-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Higher After Post-CPI Chop

EXECUTIVE SUMMARY

- House Passes $1.9T Stimulus Bill, Heads to Pres Biden for signature

- MNI EXCLUSIVE: Fed Twist Would Need Severe Market Disruption

- BANK OF CANADA OVERNIGHT INTEREST RATE TARGET +0.25%

- MNI BRIEF: US Business Inflation Expectations Hit 10 Yr High

- MNI POLICY: EU RFF Borrowing 'At Least EUR56bn' In H2: Hahn

- ECB Draft Forecasts Assume Any Inflation Pickup Will Be Fleeting, Bbg

- BOJ IS SAID TO SEEK FREER YIELD FLUCTUATIONS AFTER REVIEW, USD/Yen dips

US

FED: The Federal Reserve would have to see a credit market freeze that threatens the economic recovery before it extends the maturity of its bond purchases in an Operation Twist or makes another significant monetary intervention, former Fed officials told MNI.

- Despite mounting investor speculation of Fed action, the central bank is likely to look through the rapid rise in long-term Treasury yields and even welcome them as a sign of an improving outlook, the sources said. For more see MNI Policy main wire at 0931ET.

CANADA

BOC: The Bank of Canada maintained asset purchases of at least CAD4 billion a week and said QE will be adjusted as policy makers gain confidence in the economic rebound, while holding the 0.25% interest rate and reiterating slack in the economy means conditions for an increase won't be in place for two years.

- "We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank's January projection, this does not happen until into 2023," policy makers led by Governor Tiff Macklem said in a statement.

EUROPE

EU: The European Union would issue a minimum of EUR56bn in the second half of this year for pre-financing of the EU's Recovery and Resilience Fund / NexGen programme, Budget Commissioner Johannes Hahn said Wednesday, adding that "It may be more."

- Hahn said that borrowing strategy for the RRF is currently being developed in terms of its volumes and frequency, he said. For more see MNI Policy main wire at 0958ET.

OVERNIGHT DATA

- US FEB CPI 0.4%, CORE 0.1%; CPI Y/Y 1.7%, CORE Y/Y 1.3%

- US FEB ENERGY PRICES 3.9%

- US FEB OWNERS' EQUIVALENT RENT PRICES 0.3%

- US TREASURY FEB BUDGET DEFICIT $311B VS $235B YR-AGO MONTH

- US TREASURY FEB BUDGET OUTLAYS $559B; +32% VS YR-AGO MONTH

- FYTD21 BUDGET DEFICIT +68% VS YR-AGO, $1.047T VS $624B FYTD20

- US MBA: REFIS -5% SA; PURCH INDEX +7% SA THRU MAR 5 WK

- US MBA: UNADJ PURCHASE INDEX +2% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.26% VS 3.23% PREV

- BANK OF CANADA OVERNIGHT INTEREST RATE TARGET +0.25%

- BOC REITERATES CONDITIONS FOR RATE HIKE NOT SEEN UNTIL 2023

- BOC MAINTAINS QE PACE OF AT LEAST CAD4B PER WEEK

- BOC SAYS QE TO BE ADJUSTED AS POLICYMAKERS GAIN CONFIDENCE

- BOC CPI TO TEMPORARILY BE ABOUT 3% IN COMING MONTHS, THEN SLOW

MARKETS SNAPSHOT

Key late session market levels

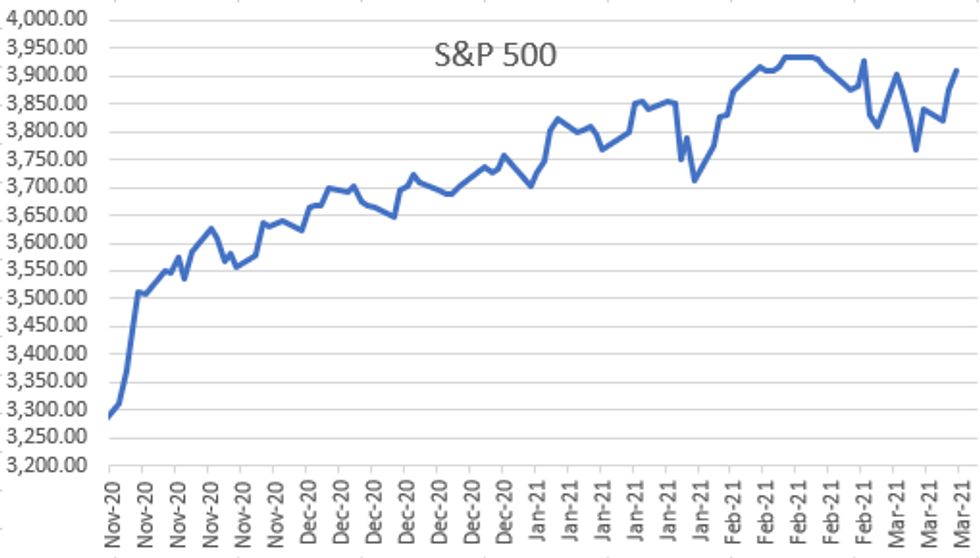

- DJIA up 493.67 points (1.55%) at 32352.94

- S&P E-Mini Future up 31.5 points (0.81%) at 3909.25

- Nasdaq up 36.1 points (0.3%) at 13127.78

- US 10-Yr yield is down 0.3 bps at 1.523%

- US Jun 10Y are up 6.5/32 at 132-16

- EURUSD up 0.0021 (0.18%) at 1.1921

- USDJPY down 0.08 (-0.07%) at 108.42

- WTI Crude Oil (front-month) up $0.52 (0.81%) at $64.48

- Gold is up $7.77 (0.45%) at $1724.31

European bourses closing levels:

- EuroStoxx 50 up 33.87 points (0.89%) at 3819.92

- FTSE 100 down 4.74 points (-0.07%) at 6725.6

- German DAX up 102.31 points (0.71%) at 14540.25

- French CAC 40 up 65.58 points (1.11%) at 5990.55

US TSY SUMMARY: Post-CPI Chop; SLR Extension Debate

Choppy first half, Tsy futures see-sawed following CPI: Core +0.1015% M/M unrounded, so firmly bottom of 0.1-0.3% expected range and 0.2% median. Mainly due to drop in core goods prices, -0.2% M/M, lowest since May 2020. Core services were +0.2%, highest since Nov 2020.- Decent early two-way as Tsys drew fast$ selling on bounce, while buyers reloaded. Appr 95,000 TYM traded in the five minutes after the CPI data release, from 132-08 to -13.5, 132-11.5 high volume price.

- Another day closer to SLR deadline on March 31, participants still expect extension. Buy the rumor, sell the fact.

- Rates extended top end of range ahead the $38B 10Y note auction re-open, sold off briefly after small tail: drawing 1.523% high yield (1.155% last month) vs. 1.520% WI; 2.37 bid/cover (2.37 previous).

- After some chunky flatteners Blocked in prior session, steepeners gained momentum: On the heels of lar +18,934 TYM blocked 132-11, second leg showed up: -4,638 WNM at 187-16 -- post-time bid at 0935:37ET. Appears to be steepener, $1.6M dv01.

- Option flow continued to revolve around puts with some notable consolidation: -20,500 TYK 128/131.5 put spds, 35-33 (unwind, paper +30k 45-47 Monday).

- The 2-Yr yield is down 0.6bps at 0.1548%, 5-Yr is down 1.3bps at 0.7923%, 10-Yr is down 0.3bps at 1.523%, and 30-Yr is up 1.4bps at 2.2479%

US TSY FUTURES CLOSE: Hold Gains W/Higher Stocks

Tsy futures hold firmer across the board, just off the top end of the range as equities remain strong (ESH1 +33; DJIA +525.0). Yield curves mixed, 5s and 10s vs. 30s steeper.

- 3M10Y -0.938, 147.641 (L: 145.587 / H: 152.417)

- 2Y10Y -0.093, 136.272 (L: 134.911 / H: 139.999)

- 2Y30Y +1.5, 208.583 (L: 206.876 / H: 211.515)

- 5Y30Y +2.35, 145.03 (L: 142.561 / H: 147.376)

- Current futures levels:

- Jun 2Y up 0.5/32 at 110-11.75 (L: 110-10.75 / H: 110-12)

- Jun 5Y up 5/32 at 123-30 (L: 123-23.25 / H: 123-31.75)

- Jun 10Y up 7.5/32 at 132-17 (L: 132-04.5 / H: 132-21.5)

- Jun 30Y up 12/32 at 158-5 (L: 157-10 / H: 158-11)

- Jun Ultra 30Y up 16/32 at 187-29 (L: 186-19 / H: 188-10)

US EURODOLLAR FUTURES CLOSE: Greens Outperform

Trading steady to mixed, weaker short end underperforms better levels in Greens. Lead quarterly EDH1 trades weaker all session after 3M LIBOR bounced +0.00688 to 0.18413% (-0.00125/wk) after nearly tapping Record Low of 0.17525% (2/19/21) on Tuesday. Current levels:

- Mar 21 -0.005 at 99.815

- Jun 21 -0.005 at 99.835

- Sep 21 -0.005 at 99.815

- Dec 21 -0.005 at 99.760

- Red Pack (Mar 22-Dec 22) steady to +0.025

- Green Pack (Mar 23-Dec 23) +0.030 to +0.045

- Blue Pack (Mar 24-Dec 24) +0.025 to +0.035

- Gold Pack (Mar 25-Dec 25) +0.015 to +0.025

Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.07725% (-0.00038/wk)

- 1 Month -0.00125 to 0.10588% (+0.00263/wk)

- 3 Month +0.00688 to 0.18413% (-0.00125/wk) (Just above Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00413 to 0.19363% (-0.00225/wk)

- 1 Year -0.00100 to 0.27863% (+0.00088/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $219B

- Secured Overnight Financing Rate (SOFR): 0.02%, $914B

- Broad General Collateral Rate (BGCR): 0.01%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $341B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $5.821B submission

- Thu 3/11 1500ET Next scheduled release schedule

PIPELINE: Upsized $6.5B United Airlines Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/10 $6.5B #American Airlines, $3.5B 5NC 5.5%, $3B 8NC 5.75%

- 03/10 $500M *IADB 7Y FRN SOFR+27a

- On tap for Friday:

- 03/12 $800M Pitney Bowes 6NC3, 8NC3

- However, Verizon debt something to be alert for as they still hold the record for largest multi-tranche jumbo issuance w/ $49B back in August 2013.

- In 2020, Verizon only issued a total of $15.5B:

- November 2020 $12B *Verizon 5pt: $2B 5Y +40, $2.25B +10Y +85, $3B 20Y +115, $2.75B 30Y +115, $2B 40Y +130

- March 2020 $3.5B Verizon 3pt: $750M 7Y +215, $1.5B 10Y +225, $1.25B 30Y +250.

FOREX: JPY Downtrend Pauses as Markets Ponders Two-Way Risk for Yields

- JPY bounced well off the overnight lows, dragging USD/JPY further off the week's best levels of 109.23 as Bloomberg reported that the Bank of Japan were said to be seeking a freer rein over bond yield fluctuations as part of their policy review. This re-introduction of two-way risk to Japanese bond markets underpinned the drop in USD/JPY, but a slip through 108.27 is needed to halt current bullish momentum.

- The greenback traded mixed, trading largely inside recent ranges against most others in G10. EUR/USD shrugged off sourced reports that the ECB see only a fleeting bounceback in inflation as part of their forecasts due for release Thursday.

- NOK was among the best performers, with CHF and CAD trading poorly. The Bank of Canada stood pat on policy but reaffirmed the pace of their asset purchase program against outside expectations of a taper.

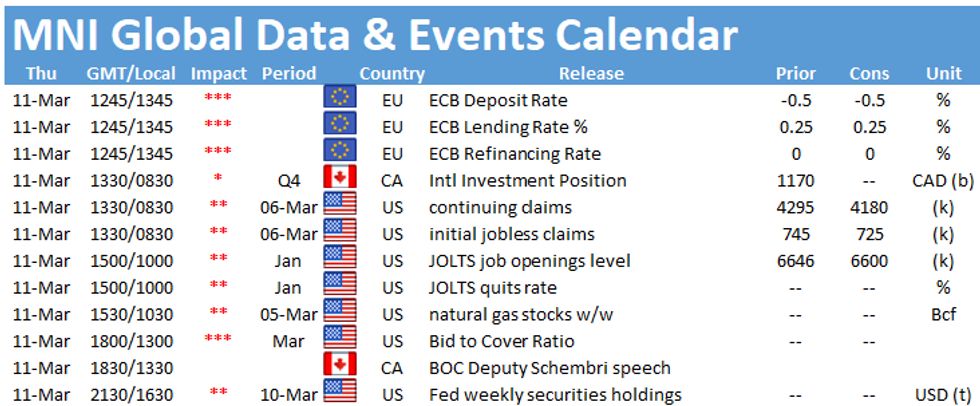

- Focus Thursday rests on the ECB. The bank are seen keeping policy unchanged, but plenty of focus rests on the governing council's explanation for the slowing in their asset purchase program in recent weeks. US weekly jobless claims are also on the docket.

BONDS/EGBs-GILTS CASH CLOSE: Awaiting Lagarde

Bund and Gilt yields fell Wednesday, with mixed moves (UK short-end outperformed, whereas it was the opposite in Germany). Periphery spreads a little tighter.

- Little newsflow driving the market, with more attention on US CPI data (which came in on the soft side, boosting global core FI), and the ECB decision and Pres Lagarde's press conf on Thursday.

- In data, French IP came in stronger than expected; bond supply came from UK (Linker, GBP800mn), Germany (Bobl, EUR3.2595bn allotted), Portugal (OTs, EUR1.25bn), with Latvia selling E1.25bn in 10-yr bonds via syndication.

- Late in the session, the EU sent an RfP for further SURE issuance.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.682%, 5-Yr is down 0.7bps at -0.616%, 10-Yr is down 1.2bps at -0.313%, and 30-Yr is down 2.1bps at 0.184%.

- UK: The 2-Yr yield is down 1.8bps at 0.066%, 5-Yr is down 1.4bps at 0.319%, 10-Yr is down 1.3bps at 0.714%, and 30-Yr is down 1.3bps at 1.229%.

- Italian BTP spread down 0.5bps at 98.8bps /Spanish spread up 0.1bps at 66.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.