-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: What Powell Didn't Say That Mattered

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed To Extend Capital Relief, Eyes Permanent Fix

- MNI REALITY CHECK: US Feb Jobs Likely to Disappoint Again

- MNI INTERVIEW: BOE Should Unwind QE Early, Says Ex-Deputy Bean

- MNI INSIGHT: EU Fiscal Rules Reform Talk Delayed To Sept

- OIL JUMPS MORE THAN 5% AFTER OPEC AGREES TO KEEP OUTPUT, Bbg

US

FED: U.S. regulators including the Federal Reserve are likely to extend a temporary rule easing banks' supplementary leverage ratios for several months more amid concerns that a return to higher capital standards would crimp the flow of credit to a still-convalescent economy, an industry source and former regulatory officials told MNI.

- Officials will also debate permanent concessions to banks at a time of unprecedented expansion of reserves from QE, despite objections from Democratic lawmakers that easier SLR rules weaken the post-crisis financial stability framework, sources said. For more see MNI Policy main wire at 0746ET.

US: U.S. payrolls growth likely rebounded in February after a weaker-than-expected January, though the rate of monthly job growth still isn't anywhere near where it needs to be for a speedy labor market recovery, recruiters and industry experts told MNI.

- The labor market in February improved solidly over January, said Julia Pollak, a labor economist at online jobs marketplace ZipRecruiter, although she warns Friday's report from the Bureau of Labor Statistics is set to disappoint again. For more see MNI Policy main wire at 1401ET.

EUROPE

UK: The Bank of England should make an early start to unwinding quantitative easing, and begin by ceasing reinvestments, former Deputy Governor Charles Bean, now a top official at the Office for Budget Responsibility, told MNI.- The Bank is reviewing its pre-Covid strategy of only unwinding QE after hiking rates from their current 0.1% to 1.5%, which will include weighing the relative importance of asset purchases in supporting both financial stability and the broader economy. It would be appropriate for the BOE to decide to reduce the stock of gilts accumulated since last March, Bean said in an interview.

- It had previously been expected that consultation on reform of the Stability Pact would kick off this Spring after last year's planned discussion on economic governance reform was derailed by the Covid crisis and any further delay could threaten the Spring 2022 timetable for the submissions of draft 2023 national budgets to Brussels. For more see MNI Policy main wire at 1220ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS +9K TO 745K IN FEB 27 WK

- US PREV JOBLESS CLAIMS REVISED TO 736K IN FEB 20 WK

- US CONTINUING CLAIMS -0.124M to 4.295M IN FEB 20 WK

- US Q4 REV NONFARM PRODUCTIVITY -4.2%; Y/Y +2.4%

- US Q4 UNIT LABOR COSTS +6.0%; Y/Y +4.2%

- US JAN FACTORY ORDERS +2.6%; EX-TRANSPORT NEW ORDERS +1.7%

- US JAN DURABLE ORDERS +3.4%

- US JAN NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.4%

- US CHALLENGER: FEB LAYOFF INTENTIONS 34,531 V JAN 79,552

- US CHALLENGER: FEB 2020 LAYOFF INTENTIONS WERE 56,660

- US CHALLENGER: LAYOFF INTENTIONS LED BY RETAIL

- US CHALLENGER: FEB HIRING INTENTIONS 146,403 V JAN 72,063

- US CHALLENGER: HIRING INTENTIONS LED BY RETAIL

- US CHALLENGER: FEB 2020 HIRING INTENTIONS WERE 88,202

- CANADA Q4 LABOR PRODUCTIVITY -2.0% QOQ

MARKET SNAPSHOT

Key late session market levels

- DJIA down 308.56 points (-0.99%) at 30964.55

- S&P E-Mini Future down 42.5 points (-1.11%) at 3774

- Nasdaq down 227.5 points (-1.8%) at 12770.95

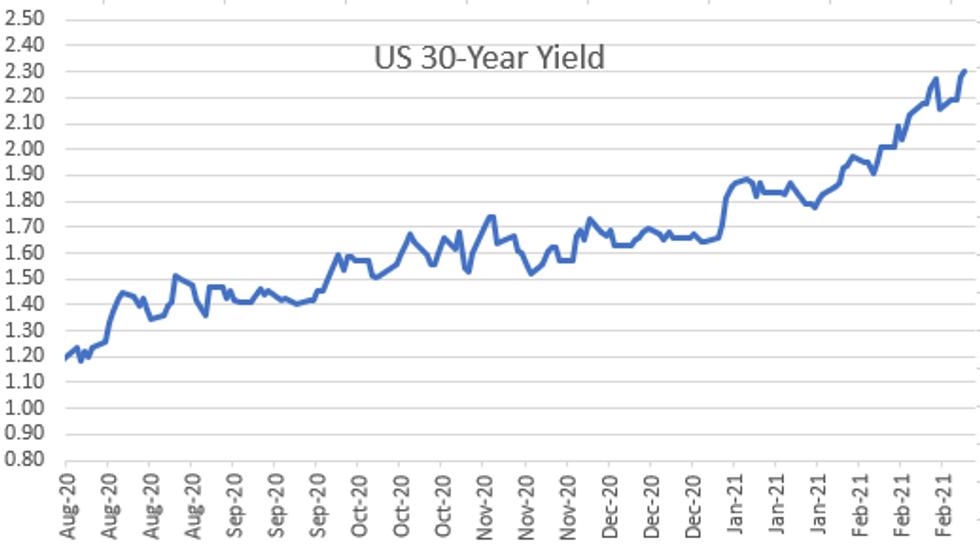

- US 10-Yr yield is up 6.1 bps at 1.5414%

- US Jun 10Y are down 19/32 at 132-14.5

- EURUSD down 0.0092 (-0.76%) at 1.1971

- USDJPY up 0.84 (0.79%) at 107.86

- WTI Crude Oil (front-month) up $2.62 (4.28%) at $63.92

- Gold is down $12.12 (-0.71%) at $1698.81

European bourses closing levels:

- EuroStoxx 50 down 7.93 points (-0.21%) at 3704.85

- FTSE 100 down 24.59 points (-0.37%) at 6650.88

- German DAX down 23.69 points (-0.17%) at 14056.34

- French CAC 40 up 0.59 points (0.01%) at 5830.65

US TSY SUMMARY: Nothing New From Fed Powell

Tsy yields surged to week high of 1.5536% (compared to 1.6085% high last Thu) while Fed Chair held the normal Fed line: keeping longer run inflation expectations anchored AT 2%, a transient increase in inflation will no effect inflation over longer periods.- Tsy futures see-sawed near lows after the virtual Fed Chair Powell event, no bounce as market priced out any hopes of Twist 3.0 that some had hoped would be mentioned before the Fed goes into Blackout at midnight Friday.

- Jun 10Y futures slipped to 132-11.5 low, still trading within the body of price action from Feb 25. In candle terms the pattern on this day is a bearish standard line - a continuation pattern. Attention on 131-31, Feb 25 low.

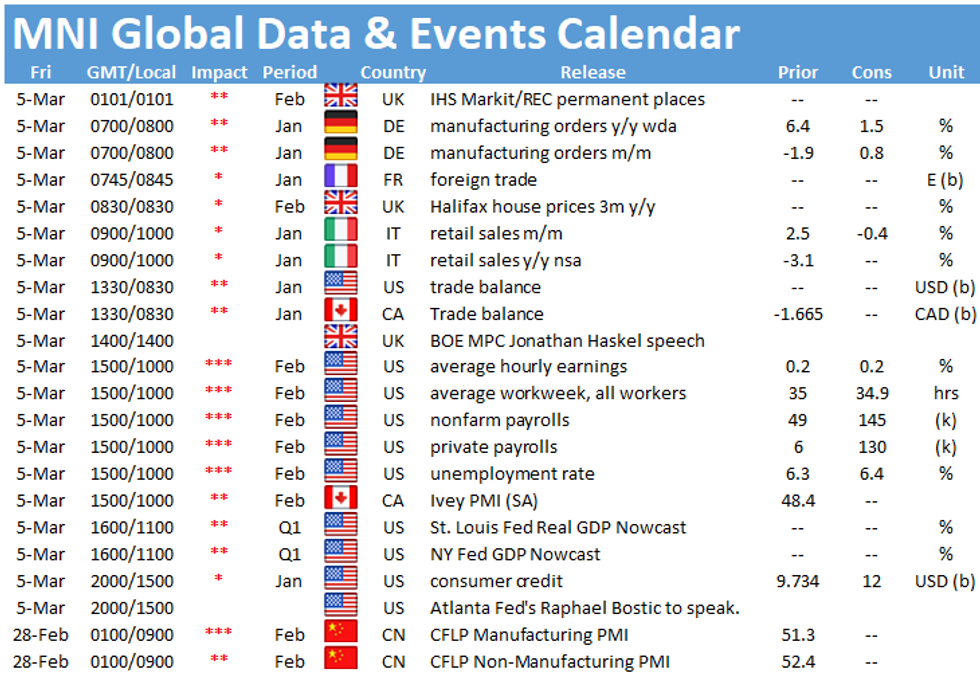

- Not much of an initial react to weekly claims that climbed 9k to 745k, focus on Friday's Feb NFP, +195k mean on wide range of estimates. But a strong bounce after weak Jan gain of +49k will most likely exacerbate the surge in yields.

- Flow included moderate two-way across curve pre-Powell, better prop and fast$ selling emerged as Fed Powell did not lend credence to Twist 3.0, SLR extension or any other measure ahead of Fed blackout late Friday. Large Red Sep/Dec Spread >80,000 EDU2/EDZ2 spds sold 0.110-0.105. Moderate deal-tied hedging. 10Y Repo fail likely rebound after Tsy annc $120B 3-, 10- 30Y auctions next week.

- The 2-Yr yield is up 0.2bps at 0.1427%, 5-Yr is up 4.2bps at 0.7736%, 10-Yr is up 6.2bps at 1.5432%, and 30-Yr is up 2.3bps at 2.2989%.

US TSY FUTURES CLOSE: Near Post-Powell Lows

Futures sold off after Fed Chair Powell did not mention Twist 3.0 or SLR extension, held Fed line: keeping longer run inflation expectations anchored AT 2%, a transient increase in inflation will no effect inflation over longer periods. Yield curves bounced, short end steeper. Little late follow-through ahead Fri Fedb NFP.

- 3M10Y +5.374, 149.394 (L: 140.421 / H: 151.811)

- 2Y10Y +5.765, 139.374 (L: 130.736 / H: 140.693)

- 2Y30Y +2.231, 215.352 (L: 208.615 / H: 217.147)

- 5Y30Y -2.03, 152.234 (L: 151.129 / H: 156.153)

- Current futures levels:

- Jun 2Y steady at at 110-13.125 (L: 110-12.375 / H: 110-13.625)

- Jun 5Y down 7/32 at 124-1.5 (L: 123-31.25 / H: 124-12.25)

- Jun 10Y down 18/32 at 132-15.5 (L: 132-11.5 / H: 133-06)

- Jun 30Y down 1-8/32 at 157-9 (L: 156-31 / H: 158-31)

- Jun Ultra 30Y down 1-12/32 at 186-3 (L: 185-05 / H: 188-08)

US EURODOLLAR FUTURES CLOSE: Short End Outperforms, 3M LIBOR Near All-Time Low

Futures trading mixed after the bell, short end bid after 3M LIBOR set -0.01825 to 0.17550% (-0.01288/wk) ** (Just above Record Low of 0.17525% on 2/19/21). Greens through Golds broadly lower on heavier volumes (-20k EDZ5 Block sale; large Red Sep/Dec Spread >80,000 EDU2/EDZ2 spds sold 0.110-0.105.).

- Mar 21 +0.005 at 99.825

- Jun 21 -0.005 at 99.835

- Sep 21 +0.005 at 99.830

- Dec 21 +0.005 at 99.780

- Red Pack (Mar 22-Dec 22) -0.015 to +0.005

- Green Pack (Mar 23-Dec 23) -0.055 to -0.035

- Blue Pack (Mar 24-Dec 24) -0.075 to -0.06

- Gold Pack (Mar 25-Dec 25) -0.095 to -0.08

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00037 at 0.07813% (-0.00587/wk)

- 1 Month +0.00050 to 0.10350% (-0.01500/wk)

- 3 Month -0.01825 to 0.17550% (-0.01288/wk) ** (Just aboveRecord Low of 0.17525% on 2/19/21)

- 6 Month -0.00775 to 0.20325% (+0.00025/wk)

- 1 Year +0.00175 to 0.28375% (+0.00000/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $215B

- Secured Overnight Financing Rate (SOFR): 0.04%, $897B

- Broad General Collateral Rate (BGCR): 0.03%, $374B

- Tri-Party General Collateral Rate (TGCR): 0.03%, $342B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.426B submission

- Next scheduled purchase:

- Fri 3/5 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: Atmos Energy Edges Past Nissan

- Date $MM Issuer (Priced *, Launch #)

- 03/04 $2.2B #Atmos Energy $1.1B 2NC.5 +48, $1.1B 2NC.5 FRN L+38

- 03/04 $2B #Nissan Motor $300M 3Y +75, $300M 3Y FRN L+64, $800M 5Y +125, $600M 7Y +155

- 03/04 $2B #Lloyds $1B 3NC2 +55, $1B 6NC5 +85

- 03/04 $1B #Entergy Louisiana $500M 11Y +85, $00M 20Y +95

- 03/04 $1B *Swedish Export 3Y +4

- 03/04 $900M LPL Holdings 8NC3

- 03/04 $800M PerkinElmer 10Y+130a, 30Y +155a

- 03/04 $500M #MassMutual 10Y +63

- 03/04 $2.5B Energean Israel 3NC 4.75%, 5NC 5.12%, 7NC 5.62%, 10NC +6% investor call

FOREX: Greenback Strength Pervades as Powell Drops No Dovish Hints

- Markets largely consolidated ahead of the main event of the day - a pre-blackout period appearance from Fed Chair Powell - who stopped short of market expectations for a dovish hint on future policy.

- By not hinting of further accommodation at March's meeting, Powell boosted Treasury yields and the greenback, prompting a rally to one-mwonth highs for the USD index.

- This worked against most major pairs, pressuring EUR/USD through 1.20 and GBP/USD over 100 pips off the session's best levels.

- Equities spiralled on Powell's neutral and defensive approach to policy, taking the wind out of the sails of commodity-tied and growth proxy FX, prompting AUD/USD to re-circle the week's lowest levels. USD/JPY was the main beneficiary, extending the streak of higher highs to eight consecutive sessions.

- Focus Friday rests on the February jobs report, with the US expected to have added 195k jobs on the month. The unemployment rate is forecast unchanged at 6.3%.

BONDS/EGBs-GILTS CASH CLOSE: UK Long End Roars Back

A reasonably quiet cash session Thursday, with market participants focused on an appearance by Fed Chair Powell after the close.

- The UK long end continued to outperform strongly as the session went on, 5s30s returning to the lows of Tues after some steepening Weds.

- BTP spreads widened throughout the session; Democrats party leader Zingarelli announced his resignation this afternoon.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.7bps at -0.686%, 5-Yr is down 1.6bps at -0.62%, 10-Yr is down 2.3bps at -0.311%, and 30-Yr is down 1.8bps at 0.202%.

- UK: The 2-Yr yield is down 0.9bps at 0.08%, 5-Yr is down 2.4bps at 0.342%, 10-Yr is down 4.8bps at 0.731%, and 30-Yr is down 5.7bps at 1.283%.

- Italian BTP spread up 0.8bps at 105.1bps / Spanish spread up 1.2bps at 69bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.