-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Aussie Trimmed Mean Rises In Oct

MNI ASIA OPEN: Senate Passes $1.9T Stimulus; Jobs Surge

EXECUTIVE SUMMARY

- BIDEN'S $1.9 TRILLION STIMULUS BILL PASSED BY U.S. SENATE, Bbg

- MNI BRIEF: Huge US Feb Payrolls Number Won't Move Fed Thinking

- MNI EXCLUSIVE: China To Beat 2021 Growth Target, Advisors Say

US

US: U.S. payrolls growth surged in February, rising by 379,000 when financial markets had expected a gain of 200,000, boosted by the the leisure and hospitality sector recalling 355,000 workers. The unemployment rate also fell by a tenth to 6.2%. Net revisions for prior months were +38,000.

- The report is likely not a gamechanger for the Fed, which is looking for a substantial rebound in labor force participation. That rate held steady at 61.4%, while the employment-population ratio added just a tenth to 57.6%. Treasuries traded lower on the report, with the benchmark 10-yr note last trading at 1.595%, extending the move seen from Thursday's U.S. session.

US TSYS: Real Yields Lead Initial Tsy Move Post-Payrolls

The sharp rise in yields immediately post-payrolls was led by real yields, with inflation breakevens also making up ground lost since Powell's comments yesterday.

- Decomposing the 10-Yr nominal yield move +6bps at one point: 10-Yr real yields up ~4bps) and B/Es up ~ 2bps. Indicative of stronger economic outlook, higher inflation, and tighter Fed policy in light of stronger-than-expected jobs data.

- That said, real yields have now fully reversed the knee-jerk move (bringing nominal yields back below 1.60%) though breakevens are holding their gains.

- We'll see how it settles down but that's the opposite of the move during Powell's commentary when real yields kept rising and breakevens faded. Perhaps suggesting this time that the market believes the Fed could go a little bit more dovish after all?

ASIA

CHINA: China's 2021 economic targets, including growth of above 6%, should be easy to exceed and leave policy room to address structural issues as the government fleshes out a new five-year plan which will focus on making growth sustainable over the longer-term, policy advisors told MNI Friday.

- Growth this year is likely to come in at over 8% as the economy rebounds from the impact of Covid, a significantly higher rate than targeted in the report delivered by Premier Li Keqiang at the opening ceremony of the National People's Congress Friday morning, they said.

MNI BRIEF: Huge US Feb Payrolls Number Won't Move Fed Thinking

U.S. payrolls growth surged in February, rising by 379,000 when financial markets had expected a gain of 200,000, boosted by the the leisure and hospitality sector recalling 355,000 workers. The unemployment rate also fell by a tenth to 6.2%. Net revisions for prior months were +38,000.

- The report is likely not a gamechanger for the Fed, which is looking for a substantial rebound in labor force participation. That rate held steady at 61.4%, while the employment-population ratio added just a tenth to 57.6%. Treasuries traded lower on the report, with the benchmark 10-yr note last trading at 1.595%, extending the move seen from Thursday's U.S. session.

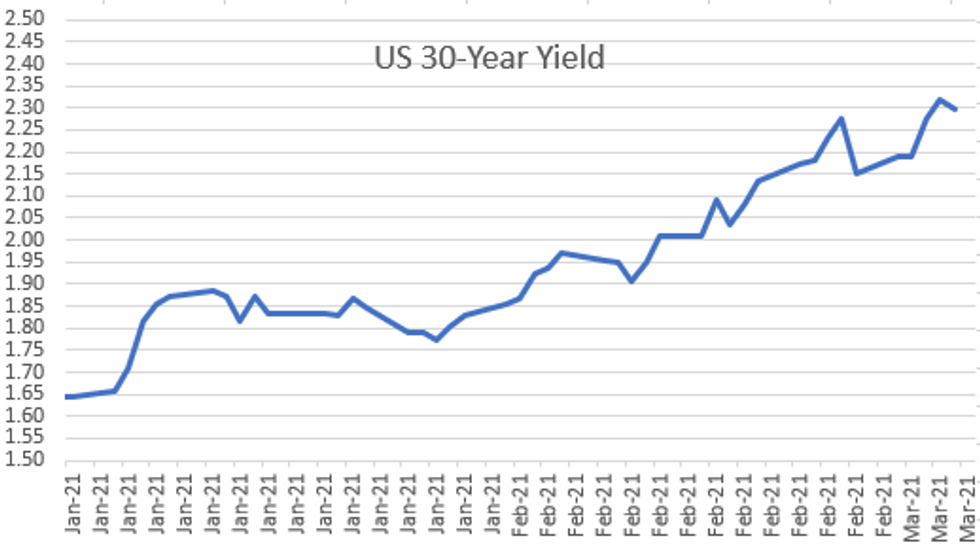

US TSY SUMMARY: Curve Lower, Flatter as Yields Reverse Off Cycle Highs

Treasuries were sold in response to the better-than-expected jobs report, with yields boosted smartly in the 10y sector of the curve. Benchmark 10y yields rose above the 1.6% mark to print 1.6238% - a new cycle high - before reversing on profit-taking flow as well as residual demand from foreign real money accounts and central banks across 5 - 10yr sector of the curve.

- The curve itself traded lower and flatter into the close. A lot of focus was paid to the sharp rise in real yields post-payrolls, with inflation breakevens initially making up lost ground following Powell's comments Thursday.

- Shortly after the data, real yields fully reversed the knee-jerk move (bringing nominal yields back below 1.60%) though breakevens are held gains.

- The Fed blackout kicks off Saturday, leaving markets to parse data due in the coming week. US CPI/PPI crosses as well as prelim Uni. of Michigan confidence.

US TSY FUTURES CLOSE:

- 3M10Y -0.299, 152.556 (L: 149.506 / H: 157.893)

- 2Y10Y +0.595, 142.332 (L: 139.549 / H: 146.933)

- 2Y30Y -1.839, 215.54 (L: 212.084 / H: 219.662)

- 5Y30Y -2.927, 149.827 (L: 145.873 / H: 154.833)

- Current futures levels:

- Jun 2Y up 0.25/32 at 110-13.12 (L: 110-12.25 / H: 110-13.875)

- Jun 5Y down 1.25/32 at 123-31 (L: 123-21.75 / H: 124-02.75)

- Jun 10Y down 1.45/32 at 132-11 (L: 131-23.5 / H: 132-17)

- Jun 30Y up 4/32 at 157-07 (L: 155-27 / H: 157-16)

- Jun Ultra 30Y up 26/32 at 186-15 (L: 184-02 / H: 187-03)

US EURODOLLAR FUTURES CLOSE:

- Mar 21 -0.002 at 99.820

- Jun 21 +0.005 at 99.840

- Sep 21 +0.005 at 99.825

- Dec 21 steady at 99.775

- Red Pack (Mar 22-Dec 22) steady to +0.005

- Green Pack (Mar 23-Dec 23) +0.005 to +0.015

- Blue Pack (Mar 24-Dec 24) steady to -0.01

- Gold Pack (Mar 25-Dec 25) -0.01 to +0.005

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00050 at 0.07763% (-0.00637/wk)

- 1 Month -0.00025 to 0.10325% (-0.01525/wk)

- 3 Month +0.00988 to 0.18538% (-0.00300/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00737 to 0.19577% (-0.00712/wk)

- 1 Year -0.00600 to 0.27775% (-0.00600/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $224B

- Secured Overnight Financing Rate (SOFR): 0.02%, $936B

- Broad General Collateral Rate (BGCR): 0.01%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $343B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $25.845B submission

- Next scheduled purchase:

- Mon 3/8 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Tue 3/9 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Wed 3/10 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 3/11 1500 Next scheduled release schedule

PIPELINE: $71.8B Priced On Week

- Date $MM Issuer (Priced *, Launch #)

- 03/05 No new issuance Friday; $71.8B/wk

- $10.4B Priced Thursday

- 03/04 $2.2B *Atmos Energy $1.1B 2NC.5 +48, $1.1B 2NC.5 FRN L+38

- 03/04 $2B *Nissan Motor $300M 3Y +75, $300M 3Y FRN L+64, $800M 5Y +125, $600M 7Y +155

- 03/04 $2B *Lloyds $1B 3NC2 +55, $1B 6NC5 +85

- 03/04 $1B *Entergy Louisiana $500M 11Y +85, $00M 20Y +95

- 03/04 $1B *Swedish Export 3Y +4

- 03/04 $900M *LPL Holdings 8NC3

- 03/04 $800M *PerkinElmer $400M each 10Y+100, 30Y +130

- 03/04 $500M *MassMutual 10Y +63

- 03/04 $2.5B Energean Israel 3NC 4.75%, 5NC 5.12%, 7NC 5.62%, 10NC +6% investor call

FOREX: Greenback Buoyed By Stellar Jobs Report, Neutral Fed

- The greenback outperformed most others in G10 Friday, following a better-than-expected jobs report. The US added 379k jobs vs. Exp. 200k and the unemployment rate unexpectedly dropped. This firmed the dollar across the board, prompting the USD index to rally to the best levels since late November last year.

- The greenback was further firmed by more less-than-dovish commentary from the Fed. Both Bullard and Kashkari appeared unperturbed by the recent volatility in US real yields, forcing markets to further accept that the Fed may not provide further monetary accommodation as soon as March's Fed meeting. The media blackout period begins Saturday evening.

- Elsewhere, commodity-tied FX traded particularly well, with NOK and CAD firmer after WTI and Brent crude futures extended their OPEC+ inspired rally. NOK/SEK traded above parity for the first time since early 2020.

- Focus in the coming week turns to US CPI / PPI metrics, the Canadian jobs report and the ECB rate decision.

BONDS/EGBs-GILTS CASH CLOSE: Following The US's Lead Again

Bund and Gilt yields spiked to/near session highs following a much stronger-than-expected US employment report, but finished toward the middle/bottom of the day's range after settling down over the course of the afternoon.

- Gilts once again underperformed; periphery spreads ended a little wider.

- The morning was quiet, apart from European cash FI catching up with the overnight bearish moves in Tsys following Fed Chair Powell's not-dovish-enough comments.

- In data, German Jan factory orders came in stronger than expected.

- Next week's highlight is the ECB monetary policy decision on Thursday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.4bps at -0.69%, 5-Yr is up 0.5bps at -0.615%, 10-Yr is up 0.9bps at -0.302%, and 30-Yr is up 0.7bps at 0.209%.

- UK: The 2-Yr yield is up 2bps at 0.1%, 5-Yr is up 2.4bps at 0.366%, 10-Yr is up 2.5bps at 0.756%, and 30-Yr is up 0.4bps at 1.287%.

- Italian BTP spread up 0.5bps at 105.6bps / Spanish spread up 0.5bps at 69.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.