-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI Asia Morning FX Analysis - Recovering Oil Price Bolsters CAD

Recovering Oil Price Bolsters CAD

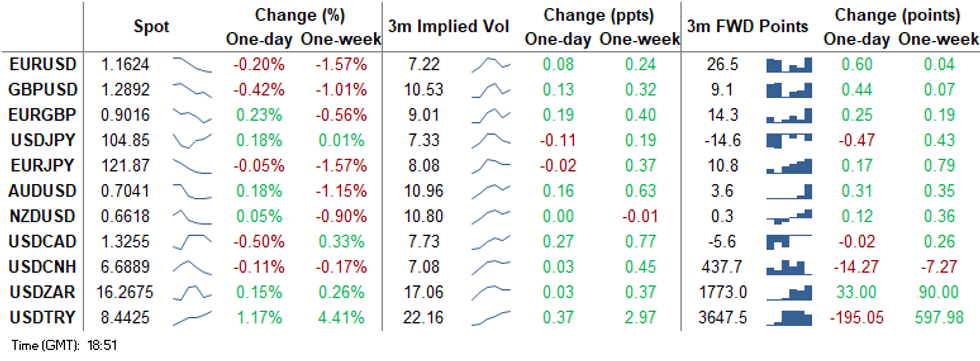

A negative start for WTI and Brent crude oil on Monday got commodity-tied FX to a bad start, but this swiftly reversed ahead of the close, with CAD, AUD and others outperforming the rest of G10 as WTI and Brent crude futures swung from losses of as much as 5% to positive territory ahead of the NY close. The moves followed wires reports that the Russian energy minister had met with domestic energy firms to discuss the option of delaying a planned easing of OPEC output curbs - effectively restricting supply for a longer period of time. Brent crude futures rose to just shy of $39/bbl after trading as low as $35.75 earlier in the day.

The USD index traded slightly higher, showing above the 100-dma at 94.262 for the first time May ahead of polling. Markets clearly remain fretful, with the VIX index holding close to multi-month highs one day out from voting.

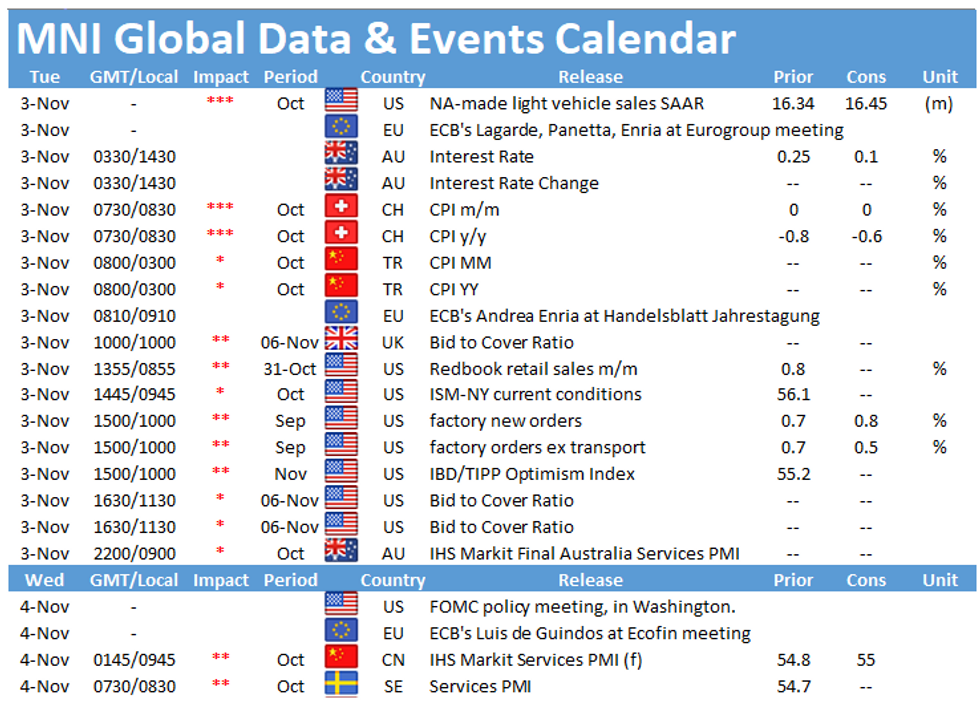

Focus Tuesday remains on the US Presidential election, with all attention paid to the early results and swing states. The RBA rate decision is also due where the bank are expected to trim the cash rate target by 15bps.

EUR/USD TECHS: Attention Is On Key Support

- RES 4: 1.1881 High Oct 21 and the bull trigger

- RES 3: 1.1798 High Oct 28

- RES 2: 1.1761 20-day EMA

- RES 1: 1.1704 High Oct 30

- PRICE: 1.1630 @ 16:42 GMT Nov 2

- SUP 1: 1.1623 Low Nov 2

- SUP 2: 1.1612 Low Sep 25 and the bear trigger

- SUP 3: 1.1576 0.764 proj of Sep 1 - 25 sell-off from Oct 21 high

- SUP 4: 1.1541 Low Jul 23

EURUSD remains just above key support at 1.1612, maintaining the weaker outlook. Last week's sell-off confirmed a clear breach of the short-term trendline support drawn off the Sep 28 low. The break, confirmed by a move below the Oct 29 low of 1.1718 as well as key support at 1.1689, Oct 15 low strengthens the bearish case and has opened 1.1612, Sep 25 low and the primary bear trigger. Initial resistance is at 1.1704, Friday's intraday high.

GBP/USD TECHS: Remains Vulnerable

- RES 4: 1.3270 2.0% 10-dma envelope

- RES 3: 1.3177 High Oct 21 and the bull trigger

- RES 2: 1.3080 High Oct 27 and key near-term resistance

- RES 1: 1.3026 High Oct 29

- PRICE: 1.2900 @ 16:43 GMT Nov 2

- SUP 1: 1.2855 Low Nov 2

- SUP 2: 1.2863 Low Oct 14 and key near-term support

- SUP 3: 1.2806 Low Sep 30

- SUP 4: 1.2794 76.4% retracement of the Sep 23 - Oct 21 rally

The GBPUSD outlook remains bearish following last week's extension lower and despite Monday's modest recovery. The breach last week of 1.2940, Oct 21 low suggests scope for a deeper pullback with attention on 1.2863, Oct 14 low and a key S/T support. Clearance of this level would open 1.2794, a Fibonacci retracement. Initial firm resistance is seen at 1.3080, Oct 27 high. A break would ease bearish pressure and open 1.3177, Oct 21 high.

EUR/GBP TECHS: Bearish Price Sequence Intact

- RES 4: 0.9146/62 1.0% 10-dma envelope / High Oct 7

- RES 3: 0.9149 Oct 20 high

- RES 2: 0.9107 High Oct 23

- RES 1: 0.9064 50-day EMA

- PRICE: 0.9018 @ 16:45 GMT Nov 2

- SUP 1: 0.8984 Low Oct 30

- SUP 2: 0.8967 76.4% retracement of the Sep 3 - 11 rally

- SUP 3: 0.8925 Low Sep 7

- SUP 4: 0.8900 Low Sep 4

EURGBP traded lower Friday and cleared 0.9007, Oct 14 low. This confirms a resumption of the downtrend that has been in place since reversing lower on Sep 11. The break lower maintains a bearish price sequence of lower lows and lower highs. This has exposed 0.8967 next, a retracement. Key short-term resistance is at 0.9149, Oct 20 high. Clearance of this level would undermine bearish conditions. Initial resistance is 0.9064, 50-day EMA.

USD/JPY TECHS: Bearish Despite Finding Support

- RES 4: 105.75 High Oct 20

- RES 3: 105.48/53 50-dma / High Oct 21

- RES 2: 105.06 High Oct 26 and key near-term resistance

- RES 1: 104.95 High Nov 2

- PRICE: 104.81 @ 16:46 GMT Nov 2

- SUP 1: 104.00 Low Sep 21 and the bear trigger

- SUP 2: 103.67 76.4% retracement of the Mar 9 - 24 rally

- SUP 3: 103.09 Low Mar 12

- SUP 4: 102.02 Low Mar 10

USDJPY maintains a bearish outlook despite recovering from recent lows. Attention remains on the key 104.00 handle, Sep 21 low. Clearance of this support would suggest scope for a deeper USD sell-off within the bear channel drawn off the Mar 24 high. A break lower would also confirm a resumption of the current downtrend and maintain the bearish price sequence of lower lows and lower highs. Firm resistance is at 105.06.

EUR/JPY TECHS: Bears Still In Charge

- RES 4: 123.82 50-day EMA

- RES 3: 123.36 20-day EMA

- RES 2: 123.19 High Oct 28

- RES 1: 122.46 High Oct 30

- PRICE: 121.93 @ 16:48 GMT Nov 2

- SUP 1: 121.50 0.764 proj of Sep 1 - 28 decline from Oct 9 high

- SUP 2: 120.70 Low Jul 13

- SUP 3: 120.39 1.000 proj of Sep 1 - 28 decline from Oct 9 high

- SUP 4: 120.27 Low Oct 10

EURJPY maintains a bearish tone following last week's move lower. The cross has cleared support at 123.03/02 and 122.38, Sep 28 low. This move lower has confirmed a resumption of the downleg that started Sep 1. Scope is seen for weakness towards 121.50 next, a Fibonacci projection. Further out, 120.39 is on the radar, also a Fibonacci projection. Initial resistance is at 122.46, Friday's high.

AUD/USD TECHS: Bearish Theme Following Break Of Support

- RES 4: 0.7243 High Oct 10 and a key resistance

- RES 3: 0.7218 High Oct 13

- RES 2: 0.7138/58 Trendline drawn off the Sep 1 high / High Oct 23

- RES 1: 0.7076 High Oct 29

- PRICE: 0.7042 @ 16:49 GMT Nov 2

- SUP 1: 0.6991 Low Nov 2

- SUP 2: 0.6965 23.6% retracement of the Mar - Sep rally

- SUP 3: 0.6943 2.0% 10-dma envelope

- SUP 4: 0.6921 Low Jul 14

AUDUSD outlook is bearish. The pair has pulled further away from trendline resistance drawn off the Sep 1 high and importantly has today traded below 0.7000, signalling a clear breach of former support at 0.7006, Sep 25 low and 0.7002, Oct 29 low. The break lower has opened 0.6965 next, a Fibonacci retracement. On the upside, trendline resistance intersects at 0.7138 where a break is required to reverse the trend.

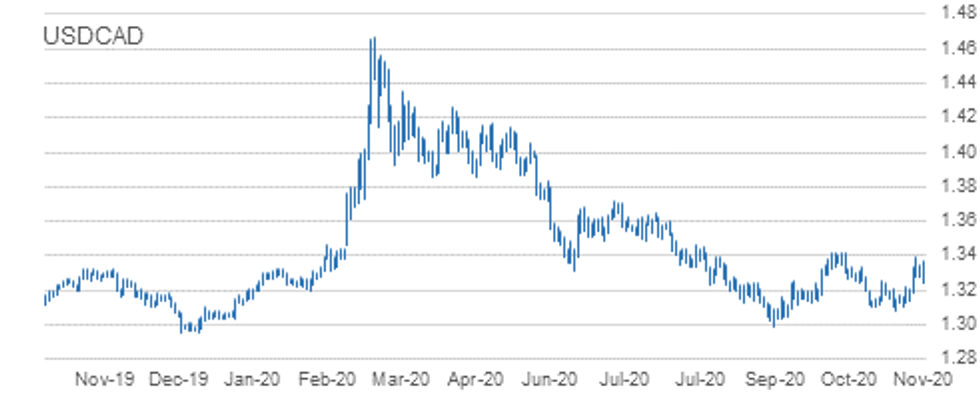

USD/CAD TECHS: Focus Is On Key Resistance

- RES 4: 1.3545 200-dma

- RES 3: 1.3474 2.0% 10-dma envelope

- RES 2: 1.3421 High Sep 30 and primary resistance

- RES 1: 1.3390 High Oct 29

- PRICE: 1.3256 @ 16:51 GMT Nov 2

- SUP 1: 1.3236 50% Retracement of the late October recovery

- SUP 2: 1.3180 Low Oct 28

- SUP 3: 1.3109/3081 Low Oct 23 / Low Oct 21 and the bear trigger

- SUP 4: 1.3047 Low Sep 7

USDCAD is consolidating. Last week's bullish weekly close cemented the break of key short-term resistance at 1.3259, Oct 15 high as well as the break of 1.3341, Oct 7 high. Gains signal scope for a climb towards 1.3421 next, Sep 30 and primary resistance. Initial firm support is seen at 1.3180, Oct 28 low. A break of this level is required to undermine the developing bullish tone. First support however lies at 1.3259.

EUR/USD: MNI KEY LEVELS

- *$1.1788 55-dma

- *$1.1782/84 50-dma/Cloud top

- *$1.1763/64 21-dma/200-hma

- *$1.1757 Sep27-2018 high

- *$1.1736 Fibo 38.2% 1.3993-1.0341

- *$1.1698 100-hma

- *$1.1691 Cloud base

- *$1.1656/57 Intraday high/100-dma

- *$1.1648/51 Lower 1.0% 10-dma env/Sep28-2018 high

- *$1.1630 Lower Bollinger Band (2%)

- *$1.1624 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *$1.1623/21 Intraday low/Oct16-2018 high

- *$1.1613/11 161.8% swing $1.1497-1.1309/Down Trendline from Jul18-2008

- *$1.1570 Jan10-2019 high

- *$1.1564 Lower Bollinger Band (3%)

- *$1.1540 Jan11-2019 high

- *$1.1530 Lower 2.0% 10-dma envelope

- *$1.1490 Jan15-2019 high

- *$1.1450/48 Jan29-2019 high/Mar20-2019 high

- *$1.1437 Mar21-2019 high

- *$1.1413/12 Lower 3.0% 10-dma env, 200-wma/Jun25-2019 high

GBP/USD: MNI KEY LEVELS

- *$1.3080 May08-2019 high

- *$1.3041 May13-2019 high

- *$1.3008/11 55-dma/200-hma

- *$1.2997/99 Cloud top/61.8% 1.3381-1.2382

- *$1.2991/94 May10-2019 low/50-dma

- *$1.2980 21-dma

- *$1.2970 May14-2019 high

- *$1.2956/57/60 Intraday high/100-hma/Cloud base

- *$1.2949/50 50-mma/200-wma

- *$1.2904 May14-2019 low

- *$1.2894 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *$1.2882/78 50% 1.3381-1.2382/100-dma

- *$1.2874 Lower 1.0% 10-dma envelope

- *$1.2855/52 Intraday low/May16-2019 high

- *$1.2835/33/31 Lower Boll Band (2%)/Feb12-2019 low/Jan21-2019 low

- *$1.2825 Jan16-2019 low

- *$1.2813/10 May21-2019 high/61.8% 1.1841-1.4377

- *$1.2784 Jun25-2019 high

- *$1.2764/63 38.2% 1.3381-1.2382/Lower Boll Band (3%)

- *$1.2759/56 Jun12-2019 high/100-wma

- *$1.2744 Lower 2.0% 10-dma envelope

EUR/GBP: MNI KEY LEVELS

- *Gbp0.9134/35 Sep11-2017 high/Upper Boll Band (2%)

- *Gbp0.9125 Cloud top

- *Gbp0.9108 Jan03-2019 high

- *Gbp0.9079 Cloud base

- *Gbp0.9068 50-dma

- *Gbp0.9062/63 Jan11-2019 high/21-dma, 55-dma

- *Gbp0.9052 100-dma

- *Gbp0.9048/51 Jul16-2019 high, Intraday high/Jul17-2019 high

- *Gbp0.9039/42 Jul18-2019 high/200-hma

- *Gbp0.9028 100-hma

- *Gbp0.9015 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *Gbp0.9010 Jul10-2019 high

- *Gbp0.9005/00 Jul23-2019 high/Jul22-2019 high

- *Gbp0.8995/90 Intraday low/Lower Boll Band (2%)

- *Gbp0.8957/53 Lower 1.0% 10-dma env/Jul23-2019 low, Lower Boll Band (3%)

- *Gbp0.8921 Jul02-2019 low

- *Gbp0.8908 200-dma

- *Gbp0.8874/73/72 Jun19-2019 low/Jun20-2019 low/Jun12-2019 low

- *Gbp0.8867/65 Lower 2.0% 10-dma env/61.8% 0.9108-0.8473

- *Gbp0.8830 Jun06-2019 low

- *Gbp0.8822 May31-2019 low, 100-wma

USD/JPY: MNI KEY LEVELS

- *Y106.03 100-dma

- *Y105.78 Upper 1.0% 10-dma envelope

- *Y105.77 Cloud top

- *Y105.49 55-dma

- *Y105.46 50-dma

- *Y105.19 Cloud base

- *Y105.17 21-dma

- *Y105.07 Cloud Kijun Sen

- *Y104.95 Intraday high

- *Y104.87 Jan03-2019 low

- *Y104.84 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *Y104.78 Cloud Tenkan Sen

- *Y104.62 200-hma

- *Y104.56 Mar26-2018 low

- *Y104.54 Intraday low

- *Y104.50 100-hma

- *Y104.12 Lower Bollinger Band (2%)

- *Y104.00 YTD low

- *Y103.94 200-mma

- *Y103.69 Lower 1.0% 10-dma envelope

- *Y103.61 Lower Bollinger Band (3%)

EUR/JPY: MNI KEY LEVELS

- *Y123.08 200-hma, 38.2% 126.81-120.78

- *Y123.01 Jun12-2019 high

- *Y122.56 Jun13-2019 high

- *Y122.24 100-hma

- *Y122.23 Jul12-2019 high

- *Y122.15 Intraday high

- *Y122.13 Jun17-2019 high

- *Y122.07 Fibo 61.8% 118.71-127.50

- *Y122.00 Lower 1.0% 10-dma envelope

- *Y121.92/95 Jun20-2019 high/50% 94.12-149.78

- *Y121.87 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *Y121.85/81 Jul15-2019 high/Lower Boll Band (2%)

- *Y121.78 100-wma

- *Y121.70 Intraday low

- *Y121.42 Jul15-2019 low

- *Y121.17 200-dma

- *Y120.89 Lower Bollinger Band (3%)

- *Y120.78 Jul18-2019 low, Jun03-2019 low

- *Y120.77 Lower 2.0% 10-dma envelope

- *Y120.50 Jul23-2019 low

- *Y120.24 Fibo 61.8% 109.57-137.50

AUD/USD: MNI KEY LEVELS

- *$0.7184/89 50-dma, 55-dma/Cloud base

- *$0.7153 Upper 1.0% 10-dma env, Apr17-2019 low

- *$0.7140 Apr16-2019 low

- *$0.7115/16 100-dma/21-dma, Apr12-2019 low

- *$0.7110 Apr10-2019 low

- *$0.7087/88 200-hma/Apr08-2019 low

- *$0.7069/73 Apr30-2019 high/Mar29-2019 low

- *$0.7057 Jul22-2019 high

- *$0.7052/53/54 100-hma/Apr02-2019 low/Intraday high

- *$0.7044/48 Jul16-2019 high/May07-2019 high, Jul04-2019 high

- *$0.7042 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *$0.7011 Lower 1.0% 10-dma envelope

- *$0.6995/91 Lower Boll Band (2%)/Intraday low

- *$0.6985 Jan03-2019 low

- *$0.6971/67 Jul12-2019 low/Jun11-2019 high

- *$0.6940/36 Lower 2.0% 10-dma env/Lower Boll Band (3%)

- *$0.6909 Jun19-2019 high

- *$0.6893 100-wma

- *$0.6879 Jun20-2019 low

- *$0.6869 Lower 3.0% 10-dma envelope

- *$0.6855 Jun19-2019 low

USD/CAD: MNI KEY LEVELS

- *C$1.3376 100-wma, 50% 1.4690-1.2062

- *C$1.3370 Intraday high

- *C$1.3358 Fibo 50% 1.3565-1.3151

- *C$1.3349 Upper Bollinger Band (2%)

- *C$1.3345/48 Jun12-2019 high/Upper 1.0% 10-dma env

- *C$1.3328 100-dma, 38.2% 1.2783-1.3665

- *C$1.3309 Fibo 38.2% 1.3565-1.3151

- *C$1.3300 Jun13-2019 low

- *C$1.3295/97 100-hma/Cloud top

- *C$1.3286 Jun20-2019 high

- *C$1.3254 ***CURRENT MARKET PRICE 18:48GMT MONDAY***

- *C$1.3245/40 Intraday low/Cloud base

- *C$1.3227/26/24 200-hma/Jun10-2019 low/50% 1.2783-1.3665

- *C$1.3208/06/05 50-dma/55-dma/21-dma

- *C$1.3181 50-mma

- *C$1.3164/63/61 Jul23-2019 high/Feb21-2019 low/200-wma

- *C$1.3151/50 Jun20-2019 low/Feb20-2019 low

- *C$1.3120/16 61.8% 1.2783-1.3665/Jul23-2019 low

- *C$1.3113 Feb25-2019 low

- *C$1.3107 Jun26-2019 low

- *C$1.3083 Lower 1.0% 10-dma envelope

Expiries for Nov3 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1435-50(E529mln), $1.1590-00(E590mln), $1.1650(E518mln), $1.1725(E585mln), $1.1900-05(E1.4bln)

USD/JPY: Y104.50-55($540mln), Y105.45-49($1.3bln)

GBP/USD: $1.2850(Gbp684mln), $1.3100(Gbp631mln)

EUR/GBP: Gbp0.9000(E720mln)

AUD/USD: $0.7000(A$686mln), $0.7035-55(A$847mln)

USD/CNY: Cny6.5334($1.2bln), Cny6.72($500mln)

Larger Option Pipeline

EUR/USD: Nov06 $1.1600(E1.0bln), $1.1795-05(E1.0bln)

USD/JPY: Nov04 Y105.00($1.1bln), Y106.00-09($1.2bln); Nov05 Y106.06-09($1.6bln); Nov06 Y104.89-00($1.0bln)

EUR/JPY: Nov05 Y124.50(E1.1bln)

USD/CNY: Nov05 Cny6.75($1.0bln), Cny6.80($1.9bln), Cny6.85($1.3bln); Nov06 Cny6.70($1.2bln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.