-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Taper Green Light Does Not Mean Rate Liftoff

EXECUTIVE SUMMARY

- MNI: Fed's Bostic Sees Risk of Un-Anchored Inflation

- MNI: Fed's Clarida Sees Upside Inflation Risks, Taper on Track

- FED'S BOSTIC SAYS US JOBS SLOWDOWN SHOULD NOT DERAIL TAPER: FT, Bbg

- IMF TRIMS '21 WORLD GROWTH OUTLOOK, SEES `DANGEROUS DIVERGENCE'

US

FED: Atlanta Federal Reserve President Raphael Bostic on Tuesday pointed to risks that the current episode of rapid inflation will turn into a more dangerous period where price expectations become untethered, and conditions are right for the FOMC to start scaling back bond purchases.

- "Pervasive supply chain issues will probably last longer than most of us initially expected," Bostic said in prepared remarks to the Peterson Institute of International Economics. "Up to now, indicators do not suggest that long-run inflation expectations are dangerously untethered. But the episodic pressures could grind on long enough to un-anchor expectations."

- The "salient" upside risks keeping CPI above 2% for some time "argue for a removal of the Committee's emergency monetary policy stance, starting with the reduction of monthly asset purchases," Bostic said. For more see MNI Policy main wire at 1231ET.

- "I continue to believe that the underlying rate inflation in the U.S. economy is hovering close to our 2 percent longer-run objective and, thus, that the unwelcome surge in inflation this year, once these relative price adjustments are complete and bottlenecks have unclogged, will in the end prove to be largely transitory," Clarida said in prepared remarks to the Institute for International Finance.

- "I believe, as do most of my colleagues, that the risks to inflation are to the upside, and I continue to be attuned and attentive to underlying inflation trends, in particular measures of inflation expectations," Clarida said. For more see MNI Policy main wire at 1115ET.

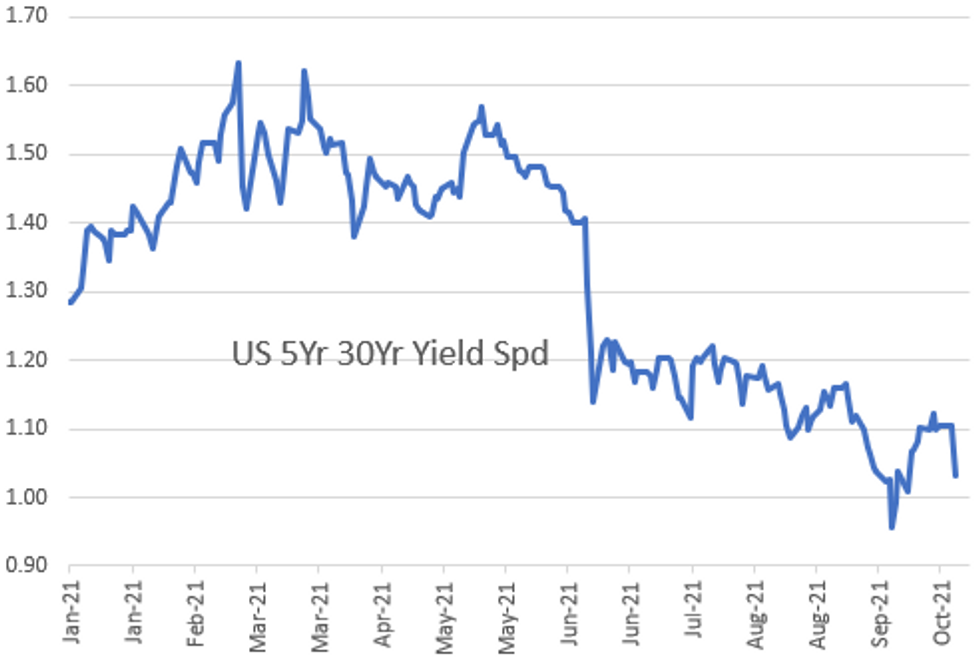

US TSYS: Yld Curves Bull Flatten, Mkt Prices Rate Liftoff Sooner Than Expected

Tsy futures traded strong Tuesday, bonds outperforming as yield curves bull-flattened back to levels not seen since late September. No single driver at play, trading desks cite array of reasons for move including Tsy supply hedging, Asian and domestic real$ acct selling in short - to intermediates.- Plausible driver: rate-hike expectations getting pushed forward as taper annc on schedule for November -- last Fri's NFP miss not enough to forestall Fed's hand. Keep in mind, as Clarida said earlier today, green light for taper does not mean green light for rate liftoff.

- Large Lead-Quarterly Eurodollar futures sale: -30,000 EDZ1 99.825 (-0.005) prior to latest comments from Fed VC Clarida (echoing Bostic earlier: Fri's Sep NFP miss does not derail taper annc in November).

- Tsy auctions, 3- and 10Y sales both stopped through:

- Treasury futures holding gains after $58B 3Y note auction (91282CDB4) stopped-through: 0.635% high yield vs. 0.637% WI; 2.36x bid-to-cover vs. 2.46x 5-auction average.

- Tsy futures continue to inch higher after $38B 10Y note auction re-open (91282CCS8) stops through with 1.584% high yield vs. 1.588% WI; 2.58x bid-to-cover on par with Sep's 2.59x but well above five auction avg: 2.53x.

- The 2-Yr yield is up 2.8bps at 0.3459%, 5-Yr is up 1.2bps at 1.071%, 10-Yr is down 3.7bps at 1.5751%, and 30-Yr is down 6.3bps at 2.1011%.

OVERNIGHT DATA

- US BLS: JOLTS OPENINGS RATE 10.439M IN AUG

- US BLS: JOLTS QUITS RATE 2.9% IN AUG

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 65.72 points (-0.19%) at 34430.69

- S&P E-Mini Future down 5.5 points (-0.13%) at 4345.5

- Nasdaq down 4.2 points (0%) at 14481.89

- US 10-Yr yield is down 3.7 bps at 1.5751%

- US Dec 10Y are up 10/32 at 131-5

- EURUSD down 0.0021 (-0.18%) at 1.1531

- USDJPY up 0.3 (0.26%) at 113.61

- WTI Crude Oil (front-month) up $0.06 (0.07%) at $80.59

- Gold is up $7.1 (0.4%) at $1761.25

- EuroStoxx 50 down 17.43 points (-0.43%) at 4055.09

- FTSE 100 down 16.62 points (-0.23%) at 7130.23

- German DAX down 52.27 points (-0.34%) at 15146.87

- French CAC 40 down 22.43 points (-0.34%) at 6548.11

US TSY FUTURES CLOSE

- 3M10Y -1.388, 152.187 (L: 152.187 / H: 157.613)

- 2Y10Y -6.279, 122.724 (L: 122.299 / H: 127.389)

- 2Y30Y -8.901, 175.326 (L: 174.454 / H: 181.856)

- 5Y30Y -7.279, 102.847 (L: 101.726 / H: 108.578)

- Current futures levels:

- Dec 2Y steady at at 109-28.5 (L: 109-27.875 / H: 109-29.5)

- Dec 5Y up 3.5/32 at 122-11 (L: 122-06.75 / H: 122-13.25)

- Dec 10Y up 10/32 at 131-5 (L: 130-25.5 / H: 131-07)

- Dec 30Y up 1-05/32 at 158-20 (L: 157-13 / H: 158-21)

- Dec Ultra 30Y up 2-15/32 at 190-22 (L: 188-02 / H: 190-24)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.830

- Mar 22 -0.005 at 99.835

- Jun 22 -0.005 at 99.745

- Sep 22 -0.015 at 99.605

- Red Pack (Dec 22-Sep 23) -0.015 to -0.01

- Green Pack (Dec 23-Sep 24) -0.005 to +0.015

- Blue Pack (Dec 24-Sep 25) +0.025 to +0.045

- Gold Pack (Dec 25-Sep 26) +0.055 to +0.070

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00137 at 0.07400% (+0.00137/wk)

- 1 Month +0.00250 to 0.08788% (+0.00425/wk)

- 3 Month +0.00500 to 0.12575% (+0.00562/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00063 to 0.15713% (+0.00063/wk)

- 1 Year +0.00475 to 0.26138% (+0.01438/wk)

- Tsys 10Y-22.5Y, $1.401B accepted vs. $4.108B submission

- Next scheduled purchases

- Wed 10/13 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 10/14 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 10/14 1500ET: Update NY Fed Operational Purchase Schedule

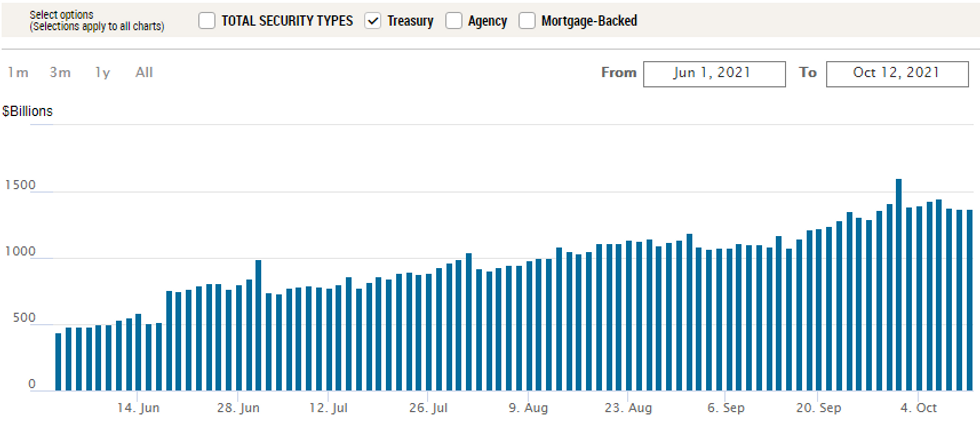

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $1,367.051B from 79 counterparties vs. $1.371.958B on Friday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: CIBC 3Y Launched Late; KFW, DBJ Expected Wednesday

- Date $MM Issuer (Priced *, Launch #

- 10/12 $2.75B #BPCE $750M 6NC5 +155, $1B 11NC10 +98, $1B 21NC20 +155

- 10/12 $2.25B #General Motors $850M 3Y +60, $400M 3Y FRN/SOFR+62, $1B 7Y +105

- 10/12 $1B #Export/Import Bank of Korea (Kexim) 7Y Green +35

- 10/12 $1.35B #CIBC $650M 3Y +40, $700M 3Y FRN/SOFR+42

- Expected Wednesday:

- 10/12 $3B KFW WNG 5Y Green +21a

- 10/12 $Benchmark Development Bank of Japan (DBJ) 5Y +16a, 10Y +28a

EGBs-GILTS CASH CLOSE: Gilts Rally After BoE Operation

The German curve bear flattened but Gilts enjoyed flattening of the bull variety Tuesday, while periphery EGB spreads tightened.

- Supply was the theme of the morning, including the EU selling E12bln of 15-Yr Green bond via syndication (>E135bln books), and Dutch, Gilt and Schatz auctions.

- And in the afternoon, Gilts rallied following a low offer-to-cover at the BoE's long-dated APF operation (30Y yields fell 6bp from that point on).

- The US's return from a holiday Monday helped exacerbate global moves in the afternoon.

- Earlier, UK labor market data came in strong, on balance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.9bps at -0.662%, 5-Yr is up 3.8bps at -0.465%, 10-Yr is up 3.5bps at -0.086%, and 30-Yr is up 1.9bps at 0.376%.

- UK: The 2-Yr yield is down 3.2bps at 0.563%, 5-Yr is down 3.1bps at 0.777%, 10-Yr is down 4bps at 1.148%, and 30-Yr is down 7.1bps at 1.448%.

- Italian BTP spread down 2.5bps at 101.2bps / Greek down 2.3bps at 102.4bps

FOREX: JPY Weaker for Fourth Consecutive Session

- For a second session, JPY was comfortably the poorest performer with markets looking to secure a close north of the key downtrendline drawn off the December 1975 high at 113.41. This marks the 11th session in the past 15 in which USD/JPY has closed higher. This opens gains for USD/JPY toward levels not seen since late 2018, with 114.55 the medium-term upside target.

- Growth proxy and high beta currencies led the way higher, with CAD, AUD and NOK among the firmest in G10. Weakness in the single currency keeps EUR/USD within range of the YTD lows printed on Oct 6th at 1.1529. This level marks the bear trigger and a break below would expose losses toward 1.1493, the 50% retracement of the Mar'20 - Jan'21 bull phase.

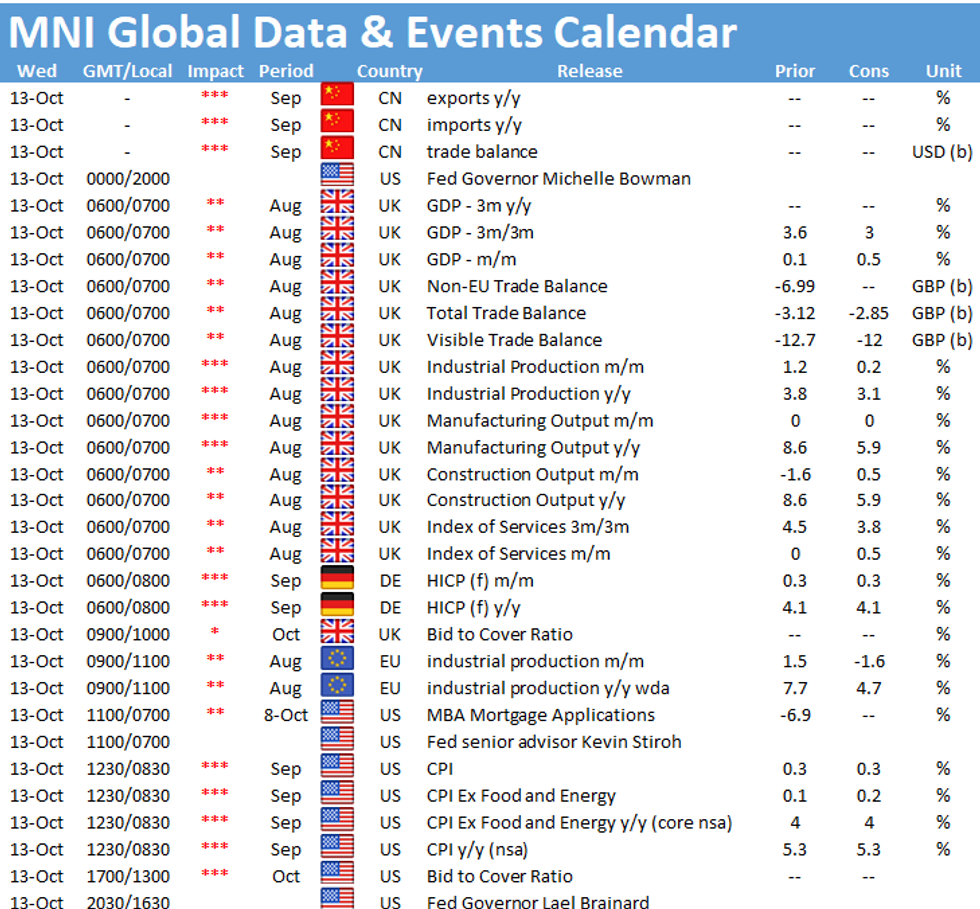

- Focus Wednesday turns to the unofficial beginning of the quarterly earnings cycle, with JPMorgan and Blackrock both due. US CPI is the data highlight, with prices expected to have risen by 0.3% on the month, keeping the annual pace a 5.3%. The Fed minutes also cross, with markets watching for any considerations of a November taper of asset purchases.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.