-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bond Rally Slows

EXECUTIVE SUMMARY

- MNI: Fed Nearing Crunch Time on Inflation Views--Ex-Officials

- MNI REALITY CHECK: US Sep Sales Seen Slowing; Shift To Goods

- MNI BRIEF: Treasury Reforms Could Impact Fed Operations -Logan

- MNI BRIEF: Fed's Bullard Says Inflation Readings 'Concerning'

- Fed's Bullard Sees 50% Odds High Inflation Will Persist in U.S., Bbg

US

FED: The Federal Reserve is fast approaching an inflection point that will clarify whether a string of recent high inflation readings will in fact subside as some policymakers expect, or force the central bank to raise interest rates as early as next year, ex-Fed officials told MNI.

- "Supply chain constraints are clearly going to last longer than they hoped—well into the second half of next year in many sectors," said Jeffrey Lacker, former president of the Richmond Fed, noting that base year effects have already petered out. Six-month inflation is now running at a 7.2% annual rate, Lacker said.

- "As long as it's just supply chains, they can hold on a little longer. But the issues are pass-through and expectations, and on those fronts the data continues to erode." For more see MNI Policy main wire at 1224ET.

FED: Potential U.S. Treasury market reforms including central clearing of trades could prove significant enough to influence the Fed's desk operations over time, a senior official for the New York Fed said Thursday.

- "These could ultimately merit a study of the costs and benefits of central clearing for some of the Desk's open market operations to ensure their ongoing effectiveness," Lorie Logan, an executive vice president in the Markets Group at the New York Fed, said in prepared remarks to the Money Marketeers of New York University.

- The first group of banks will be able to participate in the Fed's new domestic standing repo facility early next year, she said. The standing repo facility was announced in July, along with a repo facility for foreign and international monetary authorities. Such moves are "working as intended to support control over the federal funds rate and other short-term interest rates," she said. Logan also stressed that "these new repo facilities are only intended to act as occasional backstops."

- "This is concerning. While I do think there's a probability that inflation will dissipate naturally over the next six months, I wouldn't say that's such a strong case that we can count on that happening," Bullard said during a policy conference.

- Bullard added he wants to taper QE more quickly than his colleagues so the Fed has room to potentially tighten monetary policy in 2022, as Bullard has indicated may be needed. "I'd actually like to be done (tapering) at the end of the first quarter of next year."

US: The pace of retail sales likely slowed in September after a much stronger-than-expected August as consumer confidence stumbled and prices continued to skyrocket, industry experts told MNI, though new Covid-19 infections through the month likely benefited the goods sector as consumers again shied away from services.

- "My expectations are positive," National Retail Federation Chief Economist Jack Kleinhenz said of September sales, noting that wage and disposable income growth through the month should help drive spending in store.

- Store sales should also increase, in part, because of still-high Covid infection rates across the country, he said, which have "affected the composition of consumer spending."

US TSYS: Wk's Bond Rally Pace Slowing; Weekly Claims Declines

Bond yields continued to fall Thursday, but the week's pace has slowed, rates holding to a narrower range all session. Knock-on bid from EGBs continued to be a factor cited by sell-side desks, curve steepener unwinds running their course.- Tsys trimmed gains after lower than estimated weekly claims of 293k -- lowest since pre-pandemic, tame PPI at .5 and .2 core. Fast two-way immediately after release seeing better selling in 10s-30s from prop and real$ accts. Yield curves bouncing after week's broad flattening, finished the session mixed: 5s30s climbed back over 100.0 briefly, receded into the second half: +1.44 at 96.99.

- Surprise $5B 2pt issuance from Morgan Stanley weighed on 5s-10s on rate-lock hedging. More banks sure to follow as they exit earnings blackout. May help push total October issuance estimate over $125B.

- Fed Speak: "Supply chain constraints are clearly going to last longer than they hoped—well into the second half of next year in many sectors," said Jeffrey Lacker, former president of the Richmond Fed, noting that base year effects have already petered out. Six-month inflation is now running at a 7.2% annual rate, Lacker said. "As long as it's just supply chains, they can hold on a little longer. But the issues are pass-through and expectations, and on those fronts the data continues to erode."

- After the close the 2-Yr yield is down 1bps at 0.3481%, 5-Yr is down 2.4bps at 1.0452%, 10-Yr is down 2.3bps at 1.5142%, and 30-Yr is down 1.2bps at 2.0167%.

OVERNIGHT DATA

US: Jobless Claims Below 300K, Fresh Post-Covid Low U.S. jobless claims fell steadily to 293,000 in the latest week, the Department of Labor said Thursday, a sign of an improving labor market that is likely to allow Federal Reserve officials to start paring back their bond buys as early as next month.- Many employers have blamed a recent slowdown in hiring on persistent labor shortages, although MNI's reporting indicates rising worker bargaining power is also behind a softening of employment gains over the last two months.

- US JOBLESS CLAIMS -36K TO 293K IN OCT 09 WK

- US PREV JOBLESS CLAIMS REVISED TO 329K IN OCT 02 WK

- US CONTINUING CLAIMS -0.134M to 2.593M IN OCT 02 WK

- US SEP FINAL DEMAND PPI +0.5%, EX FOOD, ENERGY +0.2%

- US SEP FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

- US SEP FINAL DEMAND PPI Y/Y +8.6%, EX FOOD, ENERGY Y/Y +6.8%

- US SEP PPI: FOOD +2.0%; ENERGY +2.8%

- US SEP PPI: GOODS +1.3%; SERVICES +0.2%; TRADE SERVICES +0.9%

- CANADIAN AUG MANUFACTURING SALES +0.5% MOM

- CANADA AUG FACTORY INVENTORIES +2.1%; INVENTORY-SALES RATIO 1.59

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 503.67 points (1.47%) at 34881.47

- S&P E-Mini Future up 70.25 points (1.61%) at 4425.25

- Nasdaq up 240.7 points (1.7%) at 14812.55

- US 10-Yr yield is down 2.3 bps at 1.5142%

- US Dec 10Y are up 10.5/32 at 131-17.5

- EURUSD up 0.0002 (0.02%) at 1.1596

- USDJPY up 0.4 (0.35%) at 113.65

- WTI Crude Oil (front-month) up $1 (1.24%) at $81.44

- Gold is up $5.1 (0.28%) at $1798.02

- EuroStoxx 50 up 65.78 points (1.61%) at 4149.06

- FTSE 100 up 65.89 points (0.92%) at 7207.71

- German DAX up 213.34 points (1.4%) at 15462.72

- French CAC 40 up 87.83 points (1.33%) at 6685.21

US TSY FUTURES CLOSE

- 3M10Y -2.176, 146.431 (L: 145.208 / H: 149.844)

- 2Y10Y -1.643, 116.034 (L: 115.713 / H: 120.662)

- 2Y30Y -0.477, 166.39 (L: 166.32 / H: 171.969)

- 5Y30Y +1.333, 96.925 (L: 95.6 / H: 100.846)

- Current futures levels:

- Dec 2Y up 1.25/32 at 109-27.75 (L: 109-26.625 / H: 109-28.375)

- Dec 5Y up 7/32 at 122-14 (L: 122-07.5 / H: 122-15)

- Dec 10Y up 10.5/32 at 131-17.5 (L: 131-06 / H: 131-19.5)

- Dec 30Y up 17/32 at 160-6 (L: 159-06 / H: 160-11)

- Dec Ultra 30Y up 30/32 at 193-25 (L: 191-20 / H: 193-27)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.825

- Mar 22 steady at 99.815

- Jun 22 steady at 99.720

- Sep 22 steady at 99.580

- Red Pack (Dec 22-Sep 23) +0.015 to +0.050

- Green Pack (Dec 23-Sep 24) +0.055 to +0.065

- Blue Pack (Dec 24-Sep 25) +0.055 to +0.060

- Gold Pack (Dec 25-Sep 26) +0.050 to +0.055

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00163 at 0.07200% (-0.00063/wk)

- 1 Month -0.00437 to 0.08588% (+0.00225/wk)

- 3 Month -0.00150 to 0.12225% (+0.00112/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00250 to 0.15925% (+0.00275/wk)

- 1 Year +0.00688 to 0.27263% (+0.02563/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $270B

- Secured Overnight Financing Rate (SOFR): 0.05%, $907B

- Broad General Collateral Rate (BGCR): 0.05%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsys 22.5Y-30Y, $2.001B accepted vs. $4.827B submission

- Next scheduled purchases, note Tuesday's double operation

- Fri 10/15 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Mon 10/18 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 10/19 1010-1030ET: 2.25Y-4.5Y, appr $8.425B

- Tue 10/19 1100-1120ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 10/20 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 10/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

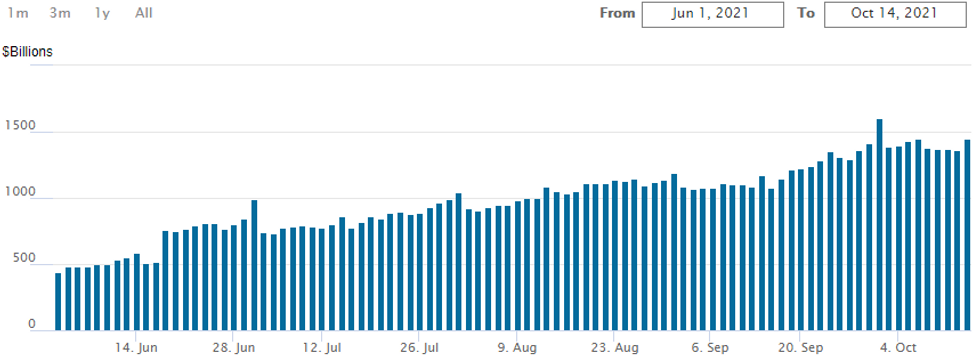

FED Reverse Repo Operation Usage Climbing

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,445.660B from 83 counterparties vs. $1.364.701B on Wednesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Surprise $5B Morgan Stanley 2Pt Post-Earnings

More banks sure to follow as they exit earnings blackout. May help push total October issuance estimate over $125B.- Date $MM Issuer (Priced *, Launch #

- 10/14 $5B #Morgan Stanley $2.5B each: 4NC3 +57, 11NC10 +100

- 10/14 $1B *Province of Manitoba 7Y global +20

- 10/14 $1B #Republic of Columbia 5.2% 05/15/49 tap 5.125%

EGBs-GILTS CASH CLOSE: Gilts Continue To Drive Bullish Retracement

European FI staged more impressive gains Thursday as yields retreat from the recent highs, with the core space seeing short-end GIlts and 10Y Bunds outperforming.

- The gains came against a backdrop of stronger equities and (somewhat counterintuitively given their role in the recent inflation narrative) commodity prices.

- The risk-on atmosphere helped periphery EGB spreads tighten (though Greece widened).

- Hard to pin the move on any particular factor, though it seems the hawkish BoE / inflation narrative weakening Gilts of late may have gone too far and the move is now unwinding. The violence of the UK move has arguably helped catalyse the Bund rally.

- BoE's Mann noted she was willing to hold fire on rate hikes, helping 2Y Gilts continue their rally later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at -0.692%, 5-Yr is down 5.8bps at -0.537%, 10-Yr is down 6.4bps at -0.191%, and 30-Yr is down 6.1bps at 0.238%.

- UK: The 2-Yr yield is down 6.2bps at 0.514%, 5-Yr is down 6.4bps at 0.699%, 10-Yr is down 4.7bps at 1.042%, and 30-Yr is down 5.4bps at 1.289%.

- Italian BTP spread down 0.7bps at 102.4bps / Greek up 3.5bps at 109.1bps

FOREX: JPY Resumes Slide, Testing Week's Lows vs. USD

- The greenback traded poorly Thursday, falling against most others in G10 as a lower, flatter yield curve drained recent greenback strength. The USD index showed below the 94.00 handle, but managed to recoup some of the lost ground just after the London close.

- JPY resumed recent weakness, underperforming all others as both equity markets and treasuries surged. USD/JPY traded either side of the 113.50 level, not quite touching the week's cycle highs of 113.80, but clearly signalling that another test of the highs is within range.

- Growth proxies and commodity-tied currencies extended Wednesday's outperformance, with NZD and CAD trading solidly throughout. NZD/USD traded at a new October high, topping the 50- and 100-dmas in the process at 0.7003 and 0.7026 respectively.

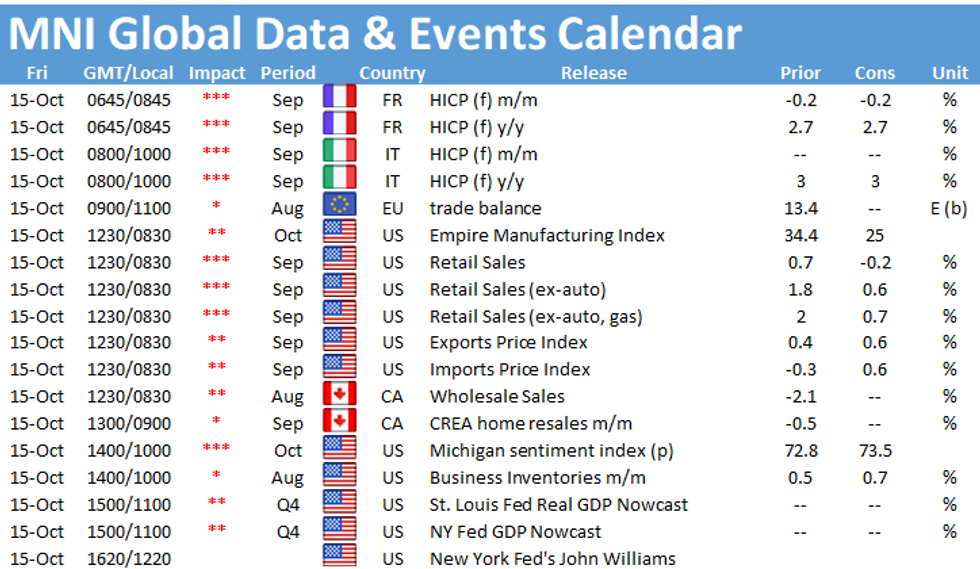

- US retail sales data for September crosses on Friday, with import/export price numbers also due. UMich data is prelim for October, so could also draw focus. Fed's Bullard, Harker and Williams are also due to speak.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.