-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Tsy Marketable Borrow Ests Well Below Expected

EXECUTIVE SUMMARY

- Treasury Announces Marketable Borrowing Estimates - Well Below Expected

- MNI BRIEF: Still 'In Depth' of Covid Recession -- Fed's Rosengren

- MNI INTERVIEW: US Factory Prices May Rise Past 10Y High- ISM

- MNI BRIEF: US CBO- PCE Inflation Below 2% Until At Least 2024

- MNI SOURCES: Fiscal Hawks May Block Plans To Ease EU Debt Rules

- MNI BRIEF:ECB Must Look Past Supply-Side Infl Effect: Bulletin

- MNI INTERVIEW: BOC May End QE Purchases by Midyear-Ex Official

- MERKEL SAYS CAN OFFER VACCINE TO ALL GERMANS BY END OF SUMMER, Bbg

US

TSY: Treasury Announces Marketable Borrowing Estimates - Well Below Expected

- During the January - March 2021 quarter, Treasury expects to borrow $274 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $800 billion. The borrowing estimate is $853 billion lower than announced in November 2020. The decrease in privately-held net marketable borrowing is primarily driven by a higher beginning-of-January cash balance as a result of lower-than-assumed expenditures.

- During the April - June 2021 quarter, Treasury expects to borrow $95 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $500 billion.

- "I hope over the course of the spring we're really talking about a significant recovery but I think it does depend on some of the public health outcomes," he said.

US: U.S. manufacturers could see further price gains after the ISM index showed the biggest increase since 2011, survey chair Tim Fiore told MNI Monday.

- January's price gains reflected stronger demand, supply chain bottlenecks and a weak U.S. dollar, he said. Manufacturers were also bidding up orders in December as expectations grew that price increases would continue into early 2021. For more see MNI Policy main wire at 1415ET.

US: The Congressional Budget Office said Monday it does not see core inflation rising above the Federal Reserve's 2% target until 2024 at the earliest.

- "Inflation, as measured by the price index for personal consumption expenditures, rises gradually over the next few years and rises above 2.0 percent after 2023," said the CBO in a updated 10-year forecast. CBO projects economic activity will remain below potential until 2025, with employment not returning to pre-pandemic levels until 2024. For more see MNI Policy main wire at 1136ET.

CANADA

BOC: The Bank of Canada will probably taper QE again in April and could stop making purchases altogether by mid-year as the economic rebound firms up, former central bank and finance department economist Charles St-Arnaud told MNI.

- Economic weakness has been widely varied across industries, suggesting fiscal policy is a better remedy than aggressive monetary stimulus, said St-Arnaud, now chief economist at Credit Union Central Alberta. Canada last year began with at least CAD5 billion a week of QE and scaled it back to at least CAD4 billion a week, and April is a good time to taper again as more evidence of progress on a vaccine and stores re-opening appears, he said. For more see MNI Policy main wire at 1510ET.

EUROPE

EU: A proposed overhaul of the eurozone's strict limits on public debt is likely to lead to few changes, with fiscal hawks within the European Commission strongly resisting any loosening of the rules to allow governments to spend more, EU officials said. For more see MNI Policy main wire at 1116ET.

ECB: Policymakers at the European Central Bank will need to look past supply-side effects "to gain a clearer picture of the disinflationary demand effects that inevitably come with income losses and uncertainty," according to a staff research paper in this month's edition of the bank's Economic Bulletin, published Monday.

OVERNIGHT DATA

- ISM Jan Manufacturing PMI Eases To 58.7 vs Dec 60.5

- US ISM NEW ORDERS INDEX 61.1 JAN VS 67.5 DEC

- US ISM EMPLOYMENT INDEX 52.6 JAN VS 51.7 DEC

- US ISM PRODUCTION INDEX 60.7 JAN VS 64.7 DEC

- US ISM SUPPLIER DELIVERY INDEX 68.2 JAN VS 67.7 DEC

- US ISM INVENTORIES INDEX 50.8 JAN VS 51.0 DEC

- US DEC CONSTRUCT SPENDING +1.0%

- US DEC PRIVATE CONSTRUCT SPENDING +1.2%

- US DEC PUBLIC CONSTRUCT SPENDING +0.5%

U.S. CONGRESSIONAL BUDGET OFFICE FORECASTS U.S. REAL GDP GROWTH FOR CALENDAR YEAR 2021 AT 4.6% VS 3.5% CONTRACTION FOR 2020

MARKET SNAPSHOT

Key late session market levels- DJIA up 299.6 points (1%) at 30270.67

- S&P E-Mini Future up 66 points (1.78%) at 3770.5

- Nasdaq up 336.7 points (2.6%) at 13403.93

- US 10-Yr yield is up 0.5 bps at 1.0706%

- US Mar 10Y are up 6/32 at 137-7

- EURUSD down 0.0068 (-0.56%) at 1.2066

- USDJPY up 0.25 (0.24%) at 104.94

- WTI Crude Oil (front-month) up $1.48 (2.84%) at $53.67

- Gold is up $12.95 (0.7%) at $1860.08

European bourses closing levels:

- EuroStoxx 50 up 49.41 points (1.42%) at 3530.85

- FTSE 100 up 58.96 points (0.92%) at 6466.42

- German DAX up 189.15 points (1.41%) at 13622.02

- French CAC 40 up 62.47 points (1.16%) at 5461.68

Nor'easter Dampens Volumes

Inside range session for rates Monday, Tsys firmer but off midday highs after the bell, volumes dampened by blizzard conditions closing large swaths of the Eastern seaboard Monday.- Equities gained (S&Ps +1.78%) as did West Texas crude (WTI +1.47) and Gold (+13.77) amid multiple Fed speakers -- Boston Fed President Eric Rosengren said Monday the U.S. economy is still "in the depth of it" when it comes to the Covid-19 slump: "I hope over the course of the spring we're really talking about a significant recovery but I think it does depend on some of the public health outcomes," he said.

- Moderate two-way flow included deal-tied hedging from near $25B high-grade corporate issuance, $14B Apple 6-tranche jumbo lead followed by $5.5B Altria 4-part jumbo.

- Modest two-way option volumes with pick-up in upside call buying

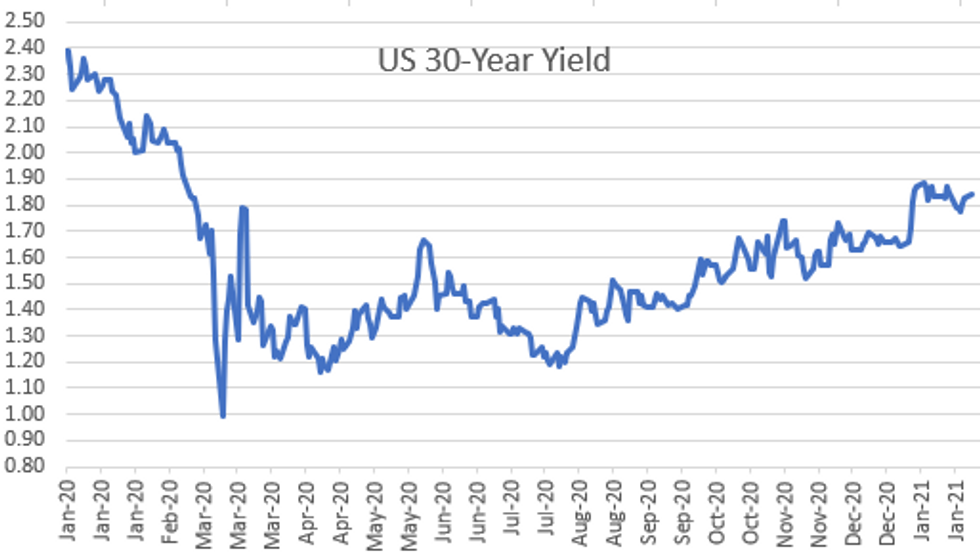

- The 2-Yr yield is unchanged at 0.1093%, 5-Yr is unchanged at 0.4193%, 10-Yr is up 0.5bps at 1.0706%, and 30-Yr is up 1.3bps at 1.8425%.

US TSY FUTURES CLOSE: Post-Close Rebound

Tsys trading moderately bid all session, pared gains into the close have bounced back to near midday highs. Generally subdued week/month opener, however, as blizzard conditions closes large swaths of the Eastern seaboard Monday.

- 3M10Y +0.429, 101.399 (L: 100.041 / H: 102.937)

- 2Y10Y +0.373, 95.595 (L: 94.94 / H: 97.666)

- 2Y30Y +1.114, 172.699 (L: 171.363 / H: 174.605)

- 5Y30Y +1.23, 141.896 (L: 140.4 / H: 142.956)

- Current futures levels:

- Mar 2Y up 0.375/32 at 110-16 (L: 110-15.75 / H: 110-16.25)

- Mar 5Y up 3.5/32 at 125-31.5 (L: 125-30 / H: 126-00.75)

- Mar 10Y up 6.5/32 at 137-7.5 (L: 137-02 / H: 137-09.5)

- Mar 30Y up 13/32 at 169-4 (L: 168-22 / H: 169-12)

- Mar Ultra 30Y up 25/32 at 205-16 (L: 204-20 / H: 206-00)

US EURODOLLAR FUTURES CLOSE: New Record 3M LIBOR Low

Whites through Reds held steady to marginally mixed all day, Greens-Golds holding mildly higher on narrow range. Lead quarterly EDH1 steady even as 3M LIBOR -0.00638 to 0.19550% (-0.01337 net last wk) ** 3M New record Low vs. 0.20188% on 1/29/21. Current levels:

- Mar 21 steady at 99.840

- Jun 21 +0.005 at 99.850

- Sep 21 steady at 99.835

- Dec 21 -0.005 at 99.795

- Red Pack (Mar 22-Dec 22) -0.005 to +0.010

- Green Pack (Mar 23-Dec 23) +0.015 to +0.020

- Blue Pack (Mar 24-Dec 24) +0.020

- Gold Pack (Mar 25-Dec 25) +0.020 to +0.025

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00050 at 0.07925% (-0.00750 net last wk)

- 1 Month -0.00650 to 0.11300% (-0.00525 net last wk)

- 3 Month -0.00638 to 0.19550% (-0.01337 net last wk) ** 3M New record Low vs. 0.20188% on 1/29/21

- 6 Month -0.00825 to 0.21500% (-0.01275 net last wk)

- 1 Year -0.00563 to 0.30550% (-0.00112 net last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $62B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $186B

- Secured Overnight Financing Rate (SOFR): 0.06%, $915B

- Broad General Collateral Rate (BGCR): 0.04%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $317B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $4.020B submission

- Next scheduled purchases:

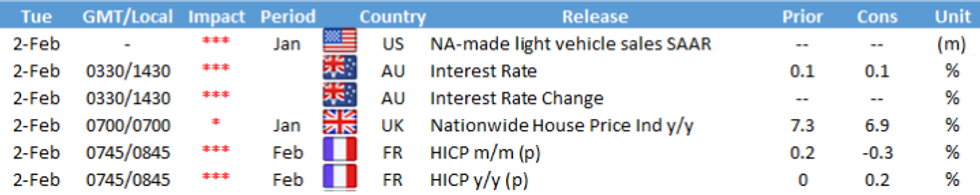

- Tue 2/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 2/03 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 2/04 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: $14B Apple 6-Part Jumbo Kicks Off February

$14B Apple 6-part jumbo kicks off February, matches all of 2020 issuance from tech icon

- Date $MM Issuer (Priced *, Launch #)

- 02/01 $14B #Apple 6-part jumbo: $2.5B 5Y +32, $2.5B 7Y +47, $2.75B 10Y +57, $1.5B 20Y +72, $3B 30Y +82, $1.75B 40Y +95. Last year Apple issued $14B total: $5.5B on August 13, 2020 w/ $1.25B 5Y +28, $1.25B 10Y +58, $1.25B 30Y +100, $7.75B 40Y +118; $8.5B issued on May 4, 2020: $2B 3Y +60, $2.25B 5Y +80, $1.75B 10Y +110, $2.5B 30Y +145. Apple also in the top ten record jumbo issuance w/$17B back in April 2013.

- 02/01 $5.5B #Altria Group $1.75B 11Y +138, $1.5B 20Y +178, $1.25B 30Y +188, $1B 40Y +218

- 02/01 $1.5B #UBS PerpNC10 4.375%

- 02/01 $850M #National Rural Utilities $500M 3Y +2, $350M 10Y +60

- 02/01 $700M *GATX Corp $400M 10Y +90, $300M 30Y +125

- 02/01 $600M *Hyundai 5Y +92.5

- Rolled to Tuesday:

- 02/01 $1B Clear Channel Worldwide 7NC3

- 02/02 $Benchmark World Bank 10Y +14a

- No new issuance Friday; Total January issuance $227.55B

FOREX: Greenback Reaches New 2021 Highs

Risk appetite was buoyed early Monday, as stocks globally bounced back from a particularly soft performance last week. This sentiment was partially echoed in currency markets, with CHF offered.

- A solid greenback followed a round of soft Eurozone economic data, as German retail sales and a number of PMIs missed expectations, helping boost the USD index further above the 50-dma to hit the best levels of the year.

- CHF was one of the weakest performers in G10, falling against most others, as equities traded well and risk appetite seemed to find some more solid ground. CHF downside protection was in vogue, with sizeable USD/CHF call options trading throughout European hours.

- Focus Tuesday turns to prelim French CPIs, Italian growth data for Q4 and the RBA rate decision. The RBA are seen keeping rates unchanged, with markets watching for any mention of the RBA's asset purchase programme. ECB's de Cos, Fed's Kaplan and Mester are due to speak.

EGBs-GILTS CASH CLOSE: BTPs Gain Ahead Of Tuesday Politics

Bunds and Gilts closed mixed after earlier weakness, in a mostly risk-on session to open the month / week, with periphery EGB spreads tightening.

- Markets largely looked through weak data in the morning (Spanish Mfg PMI and German retail sales, though Italian PMI was strong).

- BTPs looking through political risk amid Tuesday deadline set by Pres Mattarella for PM Conte and relevant parties to come up with a resolution to the current impasse.

- Issuance picking up w EUR benchmark mandates announced for Finland, Cyprus, Belgium, see our previews out earlier. Tuesday will also be eyed for French flash CPI and Italy and Eurozone Q4 prelim GDP.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1bps at -0.723%, 5-Yr is up 0.5bps at -0.73%, 10-Yr is up 0.2bps at -0.516%, and 30-Yr is unchanged at -0.077%.

- UK: The 2-Yr yield is unchanged at -0.106%, 5-Yr is down 0.6bps at -0.034%, 10-Yr is down 0.6bps at 0.321%, and 30-Yr is down 0.5bps at 0.892%.

- Italian BTP spread down 2.4bps at 113.7bps

- Spanish bond spread down 0.5bps at 61.1bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.