-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI ASIA OPEN: Risk-Off Resumes, 10YY Through 100DMA at 1.404%

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Bracing For Risk of Persistent Inflation

- MNI: St. Louis Fed Model Sees Pick-Up In November Hiring

- MNI INTERVIEW: Supply Kinks to Abate Despite Omicron - ISM

- MNI INTERVIEW: Omicron Impact Likely Small-Dallas Fed Economist

- MERKEL PROPOSES NATION-WIDE RESTRICTIONS FOR UNVACCINATED, Bbg

- US FEDERAL RESERVE RELEASES BEIGE BOOK SURVEY OF U.S. ECONOMY

- ECONOMIC ACTIVITY GREW AT A MODEST TO MODERATE PACE IN MOST FEDERAL RESERVE DISTRICTS DURING OCTOBER AND EARLY NOVEMBER

- THE OUTLOOK FOR OVERALL ACTIVITY REMAINED POSITIVE IN MOST DISTRICTS, BUT SOME NOTED UNCERTAINTY ABOUT WHEN SUPPLY CHAIN AND LABOR SUPPLY CHALLENGES WOULD EASE.

US

FED: The emergence of the Omicron variant of Covid-19 could represent a significant downside risk, but if the new variant is similar to others then the base case remains for robust U.S. growth upward of 4% next year, the Dallas Federal Reserve Bank's research director told MNI.

- "The impact on the economy has become smaller and smaller with each subsequent wave" of Covid, said Marc Giannoni in an interview late Tuesday. "The overall impact on overall aggregate demand is going to be somewhat more subdued than has been the case in the past."

- Giannoni sees above-trend growth next year and expects to see unemployment drop under 4% next year, with diminishing slack, though he stressed his outlook rests on the assumption that the new variant may be more transmissible but is not more deadly nor able to evade vaccine protection. Forecasters face a "black hole" of uncertainty before details and data are released on Omicron, he said. For more see MNI Policy main wire at 0834ET.

- “If that’s the base case, that the inflation that we’re experiencing right now will be a little bit more durable, then I think you have to prepare the ground,” Athreya said in an interview. “It makes a lot of sense to me that you want to at least be in a position to hike.”

- Because QE works best in economic emergencies, the danger of winding it down more rapidly now is probably low, he said. For more see MNI Policy main wire at 1304ET.

- The model forecast a seasonally adjusted gain of 100,000 jobs in October, as measured by the BLS's household survey. The actual figure came in at 359,000. "My forecast fell short last month, but I still consider it to be reasonably good," Dvorkin said.

- The BLS's household survey tracks closely headline payrolls figures from the establishment survey but the figures can differ by hundreds of thousands month to month due to differing definitions of employment and technical factors.

- Payrolls rose by 531,000 in October and are expected to gain another 525,000 in November.

- "The biggest issue of concern is the international supply chain and those countries that don't have access to the vaccines and the best example is what happened in Malaysia with the semiconductor industry," said Fiore when asked about Omicron and the outlook. "If it's just another wave of another variant then that's okay and we'll deal with it."

- The ISM Manufacturing index rose to 61.1 in November, indicating the 18th straight month of expansion even as limited supply continued constraining the expansion, but Fiore said Omicron is not reflected in the report and it is not currently expected to have much impact.

US TSYS: Late Rate Rally, Risk-Off as Omicron Comes to US

Rates rebounded early in second half, finish session on highs after the first Omicron-Covid variant reported in US (California, from individual that was fully vaccinated). Geopol concerns over Russia/Ukraine and China/Taiwan tensions likely adding to the renewed risk-off tone. Risk assets tumbled late (ESZ1 -57.0; WTI -95.0).

- Tsys held weaker levels for much of the first half, in-line ADP employment (+534K vs. Exp. +525k) largely ignored, started to rebound after Fed Chairman Powell comments largely echoed Tue's hawkish tone until: "Taper need not be disruptive event in markets" spurred some sell unwinds. Trading desks reported decent real$ buying in 2s, 20s and 30s, better deal-tied rate-locks in 10s and 30s in the first half.

- Tsy futures traded steady (10s) to mixed, curves flatter after first Omicron variant reported in California. Noted buyers earlier in the session, trading desks report real$ selling 30s with leveraged$ accts, central bank selling 20s helping keep rates relatively in line. Large Block buys well through offers late in 30Y, 10- and 30Y ultra-bonds.

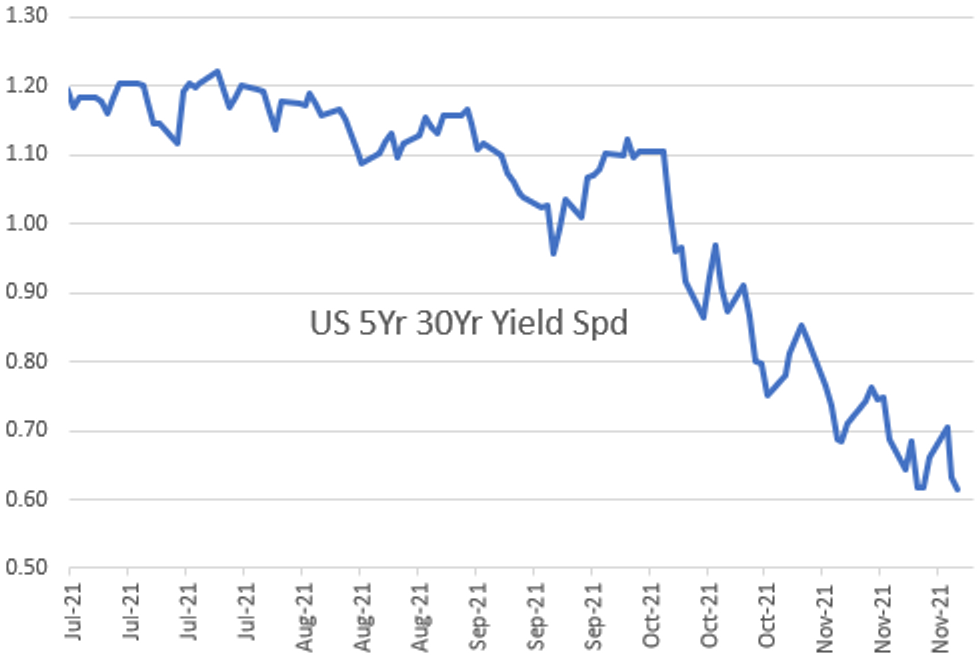

- The 2-Yr yield is down 0.6bps at 0.5592%, 5-Yr is down 1.8bps at 1.1419%, 10-Yr is down 2.9bps at 1.4155%, and 30-Yr is down 3.3bps at 1.7578%.

OVERNIGHT DATA

- US DATA: ADP Employment Change Slightly Beats Expectations

- US ADP Employment Change (Nov) M/M +534K vs. Exp. +525k (Prev. +571k, Rev. +570k)

- US ISM PURCHASING MANAGERS INDEX 61.1 NOV VS 60.8 OCT

- US ISM PRICES PAID INDEX 82.4 NOV VS 85.7 OCT (NSA)

- US ISM NEW ORDERS INDEX 61.5 NOV VS 59.8 OCT

- US ISM EMPLOYMENT INDEX 53.3 NOV VS 52.0 OCT

- US ISM PRODUCTION INDEX 61.5 NOV VS 59.3 OCT

- US ISM SUPPLIER DELIVERY INDEX 72.2 NOV VS 75.6 OCT

- US ISM ORDER BACKLOG INDEX 61.9 NOV VS 63.6 OCT (NSA)

- US ISM INVENTORIES INDEX 56.8 NOV VS 57.0 OCT

- US ISM CUSTOMER INV INDEX 25.1 NOV VS 31.7 OCT (NSA)

- US ISM EXPORTS INDEX 54.0 NOV VS 54.6 OCT (NSA)

- US ISM IMPORTS INDEX 52.6 NOV VS 49.1 OCT (NSA)

- US OCT CONSTRUCT SPENDING +0.2%

- US OCT PRIVATE CONSTRUCT SPENDING -0.2%

- US MBA: REFIS -15% SA; PURCH INDEX +5% SA THRU NOV 26 WK

- US MBA: UNADJ PURCHASE INDEX -8% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.31% VS 3.24% PREV

- US MBA: MARKET COMPOSITE -7.2% SA THRU NOV 26 WK

MARKET SNAPSHOT

Key late session market levels

- DJIA down 462.44 points (-1.34%) at 34072.59

- S&P E-Mini Future down 57.25 points (-1.25%) at 4515.25

- Nasdaq down 288.4 points (-1.9%) at 15274.21

- US 10-Yr yield is down 2.5 bps at 1.4189%

- US Mar 10Y are up 6.5/32 at 131-0.5

- EURUSD down 0.0027 (-0.24%) at 1.1315

- USDJPY down 0.34 (-0.3%) at 112.81

- WTI Crude Oil (front-month) down $0.75 (-1.13%) at $65.49

- Gold is up $3.98 (0.22%) at $1779.10

- EuroStoxx 50 up 116.09 points (2.86%) at 4179.15

- FTSE 100 up 109.23 points (1.55%) at 7168.68

- German DAX up 372.54 points (2.47%) at 15472.67

- French CAC 40 up 160.71 points (2.39%) at 6881.87

US TSY FUTURES CLOSE

- 3M10Y -2.287, 136.565 (L: 130.152 / H: 144.387)

- 2Y10Y -1.563, 85.775 (L: 85.014 / H: 90.514)

- 2Y30Y -2.286, 119.803 (L: 118.764 / H: 125.199)

- 5Y30Y -1.326, 61.568 (L: 59.048 / H: 63.198)

- Current futures levels:

- Mar 2Y down 2.375/32 at 109-9.375 (L: 109-05.5 / H: 109-10)

- Mar 5Y steady at at 121-12.75 (L: 120-29 / H: 121-14.25)

- Mar 10Y up 6.5/32 at 131-0.5 (L: 130-06 / H: 131-03.5)

- Mar 30Y up 16/32 at 162-20 (L: 161-01 / H: 162-26)

- Mar Ultra 30Y up 29/32 at 201-15 (L: 198-09 / H: 201-28)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.798

- Mar 22 -0.005 at 99.715

- Jun 22 -0.015 at 99.535

- Sep 22 -0.020 at 99.320

- Red Pack (Dec 22-Sep 23) -0.03 to -0.015

- Green Pack (Dec 23-Sep 24) -0.01 to +0.030

- Blue Pack (Dec 24-Sep 25) +0.040 to +0.055

- Gold Pack (Dec 25-Sep 26) +0.055 to +0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00063 at 0.07713% (+0.00300/wk)

- 1 Month +0.00863 to 0.10263% (+0.01275/wk)

- 3 Month +0.00138 to 0.17463% (-0.00075/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00625 to 0.24950% (+0.00350/wk)

- 1 Year +0.07587 to 0.45825% (+0.04787/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $220B

- Secured Overnight Financing Rate (SOFR): 0.05%, $1,067B

- Broad General Collateral Rate (BGCR): 0.05%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $5.251B accepted vs. $15.925B submission

- Next scheduled purchases

- Thu 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.075B

- Fri 12/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

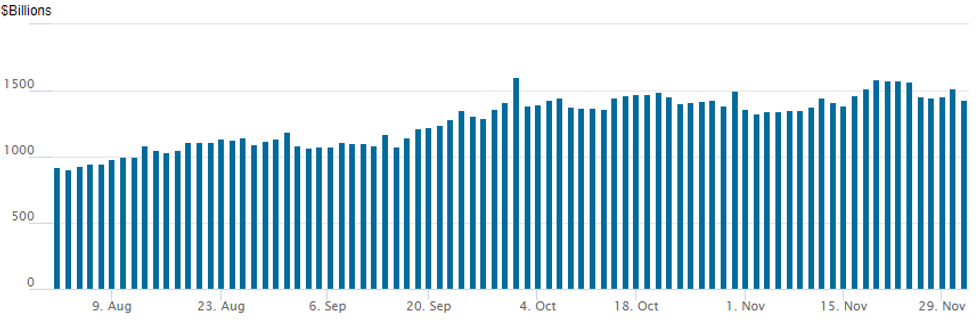

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,427.347B from 75 counterparties vs. $1,517.956B on Tuesday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: $3.25B Goldman Sachs 3Pt Launched

$14.55B To price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 12/01 $3.25B #Goldman Sachs 2NC1 fix/FRN +65, 2NC1 FRN/SOFR+62, 1.948% 2027 tap +90

- 12/01 $3B #T-Mobile $500M +7Y +105, $1B +10Y +130, $1.5B 2052 3.4% tap +165

- 12/01 $2B #Bank of America 4NC3 Green +67

- 12/01 $1.25B #Sysco $450M 10Y +105, $800M 30Y +140

- 12/01 $1B #Blackrock +10Y +90a

- 12/01 $750M #Marsh & McLennan $400M 10Y +95, $350M 30Y +112.5

- 12/01 $1B #Danaher 30Y +105

- 12/01 $750M #KKR 30Y +147

- 12/01 $550M #So-California Edison WNG 1Y FRN/SOFR+47

- 12/01 $500M #Pricoa Global Funding 3Y +33

- 12/01 $500M New Development Bank (NDB) 3Y FRN/SOFR+28a

EGBs-GILTS CASH CLOSE: Bear Flattening, Though Greece Impresses

European FI ended Wednesday largely weaker, though off worst levels seen early in the session, with short-end/belly yields underperforming in tandem with rising U.S. rate hike expectations.

- Bunds and Gilts bear flattened, with the UK underperforming.

- A Reuters sources report that some ECB governors advocate delaying decisions on stimulus plans beyond the Dec 16 meeting a little after midday GMT saw eurozone FI strengthen; Greek bonds easily outperformed on the session following this report.

- We saw further gains into the cash close as headlines crossed that Chancellor Merkel proposing lockdowns for unvaccinated Germans.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.4bps at -0.713%, 5-Yr is up 2.2bps at -0.596%, 10-Yr is up 0.4bps at -0.345%, and 30-Yr is up 0.6bps at -0.052%.

- UK: The 2-Yr yield is up 4.3bps at 0.527%, 5-Yr is up 3.3bps at 0.653%, 10-Yr is up 0.9bps at 0.818%, and 30-Yr is up 3.2bps at 0.885%.

- Italian BTP spread up 3.7bps at 135.5bps / Greek down 5.2bps at 156.1bps

FOREX: JPY Trades Firmly As Sentiment Dampens, Greenback Rallies Back To Unchanged

- Growth proxies and commodity-tied FX initially outperformed on Wednesday. However, as both equities and commodities reversed course throughout the US session, the US dollar/haven FX rallied and risk-tied currencies retraced lower.

- The Japanese Yen topped the G10 leaderboard, rising 0.35% against the greenback with greater gains evident on the crosses. USDJPY short-term bearish technical threat remains in place. Tuesday's weakness saw prices test and show below key short-term support at 112.73, Nov 9 low before prices improved ahead of the close. A clear break would open 112.08 next, a recent breakout level.

- One of the sharpest reversals was in USDCAD, bouncing just under 1% from lows of 1.2714 to around 1.2830. A strengthening of the current bullish theme signals scope for strength towards 1.2896 next, the Sep 20 high.

- Despite the early dollar weakness, price action has been supportive throughout the latter half of the session with broad dollar indices trading on the front foot and into positive territory as of writing.

- Back in the spotlight in emerging markets was the Turkish lira, which sharply rallied as the Turkish central bank intervened in the market. This comes following the Presidents unwavering rhetoric towards lowering interest rates. The Turkish monetary authority said that they intervened in markets by selling foreign currencies for the first time in seven years. After the colossal move from 13.88 down to 12.42, the pair consolidated within a 13.00-13.40 range for the rest of the session, currently down 1.8% on the day.

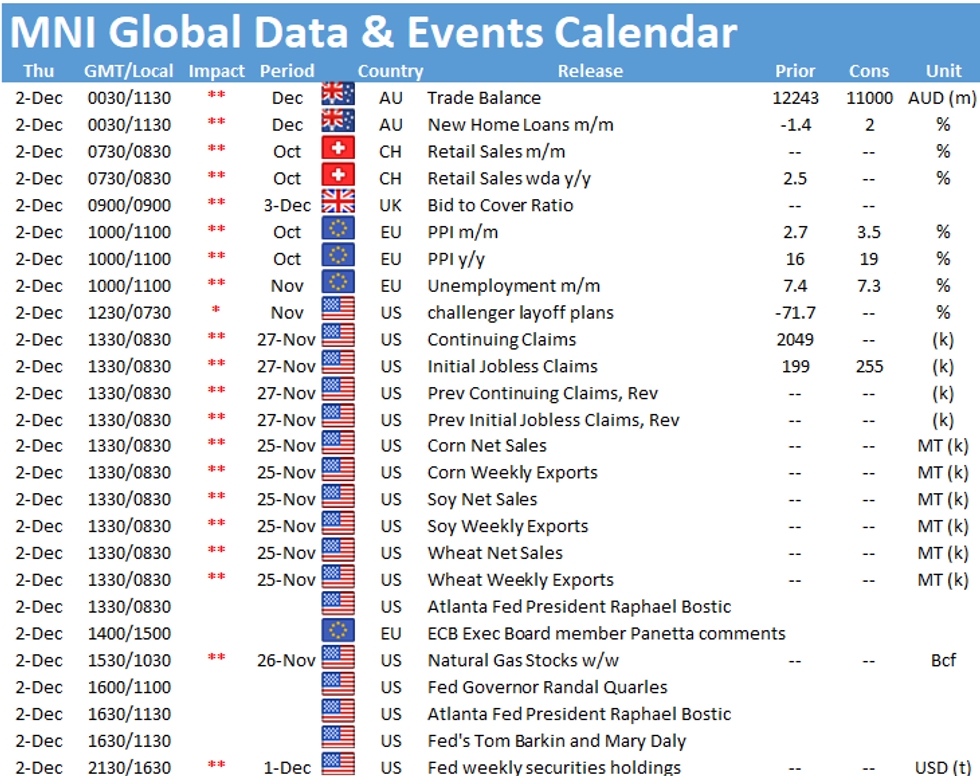

- Australian retail sales and trade balance data due overnight before European unemployment figures. US unemployment claims also due with a number of potential Fed speakers listed as we approach the FOMC blackout. The markets focus will be on Friday’s release of US non-farm payrolls.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.