-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fiscal Stopgap Easier Than Covid Relief

EXECUTIVE SUMMARY

- MNI BRIEF: Congress To Vote On One-Week Fiscal Stopgap

- MNI BRIEF: US Covid Relief Bill Odds Are Edging Up- Kudlow

- MNI INSIGHT: More QE, No Negative Rates, In BOE Brexit Toolbox

- MNI BRIEF: Still No EU/UK Agreement On Trade

- EU-UK: Markets Look Toward Johnson / VdL Meeting in "Coming Days"

- MNI PREVIEW: BOC Seen Holding CAD4B QE Pace, 0.25% Rate

- MNI BRIEF: Canada Ivey Job Index in 1st Negative Turn Since May

- U.S. SANCTIONS CHINA OFFICIALS FOR HONG KONG-RELATED ACTIONS, Bbg

US

US: The U.S. House of Representatives will vote Wednesday on a one-week stopgap spending bill that would push off a partial government shutdown until Dec. 18, according to House Majority Leader Steny Hoyer.

- "I am disappointed that we have not yet reached agreement on government funding," and the interim funding will allow talks to continue, Hoyer tweeted Monday.

- Extending the funding deadline also gives Congress extra time to come to an agreement on a potential Covid relief package.

US: White House chief economic adviser Larry Kudlow said Monday "the odds are improving" that lawmakers in Washington can agree to another economic relief program before year-end.

- "We are focusing on this USD900 billion Problem Solver's package," he said at a Washington Post event, seemingly distancing the White House from a USD332 billion Senate GOP proposal released last week.

- While the President has not endorsed the USD908 billion bipartisan proposal unveiled last week, Kudlow said, it is "likely" Trump would sign the bipartisan plan if it clears Congress, he said.

EUROPE

BOE: The results of the Bank of England's consultation on negative rates may not see the light of day this year, leaving additional quantitative easing as the main item in its toolkit in case of any fresh shock such as financial stress caused by a no-deal Brexit, MNI understands. For more see MNI Policy MainWire, 1008ET.

EU/UK: The UK and the European Union are still unable to agree a final deal on a post-Brexit trade deal, a joint statement from Prime Minister Boris Johnson and Commission President Ursula von der Leyen released Monday said

- "As agreed on Saturday, we took stock today of the ongoing negotiations. We agreed that the conditions for finalising an agreement are not there due to the remaining significant differences on three critical issues: level playing field, governance and fisheries," the statement said.

- "We asked our chief negotiators and their teams to prepare an overview of the remaining differences to be discussed in a physical meeting in Brussels in the coming days," it added.

- Not too much of a response here in GBP - 1.3333 on last check. Ultimately the story remains the same: three big issues, all need resolution. Slight positive may be that the UK PM and EU's VdL are to meet face-to-face, which could raise the likelihood of a political deal to avoid the cliff-face of a No Deal end to the transition period.

CANADA

BOC: The Bank of Canada is expected to hold its key lending rate at 0.25% Wednesday and maintain CAD4 billion a week of asset purchases, avoiding another scaling back of QE as vaccine breakthroughs keep economic recovery in sight amid the current rise in Covid cases. For more see MNI Policy MainWire, 1517ET

DATA: Canada's Ivey purchasing manager index showed a negative employment reading for the first time since May around the spring lockdown, though overall conditions remain positive.

- The Ivey employment index reported: Monday fell to 48.1 in November from 56.1 the prior month, with readings less than 50 suggesting a decline. The overall index declined to 52.7 from 54.5, and in April reached a record low 22.8

OVERNIGHT DATA: Limited

- US OCT CONSUMER CREDIT +$7.2BB

- US OCT NONREVOLVING CREDIT +$12.7BB

- US OCT REVOLVING CREDIT -$5.5B

MARKETS SNAPSHOT

- DJIA down 197.85 points (-0.65%) at 30218.26

- S&P E-Mini Future down 13.25 points (-0.36%) at 3687

- Nasdaq up 45.2 points (0.4%) at 12464.23

- US 10-Yr yield is down 4 bps at 0.9261%

- US Mar 10Y are up 10.5/32 at 137-22.5

- EURUSD down 0 (0%) at 1.2109

- USDJPY down 0.18 (-0.17%) at 104.25

- WTI Crude Oil (front-month) down $0.55 (-1.19%) at $45.84

- Gold is up $20.5 (1.11%) at $1830.65

- European bourses closing levels:

- EuroStoxx 50 down 9.19 points (-0.26%) at 3522.96

- FTSE 100 up 5.16 points (0.08%) at 6583.74

- German DAX down 27.96 points (-0.21%) at 13260.25

- French CAC 40 down 35.77 points (-0.64%) at 5567.02

US TSY SUMMARY: Targeted Relief Better Than No Relief at All

Fairly muted opening session for the new week, modest volumes (TYH under 1M after the bell), yld curves scale back from last Friday's 9-month highs (mid-March lvls).- Tentative risk-on unwinds with no fiscal stimulus deal annc (though Sen leader McConnell annc Sen will pass a one-week stopgap spending bill to keep govt running.

- Equities did pare losses after McConnell mentioned targeted aid bill, a non-starter for Democrats deemed not enough aid.

- Decent pick-up in swappable corporate issuance, over $11B, generated two-way rate locks/unwinds, modest option tied flow, two-way with better buying from prop and fast$ accts in intermediates.

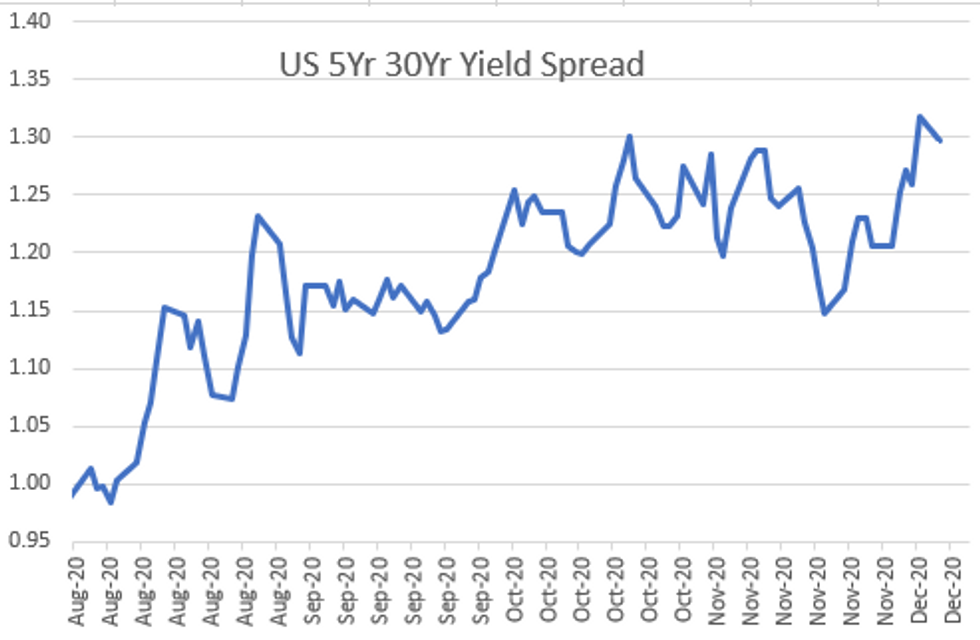

- The 2-Yr yield is down 1bps at 0.1408%, 5-Yr is down 2.7bps at 0.3893%, 10-Yr is down 4bps at 0.9261%, and 30-Yr is down 4.9bps at 1.6857%.

US TSY FUTURES CLOSE: Yld Curves Bull Flatten On Modest Volumes

Firmer across the board, long end leading all session, scaling back portion of last week's risk-on sentiment as market still awaits fiscal support. Sen McConnell did say Congress would pass one-week stopgap spending bill to keep US govt open.

Latest levels:

- 3M10Y -3.049, 85.338 (L: 84.324 / H: 88.798)

- 2Y10Y -2.825, 78.663 (L: 77.969 / H: 81.986)

- 2Y30Y -3.552, 154.622 (L: 153.55 / H: 158.72)

- 5Y30Y -1.749, 129.749 (L: 128.436 / H: 131.862)

- Current futures levels:

- Mar 2Y +0.5/32 at 110-13.375 (L: 110-12.75 / H: 110-13.62)

- Mar 5Y +5/32 at 125-28.5 (L: 125-23 / H: 125-29.25)

- Mar 10Y +11/32 at 137-23 (L: 137-09 / H: 137-24)

- Mar 30Y +26/32 at 172-15 (L: 171-06 / H: 172-21)

- Mar Ultra 30Y +1-25/32 at 211-16 (L: 208-19 / H: 211-25)

US EURODLR FUTURES CLOSE: Long End Claws Higher

Futures held higher levels after the bell (steady EDM1 sole exception), Golds leading balance of strip higher by the bell. Decent volumes in Reds-Greens again, carry over from late Friday after ISDA confirmed Jun 2023 LIBOR retirement deadline. Lead quarterly held modest bid all session despite 3M LIBOR settle +0.00450 to 0.23038% (+0.00050 last wk).

- Dec 20 +0.003 at 99.758

- Mar 21 +0.005 at 99.800

- Jun 21 steady at 99.805

- Sep 21 +0.005 at 99.800

- Red Pack (Dec 21-Sep 22) +0.010 to +0.015

- Green Pack (Dec 22-Sep 23) +0.025 to +0.035

- Blue Pack (Dec 23-Sep 24) +0.045 to +0.055

- Gold Pack (Dec 24-Sep 25) +0.055 to +0.060

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00037 at 0.08288% (+0.00300 last wk)

- 1 Month -0.006300 to 0.14575% (-0.00300 last wk)

- 3 Month +0.00450 to 0.23038% (+0.00050 last wk)

- 6 Month -0.00262 to 0.25313% (-0.00163 last wk)

- 1 Year +0.00150 to 0.33825% (+0.00637 last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $152B

- Secured Overnight Financing Rate (SOFR): 0.09%, $951B

- Broad General Collateral Rate (BGCR): 0.07%, $351B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $333B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.217B submission

- Next scheduled purchases:

- Tue 12/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

PIPELINE: $11.35B To Price Monday, Dealers Lead

- Date $MM Issuer (Priced *, Launch #)

- 12/07 $2.5B #Morgan Stanley 6NC5 +60

- 12/07 $2B #Societe Generale 6NC5 +110

- 12/07 $2B #CVS $750M 2027 Tap +67, $1.25B +10Y +95

- 12/07 $1.35B #CIBC $750M 3Y +32, $600M 3Y FRN SOFR+40

- 12/07 $1.1B #KeyBank $750M 3NC2 fix/FRN +28, $350M 3NC2 FRN to SOFR+34

- 12/07 $1.9B #NASDAQ $600M 2NC1 +30, $650M 10Y +75, $650M 20Y +80

- 12/07 $500M #Codelco WNG 30Y +148

- 12/07 $Benchmark Charles Schwab investor call

- 12/07 $Benchmark Kingdom of Morocco investor call on 7Y, 12Y and 30Y

FOREX: Brexit Deal in the Balance, Sterling Slipping

As all weekend reports of Brexit deal progress were quashed ahead of the European open, GBP slipped sharply against all others, dropping close to 2 cents against the USD as markets ratcheted up the implied probability of a disruptive end to the transition period on Dec31. Options markets clearly took note, with short-end GBP options premiums shooting to fresh multi-month highs. GBP/USD traded as low as 1.3225 before staging an impressive bounce - rising to just below 1.34 ahead of the US close.

- Nonetheless, GBP was the poorest performing currency in G10 Monday. NOK, AUD and SEK were the strongest. A bounce in oil prices after early underperformance helped boost commodity-tied currencies, with WTI returning into positive territory ahead of the COMEX close on broad USD weakness.

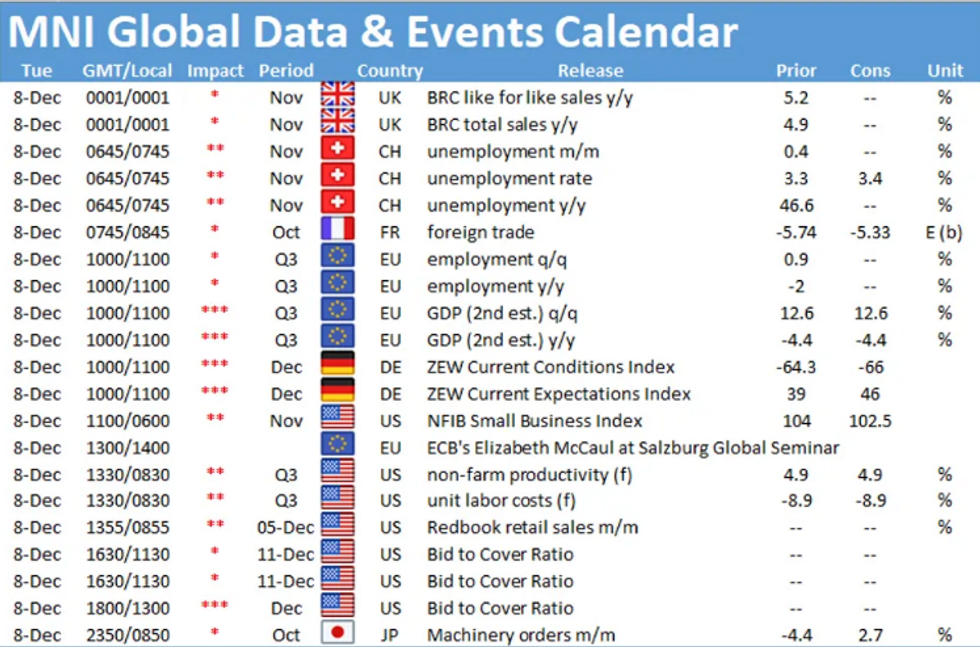

- Focus Tuesday turns to the ongoing Brexit negotiations and Germany's ZEW survey.

EGBs-GILTS CASH CLOSE: Curves Flatten On Brexit (And Not Much Else)

Monday saw a mostly quiet session with no meaningful data, supply, or speakers, and all the attention on Brexit headlines over the weekend and early on in the day. Most headlines focused on divisions between the EU-UK , in contrast w Friday's more optimistic tone.

- Gilts unsurprisingly outperformed; UK and German curves bull flattened while

- periphery spreads widened. And most of the move happened in early London

- trade, with limited price movement the rest of the day.

- Ultimately we continue to await developments ahead of this week's European Council, and attention on UK parliament as they eye the Internal Market Bill.

- Tuesday's docket includes German Dec ZEW and Gilt supply.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- * Germany: The 2-Yr yield is down 1.2bps at -0.759%, 5-Yr is down 2.5bps at -0.777%, 10-Yr is down 3.5bps at -0.582%, and 30-Yr is down 3.6bps at -0.156%.

- UK: The 2-Yr yield is down 4bps at -0.075%, 5-Yr is down 5.3bps at -0.03%, 10-Yr is down 6.8bps at 0.283%, and 30-Yr is down 7bps at 0.854%.

- Italian BTP spread up 2bps at 119.2bps

- Spanish spread up 0.6bps at 63.4bps/ Portuguese up 0.9bps at 59.9bps

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.