-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Tsy Near Highs After Early ECB-Driven Vol

EXECUTIVE SUMMARY

- MNI BRIEF: McConnell Says US Jobless Jump Shows Relief Needed

- ECB VIEW: Market Reaction To ECB Decision/Presser Is Hawkish

- MNI BRIEF: Banks Must Manage Their Loan Book Risk: Lagarde

- MNI POLICY: BOC May Dial Back QE if Vaccination Goes Faster

- MNI BRIEF: Canada Budget Office Says Govt Deficits Understated

- U.K.'S JOHNSON SAYS PREPARE FOR NO EU TRADE DEAL AFTER BREXIT, Bbg

US

US: U.S. Senate Majority Leader Mitch McConnell said a jump in initial jobless claims reported Thursday indicated a need for additional fiscal relief.

- "Our economic recovery thus far has been faster than expected," McConnell said on the Senate floor. "But our people need another dose of support as we hope to close out this battle with the virus. We should be doing everything we can to prevent layoffs and create jobs where possible."

- McConnell, who controls the schedule of the Senate, anticipated senators would be working late Thursday and may be in session on Friday to finish a defense spending package and pass a stopgap bill, providing an additional week to close out negotiations over year-long government funding and Covid relief.

- Issuing more cash contracts that use SOFR, the designated successor to LIBOR in the U.S., will build demand for SOFR derivatives, a necessary step to develop forward-looking term SOFR rates, he said. That would be the last step in the transition away from LIBOR.

EUROPE

ECB: The initial reaction to the ECB decision was hawkish, with higher yields across the German curve and wider periphery EGB spreads.

- Overall the size of the PEPP envelope increase was in line with expectations, with doves rebuffed to some degree by Lagarde saying that it need not be used in full. And as a BBG sources headline put it, the 9-month extension of PEPP was a 'compromise' by the Governing Council.

- Also disappointing the doves: TLTRO adjusted to make it "a little bit more challenging" (per Lagarde) to get funding at lowest possible rate of -1%.

- Bund futures 45 ticks lower vs time of the decision, though had dropped as much as 75 ticks. BTP 10-Yr spread/Bunds 2bps wider, though had knee-jerked lower on the decision. EUR hit session highs of 1.2135 vs USD during the presser.

ECB: It is for banks to manage the risk on loans by accessing lending criteria, European Central Bank President Christine Lagarde said Thursday. Speaking after the central bank extended and modestly eased the terms for the TLTRO3, Lagarde said in response to an MNI question that it was the job of the central bank to ensure the criteria were in place for the banks to lend to the real economy, but banks needed to manage their own risk.

CANADA

BOC: Bank of Canada Deputy Governor Paul Beaudry hinted Thursday that progress on Covid-19 vaccines could hasten a winding down of QE if the economy rebounds faster than policy makers expected.- "The faster people get vaccinated and more people get back to work in contact-sensitive sectors, the more quickly the recovery could unfold," Beaudry said in the text of a speech. "In that context, we may need to re-examine the amount of stimulus needed to achieve our inflation target. Earlier in my speech, I illustrated how we could withdraw stimulus from our QE program when the time comes." For more see MNI Policy MainWire, 1334ET.

CANADA: Canada's independent parliamentary budget officer said Thursday the government's recent fiscal update may be understating deficits, and the plan to offer an extra CAD100 billion of stimulus may come too late after the job market has recovered.

- The PBO's estimated deficit for fiscal 2022-23 of CAD58.1 billion is CAD7.4 billion wider than the government's projection, a trend that persists over the next three years.

- PBO Link: https://tinyurl.com/yx8l44yz

OVERNIGHT DATA

US PREV JOBLESS CLAIMS REVISED TO 716K IN NOV 28 WK

US CONTINUING CLAIMS +0.230M to 5.757M IN NOV 28 WK

US NOV CPI 0.2%, CORE 0.2%; CPI Y/Y 1.2%, CORE Y/Y 1.6%

US NOV ENERGY PRICES 0.4%

US NOV OWNERS' EQUIVALENT RENT PRICES 0.0%

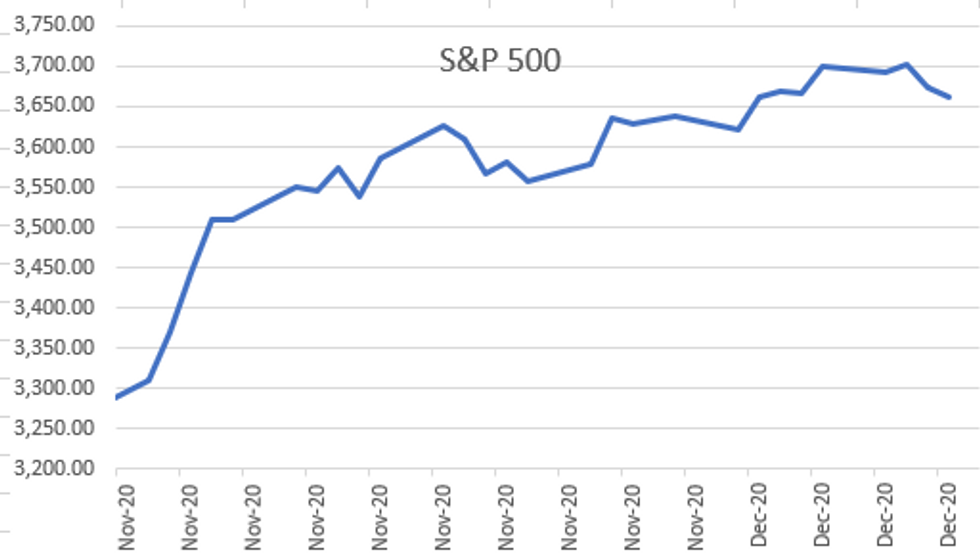

MARKETS SNAPSHOT

- DJIA down 134.09 points (-0.45%) at 30068.81

- S&P E-Mini Future down 11.25 points (-0.31%) at 3668.5

- Nasdaq up 34.4 points (0.3%) at 12338.95

- US 10-Yr yield is down 2 bps at 0.9162%

- US Mar 10Y are up 6.5/32 at 137-26.5

- EURUSD up 0.0042 (0.35%) at 1.2091

- USDJPY up 0.04 (0.04%) at 104.49

- WTI Crude Oil (front-month) up $1.26 (2.77%) at $46.18

- Gold is down $5.87 (-0.32%) at $1835.55

- European bourses closing levels:

- EuroStoxx 50 down 6.71 points (-0.19%) at 3531.59

- FTSE 100 up 35.47 points (0.54%) at 6587.96

- German DAX down 44.53 points (-0.33%) at 13336.58

- French CAC 40 up 2.83 points (0.05%) at 5556.16

US TSY SUMMARY: Risk-Off Back To The Fore

Choppy early trade generated better volumes into the NY open and again into the NY session close as Bonds surged to new session highs.

- Tsys had extended late overnight highs but reversed the move after ECB ramped up asset purchases by E500B. Risk-off remained underlying theme w/futures climbing back to pre-ECB highs ahead weekly claims -- and pared gains yet again after higher than exp weekly (716K) and continuing (5.757M) jobless claims.

- Rates settled into a range from midmorning on -- but extended highs into the close as chances of a bipartisan Covid relief bill waned.

- Session flow included two-way in 5s from various accts, real$ +10s, bank portfolio buying across the curve, pre-auction short sets in 30s.

- Strong 30Y Auction, after last tailin in Oct: Tsys bounce after strong US Tsy $24B 30Y bond auction (912810SS8) yields 1.665% (1.680% last month) vs. 1.677% WI; w/ 2.48 bid/cover (2.29 prior). Indirects drew 65.87% vs. 61.90% prior, 16.77% directs vs. 16.54%, and 17.36% for dealers vs. 21.56% prior.

- The 2-Yr yield is down 1.2bps at 0.1369%, 5-Yr is down 1.9bps at 0.3845%, 10-Yr is down 2.7bps at 0.9096%, and 30-Yr is down 4.5bps at 1.6396%.

US TSY FUTURES CLOSE: Extends Session Highs Into Close

Waves of better buying later in the second half helped push bods to new session highs, yld curves bull flattening. Choppy session on decent volume, futures broke higher after a strong 30Y auction (1.665% yld vs. 1.677% WI).

- 3M10Y -2.481, 83.522 (L: 83.027 / H: 86.843)

- 2Y10Y -1.094, 77.237 (L: 76.543 / H: 79.289)

- 2Y30Y -3.222, 149.933 (L: 149.27 / H: 153.745)

- 5Y30Y -2.543, 125.212 (L: 124.972 / H: 128.482)

- Current futures levels:

- Mar 2Y +1/32 at 110-13.875 (L: 110-13 / H: 110-13.875)

- Mar 5Y +4/32 at 125-30 (L: 125-27 / H: 125-30.75)

- Mar 10Y +7/32 at 137-27 (L: 137-20 / H: 137-29)

- Mar 30Y +29/32 at 173-12 (L: 172-17 / H: 173-16)

- Mar Ultra 30Y +1-30/32 at 213-17 (L: 211-23 / H: 213-23)

US EURODLR FUTURES CLOSE: Heavy Short End Volume, December Expires Early Monday

Futures traded firmer all session, short end lagging lagging higher levels out the strip -- but Whites through Reds far outpaced on volumes again, outright (over 65,000 EDZ0 +99.775 late, total EDZ0 volume near 300k) and on spd with EDZ0 expiring early Monday. Current levels:

- Dec 20 +0.005 at 99.775

- Mar 21 +0.005 at 99.810

- Jun 21 +0.010 at 99.820

- Sep 21 +0.010 at 99.810

- Red Pack (Dec 21-Sep 22) +0.010 to +0.020

- Green Pack (Dec 22-Sep 23) +0.020 to +0.025

- Blue Pack (Dec 23-Sep 24) +0.025 to +0.030

- Gold Pack (Dec 24-Sep 25) +0.035 to +0.040

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08288% (-0.00038/wk)

- 1 Month +0.00600 to 0.15388% (+0.00183/wk)

- 3 Month -0.00113 to 0.21950% (-0.00658/wk)

- 6 Month -0.00600 to 0.24475% (-0.01100/wk)

- 1 Year -0.00138 to 0.33450% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $172B

- Secured Overnight Financing Rate (SOFR): 0.08%, $935B

- Broad General Collateral Rate (BGCR): 0.06%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $340B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $8.890B submission

- Next scheduled purchase:

- Fri 12/11 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

PIPELINE: Issuance Pace Slowing Into Holidays

- Date $MM Issuer (Priced *, Launch #)

- 12/10 $1.5B #HSBC Holdings PerpNC10 4.6%

- -

- $725M Priced Tuesday; $22.841B total/wk

- 12/09 $725M *Realty Income $325M 5Y +50, $400M 12Y +100

- 12/09 $Benchmark Lao People's Democratic Rep 5Y investor calls

FOREX: Markets Brush Off Lagarde's FX Warning

Traders brushed off Lagarde's warning that the ECB would "carefully monitor" the exchange rate by bidding up the EUR in response to the ECB's recalibration of policy. The ECB expanded the size of the PEPP envelope by 500bln (largely alongside expectations) and extended the duration of their bond-buying program by another nine months - although various sourced reports suggest there was much consternation among the board on this. EUR/USD rallied to touch 1.2159 before fading.

- Sterling remains a laggard, falling against all others Thursday as Brexit ire extends into another session. The currency took a late dip just after the London close as the UK PM Johnson warned the public and UK business to prepare for no EU trade deal after the end of the transition period. GBP/USD traded a low of 1.3246, but stayed clear of Monday's worst levels.

- Focus Friday turns to Italian industrial production numbers, US PPI for November and prelim December Uni. of Michigan confidence data.

EGBs-GILTS CASH CLOSE: Gilts Easily Outperform In A Very Busy Session

A very busy session, with Gilt yields ultimately settling lower and Bund yields higher. Mkts opened on a bullish note with Wednesday's Brexit talks having gone poorly and bringing a 'no deal' outcome clearly into focus. Gilts rallied at the open, and outperformed all day.

- But the mood turned more hawkish as the ECB decision and press conference were seen to disappoint dovish expectations. Bunds sold off in a bear flattening move with Schatz underperforming, BTP spreads initially widened but came back in.

- * Friday sees 2-day European summit continue, with BOE financial stability report published at 0700GMT. Speakers include ECB's Holzmann and de Cos. Light data schedule though (mostly final Eurozone CPIs).

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.8bps at -0.766%, 5-Yr is up 0.6bps at -0.787%, 10-Yr is up 0.2bps at -0.603%, and 30-Yr is down 0.7bps at -0.186%.

- UK: The 2-Yr yield is down 3.5bps at -0.115%, 5-Yr is down 4.3bps at -0.083%, 10-Yr is down 6bps at 0.201%, and 30-Yr is down 6.4bps at 0.744%.

- Italian BTP spread down 2.2bps at 116.5bps

- Spanish bond spread down 0.1bps at 62.5bps

- Portuguese spread down 0.5bps at 58.3bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.