-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Lead-Up To Sep FOMC, 100Bp Hike Bets Cool

EXECUTIVE SUMMARY

- MNI Fed Preview - September 2022: Terminal Vision

- MNI INTERVIEW: Fed Needs To Hike To At Least 5%- Bordo

- MNI STATE OF PLAY: Fed Eyes Third 75BP Hike, Higher Peak Rates

US

FED: Fed Preview - Terminal Vision

- Along with a 75bp hike at the September meeting, the FOMC will attempt to cement “higher for longer” rate pricing.

- With changes to the statement likely to be limited, immediate focus will be on the Dot Plot’s end-2022 median rate forecast and the 2023 “terminal” rate, for which sell-side expectations center on 3.9% and 4.2%, respectively.

- MNI sees a flatter Fed funds rate “Dot Plot” than consensus, though risks to the 2023 Dot lie to the upside of 4.1%.

FED: The Federal Reserve must keep playing catch-up with inflation and a benchmark rate of at least 5% is needed to keep things from getting out of control, former Fed visiting scholar Michael Bordo told MNI.

- The Fed has a long track record of being slow to tighten and the fed funds rate may need to climb even higher than 5% to restore price stability, he said in a phone interview. While a recession is likely, that pain should be mild in comparison with the prospect of 1970s-style inflation returning, he said.

- “If the Fed doesn’t follow through, raise the policy rate above the rate of inflation, or the rate of expected inflation, if they don’t have a positive real interest rate, inflation will not be licked. I feel very strongly on that,” Bordo said. For more see MNI Policy main wire at 1052ET.

- The move would take the federal funds rate to a 3%-3.25% target range for the first time since 2008. Accompanying that decision, a quarterly refresh of the FOMC's economic projections will likely show a faster pace of tightening for the remaining months of 2022 and into 2023 than officials expected in June, as well as lower growth and higher inflation and unemployment.

- The new "dot plot" is likely to show rates rising to 4% or above by year-end and peaking at around 4.5% in 2023, former Fed officials and staffers told MNI, though many believe rates will ultimately need to rise to 5% or higher, more than futures markets are pricing. Fed funds implied rates peak in March 2023 at 4.5%, just a tad above 4.25% in December.

US TSYS: Relative Calm Ahead Flood of Central Bank Policy Annc's

Tsys holding mostly weaker after the bell (Dec Ultra-Bond outperforming), Inside session range after Tsy yields tapped multi-year highs: 2s at 3.9655% high; 5s at 3.7124%; 10s at 3.5158% high; 30Y at 3.5679%).

- Relative calm before a flood of central bank rate anncs lead by the FOMC (Wed) and BoE (Thu), followed by Riksbank, Canada, China on Tue; Boj, SNB, Norges on Thu. Light volumes (TYZ2 <850k w/ Japan out for one day holiday (Respect for the aged) and London banks closed for the Queen's funeral.

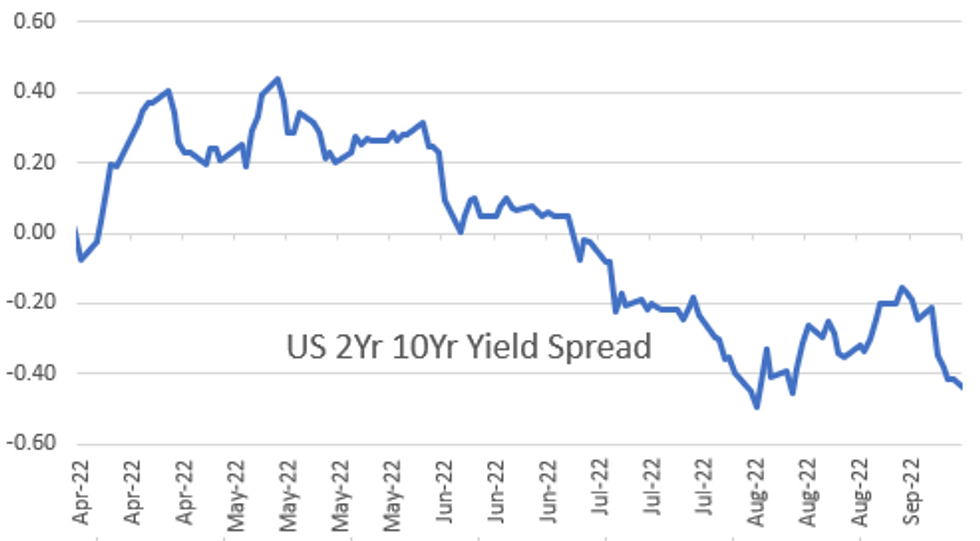

- No obvious headline or block driver as futures bounced off morning lows, long end outperforming as curves extended inversion (2s10s currently -4.008 at -46.407 vs. -48.142 low; 5s30s -6.037 at -18.340 vs. -19.977 low).

- Plausible driver: carry-over curve flattening/steepener unwinds from deep pocket accts firm up opinion on forward policy/recession chances ahead Wednesday's FOMC (includes Summary of Economic Projections, Fed Chairman Powell news conf 30 minutes after the 1400ET annc); 75bp hike widely anticipated, option trades seeing unwind of 100bps hike bets, while debate over 50-75bps moves in Nov and Dec meetings continues.

- Current cross-asset levels: Stocks gaining late - modest relief rally as bets on 100bp hike this Wed receded, SPX extending session highs w/ESZ2 at 3916.25 (+26.25), Crude mildly higher - well off lows (WTI +0.30 at 85.41 vs. 82.15 low), Gold weaker (1673.21 -1.85).

- The 2-Yr yield is up 7.7bps at 3.9443%, 5-Yr is up 5.7bps at 3.6876%, 10-Yr is up 3.5bps at 3.4846%, and 30-Yr is down 1bps at 3.5032%.

OVERNIGHT DATA

- US NAHB HOUSING MARKET INDEX 46 IN SEP

- US NAHB SEP SINGLE FAMILY SALES INDEX 54; NEXT 6-MO 46

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 88.7 points (0.29%) at 30903.69

- S&P E-Mini Future up 13 points (0.33%) at 3901.5

- Nasdaq up 46.8 points (0.4%) at 11493.03

- US 10-Yr yield is up 3.5 bps at 3.4846%

- US Sep 10Y are down 12.5/32 at 114-11.5

- EURUSD up 0.0006 (0.06%) at 1.0022

- USDJPY up 0.29 (0.2%) at 143.21

- WTI Crude Oil (front-month) up $0.54 (0.63%) at $85.65

- Gold is down $2.27 (-0.14%) at $1672.78

- EuroStoxx 50 down 0.92 points (-0.03%) at 3499.49

- German DAX up 61.98 points (0.49%) at 12803.24

- French CAC 40 down 15.71 points (-0.26%) at 6061.59

US TSY FUTURES CLOSEv

- 3M10Y +4.317, 31.81 (L: 25.616 / H: 34.96)

- 2Y10Y -3.991, -46.39 (L: -48.142 / H: -42.334)

- 2Y30Y -8.502, -44.531 (L: -46.154 / H: -36.86)

- 5Y30Y -6.317, -18.62 (L: -19.977 / H: -12.288)

- Current futures levels:

- Sep 2Y down 5/32 at 103-11.375 (L: 103-11.625 / H: 103-12.125)

- Sep 5Y down 10.5/32 at 109-1 (L: 109-02.25 / H: 109-05.5)

- Sep 10Y down 12.5/32 at 114-11.5 (L: 114-09.5 / H: 114-23)

- Sep 30Y down 8/32 at 131-12 (L: 130-26 / H: 131-13)

- Sep Ultra 30Y up 12/32 at 143-23 (L: 142-14 / H: 143-27)

US 10YR FUTURE TECHS: (Z2) Approaching Key Support

- RES 4: 119-01 High Aug 18

- RES 3: 118-00 High Aug 26

- RES 2: 117-16+ 50 day EMA values

- RES 1: 116-10+/26 20-day EMA / High Sep 2

- PRICE: 114-16+ @ 1230ET Sep 19

- SUP 1: 114-07 Low Sep 14

- SUP 2: 114-06 Low Jun 14 and a key support

- SUP 3: 114-00 Round number support

- SUP 4: 113-19 Low Sep 19 2019 (cont)

Treasuries remain soft with the contract trading at its recent lows. Trend signals continue to highlight a bearish theme and sights are on the key support at 114-06, the Jun 14 low. A break of this level would confirm an important technical break and highlight a resumption of the broader downtrend, exposing the 114-00 handle initially. Firm resistance is at 116-26, the Sep 2 high.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.045 at 95.425

- Mar 23 -0.080 at 95.335

- Jun 23 -0.095 at 95.390

- Sep 23 -0.095 at 95.550

- Red Pack (Dec 23-Sep 24) -0.10 to -0.09

- Green Pack (Dec 24-Sep 25) -0.085 to -0.07

- Blue Pack (Dec 25-Sep 26) -0.065 to -0.04

- Gold Pack (Dec 26-Sep 27) -0.04 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: No new settles Monday due to London bank closure for Queen's funeral. Last Friday's sets' and total change on the week:

- O/N -0.00543 to 2.31557% (+0.00100 total last wk)

- 1M +0.02043 to 3.01386% (+0.24072 total last wk)

- 3M +0.03815 to 3.56529% (+0.31986 total last wk) * / **

- 6M +0.06029 to 4.12329% (+0.31215 total last wk)

- 12M +0.05071 to 4.67214% (+0.48314 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.56529% on 9/16/22

- Daily Effective Fed Funds Rate: 2.33% volume: $96B

- Daily Overnight Bank Funding Rate: 2.32% volume: $294B

- Secured Overnight Financing Rate (SOFR): 2.27%, $952B

- Broad General Collateral Rate (BGCR): 2.26%, $392B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $376B

- (rate, volume levels reflect prior session)

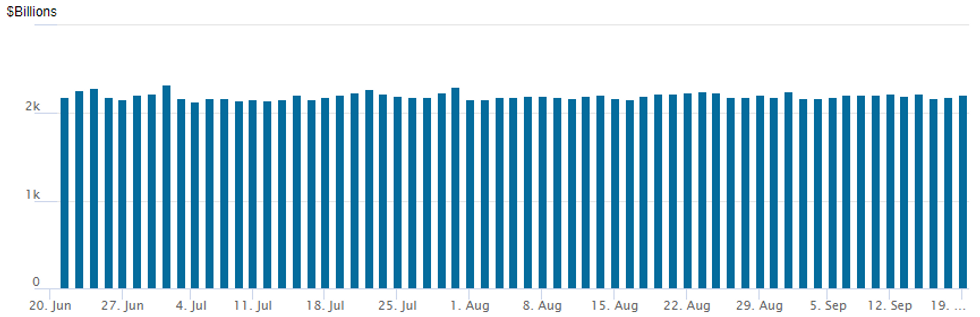

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages climbs to $2,217.542B w/ 101 counterparties vs. $2,186.833B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: ADP 2Y on Tap Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 09/19 No new issuance Monday; expected Tuesday:

- 09/20 $Benchmark ADB 2Y SOFR+10a, 10Y SOFR+52a

- 09/15 No new US$ issuance Friday after $24.3B total issued on week

FOREX: Risk Recovery Sees Greenback Pare Earlier Gains

- The greenback had started the week as the best performing G10 currency as risk sentiment soured from the open and equities extended below last week’s lows. However, Monday’s session turned out to be a tale of two halves, with a solid bounce in both equities and oil prices weighing on the greenback throughout the US session, culminating in the USD index trading close to unchanged from Friday’s close.

- With no direct headlines driving the price action, markets may have overextended given the holidays in the UK and Japan, with potential profit taking dynamics coming into play ahead of the FOMC decision on Wednesday.

- NZDUSD has underperformed, following momentum selling below the psychological 0.60 handle. The pair continues to print fresh cycle lows (0.5930), the worst levels since May 2020.

- Additionally, USDCAD extended on last week’s strength which resulted in a break of key resistance and the bull trigger. This confirmed a resumption of the broader uptrend and saw the pair get as high as 1.3344 on Monday. Despite this bullish price action, the pair has had the most significant turnaround, closing the gap with the overnight lows at 1.3250 and narrowing in on the initial recent breakout level at 1.3224, the Jul 14 high.

- Japan returns on Tuesday and National Core CPI data is on the docket. Following this markets will receive the latest RBA Monetary Policy Meeting Minutes. Canadian August CPI highlights Tuesday’s North American session with US building permits a minor data point. Potential comments from ECB’s Lagarde due to speak at an event hosted by the Frankfurt Society for Trade, Industry, and Science.

- Focus then turns firmly to a slew of DM and EM central bank decisions/projections, headlined by the Federal Reserve on Wednesday.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2022 | 2330/0830 |  | JP | Natl CPI | |

| 20/09/2022 | 0115/0915 |  | CN | PBoC Rate Decision | |

| 20/09/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 20/09/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/09/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/09/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 20/09/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/09/2022 | 1700/1900 |  | EU | ECB Lagarde Lecture in Frankfurt | |

| 20/09/2022 | 1930/1530 |  | CA | BOC Deputy Beaudry speech "Pandemic macroeconomics: What we’ve learned, and what may lie ahead." |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.