-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds New Cycle Highs Pre-Jobs Data

- MNI BOC: UNCERTAINTY AROUND CPI RETURNING TO 2% IN MID-2025

- MNI BOC REMAINS CONCERNED ABOUT PERSISTENT TREND INFLATION

- ATL FED BOSTIC: I WANT US TO HOLD RATES STEADY 'FOR A LONG TIME', Bbg

- ATL FED BOSTIC: FED IS IN RESTRICTIVE TERRITORY AND THAT IS HELPING INFLATION FALL, Bbg

Key Links:MNI: Bostic Wants Fed Pause, Sees Risks From Yield Surge / MNI INTERVIEW: Fed's Fujita Sees Signs of Jobs Soft Landing / MNI BRIEF: Fed's Mester: 10-Year Yield Surge Affects Policy / MNI: BOC: Sticky Inflation Clouds Return To Target By Mid-2025

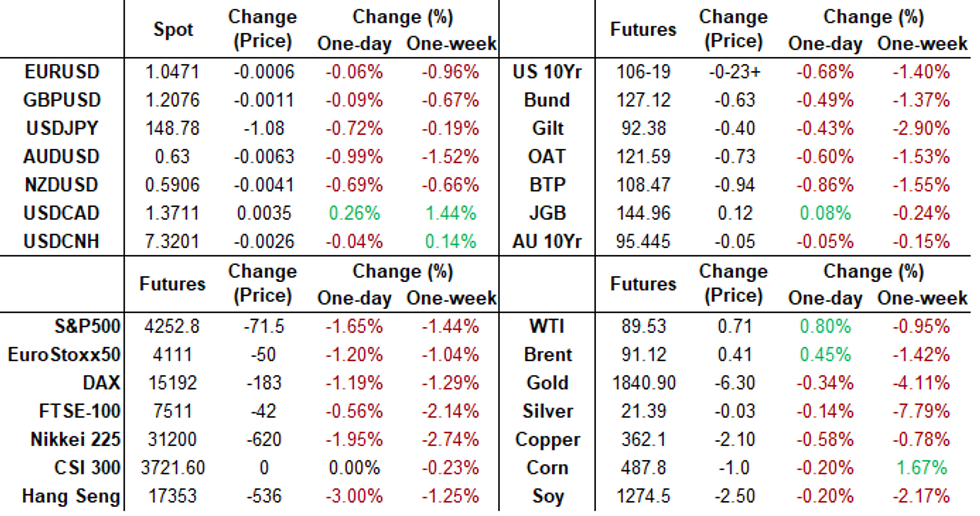

US TSYS 10Y Yield New Cycle High of 4.8081%

- Treasury futures continue to extend lows in late trade, as 10Y yield climbs to new 16Y high of 4.8081%. Curves making new cycle highs: 3M10Y +9.075 at -70.705, 2Y10Y +7.920 at -34.846.

- Dec'23 10Y futures crossed technical support of 106-23 (Low Oct 3 & 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing) to 106-18 low briefly, and is back to 106-20.5 (-22) after the bell

- Bids pulled or shifted lower as focus turns to surge of scheduled economic data tomorrow that includes ADP Private Employ, ISM Services.

- Cross asset summary: Greenback remains strong but off highs (DXY +.118 at 107.022), Gold weaker (-2.77 at 1825.27), crude firmer (WTI +0.54 at 89.36). Stocks at/near session lows with S&P E-Mini futures back to early June levels: down 62 points (-1.43%) at 4262.25, DJIA down 443.64 points (-1.33%) at 32989.56, Nasdaq down 249.9 points (-1.9%) at 13057.9.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00343 to 5.32751 (+0.00852/wk)

- 3M +0.02614 to 5.41429 (+0.01879/wk)

- 6M +0.03313 to 5.48573 (+0.01846/wk)

- 12M +0.04399 to 5.47767 (+0.01141/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% volume: $240B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.513T

- Broad General Collateral Rate (BGCR): 5.30%, $537B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $526B

- (rate, volume levels reflect prior session)

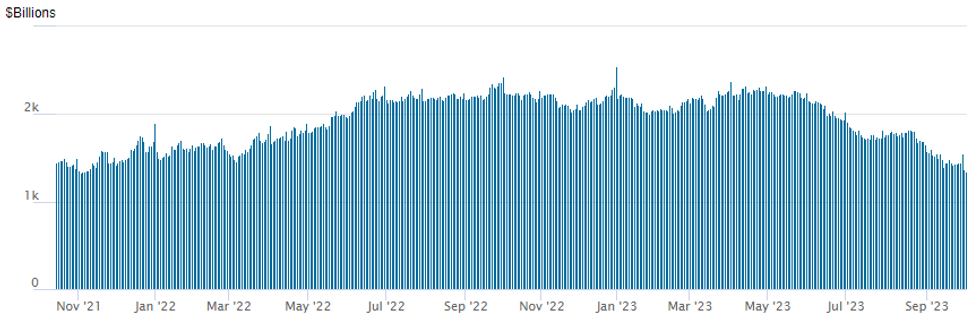

FED REVERSE REPO OPERATION: Extending New Low

NY Federal Reserve/MNI

Repo operation usage falls to $1,348.465B - new low since early November 2021 w/97 counterparties vs. $1,365.739B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options traded mixed on decent volume Tuesday as underlying futures adjusted to "higher for longer" monetary policy, heavy selling to new cycle lows, 10Y yield marked new 16Y high at 4.806%. Rate hike projections into early 2024: November at 30.5% w/ implied rate change of +7.6bp to 5.405%, December cumulative of 13.3bp at 5.462%, January 2024 13.4bp at 5.463%. Fed terminal at 5.46% in Jan'24-Feb'24.

- SOFR Options:

- 1,500 SFRH4 94.56/94.68/94.75/94.87 call condors ref 94.58

- Block, +5,000 0QZ3 96.00 calls 9.0 ref 95.295

- Block, 5,000 SFRX3 94.75 calls vs. 10,000 SFRZ3 94.00 puts, 0.0 net

- Block, 7,500 SFRF4 94.62/94.68/94.81/94.87 call condors, 1.0 vs. 94.55/0.05%

- Block, 5,000 0QZ3 96.00 calls, 9.5 ref 95.36

- Block/pit, -55,000 0QV3 95.62/95.87 call spds, 1.5 ref 95.32

- 2,000 0QV3 and 0QX3 95.87/96.12/96.37 call flys

- 2,500 SFRU3 94.31/94.50 2x1 put spds

- 2,000 SFRU4 94.50/94.62 put spds ref 95.01

- Treasury Options:

- Block, -13,557 TYX3 107.5 puts, 124 ref 106-22

- -35,000 FVZ3 105/105.75/106.5 call trees, 1 to 0, ref 104-20 to -19.5

- 3,400 TYX3 108/109 call spds, 17 ref 107-01.5

- 5,000 TYZ3 110.5 calls 17 ref 107-01.5

- 7,000 TYX3 106.5 puts, 42 ref 107-02.5

- 1,000 TYX3 106/107 put spds, 20 ref 107-02.5, total volume over 4k

- 2,000 USZ3 124 calls, 8 last

- over 3,600 FVX3 106 calls, 11 last

- over 3,800 TYZ3 108 calls, 34 last

- over 13,500 weekly 10Y midcurve 108.5 calls, 4 ref 107-06

EGBs & Gilts Stabilise Off Cheaps

EGBs and gilts stabilise alongside U.S. Tsys, with fundamental headline flow remaining light.

- Bunds now twist steepen on the day, while gilts bull steepen.

- Gilts maintain broader outperformance amongst core global FI markets.

- The pause in the outright sell off and equities ticking away from lows allows BTPs to pare some of the widening vs. Bunds flagged earlier (to sit ~3bp wider on the day vs. Bunds after narrowing by 6bp on Monday).

FOREX JPY Volatility Raises Intervention Questions

- The greenback trended higher across US hours, aided by further gains to cycle highs for the belly and longer-end of the US curve. Bear steepening of US yields supported the USD Index through to resume it's medium-term uptrend off the July lows, putting USD/JPY briefly above Y150.00.

- A sharp and abrupt fall in the pair off the highs has raised considerable suspicion of official intervention in the currency rate (a Japanese finance ministry official declined to comment on the matter), but markets may have to wait until the month-end BoJ intervention data release for any confirmation.

- The strong recovery off the USD/JPY lows may suggest a lack of follow through from any intervention, with spot recouping close to 175 pips off the 147.43 low. This keeps the pressure turned higher for now, and markets will be looking to test if any further breaks of Y150 will be followed by an abrupt decline.

- AUD and NZD traded poorly across the session, with the continuity in RBA policy and the openness to further hikes doing little to prop the currency. Weakness across equity markets sapped higher beta currency performance, keeping AUD/USD's downtrend intact and opening new pullback lows. 0.6170 marks next key support.

- Focus Wednesday turns to the final composite and services PMI data from across Europe, as well as the ADP and ISM Services releases. JOLTs data cemented the strong labour market backdrop evident in Monday's ISM Manufacturing Index, potentially posing upside risks to Friday's NFP.

- Consensus looks for Change in Nonfarm Payrolls of +170k, but the whisper number has already begun to populate higher.

Expiries for Oct04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0475(E841mln)

- USD/JPY: Y148.00($567mln), Y148.50($723mln), Y150.00($766mln)

- EUR/JPY: Y154.00(E520mln)

- AUD/USD: $0.6490(A$550mln), $0.6700(A$1.4bln)

Late Equity Roundup: Consumer Discretionary, Real Estate, IT Lagging

- Stocks remain weaker in late trade, support waning all day after this morning's stronger than expected JOLTS Job Openings (9.610M vs. 8.808M est, 8.827M prior) that also helped push Treasury 10Y yield to new 16 year high of 4.8039 (+.1253) in late trade. S&P E-Mini futures back to early June levels: down 67.25 points (-1.56%) at 4256.5, DJIA down 479.74 points (-1.43%) at 32953.52, Nasdaq down 274.7 points (-2.1%) at 13034.05.

- Laggers: Consumer Discretionary, Real Estate and Information Technology sectors continued to underperform in late trade. Auto makers and broadline retailers weighed on Discretionary sector shares: Amazon -3.7%, Etsy -3.23%, GM -3.3%, Ford -1.87%, Tesla -1.91%.

- Real Estate Investment Trusts (REITs) underperformed, particularly hotel and health care REITs: Welltower Inc -3.06%, Ventas -2.8%, Host Hotels -2.6%. Meanwhile, Software and services shares weighed on IT: EPAM -3.95%, Ansys -3.5%, Cadence Design -3.5%.

- Leaders: Utilities, Materials and Energy sectors outperformed, the former taking the lead in the second half led by gas and multi-energy providers: NI Source +3.85%, CMS Energy +2.6%, Atmos +1.35%.

- Meanwhile, metals and mining shares backstopped Materials with Nucor Corp +.71%, Energy supported by equipment and services providers: Schlumberger +0.62%, Haliburton +0.25%.

E-MINI S&P TECHS: (Z3) Bear Threat Still Present

- RES 3: 4566.00 High Sep 15 and a key resistance

- RES 2: 4415.45/4461.47 20- and 50-day EMA values

- RES 1: 4399.00 High Sep 22

- PRICE: 4260.00 @ 1550 ET Oct 3

- SUP 1: 4251.25 Low Oct 3

- SUP 2: 4242.15 1.236 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 3: 4194.75 Low May 24

A bear cycle in S&P E-minis remains in play and the contract is trading closer to its recent lows. The recent break of support at 4397.75, the Aug 18 low, reinforced bearish conditions and signals scope for a continuation lower. Sights are on 4242.15, a Fibonacci retracement point. Initial firm resistance is 4461.47, the 50-day EMA. Ahead of the 50-day average is resistance at 4399.00, the Sep 22 high, and 4415.45, the 20-day EMA.

COMMODITIES

- WTI Crude Oil (front-month) up $0.71 (0.8%) at $89.53

- Gold is down $3.49 (-0.19%) at $1824.53

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/10/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 04/10/2023 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 04/10/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 04/10/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 04/10/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/10/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/10/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/10/2023 | 0815/1015 |  | EU | ECB's Lagarde speaks at ECB MP Conference | |

| 04/10/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 04/10/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 04/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/10/2023 | 1140/1340 |  | EU | ECB's de Guindos speaks at Cyprus CB Conference | |

| 04/10/2023 | - |  | UK | BoE's Bailey Interview in Prospect Magazine | |

| 04/10/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/10/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 04/10/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/10/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/10/2023 | 1400/1600 |  | EU | ECB's Panetta speaks at ECB MP Conference | |

| 04/10/2023 | 1425/1025 |  | US | Fed Governor Michelle Bowman | |

| 04/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 04/10/2023 | 1600/1800 |  | EU | ECB's Lagarde speaks at Columbia University |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.