-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

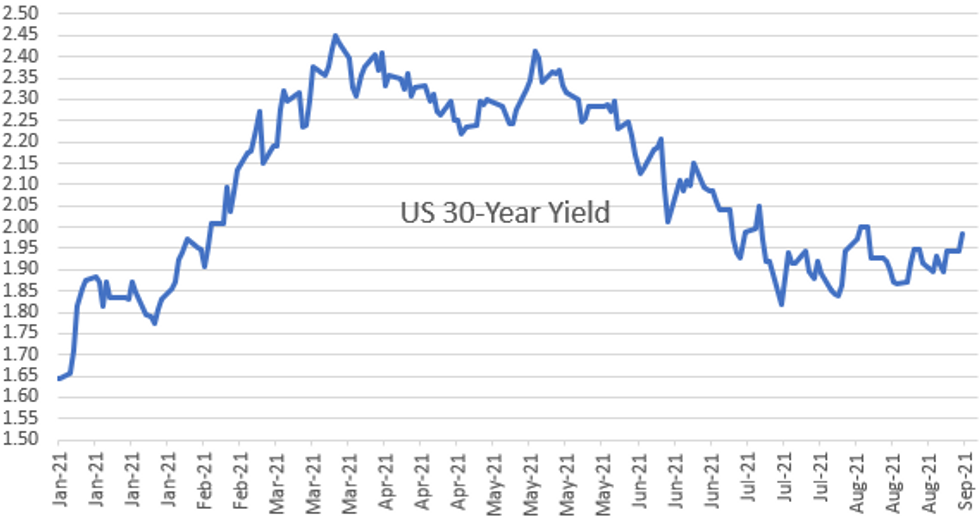

MNI ASIA OPEN: 30Y Bond Ylds Back to Mid-August Lvl

EXECUTIVE SUMMARY

- US PRES BIDEN TO LAY OUT PLAN TO STOP DELTA, BOOST VACCINATIONS THURSDAY, Bbg

- SCOTLAND AIMS TO HOLD NEW INDEPENDENCE VOTE BEFORE END OF 2023, Bbg

US TSYS:: High-Grade Issuance Surge, Tsy Auctions Weighed on Rates

Markets returned from extended holiday weekend to carry-over weakness in rates Tuesday -- no significant economic data or market moving headlines, but pressured by surge in corporate issuance, four US Tsy bill auctions and $58B 3Y note auction. Tsy auctions were anticipated, but the breadth and size of the corporate issuance spurred speculative selling to get ahead of rate lock hedging -- exacerbating the curve steepening sell-off. 30YY climbed to 1.9965% high, last seen Aug 13.

- Over $30B high-grade corporate issuance issued Tuesday from a mix of 21 corporations, banks and supra-sovereigns (multi-tranche Nestle ($5B) and TD Bank ($4.5B) leading). Midday rebound off lows stalled as rate locks came back on as size of Nestle and TD Bank made the rounds.

- Tsys held weaker/off mid-morning lows after $58B 3Y note auction (91282CCX7) stops through: 0.447% high yield vs. 0.450% WI; 2.45x bid-to-cover steady w/5 auction avg. Indirect take-up remains strong at 56.67% vs. 55.41% last month, while direct bidder take-up climbs to new 1+ year high of 18.97%. Primary dealer take-up slips to 24.37% vs. Aug's 26.17% and well off 29.53% 5M average.

- Aside from deal and Tsy auction hedging, there was decent rolling of Sep MAC Swap futures (>65k) to Dec on CME Block cross facility.

- The 2-Yr yield is up 1.4bps at 0.2201%, 5-Yr is up 3.4bps at 0.8174%, 10-Yr is up 4.6bps at 1.3681%, and 30-Yr is up 4.1bps at 1.9833%.

OVERNIGHT DATA

No relevant economic data released Tuesday.

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 214.39 points (-0.61%) at 35155.77

- S&P E-Mini Future down 9.5 points (-0.21%) at 4525.5

- Nasdaq up 31.2 points (0.2%) at 15395.25

- US 10-Yr yield is up 4.6 bps at 1.3681%

- US Dec 10Y are down 12/32 at 133-0.5

- EURUSD down 0.0025 (-0.21%) at 1.1845

- USDJPY up 0.43 (0.39%) at 110.29

- WTI Crude Oil (front-month) down $0.92 (-1.33%) at $68.38

- Gold is down $26.52 (-1.45%) at $1796.77

- EuroStoxx 50 down 21.12 points (-0.5%) at 4225.01

- FTSE 100 down 37.81 points (-0.53%) at 7149.37

- German DAX down 89.03 points (-0.56%) at 15843.09

- French CAC 40 down 17.43 points (-0.26%) at 6726.07

US TSY FUTURES CLOSE

- 3M10Y +5.505, 132.923 (L: 128.179 / H: 134.282)

- 2Y10Y +3.345, 114.775 (L: 112.84 / H: 116.361)

- 2Y30Y +2.943, 176.334 (L: 174.275 / H: 177.773)

- 5Y30Y +0.806, 116.477 (L: 115.255 / H: 117.289)

- Current futures levels:

- Dec 2Y down 1/32 at 110-4.5 (L: 110-04.5 / H: 110-05.875)

- Dec 5Y down 5.5/32 at 123-16.5 (L: 123-14.75 / H: 123-22.25)

- Dec 10Y down 12.5/32 at 133-0 (L: 132-28.5 / H: 133-12)

- Dec 30Y down 1-0/32 at 161-29 (L: 161-20 / H: 162-26)

- Dec Ultra 30Y down 1-20/32 at 195-6 (L: 194-24 / H: 196-23)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.883

- Dec 21 steady at 99.825

- Mar 22 steady at 99.855

- Jun 22 steady at 99.815

- Red Pack (Sep 22-Jun 23) -0.03 to -0.005

- Green Pack (Sep 23-Jun 24) -0.05 to -0.035

- Blue Pack (Sep 24-Jun 25) -0.055 to -0.05

- Gold Pack (Sep 25-Jun 26) -0.055 to -0.05

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00213 at 0.07288% (+0.00213/wk)

- 1 Month +0.00013 to 0.08313% (+0.00025/wk)

- 3 Month +0.00137 to 0.11600% (+0.00050/wk) ** Record Low .11463% on 9/6/21

- 6 Month -0.00062 to 0.14813% (-0.00025/wk)

- 1 Year +0.00050 to 0.22000% (-0.00275/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.05%, $883B

- Broad General Collateral Rate (BGCR): 0.05%, $386B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.673B submission

- Next scheduled purchases:

- Wed 9/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Thu 9/09 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 09/10 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage climbs to 1,079.945B from 77 counter-parties vs. $1,074.707B last Friday. Record high holds at $1,189.616B set Tuesday, Aug 31.

PIPELINE: Over $30B To Price Tuesday

Multi-tranche Nestle ($5B) and TD Bank ($4.5B) lead surge in corporate, bank and supra-sovereign issuance Tuesday -- over $30B while still waiting on RBC 5Y details.

- Date $MM Issuer (Priced *, Launch #)

- 09/07 $5B #Nestle 6pt: $1.5B 3NC2 +18a, $500M each: 5Y +35, 7Y +40, 10Y +50, 20Y +60, 30Y +68

- 09/07 $4.5B #TD Bank $1B 3Y +30, $900M 3Y FRN/SOFR, $1.4B 5Y +47, $300M 5Y FRN/SOFR, $900M 10Y +67

- 09/07 $Benchmark Royal Bank of Canada 5Y +18

- 09/07 $3B #Home Depot $1B each: 7Y +42, 10Y +57, 30Y +82

- 09/07 $2B #Caterpillar Financial $750M 3Y +22, $750M 3Y FRN/SOFR+27, $500M 5Y +37

- 09/07 $2B #ING $1B perp NC6 3.875%, $1B perp NC10 4.25%

- 09/07 $2B #Danske Bank $1B 4Y +55, $1B 6Y +73

- 09/07 $1.75B #American Honda $1B 3Y +35, $750M 5Y +50

- 09/07 $1.5B #GA Global Funding $500M each: 3Y+45, 3Y FRN/SOFR+50, 7Y+85

- 09/07 $1.5B *Waste Connections $650M 10Y +85, $850M 30Y +105

- 09/07 $1.5B Texas Inst 5Y +55a, 10Y +80a, 30Y +100a

- 09/07 $1.5B #Banco Santander 6NC5 +90

- 09/07 $1.35B #DCX Technology $700M 5Y +100, $650M 7Y +125

- 09/07 $1.25B *John Deere Capital $750M 2Y FRN/SOFR+12, $500M 3Y +22

- 09/07 $1B #Union Pacific $150M 2031 Tap +62.5, $850M 30Y+97

- 09/07 $1B *Enterprise Products WNG +31Y +137.5

- 09/07 $800M *DBS Group 5.5Y +37

- 09/07 $750M #Amphenol 10Y +87

- 09/07 $750M #Arche-Daniels-Midland 30Y +80

- 09/07 $700M #Packaging Corp WNG 30Y +110

- 09/07 $500M #Met Tower Funding 5Y +45

- 09/07 Investor calls: Walmart, CGI Inc, AvalonBay FI

EGBs-GILTS: Issuance Pushes Yields To Multi-Month Highs

UK and German yields rose sharply Tuesday, with bear steepening in the curves as supply weighed. Periphery spreads widened slightly, with Italy underperforming.

- The main theme was supply: Spain syndicated its inaugural Green Obli (E5bln), Austria sold E1.6bln of 10-15Y and the UK sold GBP4.5bln of 4-/50Y. The EU announced its borrowing plan update.

- All the while, heavy US Treasury and Corporate issuance pushed 10Y Bund / Gilt yields to highest levels since July / June, respectively.

- BoE Saunders said rates could rise in the next 12 months; UK PM Johnson announced a 1.25% national insurance tax hike, though little market impact as was previously reported.

- German ZEW disappointed; Eurozone GDP was revised higher.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.7bps at -0.698%, 5-Yr is up 4.2bps at -0.63%, 10-Yr is up 4.5bps at -0.322%, and 30-Yr is up 3.4bps at 0.169%.

- UK: The 2-Yr yield is up 1.4bps at 0.192%, 5-Yr is up 2.3bps at 0.377%, 10-Yr is up 4.3bps at 0.737%, and 30-Yr is up 3.5bps at 1.075%.

- Italian BTP spread up 1.8bps at 107.5bps / Spanish up 0.6bps at 69.1bps

FOREX: Dollar Index Extends Bounce As US Yields Edge Higher

- The dollar remained underpinned throughout Tuesday's session as US markets returned from the Labor Day holiday.

- Both higher U.S. yields, combined with a softer tone for equities/commodities provided the USD with solid demand. The dollar index extended on Monday's gains, recovering from a poor streak culminating in a weak headline NFP print last Friday.

- The Canadian Dollar (-0.8%) was the weakest among G10 currencies with weaker risk sentiment and the higher greenback fuelling demand for USDCAD. In similar fashion, both AUD and NZD fell over half a percent.

- With EURUSD trading higher Friday on the weaker-than-forecast NFP release, the pair touched but failed to break key resistance at the Jul 30 high of 1.1909. This level remains a key hurdle for bulls. On the downside, the support to watch is 1.1735, Aug 27 low. A break would suggest the recent rally is over.

- EMFX was also on the backfoot given the elevated US yields and stronger US dollar, with the Chilean Peso (-1.00%) and the Turkish Lira (-0.78%) faring the worst.

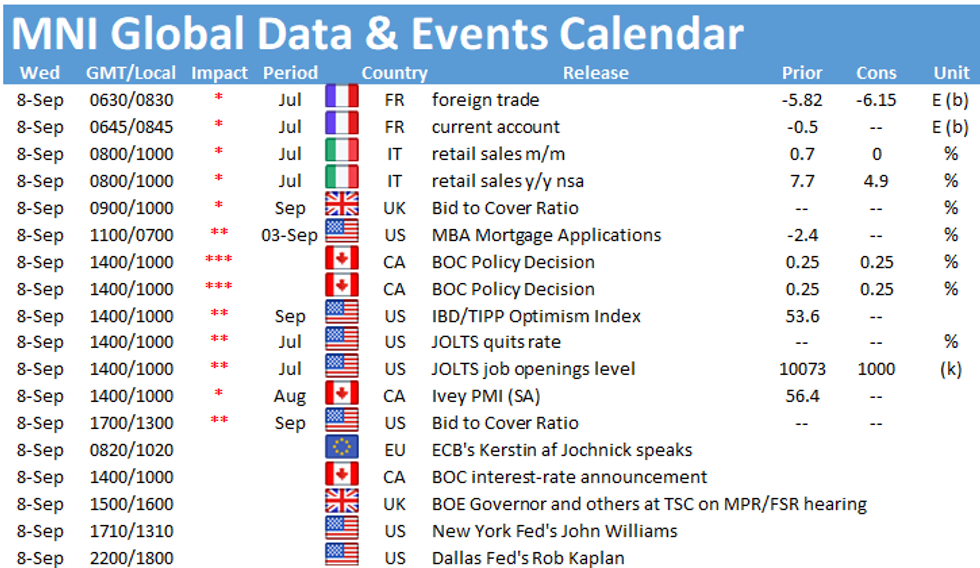

- Tomorrow, markets will await the September Bank of Canada decision/statement. The BOC will likely try to avoid creating any political talking points less than two weeks ahead of the snap federal election on September 20.

- The domestic UK highlight of the week will be the Treasury Select Committee hearing tomorrow with MPC Governor Bailey and members Broadbent, Ramsden and Tenreyro all due to testify.

- Highlights in the U.S. will be July Jolts data and the Fed's Beige Book before markets prepare for the EBC statement/press conference on Thursday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.