-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

MNI ASIA MARKETS ANALYSIS - US Yields Surge As USD Strength Extends

US TSYS: Significant Cheapening As TYZ2 Clears Bear Trigger

- Cash Tsys have seen a sizeable cheapening today as the front end reversed the rally from Friday’s payrolls report and with larger relative moves further along the curve, all driven by large increases in real yields weighing on risk sentiment.

- The move came in earnest as the US came back from the Labor Day weekend but a beat for ISM services helped the move stick, with service activity holding up well at the highest index level since the April in a solid report that pushed back notably against growth fears.

- 2YY +10.1bps at 3.488%, 5YY +13.3bps at 3.426%, 10YY +13.5bps at 3.324% and 30YY +13.3bps at 3.477% all from Friday’s close, driving a 3.5bp increase in 2s10s to -16bps or

- TYZ2 has cleared the bear trigger of 115-23 (Sep 1 low) with a session low of 115-14+ (currently 115-19), opening next support at 114-26 (Jun 16 low).

- The Fed’s Beige Book comes into focus tomorrow with continued attention on growth, plus a collection of Fedspeak.

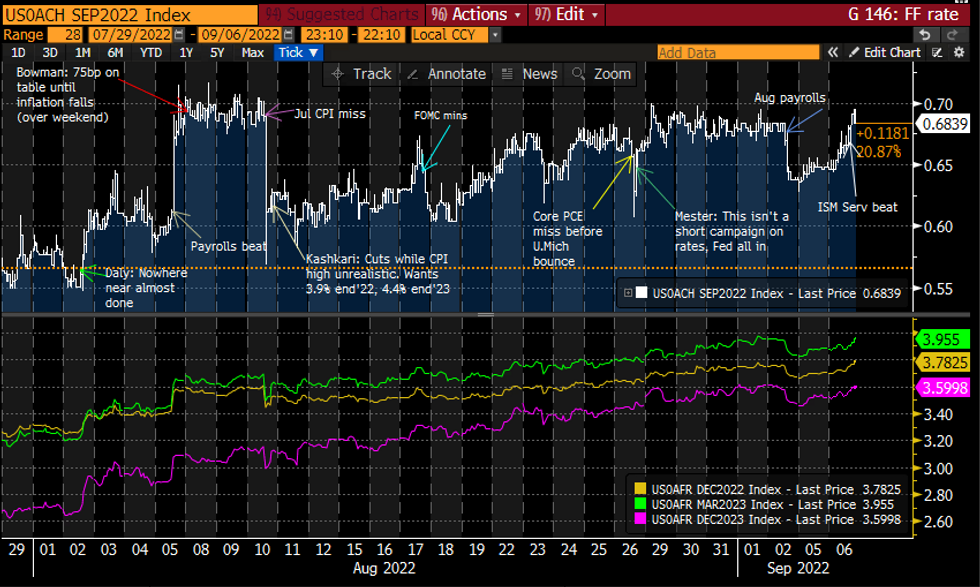

STIR FUTURES: Fed Hikes Unwind Payrolls Hit With Fedspeak Flurry Tomorrow

- Fed Funds implied hikes are holding onto a sizeable firming today, a move that started early in the session before boosted from the ISM services beat.

- Fully unwinding the hit from Friday’s payrolls with its moderately softer internals, they price 68bps for the Sep 21 FOMC before a cumulative 145bps to 3.79% in Dec’22 and 162bps to a terminal 3.96% in Mar’23.

- Fedspeak comes into focus tomorrow including a rare appearance from VC Brainard (1235ET), Mester (’22) speaking to MNI and the Beige Book.

FOMC-dated Fed Funds implied change for Sept FOMC (white) plus implied rates at select meetingsSource: Bloomberg

FOMC-dated Fed Funds implied change for Sept FOMC (white) plus implied rates at select meetingsSource: Bloomberg

OPTIONS: Mixed U.S. Rates Trade Tuesday

Tuesday's US rates options flow included:

- SFRU2 96.75p, traded 3 up to 4.25 in 3.6k

- SFRV2 96.37/96.12/95.87p fly, traded 6.5 in 3k

- SFRV2/SFRZ2 96.00/95.87ps spread, bought for 1 in 2k

- 2EU2 96.62p, sold at 11 in 5k (ref 96.645, 48 del)

- SFRX2 96.81c, traded 3 in 3k

- SFRZ2 96.56/96.43ps 2x vs 96.25/96.00ps 1x, traded 8 in 2k (block)

- 0QV2 96.75/96.50ps, traded 14.5 in 2k

- EDZ2 95.75/95.50ps, bought for 6.5/6.75 in 10k in the pit, and 7 in 20k (block)

- EDH3 99.62c, traded 0.25 and half in 3.4k

- 2EU2 96.62/96.25ps 3x2, traded 16.5 in 3k (block)

- 2EZ2 98.37c, traded 1.5 in 1k

EU OPTIONS: Large BTP Upside Play Features Tuesday

Tuesday's Europe rates / bond options flow was highlighted by a large BTP upside trade with November expiry, and included:

- DUX2 108/107.70ps, bought for 10.5 in 3k

- DUV2 108.00/107.70 put spread bought for 9 in 4k vs DUV2 108.50 call sold at 20 in 1.5k

- DUV2 107.90/70/50/30 put condor bought for 3 in 5kOEZ2 119 put bought for 64 in 5k

- IKX2 122/125cs, bought for 64 in 10k

- ERZ2 98.12/97.87/97.75/97.62p condor, sold at 5.75 in 3.2k

- ERZ2 98.00/97.75/97.62p ladder, bought for 1.5 in 4k

US: 10Y Real Yields Close In On Early 2019 Highs, Supporting USD

- Behind the current ~15bp increase in 10Y nominal yields from Friday’s close has been a 14bp increase in real yields.

- At 86bps, 10Y real yields are close to the Jun 14 high of 88bps (just prior to the Jun FOMC after the WSJ indicated a shift to 75bp pace) with those levels last seen in early 2019, bouncing from close to zero in early Aug in a factor helping support further USD strength.

- The sharp move higher sees real yields more strongly positive across the curve, something Barkin (’24 voter) has mentioned wanting to see a few times with him set set to speak again tomorrow.

US 10y real yields (white) and DXY index (yellow)Source: Bloomberg

US 10y real yields (white) and DXY index (yellow)Source: Bloomberg

MNI BoC Preview: Looking For New Guidance

- The Bank of Canada is widely expected to hike its overnight rate 75bps to 3.25% on Wednesday with only 5 of 30 analysts calling for a 50bp hike instead, following last month’s surprise front-loaded 100bp hike.

- Taking it above the BoC’s neutral 2-3% range, keen interest is on rate guidance and especially how strongly the Bank sees the need to increase rates ahead or whether it shifts to a more conditional stance.

- Any ambiguity will see particularly close focus on Rogers speaking on Thursday, with a subsequent appearance by Beaudry on Sep 20 coming after US CPI and just ahead of the Sept FOMC.

- With terminal rate expectations of circa 3.75%, there are two-sided risk with an arguable tilt to a dovish surprise.

- Full note here: https://marketnews.com/mni-boc-preview-looking-for-new-guidance

UK: LAB Hold Widest Lead Over CON Since 2013 In Latest Poll As Truss Takes Over

The latest poll from YouGov shows the main opposition centre-left Labour Party holding a 15-point lead over incoming PM Liz Truss' centre-right Conservatives. The last time Labour held such a lead in a YouGov poll was February 2013, when the Coalition gov't of former PM David Cameron was in power.

- Latest Westminster voting intention (31 Aug - 1 Sep): Con: 28% (-3 from 23-24 Aug), Lab: 43% (+4), Lib Dem: 11% (=), Green: 6% (-1), Reform UK: 3% (-2), SNP: 5% (=)

- With Truss taking over with such low support evident for the governing party and expectations for a difficult winter with rising energy prices there is already speculation as to the potential longevity of Truss' tenure in office should polls into 2023 show a Labour majority as a strong likelihood (as the current numbers do).

- Next election not due until Dec 2024 at the latest, but May 2024 seen as a more favored time. While unlikely, a snap election in the coming months cannot be ruled out.

- Should be noted that the fieldwork for this was in late-August/early-September, before the result of the Conservative leadership contest had been announced.

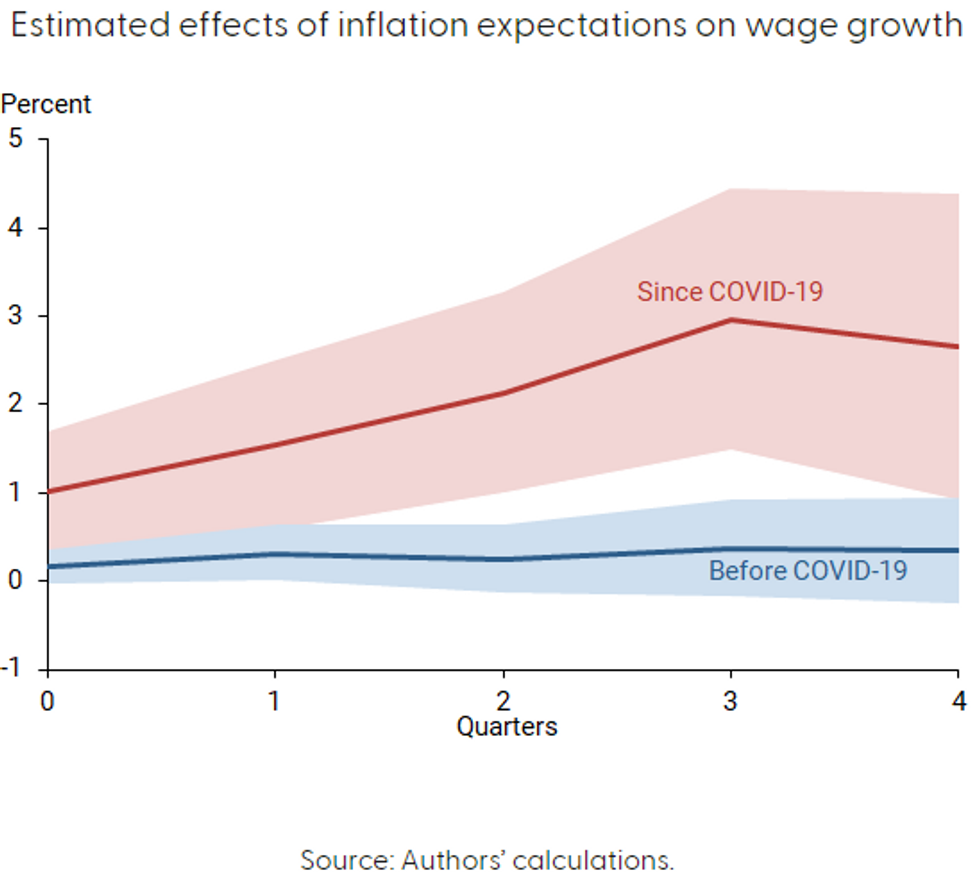

US: SF Fed Sees Inflation Expectations More Prominent Role In Wage-Setting

- SF Fed research (link) finds that "since the pandemic, inflation expectations have been playing a more prominent role in wage-setting dynamics than in the past. Moreover, the influence of inflation expectations is being felt over a longer period of time. The longer inflation and inflation expectations remain elevated, the higher and longer-lasting the pressures on wage growth are likely to be" - first chart.

Source: SF Fed

Source: SF Fed

- To this effect, the recent cooling in surveyed long-term measures of consumer inflation expectations will be welcomed, but long-term market measures such as the 5Y5Y breakeven have trended higher since mid-July to 2.35% despite the climb in 10Y real yields.

FOREX: Greenback Strength Extends, USDJPY Breaches 143.00

- Surging core yields have continued to weigh on the Japanese Yen on Tuesday, prompting USDJPY to print a fresh high of 143.07, extending the day’s gains to 1.7% and rising around 280 pips off the day's lows. Japanese authorities continue to let markets know they are watching the FX market and are vigilant, however, the language remains consistent with messaging over the past months and appears ineffective in its current form.

- Sights are on the 143.30 -- 2.23 projection of the Aug 2 - 8 - 11 price swing before the next psychological resistance point of 144.00.

- Mild pressure on equity markets also weighed on the likes of AUD and NZD which fell close to 1% against the USD, despite an overnight 50bp hike from the RBA. Outperforming in G10 was GBP, which is registering gains following new Prime Minister Liz Truss’ proposed spending package to deal with the developing energy crisis. Similarly, CAD remains unchanged ahead of tomorrow’s central bank decision.

- Despite an early bounce, EURUSD has made new cycle lows at 0.9864 which brings fresh attention to 0.9800 as next support.

- Overall, the greenback was bolstered by today's firmer US ISM Services PMI and it is worth noting there are very few notable US data points ahead of next Tuesday’s CPI release.

- Australian GDP data will precede Chinese trade balance figures. The European docket includes German Industrial production and the final reading of Eurozone GDP. Focus will then turn to the Bank of Canada, which is widely expected to hike its overnight rate 75bps to 3.25%.

- Fed speakers include Barkin, Mester and Brainard and worth noting the September ECB decision/press conference is on Thursday.

FX OPTIONS: Expiries for Sep07 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9875-00(E1.6bln), $0.9950(E803mln), $0.9960-75(E1.1bln), $1.0000(E691mln)

- USD/JPY: Y140.85-00($1.6bln)

- GBP/USD: $1.2730-50(Gbp1.2bln)

- EUR/GBP: Gbp0.8575(E1.1bln)

- USD/CNY: Cny7.0000($2.2bln)

COMMODITIES: Oil Slides On China Lockdowns, Risk Off Sentiment

- Crude oil have moved sharply lower today as new China Covid-related lockdowns and a cutting of Saudi prices to Asia added to higher yield-induced risk off sentiment, reversing yesterday’s gains helped by OPEC+ unexpectedly deciding to cut output in October.

- WTI is -0.07% at $86.74 (from Friday’s close due to Labor holiday). Support is increasingly exposed, with $85.98 (Sep 1 low) sitting a little above the bear trigger at $85.37 (Aug 16 low).

- Most active strikes in the CLV2 have been $95/bbl calls.

- Brent is -3.19% at $92.67, with a bear threat remaining present, with support at $91.81 but still a little off the key bear trigger of $89.06 (Jul 14 low).

- Gold is -0.57% at $1700.74 as USD strength and surging Tsy yields weigh on the yellow metal. It moves closer to the bear trigger at $1681 (Jul 21 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/09/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/09/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 07/09/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 07/09/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/09/2022 | 0900/1100 | *** |  | EU | GDP (2nd est.) |

| 07/09/2022 | 0900/1100 | * |  | EU | Employment |

| 07/09/2022 | 0900/1000 |  | UK | BOE Committee Hearing on August MonPol Report | |

| 07/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/09/2022 | - | *** |  | CN | Trade |

| 07/09/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/09/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 07/09/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/09/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/09/2022 | 1400/1000 |  | US | MNI Webcast With Cleveland Fed's Loretta Mester | |

| 07/09/2022 | 1635/1235 |  | US | Fed Vice Chair Lael Brainard | |

| 07/09/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 07/09/2022 | 1800/1400 |  | US | Fed Vice Chair Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.