-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Shelton Nomination Blocked

EXECUTIVE SUMMARY

- SENATE BLOCKS SHELTON NOMINATION TO FED BOARD

- MNI POLICY: Fed's Barkin Sees Divergent Recovery Scenarios

- MNI INTERVIEW: Biden Could Give Fed More Leeway-Spriggs

- MNI POLICY: Fed's Powell: Long Way From Full Recovery

- MNI EXCLUSIVE: EU Budget Standoff Set To Drag On Beyond Summit

- MNI BRIEF: ECB Unlikely To Use Deposit Rates To Spur Bank M&A

- EU: Econ Comm: Hard Work Needed To Avoid Delay To COVID-19 Recovery Fund

- DUDLEY: SAYS VERY LIKELY FED WILL EXTEND EMERGENCY LOAN PROGRAMS, Bbg

- DUDLEY: EXTENDING MATURITY OF FED BOND BUYING MAKES SENSE, Bbg

US

FED: Federal Reserve Bank of Richmond President Tom Barkin said Tuesday his outlook for 2021 remains highly uncertain depending on the path of Covid-19 and the Fed should keep its stimulus program going. For more see 11/17 main wire at 1607ET.

FED: A Biden administration will likely give the Fed more leeway to boost emergency lending and could pump money into struggling companies to boost federal support for the economy even in the absence of a large fiscal stimulus from Congress, William Spriggs, an adviser to the president-elect's campaign who is reportedly in the running for a senior government post, told MNI. For more see 11/17 main wire at 1344ET.

FED: The U.S. economy will need ongoing support from monetary and fiscal policy to navigate major risks including a surge in Covid cases that could slow the recovery, Federal Reserve Chairman Jerome Powell said Tuesday. The labor market, despite an impressive recovery from the initial second-quarter slump, was still a long way from the conditions seen before the crisis, he said. The unemployment rate was 6.9% in October.

- "It's likely the economy will continue to need support from both monetary policy and fiscal policy," Powell said. For more see 11/17 main wire at 1343ET.

EUROPE

ECB: The ECB is unlikely to follow the lead of the Bank of Japan in providing higher deposit rates for banks which consolidate or cut costs, a senior European official told MNI.

- "It would require the ECB to establish which bank restructurings are desirable and which are not," said the official, commenting on the BOJ's recent introduction of a "special deposit facility" for regional banks. "I don't think it could work in the EU."

- Comes after Hungary and Poland effectively vetoed the long-term budget and associated COVID-19 recovery fund yesterday. Gentiloni says the EU does not want to 'consider any plan B' in relation to the veto.

- If this is the case the institutions will be reliant on Poland and Hungary buckling and accepting the rule of law provision related to the distribution of funds that initiated their effective vetoes.

EU: European Union leaders are likely to need more than this Thursday's video summit to break a deadlock over the bloc's EUR1.8 trillion 2021-27 budget, vetoed by Poland and Hungary over a requirement for member states in receipt of EU funds to meet standards for rule of law, officials told MNI. For more see 11/17 main wire at 1210ET.

OVERNIGHT DATA

September's larger-than-expected increase was revised down to 1.6% (prev +1.9%).

- Motor vehicle sales were up 0.4% in October following a 2.9% increase in September. Gas station sales were also up 0.4% after rising 2.0% in September.

- Excluding motor vehicle sales, retail sales were up 0.2% in October when markets had expected a gain of 0.6%. Excluding motor vehicle and gas station sales, retail sales rose 0.2%, below forecasts for a 0.6% increase.

- Clothing and clothing accessories store sales plummeted in October, falling by 4.2% after a 8.0% gain in September.

- Sporting goods store sales also dropped by 4.2% in October. Other notable declines came from general merchandise store sales (-1.1%), furniture and home furnishing store sales (-0.4%), food and beverage store sales (-0.2%), and health and personal care store sales (-0.1%). Restaurant sales were also down -0.1%.

- Sales at non-store retailers were up 3.1% in October. Building material and garden equipment store sales rose 0.9% through the month. Sales of electronics were up 1.2%.

- October import prices fell 0.1% vs expectations for flat, driven by lower fuel prices, and September was revised down a tenth to 0.2%.

- It was the first decline since April. YoY import prices -1.0%.

- Import fuel prices -1.9%, with petroleum -1.0% and natural gas -18.1% (largest drop since June 2019)

- Nonfuel imports rose 0.1%, adding to previous months increases since April, led by industrial supplies and food and beverage. Consumer goods imports and auto import prices fell -0.2% and -0.1%, respectively.

- Prices for U.S. exports rose 0.2%, as expected, after rising 0.6% the previous month.

- Industrial production in October rose 1.1% vs 1.0% expected while September's gain was revised two-tenths higher to -0.4%.

- October capacity utilization +0.8pp to 72.8%, above expectations of 72.3%. September capacity utilization was revised up to 72.0% from 71.5%.

- Industrial production has recovered much of its 16.5% decline from February to April, but output in October was still 5.6% lower than its pre-pandemic February level.

- Manufacturing output rose 1.0% in October

- Mining -0.6%

- Utilities +3.9%

US SEP BUSINESS INVENTORIES +0.7%; SALES +0.6%

US SEP RETAIL INVENTORIES +1.7%

US NAHB HOUSING MARKET INDEX 90 IN NOV

US NAHB NOV SINGLE FAMILY SALES INDEX 96; NEXT 6-MO 89

US REDBOOK: NOV STORE SALES -1.0% V OCT THROUGH NOV 14 WK

US REDBOOK: NOV STORE SALES +1.4% V YR AGO MO

US REDBOOK: STORE SALES +1.7% WK ENDED NOV 14 V YR AGO WK

CANADA SEP WHOLESALE SALES +0.9%; EX-AUTOS +0.9%

SEP WHOLESALE INVENTORIES +0.7%: STATISTICS CANADA

FOREIGN HOLDINGS OF CANADA SECURITIES +4.5B CAD IN SEP

CANADIAN HOLDINGS OF FOREIGN SECURITIES +11.2B CAD IN SEP

MARKET SNAPSHOT

- DJIA down 104.93 points (-0.35%) at 29950.44

- S&P E-Mini Future down 6.25 points (-0.17%) at 3604.75

- Nasdaq up 20.9 points (0.2%) at 11924.13

- US 10-Yr yield is down 3.3 bps at 0.8734%

- US Dec 10Y are up 8/32 at 138-9

- EURUSD up 0.0014 (0.12%) at 1.1885

- USDJPY down 0.37 (-0.35%) at 104.21

- WTI Crude Oil (front-month) up $0.06 (0.15%) at $41.32

- Gold is down $2.53 (-0.13%) at $1887.83

- European bourses closing levels:

- EuroStoxx 50 up 2.27 points (0.07%) at 3444.1

- FTSE 100 down 55.96 points (-0.87%) at 6360.92

- German DAX down 5.14 points (-0.04%) at 13067.54

- French CAC 40 up 11.52 points (0.21%) at 5445.69

US TSY SUMMARY: Rates Higher, Risk Unwound

Tsy futures are broadly higher after the bell, near top end of the session range with equities trading weaker after clawing off lows since midmorning. Several factors at play.

- Steady bid overnight as global spread of Covid-19 continues, nations balancing shut-down to curb spd vs. negative effect on economy. Lower than exp retail sales (+0.3% vs. 0.5% exp) and revisions spurred better buying across the curve in early NY trade.

- Multiple Fed speakers to absorb again, Former NY Fed Pres Dudley on Bbg TV said US in "much worse place than we were in October" in relation to the virus; extending maturity of Fed bond buying makes sense.

- Rates see-sawed near highs all session. Equities, however, bounced around 1000ET after talk of targeted fiscal support resumed. Equities sold off after the rate close on reports of rocket attack near US Baghdad embassy (this on heels of Trump annc troop drawdown in Iraq and Afghanistan).

- Flow-wise, fast$ joined prop and real$ buying across curve, heavy rate lock sales as mkt absorbed near $40B high-grade corp debt, Dec/Mar roll getting underway.

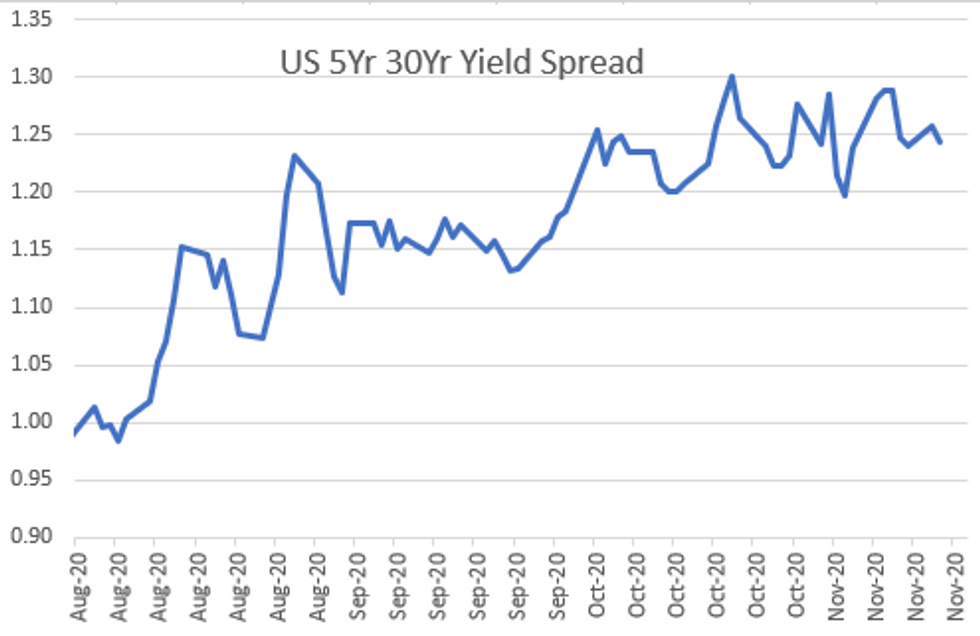

- The 2-Yr yield is down 0.4bps at 0.1732%, 5-Yr is down 2.1bps at 0.3856%, 10-Yr is down 3.3bps at 0.8734%, and 30-Yr is down 3.4bps at 1.629%.

US TSY FUTURES CLOSE: Rates Higher, Risk Unwound

Tsy futures are broadly higher after the bell, near top end of the session range with equities trading weaker after clawing off lows since midmorning. Underwhelming data, rocket attack near US Baghdad embassy and COVID-19 quarantine crack down adding to safe haven bid. Yld curves flatter:

- 3M10Y -2.591, 78.896 (L: 77.228 / H: 82.055)

- 2Y10Y -3.211, 69.491 (L: 68.837 / H: 73.523)

- 2Y30Y -3.653, 144.718 (L: 144.059 / H: 149.507)

- 5Y30Y -1.814, 123.68 (L: 122.927 / H: 126.149)

- Current futures levels:

- Dec 2Y +0.25/32at 110-11.625 (L: 110-11.25 / H: 110-11.75)

- Dec 5Y +2.75/32 at 125-17.25 (L: 125-13.5 / H: 125-18)

- Dec 10Y +8/32 at 138-9 (L: 137-30.5 / H: 138-11)

- Dec 30Y +21/32 at 172-18 (L: 171-19 / H: 172-28)

- Dec Ultra 30Y +1-10/32 at 216-0 (L: 214-02 / H: 216-19)

US TSY FUTURES: Dec/March Futures Roll Picks Up

Lead quarterly roll volume picking up -- two weeks before Dec futures cede lead to Mar futures on Nov 30 "first notice" date. Dec futures won't expire until mid-late December: 10s, 30s and Ultras on 12/21; 2s & 5s 12/31. All well under 5% completed at the moment:

- TUU/TUZ appr 3,600 0.25 last;

- FVU/FVZ appr 4,900 -9.75 last;

- TYU/TYZ appr 16,500 12.5 last;

- UXYU/UXYZ under 5,300, 19.75 last;

- USU/USZ 13,000, -1-09.25 last;

- WNU/WNZ 5,600, 1-20.75 last;

US EURODOLLAR FUTURES CLOSE: Steady/Mixed, Long End Mirrors Bond Bid

Futures trade steady/mixed after the bell, Whites lagging Reds through Golds. Lead quarterly EDZ0 weaker since 3M LIBOR surged +0.01062 to 0.23100% (+0.00900/wk). Current levels:

- Dec 20 -0.005 at 99.750

- Mar 21 -0.005 at 99.780

- Jun 21 -0.005 at 99.785

- Sep 21 steady at 99.785

- Red Pack (Dec 21-Sep 22) steady to +0.015

- Green Pack (Dec 22-Sep 23) +0.020 to +0.030

- Blue Pack (Dec 23-Sep 24) +0.035 to +0.045

- Gold Pack (Dec 24-Sep 25) +0.050 to +0.055

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00150 at 0.08213% (-0.00112/wk)

- 1 Month +0.00600 to 0.14950% (+0.01312/wk)

- 3 Month +0.01062 to 0.23100% (+0.00900/wk)

- 6 Month +0.00900 to 0.25800% (+0.01200/wk)

- 1 Year -0.00088 to 0.33875% (-0.00063/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $157B

- Secured Overnight Financing Rate (SOFR): 0.10%, $953B

- Broad General Collateral Rate (BGCR): 0.08%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $320B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.475B submission

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $38.330B submission

- Next scheduled purchases:

- Wed 11/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Surge In Domestic/Foreign Corporate Debt Issuance

$34.9B To Price Tuesday, IBRD, Saudi Aramco, Volkswagen lead

- Date $MM Issuer (Priced *, Launch #)

- 11/17 $8B *World Bank (IBRD) $3B 3Y +2, $5B 7Y +14

- 11/17 $7.5B #Saudi Aramco $500M 3Y +110, $1B 5Y +125, $1.5B 10Y +145, $2.25B 30Y 3.3% yld, $2.25B 50Y 3.65% yld

- 11/17 $4B #VW AM $1B 2Y +60, $1.25B 3Y +70, $1.25B 5Y +90, $500M 7Y +105

- 11/17 $3B *Rep of Italy +5Y +85 (+30Y still considered)

- 11/17 $2B #Deutsche Bank 6NC5 fix/FRN +175

- 11/17 $2B #HSBC 6.5NC5.5 +120

- 11/17 $1.7B #American Tower $500M 3Y +43, $650M 7Y +87.5, $550M 30Y +137.5

- 11/17 $1.5B #ANZ 15NC10 +170

- 11/17 $1.2B #Air Lease $600M 5Y tap +220, $600M 10Y +250

- 11/17 $1.1B #Entergy Louisiana 3NC1 +40

- 11/17 $1B *BNG Bank 5Y +10

- 11/17 $1B #BCFM +3Y +47

- 11/17 $900M Alexander Funding 3Y +162a

FOREX: Markets Reverse Vaccine Trade, Working Against Antipodeans

After securing an all-time high close Monday on Moderna's vaccine news, markets ebbed lower Tuesday, with profit-taking the most likely culprit. US equities shed around 0.5%, helping underpin a further JPY rise. USD/JPY sank through the Monday low with relatively little difficulty, although the Y104 handle support stands for now.

- This worked against the likes of AUD, CAD and NZD, which were the worst performing currencies in G10 Tuesday.

- GBP traded well, helping GBP/USD trade within 40 pips of the multi-month high at 1.3312 printed last week. Markets are now beginning to eye the end of next week as a key date by which to secure a Brexit deal after sources reported to Bloomberg that negotiating teams were honing in on a deal.

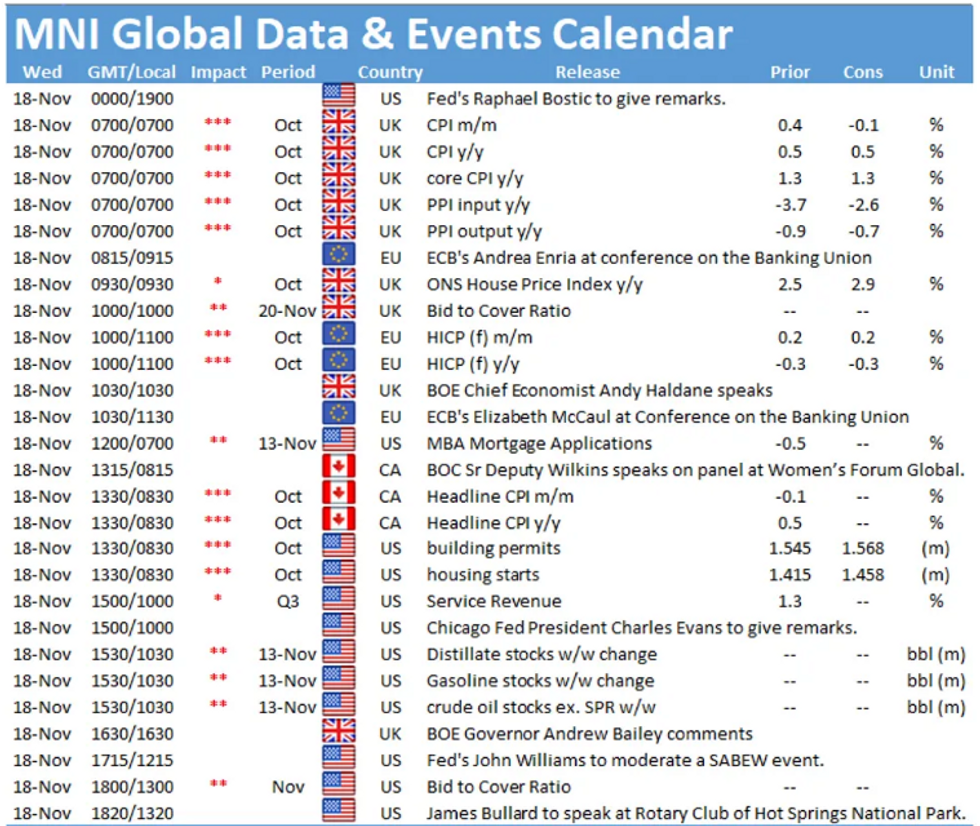

- Focus Wednesday turns to UK and Canadian inflation data for October and US Building Permits. BoE's Haldane, BoC's Wilkins and Fed's Williams, Bullard & Kaplan are on the docket.

EGBs-GILTS CASH CLOSE: Bonds Supported as Equities Stall

The gilt curve bull flattened on the day alongside weak trading in equities. Cash yields were up to 3bp lower, with the long-end outperforming. The DMO earlier sold GBP3.25bn of the 0.125% Jan-24 Gilt and GBP2.00bn 0.625%Oct-50 Gilt.

- EGBs were mixed, but core German and French bonds saw support as the equity rally stalled.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is unchanged at -0.744%, 5-Yr is down 1.1bps at -0.780%, 10-Yr is down 1.7bps at -0.564%, and 30-Yr is down 2.2bps at -0.162%.

- UK: The 2-Yr yield is down 0.8bps at -0.044%, 5-Yr is down 1.2bps at 0.003%,10-Yr is down 2.5bps at 0.321%, and 30-Yr is down 3.3bps at 0.909%.

- Italian BTP spread up 0.5bps at 119.9bps

- Spanish bond spread down 0.7bps at 63.3bps

- Portuguese PGB spread down 1.7bps at 60.0bps

- Greek bond spread down 2.8bps at 122.2bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.