-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Sep FOMC Mins Sees Taper End Mid-2022

EXECUTIVE SUMMARY

- MNI: Fed Set to Taper, Rate Hike Timing Under Debate--Minutes

- MNI BRIEF: Fed Could Start $15B Per Month Taper in Nov-Minutes

- MNI INTERVIEW: Worker Power, Not Shortage, Slows US Hiring

- PUTIN: RUSSIA READY TO SUPPLY AS MUCH GAS AS EUROPE NEEDS, Bbg (but nobody is asking)

US

FED: The Federal Reserve is set to begin reducing its USD120 billion monthly bond purchases as early as its next meeting in November, but the timing of eventual interest-rate increases remain in question, minutes to the Fed's September meeting showed.

- "All participants agreed that it would be appropriate for the current meeting's post-meeting statement to relay the Committee's judgment that, if progress continued broadly as expected, a moderation in the pace of asset purchases may soon be warranted," the minutes said.

- Financial markets have been more aggressively pricing in possible rate increases as early as next year since the Fed's September forecasts showed a growing number of officials penciling in 2022 hikes -- even though the overall committee remains evenly split.

- "The sectors most adversely affected by the pandemic had improved in recent months, but the rise in COVID-19 cases had slowed their recovery," the report said. "Inflation was elevated, largely reflecting transitory factors."

- MNI has reported the Fed could have trouble divorcing its bond tapering timeline from market expectations for rises in the federal funds rate, according to ex-central bank staffers.

- Fed officials are discussing when to slow down, or taper, the USD120 billion per month in Treasury and mortgage-backed securities. After their meeting, Fed officials said the plan could start "soon" and end by the middle of next year.

- The minutes showed that officials discussed "an illustrative plan" to reduce the purchases by USD15 billion per month: Treasury purchases by USD10 billion and USD5 billion for MBS. Wile no decision was made, "several" Fed officials said they preferred to proceed at a more rapid pace.

US: Newfound bargaining power among U.S. workers due to job availability and strong fiscal support, not a shortage of labor, helps explain a moderation in the pace of hiring, Betsey Stevenson, a former member of the White House Council of Economic Advisers, told MNI.

- "I don't think it's a shortage of workers, I think it's a massive glut of openings giving people confidence," Stevenson, also a former U.S. Labor Department chief economist, said in an interview. "It's like a big game of musical chairs -- all the chairs are lined up and people are like, 'I'm going to find a comfortable one because there are a lot of chairs out here.'"

- Economists, including policymakers at the Federal Reserve, have been puzzled by a mix of surging numbers of people quitting, at a record 11 million in July, and a jobs market still some 5 million short of pre-pandemic levels. For more see MNI Policy main wire at 1030ET.

US TSYS: Market Creates Own Green Light For Rate Hike

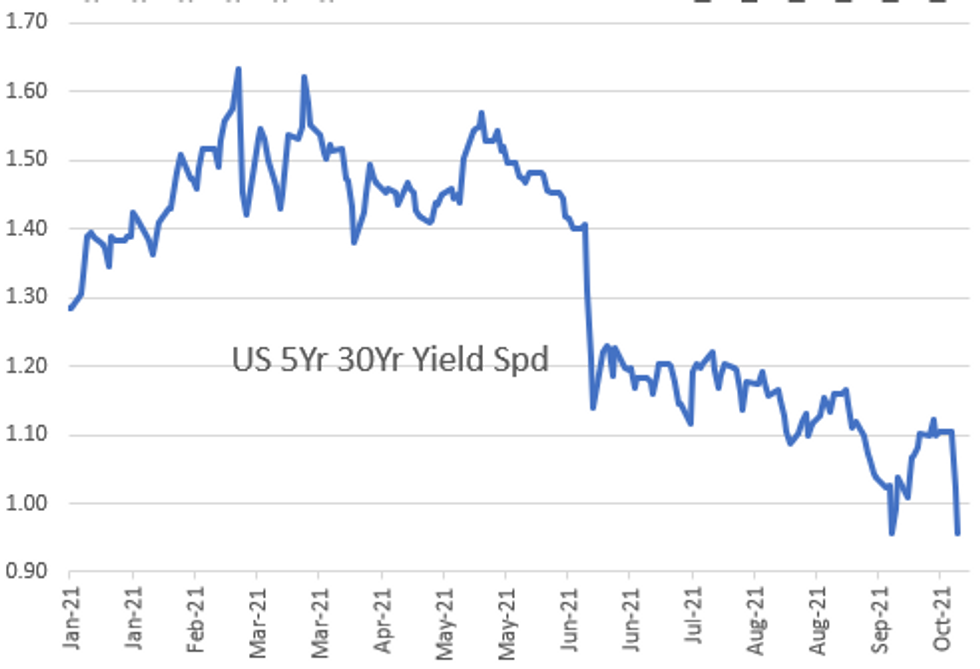

- Carry-over strength in 30Y long-Bonds continued Wednesday, yield curves extending flattener move back to Sep'21 levels not seen since July 2020. Busy session w/ CPI early, Sep FOMC minutes late.

- Higher than expected CPI (+0.4 vs. 0.3% est; unrounded % M/M: headline 0.412%, core: 0.243%) underscored rate hike ests more/sooner than later: two 25bps hikes by late 2022 as long as economy continues to improve -- then perhaps faster.

- Sep FOMC Minutes, Taper Annc in Nov, Finish Mid-2022: Tsy futures holding narrow range after Sep FOMC minutes release, Bonds near highs, yield curves near lows. Not much of a reaction to what's been assumed since the policy meeting: Taper annc at Nov meet, ending around mid-2022 as long as economy continues apace. Link to Fed for full minutes: SEP FOMC

- Massive Red Dec'22 Eurodollar futures volume running over 845,000 ahead of the Sep FOMC minutes release. Front end remained under pressure but off lows as market continued to price in appr two rate hikes by end of 2022 following pick-up in CPI. Additional flow, some option accts faded flattening via conditional steepeners, outright steepener unwinds, short set/hedging today's 30Y auction having little effect. Strong 30Y Bond sale/re-open tailed: 2.049% yld vs. 2.062% WI.

- The 2-Yr yield is up 2.8bps at 0.366%, 5-Yr is up 1.8bps at 1.0891%, 10-Yr is down 2.4bps at 1.5525%, and 30-Yr is down 5bps at 2.0456%.

OVERNIGHT DATA

- US SEP CPI 0.4%, CORE 0.2%; CPI Y/Y 5.4%, CORE Y/Y 4.0%

- US SEP ENERGY PRICES 1.3%

- US SEP OWNERS' EQUIVALENT RENT PRICES 0.4%

- Unrounded % M/M: Headline 0.412%, Core: 0.243%; Y/Y Headline 5.39%, Core: 4.025%\

- US MBA: REFIS -1% SA; PURCH INDEX +2% SA THRU OCT 8 WK

- US MBA: UNADJ PURCHASE INDEX -10% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.18% VS 3.14% PREV

- US MBA: MARKET COMPOSITE +0.2% SA THRU OCT 08 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 10.82 points (-0.03%) at 34371.01

- S&P E-Mini Future up 9.75 points (0.22%) at 4350.5

- Nasdaq up 92 points (0.6%) at 14557.94

- US 10-Yr yield is down 2.4 bps at 1.5525%

- US Dec 10Y are up 2/32 at 131-6.5

- EURUSD up 0.006 (0.52%) at 1.1589

- USDJPY down 0.25 (-0.22%) at 113.36

- WTI Crude Oil (front-month) down $0.19 (-0.24%) at $80.45

- Gold is up $31.24 (1.77%) at $1791.42

- EuroStoxx 50 up 28.19 points (0.7%) at 4083.28

- FTSE 100 up 11.59 points (0.16%) at 7141.82

- German DAX up 102.51 points (0.68%) at 15249.38

- French CAC 40 up 49.27 points (0.75%) at 6597.38

US TSY FUTURES CLOSE

- 3M10Y -3.405, 148.956 (L: 147.388 / H: 154.9)

- 2Y10Y -5.874, 117.825 (L: 116.98 / H: 123.949)

- 2Y30Y -8.323, 167.229 (L: 166.937 / H: 175.757)

- 5Y30Y -6.281, 95.829 (L: 95.045 / H: 102.664)

- Current futures levels:

- Dec 2Y down 1.5/32 at 109-27 (L: 109-24.375 / H: 109-29)

- Dec 5Y down 1.5/32 at 122-9 (L: 122-00.5 / H: 122-13.75)

- Dec 10Y up 5.5/32 at 131-10 (L: 130-25.5 / H: 131-15.5)

- Dec 30Y up 1-07/32 at 159-25 (L: 158-14 / H: 159-30)

- Dec Ultra 30Y up 2-17/32 at 193-2 (L: 190-17 / H: 193-09)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.825

- Mar 22 -0.010 at 99.820

- Jun 22 -0.020 at 99.720

- Sep 22 -0.025 at 99.580

- Red Pack (Dec 22-Sep 23) -0.05 to -0.03

- Green Pack (Dec 23-Sep 24) -0.03 to +0.015

- Blue Pack (Dec 24-Sep 25) +0.025 to +0.055

- Gold Pack (Dec 25-Sep 26) +0.060 to +0.080

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00037 at 0.07363% (+0.00100/wk)

- 1 Month +0.00237 to 0.09025% (+0.00662/wk)

- 3 Month -0.00300 to 0.12375% (+0.00262/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00038 to 0.15675% (+0.00025/wk)

- 1 Year +0.00437 to 0.26575% (+0.01875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07% volume: $275B

- Secured Overnight Financing Rate (SOFR): 0.05%, $925B

- Broad General Collateral Rate (BGCR): 0.05%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $347B

- (rate, volume levels reflect prior session)

- Tsys 4.5Y-7Y, $5.999B accepted vs. $12.392B submission

- Next scheduled purchase

- Thu 10/14 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 10/14 1500ET: Update NY Fed Operational Purchase Schedule

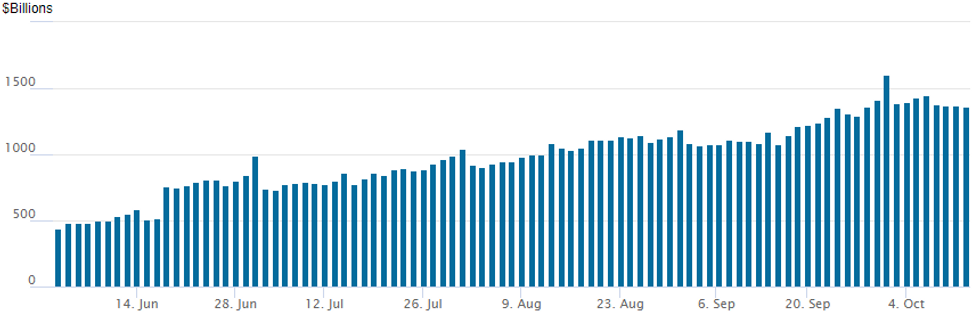

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $1,364.701B from 78 counterparties vs. $1.367.051B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $3B KFW Priced Earlier, Manitoba Expected Thursday

- Date $MM Issuer (Priced *, Launch #

- 10/13 $3B *KFW WNG 5Y Green +19

- 10/13 $1.9B *Development Bank of Japan (DBJ) $900M 5Y +14, $1B 10Y +25

- 10/13 $1B Sonic 8NC3, 10NC5 roadshow

- Expected Thursday:

- 10/14 $Benchmark Province of Manitoba 7Y global +21a

EGBs-GILTS CASH CLOSE: UK Long End Sees Biggest Rally Since March 2020

Gilts bull flattened with a massive rally in the 30Y segment Wednesday, with Bunds and periphery EGBs also gaining but unable to keep up with their UK counterparts.

- 30Y UK yields fell by more than 17bp at one point (to 1.275%), the biggest drop since March 2020, before bouncing an hour before the cash close, still ending over 10bps lower.

- Long-maturity global FI saw little reaction to a stronger-than-expected US inflation print, preferring to fade the recent sell-off (including for Gilts vs Bunds, which had previously traded at 5-year wides).

- And as the 2-Yr yield rise in the UK illustrates, rising rate hike expectations are contributing to overall flattening in global curves.

- Greek GGBs underperformed, 10Y spreads 3.2bp wider on the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.669%, 5-Yr is down 1.4bps at -0.479%, 10-Yr is down 4.1bps at -0.127%, and 30-Yr is down 7.7bps at 0.299%.

- UK: The 2-Yr yield is up 1.3bps at 0.576%, 5-Yr is down 1.4bps at 0.763%, 10-Yr is down 5.9bps at 1.089%, and 30-Yr is down 10.5bps at 1.343%.

- Italian BTP spread up 1.9bps at 103.1bps / Greek up 3.2bps at 105.6bps

FOREX: CPI Argues in Favour of Fed Action

- September CPI data came in at the top-end of analyst expectations, with Y/Y CPI rising to 5.4%, the joint highest rate since 2008. The release was initially met with a wave of USD buying, putting most major pairs under pressure. This pattern reversed into the London close however as the US curve flattened considerably thanks to outperformance in longer-end bonds. This undermined the greenback into the close, putting the USD at the bottom of the G10 pile.

- Scandi currencies were the outperformers, with persistent strength in energy prices buoying the NOK while markets pre-positioned for the Swedish CPI release on tomorrow.

- Earnings season continues Thursday after the disappointing start from JP Morgan, with names including Morgan Stanley, Citigroup, Bank of America and Wells Fargo on the docket for Thursday.

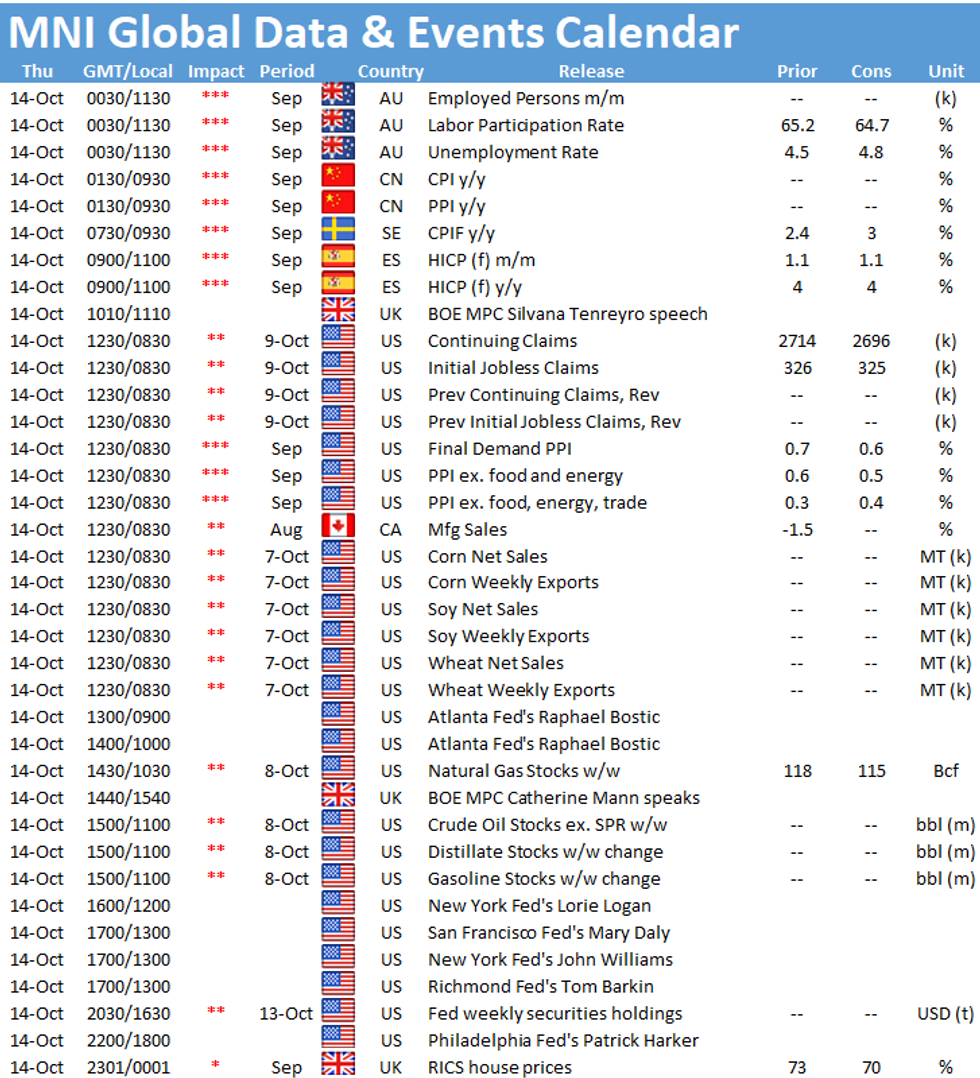

- Australian jobs data is expected to show a a loss of 110k jobs over September, while more inflation data from China and the US is scheduled. Central bank speakers include BoE's Tenreyro, Fed's Bullard and Bostic as well as ECB's Knot.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.