-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI ASIA OPEN: Stocks Surge In Spite Of Election Uncertainty

EXECUTIVE SUMMARY

- MNI POLICY: US Vote Too Close To Call, May Be Days For Result

- MNI PREVIEW: BOE To Boost QE, But Little Guidance On How Much

- MNI INTERVIEW: BOE Needs To Speed Up, Vary QE-NIESR Economist

- MNI BRIEF: McConnell Says US In Need of Fiscal Before Year-End

- MNI INTERVIEW: US Services Job Growth Slows On Virus Limits

- BOE: BRINGING FORWARD THE ANNOUNCEMENT OF RATE DECISION ON THUR. TO 0700 GMT

US: Stimulus Light?

US: U.S. Senator Mitch McConnell said Wednesday that Congress should move before year-end to put through a "targeted" fiscal stimulus. "We need to do it, and I think we need to do it before the end of the year," the Senate Majority Leader said in a press conference in his home state of Kentucky after winning another six-year term. McConnell said there is a "possibility" the next coronavirus aid package will help state and local governments, a key Democratic ask that has so far served as a block on reaching a fiscal relief deal among Republicans and Democrats.

US: Growth in the U.S. service sector should continue but employment gains will remain muted if social distancing guidelines stay in place through winter, Institute for Supply Management services chair Anthony Nieves told MNI. For more see 11/04 main wire at 1320ET.

EUROPE

BOE: The Bank of England is set to expand its quantitative easing programme at its meeting this week as the economic outlook darkens, but a lack of guidance means modal market expectations for an additional GBP100 billion to take its stock of asset purchases to GBP845 billion could prove off the mark in either direction. For more see 11/04 main wire at 0726ET.

BOE: The Bank of England may have to accelerate the pace of its quantitative easing and extend purchases beyond gilts if it wishes to increase stimulus as increasing the volume of QE provides diminishing returns, National Institute of Economic and Social Research senior economist Corrado Macchiarelli, told MNI. For more see 11/04 main wire at 1240ET.

OVERNIGHT DATA

US DATA: September Trade Deficit -4.7% to -USD63.9B

- The U.S. international goods and services trade deficit narrowed in September, falling 4.7% to -$63.9B, according to figures published Wednesday by the Census Bureau and the Bureau of Economic Analysis, in line with market expectations.

- That decline reflected a decrease in the goods deficit to $80.7B and a slight increase in the services surplus to $16.8B.

- September exports grew by $4.4B (+2.6%) to $176.4B, while imports rose $1.2B (+0.5%) to $240.2B

- The U.S. trade gap with China narrowed slightly to -$29.6B from -$29.8B in August. The trade gap with Canada widened to -$1.3B in September from -$953M. The trade gap with the European Union also widened to -$16B from -$15.7B in August.

- US DATA: ISM Services PMI Eased in Oct

- US ISM SERVICES PMI 56.6 OCT VS 57.8 SEP

- US ISM SERVICES BUSINESS INDEX 61.2 OCT VS 63.0 SEP

- US ISM SERVICES EMPLOYMENT INDEX 50.1 OCT VS 51.8 SEP

- US ISM SERVICES NEW ORDERS 58.8 OCT VS 61.5 SEP

- US ISM SERVICES SUPPLIER DELIVERIES 56.2 OCT VS 54.9 SEP (NSA)

- The ISM Services PMI eased 1.2pt to 56.6 in Oct, falling short of market expectations looking for a broadly unchanged reading of 57.5. Among the main four categories, New Orders (-2.7pt) saw the largest decline, followed by Business Activity (-1.8pt) and Employment (-1.7pt). Supplier Deliveries (+1.3pt) was the only major category to show a monthly gain. Employment recorded the second successive reading above the 50-mark after having registered below it for six month in a row. Among all sub-indicators, Inventory sentiment (-1.3pt to 51.1) saw the biggest drop, while Imports (+5.9pt to 63.9) registered the largest increase, followed by Prices (+4.9pt to 63.9). Inventories and the Backlog of Work both ticked up 4.3pt to 53.1 and 54.4, respectively with Inventories shifting back into expansion after sitting below the 50-mark for two months. Exports ticked up as well, rising by 1.1pt to 53.7 in Oct.

US: U.S. Treasury Increases Auctions Again In Quarterly Refunding

- Next week's refunding is USD122 billion (USD54B 3Y, USD41B 10Y, USD27B 30Y)

- Treasury announces changes in coupon and FRN auction sizes that will result in an additional USD105 billion of nominal coupon issuance during the November-January quarter compared to the previous quarter.

- Treasury anticipates gradually increasing TIPS issuance across all tenors in CY 2021, expecting total gross issuance of TIPS to increase by USD10 billion to USD20 billion in CY 2021.

- No decision has been made by Treasury on a potential SOFR FRN.

- Anticipated auction sizes (in $B) for upcoming quarter

- 2-yr 3-yr 5-yr 7-yr 10-yr 20-yr 30-yr FRN

- Oct-20 54 52 55 53 35 22 23 26

- Nov-20 56 54 57 56 41 27 27 24

- Dec-20 58 56 59 59 38 24 24 24

- Jan-21 60 58 61 62 38 24 24 28

- US MBA: MARKET COMPOSITE +3.8% SA THRU OCT 30 WK

- US MBA: REFIS +6% SA; PURCH INDEX -1% SA THRU OCT 30 WK

- US MBA: UNADJ PURCHASE INDEX +25% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.01% VS 3.00% PREV

MARKETS SNAPSHOT: Key Market Levels

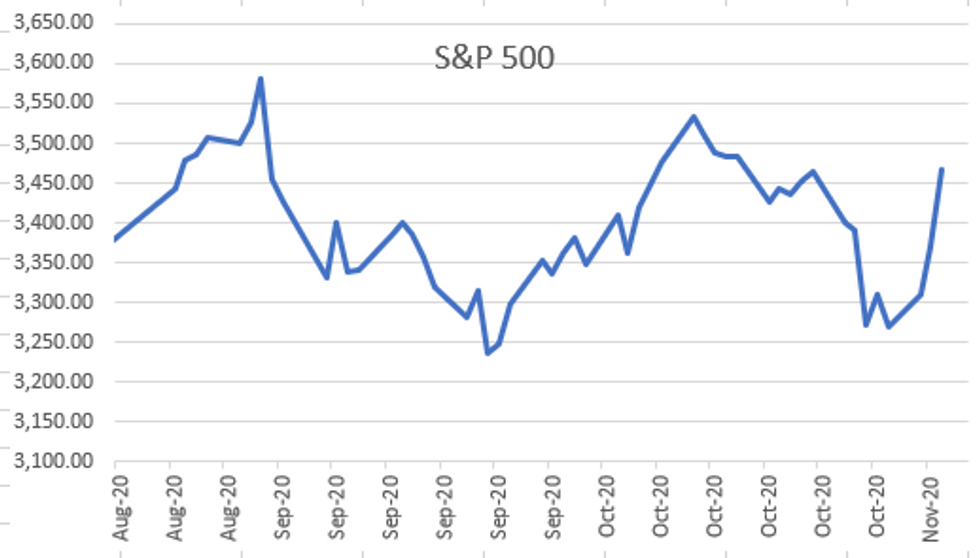

- DJIA up 402.49 points (1.46%) at 28132.15

- S&P E-Mini Future up 74.5 points (2.22%) at 3459.75

- Nasdaq up 397.3 points (3.6%) at 11601.16

- US 10-Yr yield is down 13.1 bps at 0.7679%

- US Dec 10Y are up 27/32 at 138-30

- EURUSD up 0.0003 (0.03%) at 1.1719

- USDJPY up 0.03 (0.03%) at 104.47

- WTI Crude Oil (front-month) up $1.38 (3.66%) at $39.08

- Gold is down $11 (-0.58%) at $1897.2

- European bourses closing levels:

- EuroStoxx 50 up 62.35 points (2.01%) at 3097.52

- FTSE 100 up 96.49 points (1.67%) at 5803.67

- German DAX up 235.24 points (1.95%) at 12098.75

- French CAC 40 up 117.24 points (2.44%) at 4824.92

US TSY SUMMARY

Very well bid -- and yet off early morning highs. Heavy volumes (TYZ>2.7M) amid Presidential election uncertainty driving the main driver (Biden w/248 electoral votes after officially taking Wisconsin, needs 270 to win). Late count for NV and MI leaning towards Biden, heavy mail-in ballot count remains for PA.

- Increasing odds of Biden win also driven huge buying spree in equities (S&Ps +92.0, NDX +452.0, Dow +535.0). Double digit bear flattening in yield curves, some fast$ accts stopped out in the move.

- Surge in buying across the curve kicked off early overnight as polling numbers ebbed and flowed for each candidate, yields bottomed out early (10YY 0.7545% low; 30YY 1.5029 low -- both still well off March all-time lows) but held range through NY session.

- Trump wants WI recount, in WI, suing to stop count of MI ballots.

- More prosaic items: ADP Private employ miss +365k vs. +650k est, possibly tempering Fri's NFP though no dealer adj's made (+590k est). Weekly claims and FOMC policy annc Thu. The 2-Yr yield is down 2.6bps at 0.1408%, 5-Yr is down 7.3bps at 0.3227%, 10-Yr is down 12.6bps at 0.7729%, and 30-Yr is down 12.6bps at 1.5545%.

TSY FUTURES CLOSE: Very Well Bid On Election Uncertainty

Very well bid -- and yet off early morning highs, double digit bear flattening in yield curves. Update:

- 3M10Y -12.544, 67.496 (L: 65.818 / H: 84.372)

- 2Y10Y -10.551, 62.153 (L: 60.331 / H: 76.756)

- 2Y30Y -10.812, 139.967 (L: 134.837 / H: 157.635)

- 5Y30Y -6.114, 122.166 (L: 116.912 / H: 133.018)

- Current futures levels:

- Dec 2Y up 1.62/32 at 110-13.87 (L: 110-11.87 / H: 110-14.12)

- Dec 5Y up 10.25/32 at 125-27.5 (L: 125-12.25 / H: 125-28.25)

- Dec 10Y up 28.5/32 at 138-31.5 (L: 137-20.5 / H: 139-01)

- Dec 30Y up 2-18/32 at 174-19 (L: 170-07 / H: 175-03)

- Dec Ultra 30Y up 5-01/32 at 219-12 (L: 210-12 / H: 220-30)

EURODOLLAR FUTURES CLOSE: Sharply Higher, Long End Leads, Heavy Volumes

Mirroring Tsy futures, Eurodollar futures sharply higher across the strip, long end outperforming. Lead quarterly hold modest bid since 3M LIBOR set +0.00750 to 0.23225% (+0.01650/wk). Currently:

- Dec 20 +0.005 at 99.755

- Mar 21 +0.010 at 99.795

- Jun 21 +0.010 at 99.80

- Sep 21 +0.020 at 99.805

- Red Pack (Dec 21-Sep 22) +0.020 to +0.035

- Green Pack (Dec 22-Sep 23) +0.040 to +0.060

- Blue Pack (Dec 23-Sep 24) +0.070 to +0.110

- Gold Pack (Dec 24-Sep 25) +0.115 to +0.140

US DOLLAR LIBOR

Latest settles

- O/N -0.00050 at 0.08150% (+0.00012/wk)

- 1 Month -0.00150 to 0.13613% (-0.00412/wk)

- 3 Month +0.00750 to 0.23225% (+0.01650/wk)

- 6 Month -0.00013 to 0.24375% (+0.00162/wk)

- 1 Year -0.00087 to 0.33313% (+0.00300/wk)

US TSY SHORT TERM RATES

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $157B

- Secured Overnight Financing Rate (SOFR): 0.10%, $948B

- Broad General Collateral Rate (BGCR): 0.07%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $317B

- (rate, volume levels reflect prior session)

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Next week's purchase schedule:

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

PIPELINE: Issuers remain sidelined amid US Presidential Election uncertainty

FOREX: Greenback Reverses as Biden Odds Creep Higher

Despite the overnight volatility in betting odds, Biden holds a strong likelihood of victory with just the key swing states of Nevada, Pennsylvania, Georgia and North Carolina still up for grabs. After a particularly strong start, the USD reversed into the London close, with the greenback finishing close to the lows - reflecting the incline of Biden's implied odds to win the White House throughout the day.

- Equities rallied sharply, with the S&P adding near 3% and the NASDAQ as much as 4% at some points of the session. US Treasury yields fell from the off, with the 10y yield nearing last week's lows of 0.7443.

- GBP was the sole currency in G10 to underperform the USD Wednesday, with Barnier appearing in front of EU lawmakers to warn that differences remain between the UK and EU on key topics including fishing, and level playing field regulations. GBP/USD traded either side of 1.30 throughout.

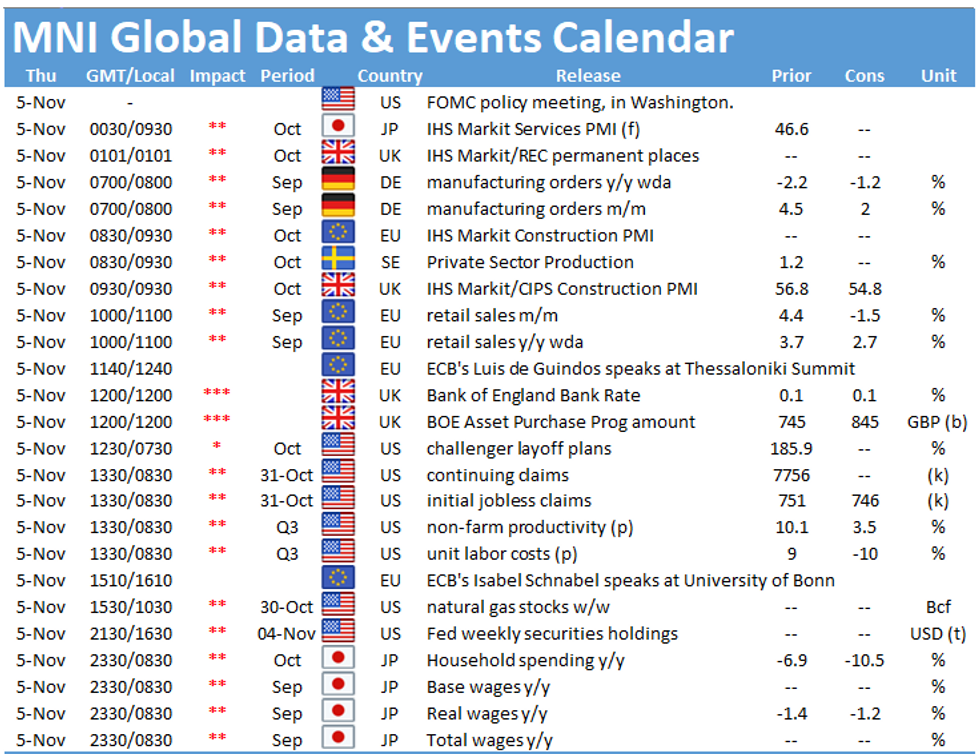

- Focus Thursday turns to the several central bank meetings - with the BoE, Norges Bank and Federal Reserve decisions all on the docket. Both the Fed and the Norges Bank are not seen making any changes to policy, but the BoE are likely to up the size of their QE programme in order just as the UK re-enter lockdown restrictions.

EGBs-GILTS CASH CLOSE: Pre-BOE Bull Flattening

The UK and German curves bull flattened (long-end Gilts outperformed) Wednesday as a US election for the ages played out (and continues to play out). Periphery EGBs were mixed, BTPs outperformed. Reminder, Thursday's BoE MPC decision has shifted earlier to 0700GMT so as not to conflict with the Chancellor's statement. Per our preview, the BoE is expected to announce an additional GBP100bn in QE.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.1bps at -0.793%, 5-Yr is down 1bps at -0.817%, 10-Yr is down 1.8bps at -0.638%, and 30-Yr is down 1.7bps at -0.231%.

- UK: The 2-Yr yield is down 3.1bps at -0.073%, 5-Yr is down 3.5bps at -0.073%, 10-Yr is down 6.5bps at 0.207%, and 30-Yr is down 7.6bps at 0.764%.

- Italian BTP spread down 2.9bps at 132.5bps

- Spanish bond spread unchanged at 73bps

- Portuguese PGB spread up 0.1bps at 70.3bps

- Greek bond spread down 2.3bps at 149.4bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.