-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Ballot Count Grinds On, Electoral Vote Stalled

EXECUTIVE SUMMARY

- - MNI EXCLUSIVE: China May Seek Phase 1 Changes, Tariff Cuts

- - MNI EXCLUSIVE: US Election Dims Lame-Duck Fiscal Aid Prospects

- - MNI INTERVIEW: BOC To Steer Away From Average-Inflation Target

- - Biden Expected To Speak To The Nation Tonight - RTRS

- - KUDLOW: MCCONNELL WANTS TO MOVE ON A TARGETED STIMULUS, Bbg

US

US: While interest in reaching an agreement on a new economic relief package before year-end has revived amongst Capitol Hill lawmakers after election week, it's unlikely to result in the major package Democrats and President Trump were negotiating before the election, former officials told MNI. For more, see 11/06 main wire at 1244ET.

US/CHINA: Chinese policy advisors are already preparing for Joe Biden to take over as U.S. president, telling MNI bilateral talks could begin as early as the second half of 2021 and that Beijing may seek lower U.S. tariffs as well as easier commitments for purchases of American exports under a Phase One trade deal the Democrat has called a disaster. For more, see 11/06 main wire at 0824ET.

CANADA

BOC: The Bank of Canada is likely to refrain from following the U.S. into average-inflation targeting, which could lead to price rises getting out of control, former research fellow Randall Morck told MNI

- "The way the Bank of Canada has been doing it makes sense going forward," said Morck, who won a multi-year research fellowship from the BOC when Mark Carney was governor. Asked whether the BOC would imitate the Federal Reserve which recently moved to average inflation targeting, he replied: "I don't think so." For more, see 11/06 main wire at 1130ET.

OVERNIGHT DATA

US DATA: October Nonfarm Payrolls Beat Expectations

- U.S. nonfarm payrolls grew 638,000 in October, above market expectations for a 593,000 gain, according to figures released Friday by the Bureau of Labor Statistics

- The unemployment rate slipped by a full percentage point to 6.9%, below forecasts for an unemployment rate of 7.6%.

- Private payrolls rose 906,000 in October, mainly driven by gains in service-producing industries like leisure and hospitality (+271k) and professional business services (+208k). Temporary help services grew by 108,700 in October from 21,800 in September

- Government payrolls fell by 268k in October after falling 220k in September

- Average hourly earnings rose 0.1% in October, below expectations for a 0.2% gain. Earnings were up 4.5% from a year earlier.

- The length of an average workweek held steady at 34.8 hours.

U.S. SEPT. WHOLESALE INVENTORIES RISE 0.4 %

U.S. SEPT. WHOLESALE SALES UP 0.1 %

The New York Fed Staff Nowcast stands at 2.86% for 2020:Q4.

St. Louis Fed Q4GDP Growth Estimate Is 3.5 Percent

CANADA OCT EMPLOYMENT +83.6K; JOBLESS RATE +8.9%

CANADA OCT FULL-TIME JOBS +69.1K; PART-TIME +14.5K

MARKET SNAPSHOT

- DJIA down 35.62 points (-0.13%) at 28390.18

- S&P E-Mini Future up 3 points (0.09%) at 3480.5

- Nasdaq up 20.8 points (0.2%) at 11890.93

- US 10-Yr yield is up 5.2 bps at 0.8151%

- US Dec 10Y are down 9/32 at 138-19

- EURUSD up 0.0058 (0.49%) at 1.1872

- USDJPY down 0.23 (-0.22%) at 103.23

- WTI Crude Oil (front-month) down $1.54 (-3.97%) at $37.62

- Gold is up $5.23 (0.27%) at $1954.61

- European bourses closing levels:

- EuroStoxx 50 down 11.51 points (-0.36%) at 3193.55

- FTSE 100 up 3.84 points (0.07%) at 5895.55

- German DAX down 88.07 points (-0.7%) at 12449.41

- French CAC 40 down 23.11 points (-0.46%) at 4950.48

US TSY SUMMARY: Scaling Back Bid As Election Uncertainty Remains

Tsy futures traded weaker after the bell, tempering the week's presidential election uncertainty amid improving poll count in favor of VP Biden. Ranges and volumes much more subdued Friday as ballot counting continues in swing states: AZ, GA, NC, NV and PA.

- * Much better than expected October employment figures, +638k vs. +593k est, added to the sell-off in rates. Tsys scale back about a third of Thursday's sharp rally as markets calm down despite ongoing election uncertainty. Yld curves bear steepen, paring appr half Thursday's move.

- * Spurious morning headline generated some early vol: "DONALD TRUMP TO ADMIT DEFEAT AFTER RECEIVING ADVICE FROM HIS ADVISERS - FOX NEWS" roiled markets before Fox News blog now says: Trump has no immediate plans to concede.

- * VP Biden is expected to speak to the nation tonight, time TBA.

- * Mixed flow across the curve saw better selling in intermediates to long end midmorning to noon, activity tapered off in the second half. The 2-Yr yield is up 0.4bps at 0.1488%, 5-Yr is up 3.2bps at 0.3578%, 10-Yr is up 5.2bps at 0.8151%, and 30-Yr is up 6.7bps at 1.5905%.

US TSY FUTURES CLOSE: Tempering Election Uncertainty

Weaker across the board, but off late morning lows, Tsys scale back about a third of Thursday's sharp rally as markets calm down despite ongoing election uncertainty. Yld curves bear steepen, paring appr half Thursday's move. Update:

- 3M10Y +5.893, 72.551 (L: 65.827 / H: 74.405)

- 2Y10Y +4.781, 66.206 (L: 60.955 / H: 67.862)

- 2Y30Y +6.286, 143.778 (L: 136.753 / H: 146.111)

- 5Y30Y +3.54, 123.149 (L: 118.706 / H: 124.654)

- Current futures levels:

- Dec 2Y -0.37/32 at 110-13 (L: 110-12.75 / H: 110-13.75)

- Dec 5Y -3.75/32 at 125-21.5 (L: 125-18.75 / H: 125-27.25)

- Dec 10Y down 9/32 at 138-19 (L: 138-12.5 / H: 139-01)

- Dec 30Y down 1-0/32 at 173-11 (L: 172-29 / H: 174-31)

- Dec Ultra 30Y down 1-30/32 at 217-6 (L: 216-02 / H: 220-19)

US EURODLR FUTURES CLOSE: Near Session Lows

Futures mostly weaker, long end of the strip underperforming. Lead quarterly holding steady after 3 Month LIBOR set' -0.00987 to a new record low of 0.20588% (-0.00275/wk).

- Dec 20 steady at 99.765

- Mar 21 steady at 99.795

- Jun 21 steady at 99.80

- Sep 21 steady at 99.80

- Red Pack (Dec 21-Sep 22) -0.01 to -0.005

- Green Pack (Dec 22-Sep 23) -0.025 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.04 to -0.025

- Gold Pack (Dec 24-Sep 25) -0.045 to -0.04

US DOLLAR LIBOR: Latest Settles, New 3M Record Low

- Latest settles

- O/N +0.00125 at 0.08263% (+0.00125/wk)

- 1 Month +0.00112 to 0.12775% (-0.01250/wk)

- 3 Month -0.00987** to 0.20588% (-0.00275/wk)

- ** 3M New record Low 0.20588% on 11/6/20 ** (prior 0.20863% on 10/19/20)

- 6 Month -0.00287 to 0.24338% (+0.00125/wk)

- 1 Year -0.00037 to 0.33338% (+0.00325/wk)

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session

- Daily Effective Fed Funds Rate: 0.09% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $164B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.11%, $938B

- Broad General Collateral Rate (BGCR): 0.08%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $319B

- (rate, volume levels reflect prior session)

FED: NY Fed operational purchase

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Next week's purchase schedule:

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

PIPELINE

Sidelined issuers due to US Presidential Election uncertainty finally broke ground with Waste Management 4-part on Thursday. No new issuance Friday

- Date $MM Issuer (Priced *, Launch #

- 11/05 $2.5B *Waste Management $500M 55Y +45, $500M +7K +60, $1B +10Y +75, $500M 30Y +100

FOREX: Markets Stabilise as Biden Looks Almost Certain

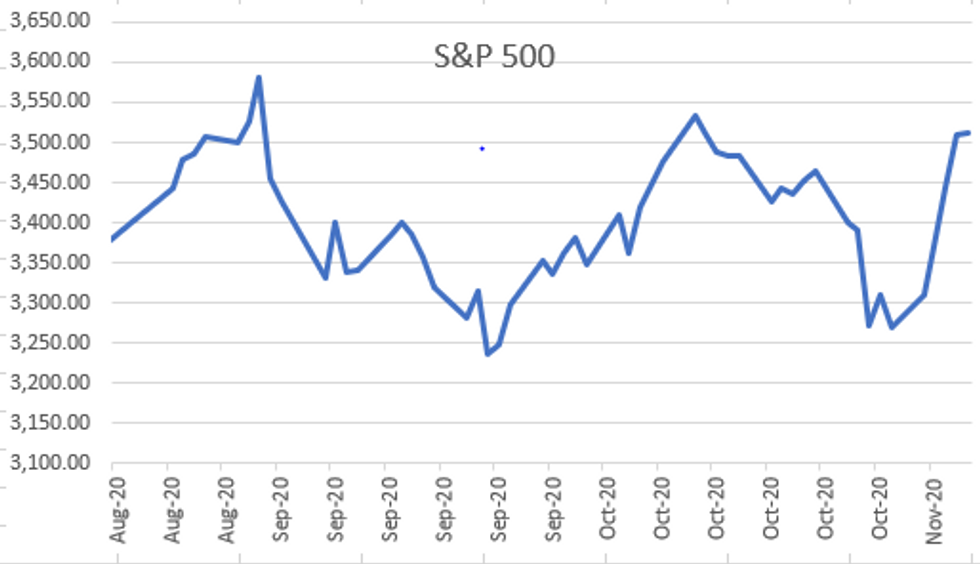

Equities stabilised Friday, with some mild profit-taking taking the S&P500 off the week's high, but still clocking a gain on the week of more than 7%. Biden looks almost certain to enter the White House in the coming days, with key swing states continuing to heavily favour the former Vice President.

- A better-than-expected Nonfarm Payrolls release also soothed markets, with the US adding 50k jobs more than expected, shrinking the unemployment rate to 6.9% - a drop of 1ppt.

- The greenback traded weaker once more, with EUR/USD climbing to further multi-month highs of 1.1891 - putting the onus in the ECB as they look to 'recalibrate' policy in December.

- AUD was the poorest performer Friday, with SEK, EUR and CHF among the strongest.

- Data covering UK jobs, German ZEW surveys and European industrial production are due in the coming week, as well as the first formal Fed speeches since the FOMC decision.

EGBs-GILTS CASH CLOSE: Bear Steepening To End The Week

A back-and-forth week ended up with bear steepening in both the Gilt and UK curves, with long-end Gilts getting hit. 30-yr Gilt yields backed up 14+bps from Thursday's post-BoE lows.

- And EGB peripheries impressed, with the US election (almost) results considered to be market-friendly - spreads dropped sharply Friday, while 10-Yr BTP yields hit all-time closing lows.

- Next week, Brexit talks will continue to highlight; plenty of data, and an ECB forum featuring names like Lagarde, Bailey and Powell.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.4bps at -0.78%, 5-Yr is up 1bps at -0.802%, 10-Yr is up 1.6bps at -0.621%, and 30-Yr is up 2.5bps at -0.202%.

- UK: The 2-Yr yield is up 1.3bps at -0.034%, 5-Yr is up 1.9bps at -0.032%, 10-Yr is up 4bps at 0.274%, and 30-Yr is up 5.7bps at 0.858%.

- Italian BTP spread down 4.4bps at 126.1bps

- Spanish bond spread down 1bps at 71.8bps

- Portuguese PGB spread down 1.2bps at 70.1bps

- Greek bond spread down 3.3bps at 143.6bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.