-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China To Enhance Fiscal Support Via CGB Issue

MNI BRIEF: U.S. Firms In China Expecting More Profits In 2024

MNI: PBOC Sets Yuan Parity Higher At 7.1049 Thurs; -5.46% Y/Y

MNI ASIA OPEN: Yields Reverse Despite Strong Employ Data

EXECUTIVE SUMMARY

- MNI: EU To Fit Defense Boost Into Fiscal Framework-Sources

- MNI BRIEF: US Feb Payrolls +678,000; Beats Expectations

- MNI OIL: White House Considering Ban On Russian Oil Imports, Crude Futures Spike

- MNI EU: Leaders To Meet For Discussions On Sanctions And EU Expansion

- S&P TO REMOVE ALL STOCKS LISTED AND/OR DOMICILED IN RUSSIA, Bbg

- Chicago Fed Evans on strong jobs data "DOESN'T REALLY CHANGE ANYTHING THAT FED CHAIR POWELL IS POSITIONING FOR .. 25 BPS MOVES AT EACH 2022 MEETING GETS CLOSE TO NEUTRAL, Bbg

US

US DATA: U.S. employers added a hefty 678,000 jobs in February, the Department of Labor said Friday: https://www.bls.gov/news.release/empsit.nr0.htm, more than the 420,000 expected by markets for a second straight month, and the unemployment rate dropped two-tenths to 3.8% as Omicron cases fell back.

- The strong jobs report should reinforce the Fed's resolve to raise the fed funds rate this year. A study by St Louis Fed economist Max Dvorkin had pointed to a strong report in February, but the outcome surpassed even his estimate.

- Average hourly earnings rose just a cent from January, less than expected. AHE is up 5.1% from a year earlier, after large increases in recent months. The average workweek rose a tenth to 34.7 hours. The labor force participation rate and employment-to-population ratio rose slightly to 62.3% and 59.9%, respectively.

EUROPE

EU: EU leaders will meet in Versailles on Thursday and Friday next week to discuss further rafts of sanctions on Russia, and the potential expansion of the EU to Ukraine, Georgia and Moldova.

- France currently holds the rotating EU presidency and French president Emmanuel Macron has said he wants to use the summit to discuss a major change in European defence policy.

- Macron also said on Wednesday that the summit may used to outline a strategy for European energy independence.

- EU expansion will be a delicate issue for EU leaders as fast-tracking the membership of post-Soviet states and may complicate a decade long period negotiations between the EU and Balkan states and NATO member Turkey.

US TSYS: Russia War Keeps Mkts on Edge, Into Weekend; Strong Jobs Data

After initial two-way trade US Tsy futures broke narrow upside range after Feb employment data showed job gains +678k vs. +415k est, AHE declines MoM from 0.61% to 0.03.

- Overall data appears "mildly less inflationary, at least from the supply side" one desk commented. Decent data but markets remained on edge as Russia war in Ukraine entered day nine.

- Equities still trading weaker after FI close, SPX eminis off late morning lows (ESH2 4282.50L) to near middle of the range at 4307.5 at the moment -- still above first technical support of 4227.50/4101.75 Low Feb 25 / Low Feb 24 and a bear trigger. Markets remain on edge going into the weekend.

- Late session risk aversion: Tsys turn higher, additional selling in stocks after headlines noted access to Twitter and Facebook blocked in Russia -- social media outlets a non-state media source of news for Russians. WTI spiked to session highs of $115.36 in late trade as WH spokesperson said banning Russia oil imports had been discussed.

- While FI markets traded strong all day -- short end remained under heavy pressure: lead quarterly Eurodlr futures made new low for yr at 99.15 (-0.140), well past prior low of 99.205 from Feb 10 as 50bp liftoff pricing gains momentum -- 25bp hike on March 16 a foregone conclusion after Fed Chairman Powell sees as appropriate (Thu's Senate testimony).

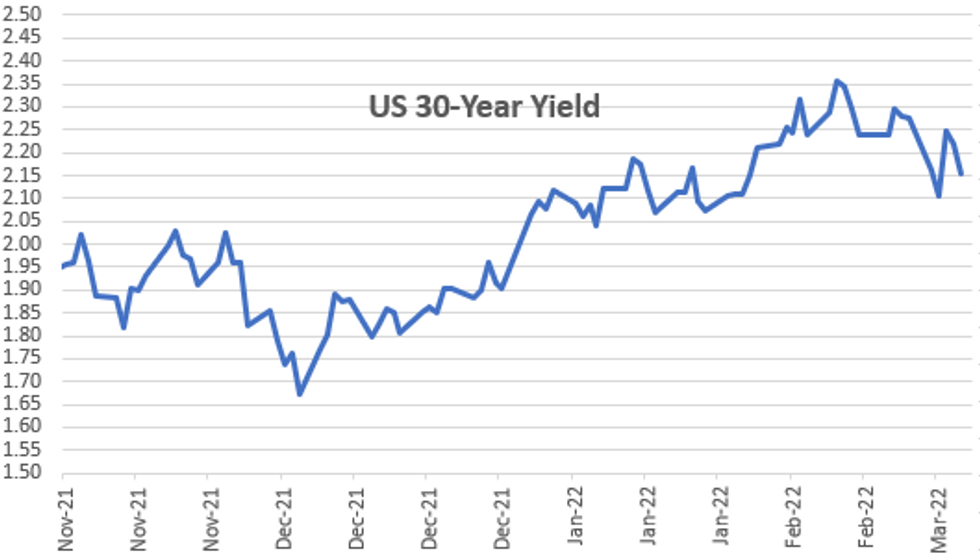

- The 2-Yr yield is down 4bps at 1.4899%, 5-Yr is down 9.5bps at 1.6372%, 10-Yr is down 11bps at 1.7307%, and 30-Yr is down 6.7bps at 2.1533%.

OVERNIGHT DATA

- U.S. FEB. PAYROLLS INCREASE 678,000; EST. 422,500

- US FEB UNEMPLOYMENT RATE 3.8%

- US FEB AVERAGE HOURLY EARNINGS +0.0% Vs JAN +0.6%; +5.1% YOY

- US FEB AVERAGE WEEKLY HOURS 34.7 HRS

- BLS PAYROLLS NET REVISIONS FOR JAN, DEC +92K

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 391.93 points (-1.16%) at 33399.99

- S&P E-Mini Future down 58.25 points (-1.34%) at 4300.5

- Nasdaq down 290.3 points (-2.1%) at 13248.14

- US 10-Yr yield is down 11 bps at 1.7307%

- US Jun 10Y are up 29.5/32 at 128-14

- EURUSD down 0.015 (-1.36%) at 1.0916

- USDJPY down 0.59 (-0.51%) at 114.87

- WTI Crude Oil (front-month) up $7.98 (7.41%) at $115.62

- Gold is up $33.2 (1.71%) at $1969.01

- EuroStoxx 50 down 185.77 points (-4.96%) at 3556.01

- FTSE 100 down 251.71 points (-3.48%) at 6987.14

- German DAX down 603.86 points (-4.41%) at 13094.54

- French CAC 40 down 316.71 points (-4.97%) at 6061.66

US TSY FUTURES CLOSE

- 3M10Y -9.022, 138.826 (L: 132.642 / H: 148.374)

- 2Y10Y -6.765, 23.881 (L: 22.627 / H: 31.501)

- 2Y30Y -2.446, 66.141 (L: 64.225 / H: 72.261)

- 5Y30Y +3.079, 51.448 (L: 47.213 / H: 55.023)

- Current futures levels:

- Jun 2Y up 3.5/32 at 107-16.75 (L: 107-11.75 / H: 107-22)

- Jun 5Y up 16.25/32 at 118-23 (L: 118-03.5 / H: 119-00.5)

- Jun 10Y up 29.5/32 at 128-14 (L: 127-12.5 / H: 128-27.5)

- Jun 30Y up 76/32 at 159-5 (L: 156-20 / H: 159-25)

- Jun Ultra 30Y up 83/32 at 187-2 (L: 184-02 / H: 188-12)

US 10Y FUTURES TECH: (M2) Holding Above Wednesday’s Low

- RES 4: 129-31 Low Dec 8 (cont)

- RES 3: 129-13 3.00 proj of the Feb 10 - 14 - 15 price swing

- RES 2: 129-00 Round number resistance

- RES 1: 128-31+ High Mar 1

- PRICE: 128-03+ @ 11:31 GMT Mar 4

- SUP 1: 127-00 Mar 2 low

- SUP 2: 125-29 Low Feb 25

- SUP 3: 125-14+ Low Feb 10 and the bear trigger

- SUP 4: 125-06+ Low May 30 2019 (cont)

The sell-off in Treasuries on Wednesday was short lived and the contract has recovered from the recent low of 127.00. The short-term outlook remains bullish. This week’s gains have seen price breach both the 20- and 50-day EMAs, strengthening the current positive outlook. Resistance at 128-17, Jan 24 high was breached Tuesday and this opens 129-00. Initial firm support is seen at 127-00, the Mar 2 low.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.095 at 99.185

- Jun 22 -0.030 at 98.765

- Sep 22 +0.010 at 98.470

- Dec 22 +0.025 at 98.165

- Red Pack (Mar 23-Dec 23) +0.035 to +0.125

- Green Pack (Mar 24-Dec 24) +0.125 to +0.145

- Blue Pack (Mar 25-Dec 25) +0.135 to +0.135

- Gold Pack (Mar 26-Dec 26) +0.140 to +0.145

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00086 at 0.07814% (+0.00100/wk)

- 1 Month +0.02100 to 0.31014% (+0.07957/wk)

- 3 Month +0.02700 to 0.61014% (+0.08714/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.04943 to 0.93943% (+0.11072/wk)

- 1 Year +0.02100 to 1.35286% (+0.02215/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $1.001T

- Broad General Collateral Rate (BGCR): 0.05%, $367B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $354B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

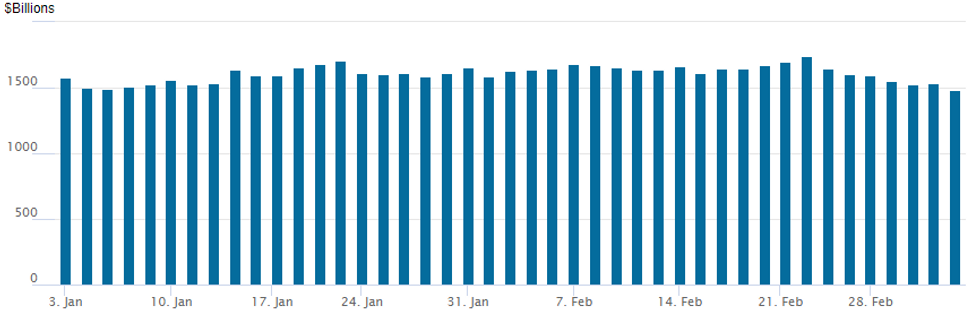

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $1,483.061B w/ 78 counterparties -- new low for the year vs. $1,533.992B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $5.5B S&P Global 5Pt Debt Issuance Launches

- Date $MM Issuer (Priced *, Launch #)

- 03/04 $5.5B #S&P Global $1.25B 5Y +90, $1.25B 7Y +110, $1.5B 10Y +130, $1B 30Y +160, $500M 40Y +180

FOREX: Souring Sentiment Prompts Flight To Quality, Euro Crosses Extend Declines

- A deterioration in risk-sentiment surrounding the Ukraine war was characterised by renewed weakness in equities and further surges in the commodity complex, especially evident in crude futures, rising another 6%. In turn, this saw further significant pressure on Euro crosses as well as lending support to the greenback approaching the weekend.

- EURUSD trades 1.2% weaker as of writing and has made notable technical progress to the downside throughout the week. Moving average studies point south and the bearish price sequence of lower lows and lower highs remains intact. 1.1000 and 1.0976, a Fibonacci projection have both been cleared with the move lower falling just shy of the 1.0871 level, the low seen on May 25, 2020.

- Continued buoyancy of the commodity complex as well as geographical dynamics made Euro crosses an even more attractive short. EURJPY (-1.85%) EURAUD (-1.89%) and EURNZD (-2.19%) all cratered throughout the session, with rising tensions in Ukraine showing very few signs of this pressure on Euro crosses abating in the short-term.

- Overall, the greenback was boosted as market participants sought a flight to quality. The dollar index rose 0.75% to extend above the 98.00 mark, edging towards the best levels of Q2 2020. The dollar strength finally put LATAM FX on the backfoot with USDMXN rising to the best levels of the year above 20.90. Additionally, the euro weakness significantly weighed on emerging market currencies in the CEEMEA region, with HUF and PLN considerably lower on Friday and prompting the Polish central bank to intervene to support the Zloty.

- A light data calendar to kick off next week with Chinese trade balance figures and German factory orders. Naturally, developments over the weekend in Ukraine will determine the direction and volatility for currencies at the Wellington open.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/03/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/03/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/03/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/03/2022 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/03/2022 | 0700/0800 | ** |  | DE | industrial production |

| 08/03/2022 | 0800/0900 | ** |  | ES | industrial production |

| 08/03/2022 | 0900/1000 | * |  | IT | retail sales |

| 08/03/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2022 | 1000/1100 | *** |  | EU | GDP (2nd est.) |

| 08/03/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/03/2022 | 1330/0830 | ** |  | US | trade balance |

| 08/03/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/03/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 08/03/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/03/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.