-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA OPEN: 10Y Yield Climbs to Late 2007 Levels

- MNI BRIEF: Americans’ Pay Floor Rises To Record-NY Fed

- MNI INTERVIEW: Trudeau Must Fix Housing Without Fanning Prices

- MNI NPLs Increase Again But At A Slower Pace Than In June - Dallas Fed

US TSYS Markets Roundup: Bonds Near Lows

- Treasury futures remain weaker but off lows after extending new cycle lows in late morning trade. Sep'23 10Y futures slipped below round number technical support of 109-00 (-20.5) to new contract low of 108-31 briefly, yield climbing to the highest level since late 2007 at 4.3518%.

- There were no obvious headline, data or Block/cross driver for the curve steepening sell-off (3M10Y +8.273 at -110.785, 2Y10Y +3.629 at -65.590).

- ncoming high-grade supply and pre-auction hedging was only a factor in the short end to 3s. Some desks posited that Fed Chairman Powell will present a hawkish or "stay the course" to address inflation at the KC Fed's annual economic symposium in Jackson Hole, WY that kicks off Thursday evening and runs through Saturday.

- Technicals in play: The trend direction in Treasuries remains down and the contract has started the week on a bearish note, breaking to a fresh cycle low. The break confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs.

- Last week’s break of support at 109.24, the Aug 4 low, also confirmed a resumption of the bear cycle. The focus is on 108.19+, a Fibonacci projection. Firm resistance is 110-21+, the 20-day EMA.

US

FED: The lowest pay Americans would accept for a new job increased to a record USD78,645, according to a New York Fed survey released Monday, as higher consumer price levels change the calculus for workers.

- The measure increased 8% on the year to July from USD72,873. The self-reported "reservation wage" climbed fastest over the year for those above the age of 45 according to the survey conducted three times a year that dates back to 2014.

- The measure grew 27% between March 2020 and July 2023.

CANADA

CANADA: Prime Minister Justin Trudeau is coming under increasing pressure to tackle Canadian anger over unaffordable housing while avoiding quick fixes that drive up inflation, and could unveil a new strategy for the troublesome sector in coming months, former adviser Tyler Meredith told MNI.

- “This has become a real metaphor issue of middle-class success,” said Meredith, who advised Trudeau and the two finance ministers in his cabinet since taking office in 2015 and is a founding partner of Meredith Boessenkool Policy Advisors.

- “Right now the government is struggling on that metric, and if they can’t at least bring it to a tie going into the next election they will have some challenges.” (See: MNI INTERVIEW: Trudeau Hints At Govt Homebuilding-Ex Adviser)

- Trudeau's Liberals must call an election by 2025 and could be pushed sooner if the NDP party it leans on to pass confidence votes withdraws their support. For more see MNI Policy main wire at 0851ET.

OVERNIGHT DATA

- No economic data or scheduled Fed speakers today.

- Chicago Fed President Goolsbee returns Tuesday at 1430ET with opening remarks at a Fed listens event on youth employment, followed by a fireside chat with Gov Bowman at 1530ET.

- Markets eager for details on next week's KC Fed Economic Policy Symposium in Jackson Hole: ‘Structural Shifts in the Global Economy,’ from August 24 to August 26 (schedule/attendees list likely announced the evening of the 24th).

FED: The Dallas Fed Banking Conditions Survey (here), collected Aug 8-16 with 71 financial institutions taking part, showed loan demand declining for the eighth period in a row, marking for a year of declines even if the rate of decline eased somewhat.

- Credit standards also tightened again although the share of respondents tightening was the smallest since February.

- Non-performing loans meanwhile increased again on balance, but by a slightly slower pace than was seen in the prior survey released Jun 26, with a net 13% seeing increases vs 15% almost two months prior.

- Non-performing loans meanwhile increased again on balance, but by a slightly slower pace than was seen in the prior survey released Jun 26, with a net 13% seeing increases vs 15% almost two months prior.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 29.36 points (-0.09%) at 34474.4

- S&P E-Mini Future up 27.75 points (0.63%) at 4410.75

- Nasdaq up 200.8 points (1.5%) at 13492.84

- US 10-Yr yield is up 8.1 bps at 4.3359%

- US Sep 10-Yr futures are down 18/32 at 109-2.5

- EURUSD up 0.0026 (0.24%) at 1.0899

- USDJPY up 0.73 (0.5%) at 146.12

- WTI Crude Oil (front-month) down $0.55 (-0.68%) at $80.70

- Gold is up $5.6 (0.3%) at $1895.03

- EuroStoxx 50 up 11.92 points (0.28%) at 4224.87

- FTSE 100 down 4.61 points (-0.06%) at 7257.82

- German DAX up 29.02 points (0.19%) at 15603.28

- French CAC 40 up 33.95 points (0.47%) at 7198.06

US TREASURY FUTURES CLOSE

- 3M10Y +8.472, -110.586 (L: -123.556 / H: -108.994)

- 2Y10Y +3.613, -65.606 (L: -69.235 / H: -64.381)

- 2Y30Y +3.211, -53.956 (L: -57.09 / H: -51.747)

- 5Y30Y +1.089, -0.299 (L: -1.633 / H: 2.981)

- Current futures levels:

- Sep 2-Yr futures down 2.875/32 at 101-9.5 (L: 101-08.5 / H: 101-12.5)

- Sep 5-Yr futures down 10.5/32 at 105-20 (L: 105-17.5 / H: 105-31.25)

- Sep 10-Yr futures down 18/32 at 109-2.5 (L: 108-31 / H: 109-22)

- Sep 30-Yr futures down 1-10/32 at 117-29 (L: 117-21 / H: 119-10)

- Sep Ultra futures down 1-16/32 at 122-29 (L: 122-17 / H: 124-18)

US 10Y FUTURE TECHS: (U3) Fresh Cycle Low

- RES 4: 112-07 High Jul 27

- RES 3: 111-29 High Aug 10

- RES 2: 111-25 50-day EMA

- RES 1: 110-07/110-21+ High Aug 15 / 20-day EMA

- PRICE: 109-02+ @ 20:01 BST Aug 21

- SUP 1: 108-31 Intraday low

- SUP 2: 108-26+ Low Oct 21 2022 (cont) and a major support

- SUP 3: 108-03+ 2.0% 10-dma envelope

- SUP 4: 107.17 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The trend direction in Treasuries remains down and the contract has started the week on a bearish note, breaking to a fresh cycle low. The break confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Last week’s break of support at 109.24, the Aug 4 low, also confirmed a resumption of the bear cycle. The focus is on 108.19+, a Fibonacci projection. Firm resistance is 110-21+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 23 -0.015 at 94.585

- Dec 23 -0.035 at 94.585

- Mar 24 -0.050 at 94.765

- Jun 24 -0.055 at 95.060

- Red Pack (Sep 24-Jun 25) -0.075 to -0.06

- Green Pack (Sep 25-Jun 26) -0.09 to -0.08

- Blue Pack (Sep 26-Jun 27) -0.10 to -0.095

- Gold Pack (Sep 27-Jun 28) -0.10 to -0.095

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00351 to 5.31778 (+.00377 total last wk)

- 3M -0.00583 to 5.37734 (+0.01860 total last wk)

- 6M -0.01552 to 5.42902 (+0.02946 total last wk)

- 12M -0.02767 to 5.35571 (+0.07756 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% volume: $257B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.314T

- Broad General Collateral Rate (BGCR): 5.27%, $549B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $541B

- (rate, volume levels reflect prior session)

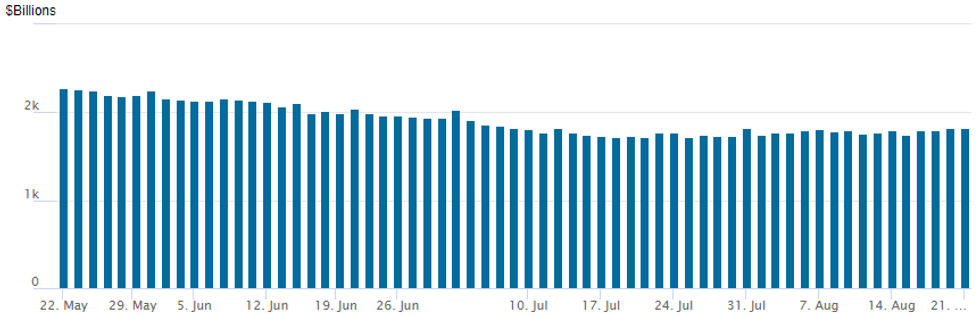

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation climbs to $1,824.788B w/96 counterparties, compared to $1,819.201B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $500M Pricoa Global Funding 3Y Debt Launched; DBJ, EIB Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 08/20 $500M #Pricoa Global Funding 3Y +88

- Rolled over to Tuesday's order of business:

- 08/21 $Benchmark DBJ (Development Bank of Japan) 3Y SOFR+65a

- 08/21 $Benchmark EIB 5Y SOFR+25a

EGBs-GILTS CASH CLOSE: Bear Steepening Resumes

Core European FI weakened Monday higher ahead of event risk later in the week.

- Yields extended higher throughout most of the session on relatively low volumes, with curves steepening.

- 10Y Bund and Gilt yields neared last week's highs, but unlike their US counterparts which hit 2007 levels, did not quite break higher.

- Given the bear steepening move, though, it appears that the higher-for-longer-trade seen for most of last week has resumed.

- An overnight risk-off move following a smaller-than-expected lending rate cut by China saw limited follow-through in Europe. With sparse data (German PPI was more deflationary than expected but triggered little reaction) and no speakers, attention was kept on global flash PMIs and Powell and Lagarde speeches at Jackson Hole later this week.

- Periphery spreads tightened modestly, led by BTPs.

- This week's thin issuance schedule (Belgium sold OLOs today) continues Tuesday with Gilt Linkers and possible EFSF syndication.

- Tuesday we also get UK public finance and Eurozone current account data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.7bps at 3.116%, 5-Yr is up 7.9bps at 2.705%, 10-Yr is up 8.1bps at 2.703%, and 30-Yr is up 6.9bps at 2.8%.

- UK: The 2-Yr yield is up 4.1bps at 5.236%, 5-Yr is up 6bps at 4.75%, 10-Yr is up 5.4bps at 4.729%, and 30-Yr is up 5.1bps at 4.925%.

- Italian BTP spread down 1.3bps at 169.4bps / Spanish down 0.7bps at 104.8bps

FOREX USD Scales Back Yield-Driven Appreciation, But USDJPY Remains In Focus

- The USD index has ultimately reversed a large part of its rise seen through the first half of the US session in moves attributed to a marching higher in US yields, with the 10Y real touching fresh highs since 2009 to push the nominal yield to its highest since 2007 with a clearance of 4.35%. An only small paring of these FI losses has seen a surprisingly large paring in the DXY for -0.1% on the day, coinciding with a second half recovery in US equities.

- Higher yields have however underpinned the bounce for USDJPY. It may be off a session high of 146.404 but still trades at 146.13 (+0.5%), firmly re-establishing itself above the 146 handle.

- Last week's price action resulted in a break of 145.07, the Jun 30 high, which confirmed a resumption of the uptrend. Moving average studies are in a bull mode condition, highlighting current positive sentiment. The initial target on the topside will be 146.56, last week's high and a resistance that dates back to November last year. Above here, the focus will shift to 147.49, a Fibonacci projection.

- Reports continue to speculate over potential BOJ intervention, however, there has no been escalation of the usual rhetoric from MOF officials. Indeed, JPMorgan stated that Japan's threshold for currency market intervention on the yen is likely to be around 150 per dollar. Analysts noted that the fundamental conditions in the Japanese economy had been improving since the last time the MoF intervened to lift the yen in September and October last year.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/08/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 22/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 22/08/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2023 | - | * |  | FR | Retail Sales |

| 22/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/08/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/08/2023 | 1830/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 23/08/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.