-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Sets Yuan Parity Higher At 7.1055 Tues; -6.03% Y/Y

MNI China Press Digest Jan 30: PBOC, He Lifeng, Evergrande

MNI ASIA OPEN - USD/Yen Decline Signaled Early Bond Bid

EXECUTIVE SUMMARY

- MNI INTERVIEW: Standing Repo Back In Fed Focus When Covid Ebbs

- MNI POLICY: US Consumer Spending Seen Fastest Since 2015-Fed

- MNI BRIEF: Mester Warns Recovery Slow Even After Vaccination

- FED'S BARKIN SHRUGS OFF INFLATION RISKS FROM STIMULUS PLAN" FT

- MESTER: TAKE SOME TIME TO RETURN INFLATION LASTINGLY ABOVE 2%, Bbg

US

FED: The Federal Reserve will likely revive an internal debate over whether to set up a standing repo facility to address proper market function after the Covid pandemic has passed, and perhaps as early as this year, St. Louis Fed Senior Vice President David Andolfatto told MNI.

- The alarming seizure of U.S. Treasury markets normally deemed ultra safe last March revived concerns about vulnerabilities posed by regulatory changes post-2008 crisis that were causing banks to hoard reserves despite the Fed's new ample reserve regime.

- Spending growth expectations over the next year of 4.2% are are the highest since June 2015. It was the second largest month to month increase in the history of the series, and was driven primarily by those under the age of 40, the survey said. That gain was greater than a 2% increase in expected earnings growth.

- Other FOMC members have been more optimistic about the speed of the recovery. Dallas Fed President Robert Kaplan told MNI last month: https://marketnews.com/mni-interview-with-dallas-f... that consumer mobility and engagement could come in the second half of the year and much earlier than the achievement of herd immunity.

OVERNIGHT DATA

No significant US data releases Monday

MARKET SNAPSHOT

Key late session market levels:- DJIA up 237.47 points (0.76%) at 31385.71

- S&P E-Mini Future up 27.75 points (0.72%) at 3908

- Nasdaq up 131.3 points (0.9%) at 13987.64

- US 10-Yr yield is up 0.5 bps at 1.1688%

- US Mar 10Y are down 2/32 at 136-20

- EURUSD up 0.0004 (0.03%) at 1.205

- USDJPY down 0.17 (-0.16%) at 105.22

- WTI Crude Oil (front-month) up $1.14 (2.01%) at $58.00

- Gold is up $16.16 (0.89%) at $1830.36

- EuroStoxx 50 up 9.74 points (0.27%) at 3665.51

- FTSE 100 up 34.2 points (0.53%) at 6523.53

- German DAX up 3.19 points (0.02%) at 14059.91

- French CAC 40 up 26.77 points (0.47%) at 5686.03

US TSY SUMMARY: 30YY Topped 2% Briefly

Decent action for a no-data session, long end bounced from opening session lows with yield curves scaling back from highs.

- Long end bounces back to steady after 30YY topped 2.0% (2.0041%) in late overnight trade, one year high. Some desks cited FX markets for initial move: 30Y bounced as US$ topped out vs. Yen -- yield curves paring gains as dollar coming off.

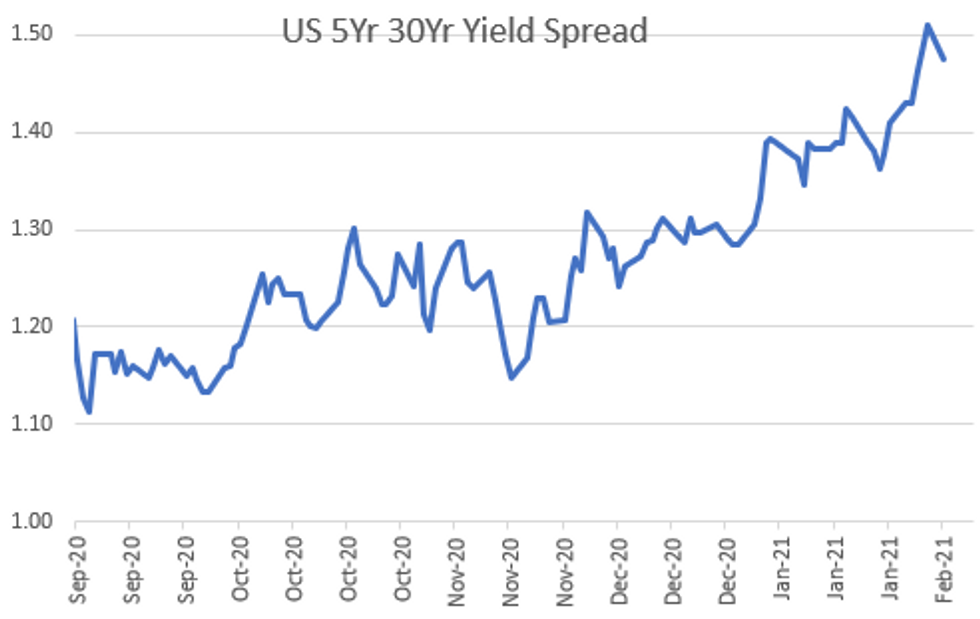

- Sources reported some 5s30s steepener unwinds after basis topped 152.0 overnight (152.305 high) levels not seen since mid-2015. Appears some accts taking cue from last week's Treasury refunding extension in 10s-30s from $24B to $27B. 5s30s curve 147.025 after the bell.

- Two-way midmorning flow saw better buying from fast$ and prop accts in intermediates, real$ buying 30s. Sporadic reports of variable annuity hedge/sales from insurance portfolios that has helped drive yield curves to multi-year highs, has grown quiet since last week's Tsy refunding.

- Market has become more inured to Covid-related headline risk, more short-term, inter-day moves tied to vaccine efficacy and/or availability while mortality rates have moderated in developed countries.

- Trump's impeachment trial Tuesday unlikely supporting factor in rates.

- The 2-Yr yield is up 1bps at 0.1111%, 5-Yr is up 1.4bps at 0.4768%, 10-Yr is up 0.2bps at 1.1653%, and 30-Yr is down 2.3bps at 1.9478%.

US TSY FUTURES CLOSE: Long End Scales Back W/Eqs Gaining Late

Futures mixed after the bell, long end outperforming but paring gains as equities continue to surge heading into the close (ESH1 +24.5). Yld curves recede after tapping new multi-year highs last week. Current levels:

- 3M10Y -0.154, 113.155 (L: 111.605 / H: 116.769)

- 2Y10Y -0.239, 105.392 (L: 104.092 / H: 109.093)

- 2Y30Y -2.266, 184.121 (L: 182.467 / H: 189.696)

- 5Y30Y -3.188, 147.592 (L: 146.503 / H: 152.305)

- Current futures levels:

- Mar 2Y down 0.375/32 at 110-15.75 (L: 110-15.625 / H: 110-16.25)

- Mar 5Y down 2/32 at 125-23.5 (L: 125-22.75 / H: 125-26)

- Mar 10Y down 1.5/32 at 136-20.5 (L: 136-14.5 / H: 136-25)

- Mar 30Y up 6/32 at 166-29 (L: 166-03 / H: 167-12)

- Mar Ultra 30Y up 16/32 at 200-27 (L: 199-05 / H: 201-25)

US EURODOLLAR FUTURES CLOSE: Lead Qrtr Steady Post 3M LIBOR Bounce

Futures trading mostly weaker after the bell, lead quarterly steady after 3M LIBOR bounced slightly off of last Fri's all-time low, settling +0.00450 to 0.19538% (-0.01100 net last wk; record Low on 2/05/21: 0.19088%). Currently:

- Mar 21 steady at 99.840

- Jun 21 steady at 99.845

- Sep 21 steady at 99.830

- Dec 21 steady at 99.790

- Red Pack (Mar 22-Dec 22) -0.01 to -0.005

- Green Pack (Mar 23-Dec 23) -0.025 to -0.015

- Blue Pack (Mar 24-Dec 24) -0.035 to -0.025

- Gold Pack (Mar 25-Dec 25) -0.03 to -0.015

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00163 at 0.08125% (+0.00413 net last wk)

- 1 Month +0.00162 to 0.12050% (-0.00062 net last wk)

- 3 Month +0.00450 to 0.19538% (-0.01100 net last wk) ** vs. record Low on 2/05/21: 0.19088%

- 6 Month +0.00050 to 0.20750% (-0.01625 net last wk)

- 1 Year +0.00225 to 0.30638% (-0.00700 net last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $205B

- Secured Overnight Financing Rate (SOFR): 0.02%, $933B

- Broad General Collateral Rate (BGCR): 0.01%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $332B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.599B accepted vs. $10.436B submission

- Next scheduled purchases:

- Tue 2/09 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 2/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 2/11 1010-1030ET: TIPS 2.25Y-4.5Y, appr $8.825B

- Thu 02/11 Next forward schedule release at 1500ET

PIPELINE: Egypt, Crown Castle Lead Issuance

$9.75B To price Monday

- Date $MM Issuer (Priced *, Launch #)

- 02/08 $3.75B #Arab Rep of Egypt $750M 5Y 3.875%, $1.5B 10Y 5.875%, $1.5B 40Y 7.5%

- 02/08 $3.25B #Crown Castle $1B 5Y +63, $1B 10Y +98, $1.25B 20Y +115

- 02/08 $1B #Becton Dickinson 10Y +80

- 02/08 $1B *McCormick WNG $500M 5Y +48, $500M 10Y +78

- 02/08 $750M #Kinder Morgan 30Y +165

- 02/08 $500M US Steel 8NC3 investor call

- Rolled to Tuesday:

- 02/09 $Benchmark Cades 5Y +9

- 02/09 $Benchmark European Inv Banks (EIB) 10Y +13a

FOREX: USD Waves Off Initial Bid to Close Lower

The greenback extended the Friday sell-off to start the week despite some early strength in the USD index Monday. This worked in favour of EUR/USD, extended the bounced off the Friday lows to show above the 1.2060 level. The single currency found some support as Italian PM-designate Draghi drew some support for his prospective government and was said to have told Italian lawmakers that a common EU budget is a priority going forward.

- AUD, NZD were the best performers in G10, with the currencies gaining amid a general risk-on environment. Both oil and equities hit new cycle highs, with the e-mini S&P touching new record levels while Brent crude oil showed above $60/bbl for the first time in over a year. SEK was the poorest performer, with the market pre-positioning ahead of this week's Riksbank rate decision.

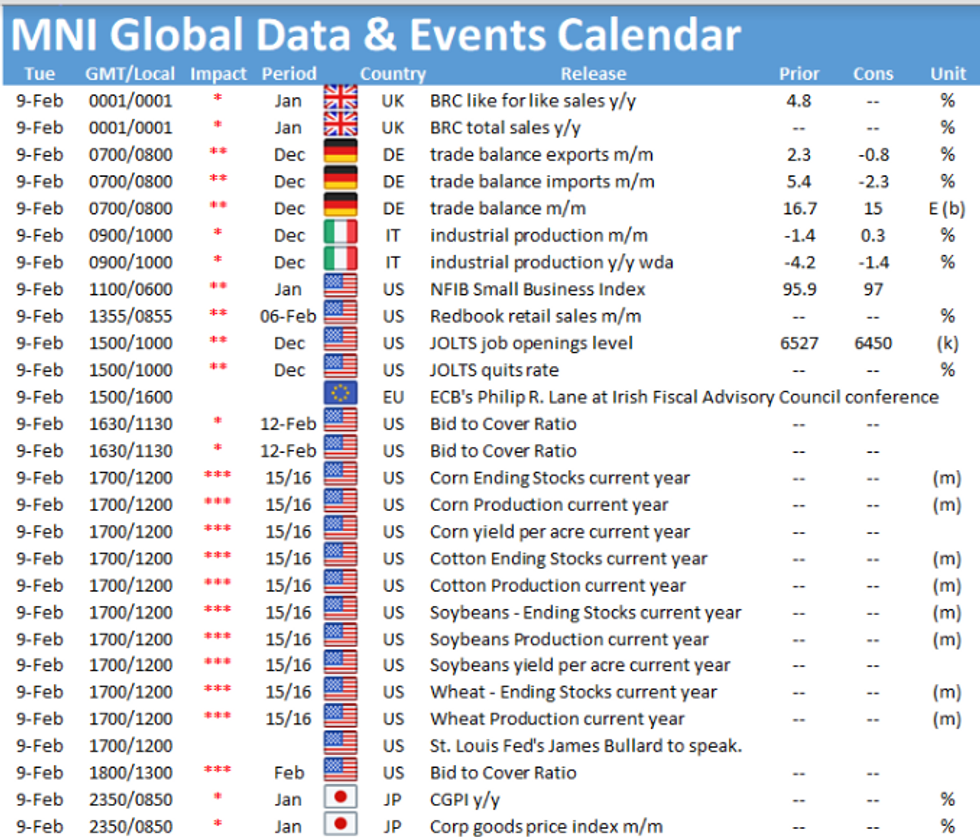

- Focus Tuesday turns to Italian industrial production and speeches from ECB's Visco, Fed's Bullard and RBA's Jones.

EGBs-GILTS CASH CLOSE: Bear Steepening Reverses

The session began with a bear-steepening sell-off and ended with a duration rally for Gilts and Bunds.

- No discernable headline trigger for the reversal, with equities higher for most of the afternoon (before a late fade), but perhaps a case of having gone too far too quickly.

- BTP spreads came off the lows but still tighter on the session as Draghi gov't formation talks continue in Italy.

- BoE's Bailey and ECB's Lagarde spoke in the afternoon but added little new.

- Slow in supply today, but Tuesday sees German linker auction, Netherland Jul-31 DSL via DDA, and Spain new 50-Yr syndication.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is unchanged at -0.711%, 5-Yr is up 0.2bps at -0.686%, 10-Yr is up 0.3bps at -0.445%, and 30-Yr is up 0.5bps at 0.019%.

- UK: The 2-Yr yield is down 0.8bps at -0.033%, 5-Yr is down 0.3bps at 0.081%, 10-Yr is down 0.7bps at 0.475%, and 30-Yr is down 1.4bps at 1.058%.

- Italian BTP spread down 2.9bps at 95.3bps/Spanish spread unchanged at 57.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.