-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: A Yield Too Far, Fed Bostic - Maybe

- MNI FED: Bostic Wants Fed Pause, Sees Risks From Yield Surge

- MNI INTERVIEW: Fed's Fujita Sees Signs of Jobs Soft Landing

- MNI BRIEF: Fed's Mester: 10-Year Yield Surge Affects Policy

- MNI: BOC: Sticky Inflation Clouds Return To Target By Mid-2025

US

FED: The Federal Reserve should stop raising interest rates and figure out how long it needs to keep policy tight in order to bring inflation back to target, Atlanta Fed President Raphael Bostic said Tuesday, flagging a possible hit to economic activity from the recent spike in long-term bond yields to 16-year highs.

- "Our policy is sufficiently restrictive at this point to get us to the 2% target," he said in a virtual briefing with reporters. "My next decision is not really on when to cut, but really how to assess how rapidly the economy is likely to move to 2% which is really much more about monitoring the degree and the scope of economic slowdown and also monitoring what's happening on the supply side."

- Bostic said the rise in the 10-year and 30-year Treasury yields to their highest levels since 2007 could become a contributing factor to the slow down in the U.S. economy, but he will have to see it in the data and consumer behavior before altering his outlook for monetary policy.

- "One of the things we're going to look at ... is the pace at which the economy slows down, and these yields I think are going to be a contributing factor to that. Ultimately, it's what happens in actual behavior."

FED: Unusually low job loss rates and unemployment insurance filings put the U.S. job market en route to a soft landing, in which inflation calms without putting millions out of work, Philadelphia Fed economist Shigeru Fujita told MNI.

- The labor market has loosened noticeably as interest rates near their cycle peak. Vacancies have fallen by nearly 2 million since the start of the year. The quits rate -- the ratio of resignations to employed that serves as a measure of workers’ willingness or ability to leave their jobs -- has drifted down to pre-pandemic highs around 2.3% from a peak of 3.0% last year. And hiring has slowed to a three-month moving average of 150,000 a month, less than half of what it was in January.

- "Layoffs are not increasing at all. It’s a good thing but I am very surprised that hasn’t changed. The job loss rate -- the monthly transition from employed to unemployed divided by total employed -- is still very low. And initial jobless claims is also very, very low. These are indications of a soft landing," Fujita said in an interview. For more see MNI Policy main wire at 1308ET.

FED: A sustained surge in 10-year Treasury yields to 16-year highs tightens financial conditions and helps moderate demand and will feed into deliberations for whether the Federal Reserve needs to raise rates one last time and how long to leave them at that peak next year, Cleveland Fed President Loretta Mester said Tuesday.

- "Those tighter higher rates will have an effect on the economy and we'll have to take that into account," she said in a call with reporters. "We're going to have to follow that and watch it, and that will influence not only our policy decisions, but how the economy evolves over the next year." She reiterated that a last quarter-point rate increase by December is likely needed and rates will stay restrictive "for some time" to get inflation back to goal by the end of 2025.

- "If the economy looks the way it did in the next meeting similar to the way it looked at our recent meeting, I would do the further rate increase," she said. "We really need to get inflation back to 2% if the economy can support that, and I think there is underlying momentum in the economy."

CANADA

BOC: Sticky inflation including the potential for firms to keep raising prices more aggressively following the pandemic may complicate the Bank of Canada's work to restore price stability, Deputy Governor Nicolas Vincent said Tuesday.

- "In July we said that inflation should gradually return to the 2% target by the middle of 2025 as excess demand dissipates and labour market conditions ease. We will be providing another update on October 25, but it is clear that we are not out of the woods yet," Vincent said in the text of a speech he's giving in Montreal. "We need to acknowledge that an unusual amount of uncertainty continues to cloud our view. And we remain concerned about the persistence of underlying inflation, which may complicate our return to price stability."

- Nicolas didn't give a view on the outlook for the Bank's 5% policy rate and the potential for another increase or a high-for-long policy, or recent data showing sluggish GDP growth and employment. The Bank left its key rate at the highest since 2001 last month and signaled officials remain prepared to hike again because of the risk elevated price gains become entrenched amid slow progress wrestling down inflation. For more see MNI Policy main wire at 0826ET.

US TSYS 10Y Yield New Cycle High of 4.8081%

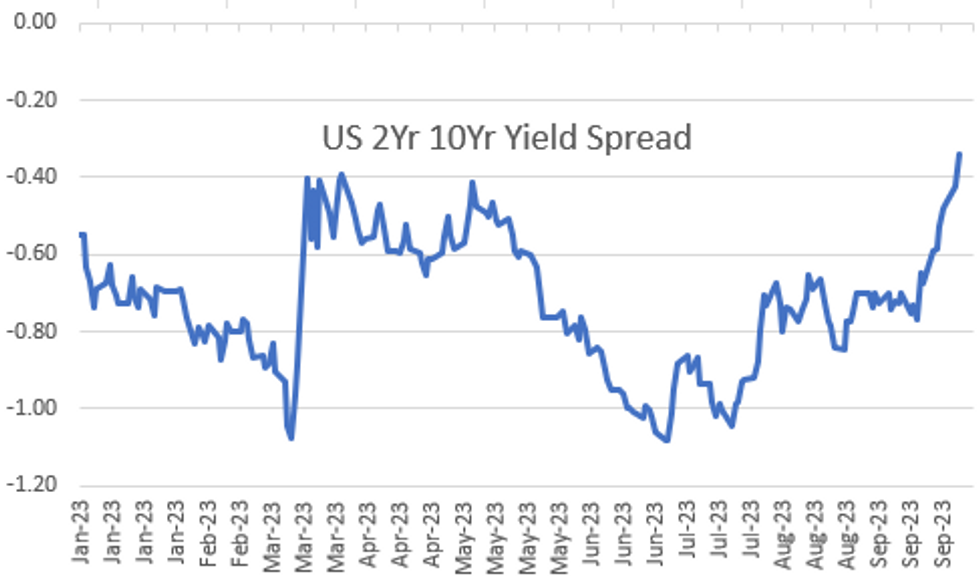

- Treasury futures continue to extend lows in late trade, as 10Y yield climbs to new 16Y high of 4.8081%. Curves making new cycle highs: 3M10Y +9.075 at -70.705, 2Y10Y +7.920 at -34.846.

- Dec'23 10Y futures crossed technical support of 106-23 (Low Oct 3 & 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing) to 106-18 low briefly, and is back to 106-20.5 (-22) after the bell

- Bids pulled or shifted lower as focus turns to surge of scheduled economic data tomorrow that includes ADP Private Employ, ISM Services.

- Cross asset summary: Greenback remains strong but off highs (DXY +.118 at 107.022), Gold weaker (-2.77 at 1825.27), crude firmer (WTI +0.54 at 89.36). Stocks at/near session lows with S&P E-Mini futures back to early June levels: down 62 points (-1.43%) at 4262.25, DJIA down 443.64 points (-1.33%) at 32989.56, Nasdaq down 249.9 points (-1.9%) at 13057.9.

OVERNIGHT DATA

- US BLS: JOLTS QUITS RATE 2.3% IN AUG

- US BLS: JOLTS OPENINGS RATE 9.610M IN AUG

- US REDBOOK: SEP STORE SALES +3.9% V YR AGO MO

- US REDBOOK: STORE SALES +3.5% WK ENDED SEP 30 V YR AGO WK

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 502.86 points (-1.5%) at 32931.44

- S&P E-Mini Future down 70.75 points (-1.64%) at 4254

- Nasdaq down 294 points (-2.2%) at 13013.35

- US 10-Yr yield is up 13 bps at 4.8081%

- US Dec 10-Yr futures are down 23.5/32 at 106-19

- EURUSD down 0.0006 (-0.06%) at 1.0471

- USDJPY down 1.08 (-0.72%) at 148.78

- WTI Crude Oil (front-month) up $0.71 (0.8%) at $89.53

- Gold is down $3.49 (-0.19%) at $1824.53

- European bourses closing levels:

- EuroStoxx 50 down 42.04 points (-1.02%) at 4095.59

- FTSE 100 down 40.56 points (-0.54%) at 7470.16

- German DAX down 162 points (-1.06%) at 15085.21

- French CAC 40 down 71.11 points (-1.01%) at 6997.05

US TREASURY FUTURES CLOSE

- 3M10Y +9.392, -70.388 (L: -84.155 / H: -70.388)

- 2Y10Y +8.551, -34.215 (L: -43.806 / H: -33.796)

- 2Y30Y +11.62, -20.182 (L: -33.289 / H: -19.122)

- 5Y30Y +6.179, 13.988 (L: 6.562 / H: 15.53)

- Current futures levels:

- Dec 2-Yr futures down 2.375/32 at 101-4.75 (L: 101-04.375 / H: 101-09)

- Dec 5-Yr futures down 12/32 at 104-17.25 (L: 104-17 / H: 104-31.75)

- Dec 10-Yr futures down 23.5/32 at 106-19 (L: 106-18.5 / H: 107-14)

- Dec 30-Yr futures down 1-26/32 at 110-18 (L: 110-16 / H: 112-24)

- Dec Ultra futures down 2-26/32 at 114-06 (L: 114-01 / H: 117-10)

US 10Y FUTURE TECHS: (Z3) Southbound

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-03+ High Sep19

- RES 1: 108-17/27 Low Sep 27 / 20-day EMA

- PRICE: 106-23 @ 16:54 BST Oct 3

- SUP 1: 106-23 Low Oct 3 & 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 2: 106-00 Round number support

- SUP 3: 105-29+ 3.0% Lower Bollinger Band

- SUP 4: 105-27 2.0% lower 10-dma envelope

The bear trend in Treasuries remains intact and the contract has traded to a fresh cycle low Tuesday. The move down confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Support at 107-05+ has given way, with market focus on 106-23, a Fibonacci projection point, at the low. On the upside initial firm resistance is seen at 108-27, the 20-day EMA. A break would signal a possible base. For now, gains are considered corrective.

SOFR FUTURES CLOSE

- Dec 23 -0.005 at 94.510

- Mar 24 steady00 at 94.585

- Jun 24 -0.005 at 94.755

- Sep 24 -0.015 at 950

- Red Pack (Dec 24-Sep 25) -0.085 to -0.025

- Green Pack (Dec 25-Sep 26) -0.135 to -0.105

- Blue Pack (Dec 26-Sep 27) -0.14 to -0.14

- Gold Pack (Dec 27-Sep 28) -0.14 to -0.135

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00343 to 5.32751 (+0.00852/wk)

- 3M +0.02614 to 5.41429 (+0.01879/wk)

- 6M +0.03313 to 5.48573 (+0.01846/wk)

- 12M +0.04399 to 5.47767 (+0.01141/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% volume: $240B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.513T

- Broad General Collateral Rate (BGCR): 5.30%, $537B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $526B

- (rate, volume levels reflect prior session)

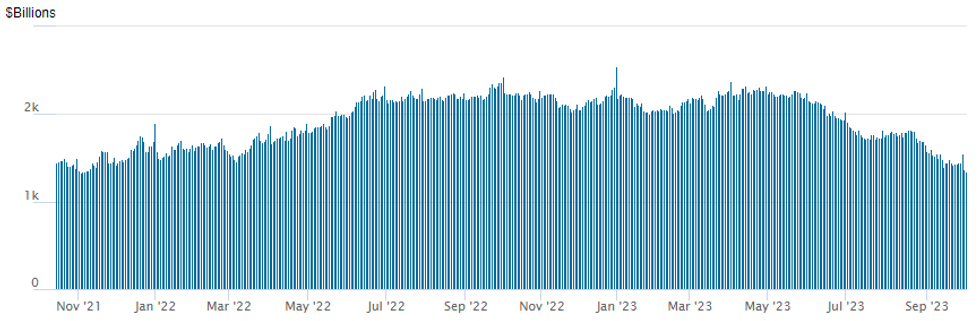

FED REVERSE REPO OPERATION: Extending New Low

NY Federal Reserve/MNI

Repo operation usage falls to $1,348.465B - new low since early November 2021 w/97 counterparties vs. $1,365.739B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Kommuninvest +2Y SOFR Rolled to Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 10/03 $750M *Emirates NBD 5Y +120

- Expected to issue Wednesday

- 10/04 $Benchmark Kommuninvest +2Y SOFR+34a

FOREX JPY Volatility Raises Intervention Questions

- The greenback trended higher across US hours, aided by further gains to cycle highs for the belly and longer-end of the US curve. Bear steepening of US yields supported the USD Index through to resume it's medium-term uptrend off the July lows, putting USD/JPY briefly above Y150.00.

- A sharp and abrupt fall in the pair off the highs has raised considerable suspicion of official intervention in the currency rate (a Japanese finance ministry official declined to comment on the matter), but markets may have to wait until the month-end BoJ intervention data release for any confirmation.

- The strong recovery off the USD/JPY lows may suggest a lack of follow through from any intervention, with spot recouping close to 175 pips off the 147.43 low. This keeps the pressure turned higher for now, and markets will be looking to test if any further breaks of Y150 will be followed by an abrupt decline.

- AUD and NZD traded poorly across the session, with the continuity in RBA policy and the openness to further hikes doing little to prop the currency. Weakness across equity markets sapped higher beta currency performance, keeping AUD/USD's downtrend intact and opening new pullback lows. 0.6170 marks next key support.

- Focus Wednesday turns to the final composite and services PMI data from across Europe, as well as the ADP and ISM Services releases. JOLTs data cemented the strong labour market backdrop evident in Monday's ISM Manufacturing Index, potentially posing upside risks to Friday's NFP.

- Consensus looks for Change in Nonfarm Payrolls of +170k, but the whisper number has already begun to populate higher.

WEDNESDA DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/10/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 04/10/2023 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 04/10/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 04/10/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 04/10/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/10/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/10/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/10/2023 | 0815/1015 |  | EU | ECB's Lagarde speaks at ECB MP Conference | |

| 04/10/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 04/10/2023 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 04/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/10/2023 | 1140/1340 |  | EU | ECB's de Guindos speaks at Cyprus CB Conference | |

| 04/10/2023 | - |  | UK | BoE's Bailey Interview in Prospect Magazine | |

| 04/10/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/10/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 04/10/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/10/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 04/10/2023 | 1400/1600 |  | EU | ECB's Panetta speaks at ECB MP Conference | |

| 04/10/2023 | 1425/1025 |  | US | Fed Governor Michelle Bowman | |

| 04/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 04/10/2023 | 1600/1800 |  | EU | ECB's Lagarde speaks at Columbia University |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.