday, keeping US CPI the highlight of the docket. This will later be complemented by the FOMC minutes later in the session.

FX Expiries for Apr10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875(E869mln), $1.0895-00(E2.3bln)

- USD/JPY: Y149.00($700mln), Y149.50($607mln), Y151.00-20($638mln), Y151.50($816mln), Y151.90-10($609mln)

- GBP/USD: $1.2675(Gbp801mln)

- AUD/USD: $0.6645-55(A$2.1bln)

- USD/CAD: C$1.3720($864mln)

- USD/CNY: Cny7.2400($514mln), Cny7.2500($1.6bln)

Equities Roundup: Off Lows, Insurance, Industrials Lagging

- Stocks hold modestly weaker late Tuesday, off morning lows as shorts cover ahead tomorrow's headline CPI inflation data. Currently, DJIA is down 31.24 points (-0.08%) at 38864.38, S&P E-Minis down 0.25 points (0%) at 5253.5, Nasdaq up 29.6 points (0.2%) at 16283.67.

- Leading Gainers: Real Estate and Utilities outperformed in the second half, investment trusts, particularly office and specialized REITs buoyed the former: Boston Properties +2.8%, SBA Communications +2.05%, American Tower +2.01%. Multi energy and water utilities buoyed the latter: Dominion +1.19%, Sempra +1.1%, American Water Works +0.97%.

- Laggers: Financial and Industrial sector shares underperformed, insurance names weighing on the former: Arch Capital -3.91%, WR Berkley -3.48%, Hartford Financial -3.35%. Construction/engineering names weighed on the Industrial sector: Huntington Ingalls -4.07%, Eaton Corp -3.60%, PACCAR Inc -3.1%.

- Reminder, the next quarterly earnings starts in earnest late this week with JP Morgan, BlackRock, Wells Fargo, State Street and Citigroup reporting Friday, April 12.

E-MINI S&P TECHS: (M4) Corrective Bear Cycle Still In Play

- RES 4: 5434.54 Bull channel top drawn from the Jan 17 low

- RES 3: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 2: 5400.00 Round number resistance

- RES 1: 5308.50/33.50 High Apr 4 / 1 and the bull trigger

- PRICE: 5266.75 @ 14:17 GMT Apr 9

- SUP 1: 5191.50 Low Apr 5

- SUP 2: 5148.94 50-day EMA

- SUP 3: 5100.00 Round number support

- SUP 4: 5018.00 Low Feb 21

The trend condition in S&P E-Minis is unchanged and remains bullish, however, the recent move down highlights a corrective cycle that remains in play for now, and last week's sell-off reinforces this condition. The contract has breached bull channel support drawn from the Jan 17 low, and cleared the 20-day EMA. This has exposed the 50-day EMA, at 5148.94 and the next key support. Key resistance and the bull trigger is 5333.50, the Apr 1 high.

COMMODITIES: Spot Gold Uptrend Extends, Crude Softens

- Spot gold tested new highs on Tuesday as demand remained strong ahead of tomorrow’s US CPI inflation report.

- The yellow metal is up 0.4% at $2,349/oz currently, having reached yet another record high of $2,365/oz earlier in the session.

- With the $2300 handle having been cleared, the next objective is $2376.5, a Fibonacci projection. Initial firm support is at $2222.4, the 20-day EMA.

- Crude markets softened further during US hours, amid the ongoing Gaza ceasefire discussions and comments from Iran’s Revolutionary Guard.

- WTI May 24 is down 1.4% at $85.2/bbl. The next objective is $89.08, a Fibonacci projection. On the downside, initial firm support to watch lies at $82.80, the 20-day.

- Iran’s Islamic Revolutionary Guard Corps naval forces said that Iran is choosing not to disrupt flows through the Strait of Hormuz in the Persian Gulf.

- Meanwhile, world oil demand growth for 2024 has been revised down by 480k b/d to 0.95m b/d in the EIA’s Short-Term Energy Outlook.

- Elsewhere, iron ore rose another 1.8% today, extending the gain from lows earlier this month to 12%.

- Prices have been supported by a brighter consumption outlook as China enters what’s typically the strongest season for steel demand. Output from the nation’s blast furnaces is starting to rise again, according to Macquarie.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/04/2024 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 10/04/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/04/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/04/2024 | 0800/1000 | * |  | IT | Retail Sales |

| 10/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/04/2024 | - | *** |  | CN | Money Supply |

| 10/04/2024 | - | *** |  | CN | New Loans |

| 10/04/2024 | - | *** |  | CN | Social Financing |

| 10/04/2024 | 1230/0830 | *** |  | US | CPI |

| 10/04/2024 | 1230/0830 | * |  | CA | Building Permits |

| 10/04/2024 | 1345/0945 |  | CA | BOC Monetary Policy Report | |

| 10/04/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 10/04/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/04/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 10/04/2024 | 1645/1245 |  | US | Chicago Fed's Austan Goolsbee | |

| 10/04/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/04/2024 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/04/2024 | 1800/1400 | *** |  | US | FOMC March Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.