-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Steep Climb For Tsy Yield Curves

EXECUTIVE SUMMARY

- MNI INTERVIEW: High Inflation Easier To Tackle-SF Fed's Curdia

- MNI INTERVIEW: Jobless Dip Masks Lasting Damage-Canada Adviser

- MNI INTERVIEW: Highest US Factory Prices in Decade May Persist

- UK GOVT: 1 VACCINE SHOT CUTS HOSPITALIZATIONS 80% IN OVER-70S, Bbg

- ECB SLOWED PACE OF EMERGENCY BOND-BUYING LAST WEEK, Bbg

US

FED: Rising U.S. inflation is so far a healthy sign of stronger growth prospects, and if expectations were to become excessive monetary authorities would find it easier to clamp down than when faced with price undershoots, San Francisco Fed Economist Vasco Curdia told MNI.

- The increase in expectations to multi-year highs by some measures is in line with the Fed's framework shift last year signaling a desire to modestly overshoot the central bank's 2% inflation goal to make up for past misses, Curdia said in an interview. For more, see MNI Policy main wire at 0847ET.

- "All indications are that prices are going to continue to stay high through Q1 and into Q2, which would indicate you're going to have a really strong economic expansion here for this year," said Fiore. For more, see MNI Policy main wire at 1459ET.

FED: Brainard Eyes Standing Repo Facility; Mkts React To "Valuations Elevated"

Fed Gov Brainard's speech on Financial Stability: https://www.federalreserve.gov/newsevents/speech/b... (out at 0905ET) outlined potential future regulatory reforms to make markets more resilient to shocks such as those in March 2020.

- Such reforms could include standing facilities to backstop repo operations in stress conditions; possible central clearing for Treasuries; . These have been discussed previously.

- Treasuries briefly ticked higher (see arrow in chart below) and equities dipped lower on the text release, though moves were subsequently erased.

The brief risk-off move is more likely to do with her comment "valuations are - The brief risk-off move is more likely to do with her comment "valuations are elevated in a number of asset classes relative to historical norms" rather than on various possible facilities being introduced in future which would likely have impacted on other market variables (eg swap spreads which didn't move).

Markets have cooled somewhat since last week's buyers strike was starkly illumined after Thursday's 7Y note sale.

- Take it from JP Morgan CEOm Jamie Dimon, however, he sees: "RATES GOING UP, WOULD NOT BUY 10-YEAR TREASURIES", Bbg

CANADA

CANADA: Falling unemployment rates are masking a protracted economic recovery that will be dominated by discouraged low-wage workers who will find it hard to re-enter the labor market, Canadian government adviser Mikal Skuterud told MNI.

- Hours worked will be a better measure of the economic recovery because they are more closely tied to total output, said Skuterud, part of an expert panel advising Statistics Canada on its labor market figures and a University of Waterloo economics professor. Total hours worked in Canada remain 4.5% below where they were before the pandemic.

OVERNIGHT DATA

US FINAL FEB MFG PMI 58.6 (58.5 EXPECTED / FLASH; 59.2 JAN)

- US ISM NEW ORDERS INDEX 64.8 FEB VS 61.1 JAN

- US ISM EMPLOYMENT INDEX 54.4 FEB VS 52.6 JAN

- US ISM PRODUCTION INDEX 63.2 FEB VS 60.7 JAN

- US ISM SUPPLIER DELIVERY INDEX 72.0 FEB VS 68.2 JAN

- US ISM INVENTORIES INDEX 49.7 FEB VS 50.8 JAN

- US JAN CONSTRUCT SPENDING +1.7%

- US JAN PRIVATE CONSTRUCT SPENDING +1.7%

- US JAN PUBLIC CONSTRUCT SPENDING +1.7%

MARKET SNAPSHOT

Key late session market levels

- DJIA up 698.88 points (2.26%) at 31632.13

- S&P E-Mini Future up 98.75 points (2.59%) at 3907.75

- Nasdaq up 395.3 points (3%) at 13586.82

- US 10-Yr yield is up 4.5 bps at 1.4496%

- US Jun 10Y are up 13/32 at 133-4

- EURUSD down 0.0029 (-0.24%) at 1.2046

- USDJPY up 0.26 (0.24%) at 106.82

- WTI Crude Oil (front-month) down $0.96 (-1.56%) at $60.55

- Gold is down $13.18 (-0.76%) at $1720.68

- EuroStoxx 50 up 70.18 points (1.93%) at 3706.62

- FTSE 100 up 105.1 points (1.62%) at 6588.53

- German DAX up 226.53 points (1.64%) at 14012.82

- French CAC 40 up 89.57 points (1.57%) at 5792.79

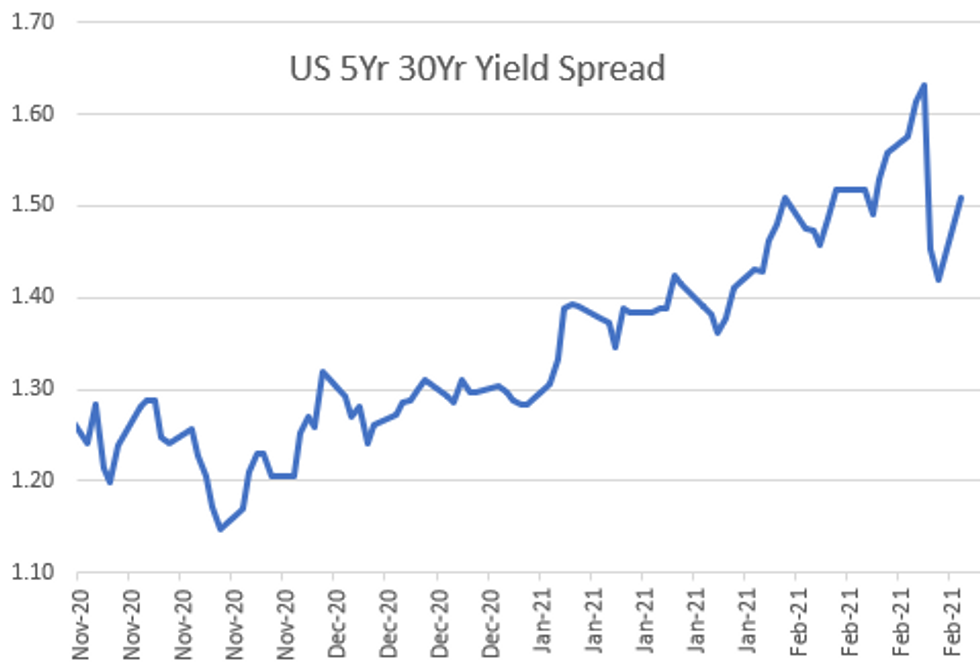

US TSY SUMMARY: Strong Rebound Yld Curves

Yield curves bounced, making new session highs (5s30s 151.036) latter half of Monday trade as duration selling in long end extends new session lows in bonds. Levels nowhere near Thursday's post 7Y auction indigestion when 30YY hit 2.3944% high (currently 2.2183%) levels closer to Fri's midrange.

- Technicals: TYM currently 133-05 +14/32 vs. 133-00 low, well above first support of 132-08, second support 131-31 Feb 25 Low and bear trigger.

- Early support in rates evaporated in lead up to early data (Jan const spend +1.7%; ISM Feb Mfg PMI 60.8 vs Jan 58.7) extended duration sale on release, better selling in 10s-30s with some prop, real$ and central bank selling in 10s-30s floowed, misc acct selling 5s-7s.

- Tsys jump-bid on Fed Gov Brainard comments, notably: BRAINARD: VALUATIONS ELEVATED IN A NUMBER OF ASSET CLASSES, Bbg, fast$ and algo-driven buying.

- Decent pick-up in swappable corporate issuance: $23.55B To Price Monday, $7B GS 6pt jumbo adds to $5.5B issued on Jan 20. Deal-tied paying evident in 10s-30s, payers in 20s second half.

- Sporadic real$ and central bank selling in 10s-30s after better selling from same in first half, generally cautious positioning as new month gets underway and Feb employment this Friday.

- The 2-Yr yield is down 0.4bps at 0.123%, 5-Yr is down 1.6bps at 0.7153%, 10-Yr is up 4.5bps at 1.4496%, and 30-Yr is up 7.5bps at 2.2266%.

US TSY FUTURES CLOSE: Recent Long End Correlation To Stocks Falters

Futures trading mixed, yield curves broadly steeper as bonds remain under pressure after the bell, with equities higher ESH1 +92.0 (not that a negative correlation is unusual!). Yield curves see strong rebound, still off last Thu's 6+ year highs. Currently:

- 3M10Y +4.368, 140.551 (L: 132.943 / H: 142.016)

- 2Y10Y +4.587, 131.796 (L: 125.822 / H: 132.803)

- 2Y30Y +7.532, 209.374 (L: 201.3 / H: 210.381)

- 5Y30Y +9.108, 150.946 (L: 143.62 / H: 151.547)

- Current futures levels:

- Jun 2Y up 1.75/32 at 110-14 (L: 110-12.625 / H: 110-14.625)

- Jun 5Y up 12.25/32 at 124-11.25 (L: 124-06.75 / H: 124-15)

- Jun 10Y up 16.5/32 at 133-7.5 (L: 133-00 / H: 133-16.5)

- Jun 30Y steady at 159-7 (L: 158-29 / H: 160-26)

- Jun Ultra 30Y down 24/32 at 188-10 (L: 187-21 / H: 191-03)

US EURODOLLAR FUTURES CLOSE: Bid Across Strip, Greens Outperform

Futures trading moderately higher across the strip, Greens (EDH3-EDZ3) outperforming, lead quarterly EDH1 bid since 3M LIBOR set -0.00413 to 0.18425% (+0.01313 net last wk). At the moment:

- Mar 21 +0.0075 at 99.8275

- Jun 21 +0.010 at 99.840

- Sep 21 +0.015 at 99.825

- Dec 21 +0.010 at 99.780

- Red Pack (Mar 22-Dec 22) +0.020 to +0.055

- Green Pack (Mar 23-Dec 23) +0.060 to +0.090

- Blue Pack (Mar 24-Dec 24) +0.040 to +0.080

- Gold Pack (Mar 25-Dec 25) +0.025 to +0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00450 at 0.07950% (+0.00587 net last wk)

- 1 Month -0.00925 to 0.10925% (+0.00305 net last wk)

- 3 Month -0.00413 to 0.18425% (+0.01313 net last wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00250 to 0.20050% (+0.00700 net last wk)

- 1 Year -0.00012 to 0.28363% (-0.00275 net last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $208B

- Secured Overnight Financing Rate (SOFR): 0.01%, $889B

- Broad General Collateral Rate (BGCR): 0.01%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $336B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.399B accepted vs. $4.080B submission

- Next scheduled purchases:

- Tue 3/2 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 3/3 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 3/4 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/5 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: $7B Goldman Sachs 6Pt Jumbo Leads

$7B GS 6pt jumbo adds to $5.5B issued on Jan 20 ($2.25B 2NC1 +35, $750M 2NC1 FRN SOFR+41, $2.5B 11NC10 fix/FRN +90),

- Date $MM Issuer (Priced *, Launch #)

- 03/01 $7B #Goldman Sachs $700M 2NC1 +40, $450M 2NC1 FRN SOFR+43, $1.75B 3NC2 +55, $700M 3NC2 FRN SOFR+58, $3B 6NC5 +73, $400M 6NC5 FRN SOFRT+81

- 03/01 $4.3B #Cigna $500M 3NC1 +35, $800M 5Y +55, $1.5B 10Y +95, $1.5B 30Y +120

- 03/01 $2.5B #Coca-Cola $750M 7Y +45, $750M 10Y +60, $1B 30Y +85

- 03/01 $2.15B #Keurig Dr Pepper Inc $1.15B 3NC1 +48, $500M 10Y +83, $500M 30Y +113

- 03/01 $1.9B #John Deere $600M 2Y +15, $800M 3Y +22, $500M 7Y +45

- 03/01 $1.5B #Roche $500M 3Y +20, $350M 3Y FRN SOFR+24, $650M 5Y +30

- 03/01 $1.5B #Toronto-Dominion Bank 3Y +32, 3Y FRN SOFR+35.5

- 03/01 $800M #Graphics Packaging Int $400M 3Y +55, $400M 5Y +80

- 03/01 $700M #PPG Ind 5Y +60

- 03/01 $600M *Estee Lauder 10Y +57

- 03/01 $600M #Fairfax Fnvl Holdings 10Y +195

FOREX: Havens Offered as Risk Sentiment Repairs

Following the sharp equity sell-off in the second half of last week, markets stabilised slightly on Monday, with gains of over 2% apiece for the main three US indices. This translated to haven FX being offered throughout the Monday session, prompting JPY and CHF to underperform all others in G10.

- At the other end of the table, Antipodean and commodity-tied currencies benefited from the bounce in the reflation trade and oil & metals prices. AUD/USD has now bounced close to 80 pips off the recent lows, but still remains shy of the cycle highs printed mid-last week.

- US data was largely ineffectual, despite February's US Manufacturing ISM beating expectations. Prices paid drew particular focus, surging to new cycle highs of 86.0 vs. Exp. 80.0 - the highest since 2008.

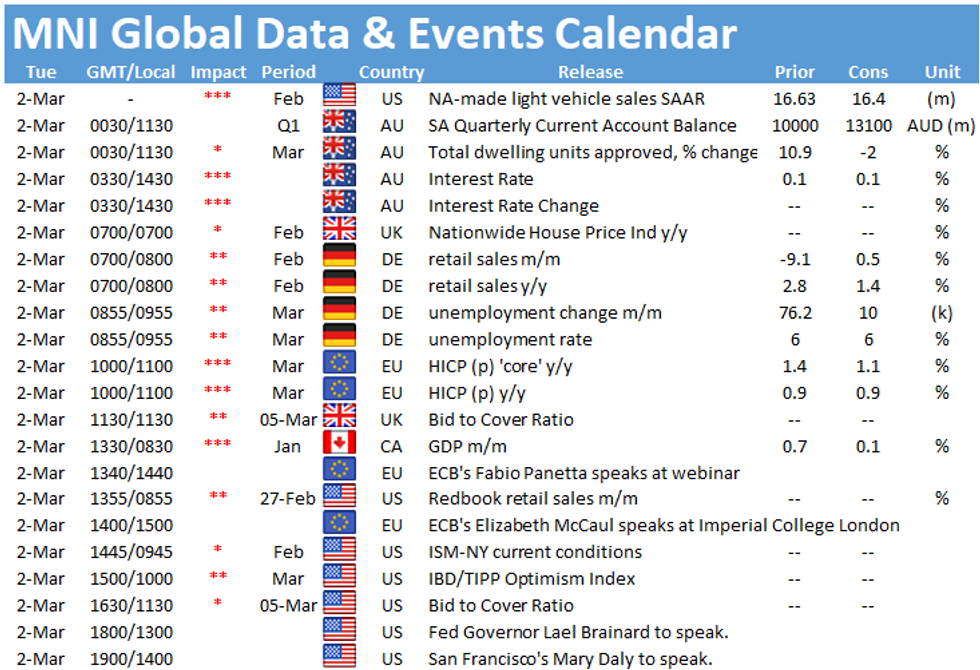

- Focus Tuesday turns to the RBA rate decision, German retail sales, prelim Eurozone CPI numbers and Canadian GDP. Fedspeak continues ahead of the blackout period at the end of this week, with Brainard and Daly both on tomorrow's docket.

BONDS/EGBs-GILTS CASH CLOSE: More Dovish ECB Talk Boosts Big Rally

Monday's session saw a big rally across the space, with 10-Yr Bunds and BTPs dropping most since June 2020, and Gilts underperforming though also stronger.

- An early rally unwinding some of last week's losses gained momentum in the afternoon on comments by ECB's Villeroy that the bank "can and must react" against "unwarranted" tightening of financial conditions. This follows last week's dovish comments by Lagarde, Schnabel, Lane.

- Bunds briefly dipped on ECB data showing a slowdown in asset purchases (vs expectations that the ECB picked up the pace during last week's bond sell-off), but an ECB spokesperson was on the wires to explain this was due to large redemptions.

- Markets largely ignored in-line/above consensus Italy and Spain Feb PMIs, and higher-than-expected German and Italian inflation.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 2.4bps at -0.687%, 5-Yr is down 6.1bps at -0.629%, 10-Yr is down 7.4bps at -0.334%, and 30-Yr is down 5bps at 0.144%.

- UK: The 2-Yr yield is down 2.9bps at 0.099%, 5-Yr is down 4.7bps at 0.353%, 10-Yr is down 6.1bps at 0.759%, and 30-Yr is down 5.2bps at 1.334%.

- Italian BTP spread down 2.9bps at 99.2bps /Spanish spread down 2.5bps at 65.8bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.