-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bonds Outperform Ahead Thu's Powell

- MNI INTERVIEW: Fed Done Hiking, Eyes Long Hold-Ex-IMF Official

- MNI: BOC Minutes Say Some Thought Another Hike Would Be Needed

- MNI Largest Weekly Mortgage Rate Decline In Over A Year

US

FED: The Federal Reserve is likely done raising interest rates because the economy is not as effusive as recent data suggest and the central bank has already done a lot to put inflation on a path back to its 2% target, former IMF economist Martin Muhleisen told MNI.

- “I don’t expect that they will be in a position to raise rates again. I don’t think the economy has that strength in it, though people are still spending like crazy,” he said in an interview. “Without an increase in wages I don’t see this really as a big factor.”

- Instead, the Fed is now focused on how long to keep rates at peak levels, and that part of the policy outlook is too data dependent for even officials to make any reliable predictions. “As far as the need to stay on hold and see how things evolve, there you need some kind of crystal ball to figure it out,” he said. “The direction is toward a cut at some point but that could be quite a while.” For more, see MNI Policy main wire at 1345ET.

CANADA

BOC: Bank of Canada officials were split on whether high-for-long interest rates would restore price stability or further tightening would be needed, according to minutes published Wednesday of the October 25 decision, which held borrowing costs at the highest since 2001.

- "Some members felt that it was more likely than not that the policy rate would need to increase further to return inflation to target," according to the Summary of Deliberations. "Others viewed the most likely scenario as one where a 5% policy rate would be sufficient to get inflation back to the 2% target, provided it was maintained at that level for long enough." The Governing Council that sets borrowing costs has six members.

- Most investors and economists predict the Bank is done after 10 earlier hikes and see a cut around the middle of next year. Governor Tiff Macklem has said it's far too soon to think about cuts but rates could move before inflation returns to 2% if there's evidence prices are stabilizing around that target. The Bank says it will take until 2025 to get inflation back in line. For more, see MNI Policy main wire at 1331ET.

US TSYS: Paring Gains, Curves Extend Flatter

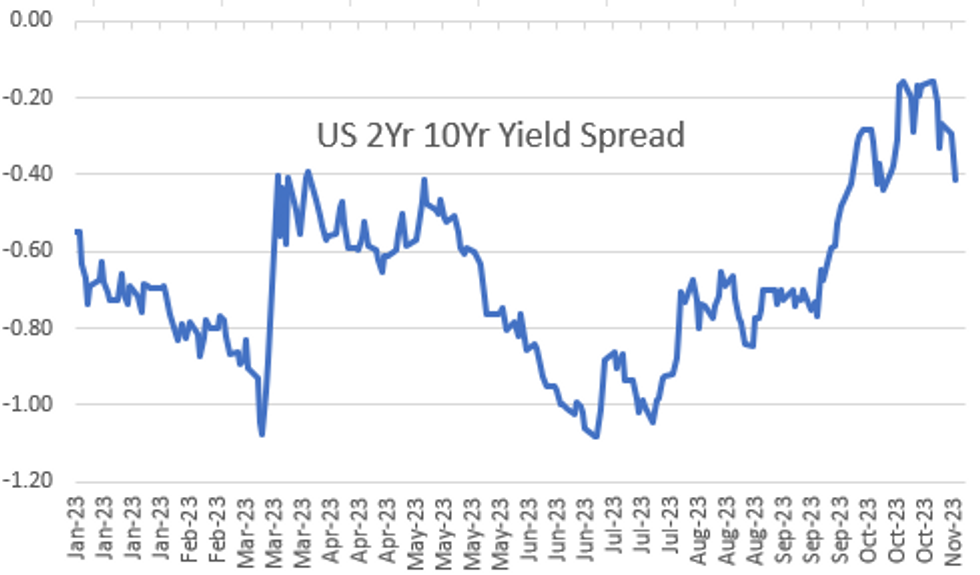

- Decent volumes by the close (TYZ3>1.6M contracts) belied a rather muted session Wednesday, Treasury futures near late session highs after the bell, curves flatter with short end rates lagging all day: 3M10Y -5.677 at -92.909, 2Y10Y -6.788 at -42.313.

- Technicals: Dec'23 10Y tap 108-14.5 high +10.5, put focus on initial technical resistance at 108-25 (Nov 3 high). Breach of that level puts focus on 109-20 (Sep 19 high).

- Projected rate cut chance into early 2024 cooled: December holds at 2.4bp at 5.347%, January 2024 cumulative 4.4bp at 5.373%, while March 2024 pricing in -22.3% (-26.1% this morning) chance of a rate cut with cumulative at -1.2bp at 5.317%, May 2024 cumulative -12.5bp at 5.204%. Fed terminal at 5.375% in Feb'24.

- Cross asset summary: West Texas crude WTI -1.80 at 75.57, Gold -20.32 at 1949.13, US$ index DXY +0.037 at 105.579.

- Focus on Thursday Fed-speak. Initially, MNI Webcast hosts Richmond Fed Barkin at 1100ET as he discusses policy, economic outlook. Please register to attend: MNI Webcast.

- Meanwhile, Fed Chairman Powell will attend a moderated discussion at an IMF Conference at 1400ET.

OVERNIGHT DATA

US MBA: MBA mortgage applications increased 2.5% in the week to Nov 3, with similar increases across both purchases (3%) and refis (2%).

- It was helped by a large 25bp decline in the 30Y conforming mortgage rate to 7.61%, down from 7.86% and the 7.90% the week before that which had marked fresh cycle highs at levels last seen in 2000.

- It’s the largest single weekly decline in the mortgage rate in over a year, although the rate only drops back to end-Sept levels.

- The spread to 10Y Treasury yields remains around the 300bp mark.

US SEP WHOLESALE INV 0.2%; SALES 2.2%

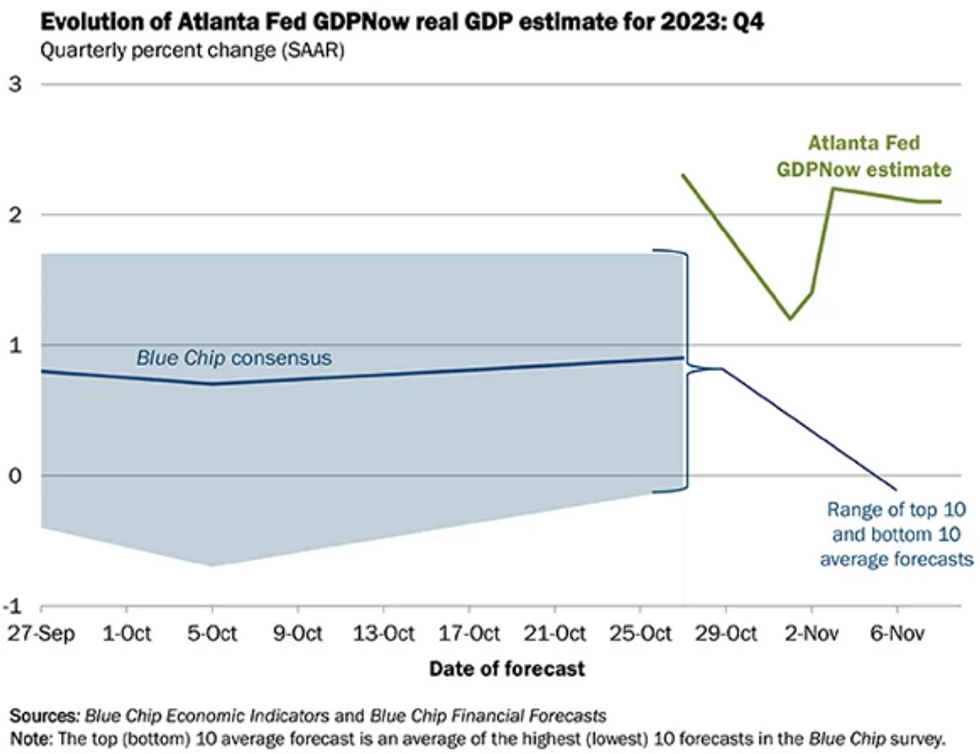

Atlanta Fed GDPNow Doesn’t See Lift From Wholesale Sales Beat

Atlanta Federal Reserve

- The Atlanta Fed GDPNow was unrevised in the Q4 estimate at 2.1%, keeping to yesterday's upward revision from 1.2% in the prior week's update (in the still early days of the current vintage).

- Wholesale sales may have come in notably stronger than expected in September earlier today (2.2% M/M vs cons 0.9%) but the decent momentum heading into Q4 hasn't carried over, with real gross private domestic investment growth revised marginally lower from -1.0% to -1.1%.

MARKETS SNAPSHOT

- Key late session market levels

- DJIA down 79.2 points (-0.23%) at 34073.13

- S&P E-Mini Future down 2.5 points (-0.06%) at 4393.5

- Nasdaq down 9.8 points (-0.1%) at 13629.49

- US 10-Yr yield is down 5.1 bps at 4.5151%

- US Dec 10-Yr futures are up 7.5/32 at 108-11.5

- EURUSD up 0.0004 (0.04%) at 1.0704

- USDJPY up 0.67 (0.45%) at 151.04

- WTI Crude Oil (front-month) down $1.81 (-2.34%) at $75.58

- Gold is down $21 (-1.07%) at $1948.39

- European bourses closing levels:

- EuroStoxx 50 up 25.12 points (0.6%) at 4178.49

- FTSE 100 down 8.32 points (-0.11%) at 7401.72

- German DAX up 76.96 points (0.51%) at 15229.6

- French CAC 40 up 47.93 points (0.69%) at 7034.16

US TREASURY FUTURES CLOSE

- 3M10Y -5.06, -92.292 (L: -93.526 / H: -83.876)

- 2Y10Y -6.171, -41.696 (L: -42.309 / H: -32.818)

- 2Y30Y -8.982, -28.519 (L: -29.241 / H: -17.694)

- 5Y30Y -5.825, 12.987 (L: 12.365 / H: 19.656)

- Current futures levels:

- Dec 2-Yr futures down 1/32 at 101-14.875 (L: 101-13.5 / H: 101-16.5)

- Dec 5-Yr futures up 1.25/32 at 105-19 (L: 105-11.75 / H: 105-21)

- Dec 10-Yr futures up 7.5/32 at 108-11.5 (L: 107-26.5 / H: 108-14.5)

- Dec 30-Yr futures up 30/32 at 114-29 (L: 113-15 / H: 115-05)

- Dec Ultra futures up 1-19/32 at 119-12 (L: 117-05 / H: 119-26)

US 10Y FUTURE TECHS: (Z3) Short-Term Bull Theme Still In Play

- RES 4: 110-07+ High Sep 14

- RES 3: 110-00 Round number resistance

- RES 2: 109-20 High Sep 19

- RES 1: 108-25 High Nov 3

- PRICE: 107-30+ @ 11:11 GMT Nov 8

- SUP 1: 107-04 20-day EMA

- SUP 2: 105-27+/105-10+ Low Nov 1 / Low Oct 19 and bear trigger

- SUP 3: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 104-25 2.0% 10-dma envelope

Treasuries maintain a firmer short-term tone and the contract is consolidating just below its recent highs. The latest rally has resulted in a move above the 50-day EMA, at 108-01+, and has delivered a print above 108-16, the Oct 12 high and a key resistance. A clear break of this 108-16 hurdle would strengthen a bullish case and signal scope for a climb towards 109-20, the Sep 19 high. Initial support lies at 107-04, the 20-day EMA.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.010 at 94.610

- Mar 24 -0.025 at 94.715

- Jun 24 -0.030 at 94.965

- Sep 24 -0.035 at 95.260

- Red Pack (Dec 24-Sep 25) -0.025 to +0.005

- Green Pack (Dec 25-Sep 26) +0.010 to +0.025

- Blue Pack (Dec 26-Sep 27) +0.035 to +0.055

- Gold Pack (Dec 27-Sep 28) +0.060 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00064 to 5.32133 (-0.00043/wk)

- 3M +0.00341 to 5.36908 (-0.01109/Wk)

- 6M +0.00385 to 5.39707 (-0.02882/wk)

- 12M +0.01328 to 5.27490 (-0.05100/Wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% volume: $244B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.546T

- Broad General Collateral Rate (BGCR): 5.30%, $590B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $576B

- (rate, volume levels reflect prior session)

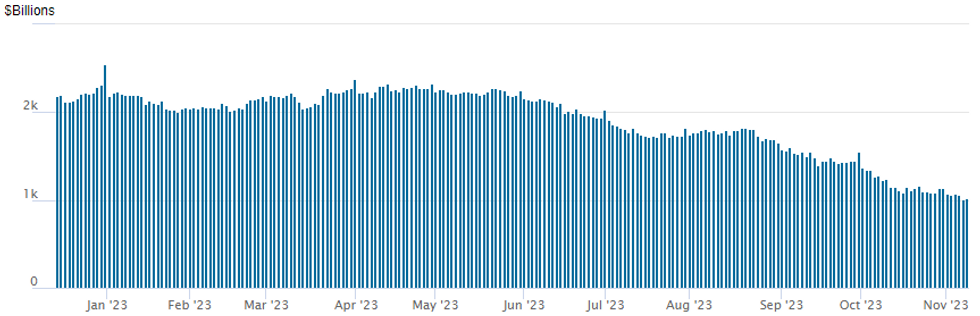

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage gains slightly: $1,024.451B w/98 counterparties vs. $1,008.685B in the prior session - the lowest level since August 2021. Today's usage compares to prior two year low of $1,054,986B from Nov 2.

PIPELINE $3.5B Westpac, $2.5B PepsiCo Corporate Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/08 $3.5B #Westpac $1B 2Y +58, $500M 2Y SOFR+72, $1.25B 5Y +103, $750M 10Y +233

- 11/08 $3.5B #UBS $1.75B PNC5 9.625%, $1.75B PNC10 9.75%

- 11/08 $2.5B #PepsiCo $1B 1Y SOFR+40, $800M 2Y +35, $700M 3Y +43

- 11/08 $1.25B *Kommuninvest 2Y SOFR+28

- 11/08 $800M #Eversource +5Y +147

- 11/08 $800M #Oncor Electric Delivery 10Y +115

- 11/08 $800M Service Properties 8NC3

- 11/08 $750M #LPL Holdings 5Y +225

- 11/08 $500M *FMO WNG 5Y SOFR+48

- 11/08 $500M #Apollo Global 10Y +195

- 11/08 $500M *Korea Housing Finance Corp (KHFC) 3Y +79

- 11/08 $Benchmark OMERS Finance 10Y SOFR+130a

EGBs-GILTS CASH CLOSE: Long End Impresses Again

The long ends of the UK and German curves rallied for the 2nd consecutive session Wednesday. Once again the 30Y segment was a standout, with yields at that tenor pushing to the lowest levels since September.

- While short-end/bellies were relatively inert, including weakness in Schatz and almost no change in Bobl - ECB and BoE hike prospects were little changed - 2Y and 5Y UK yields edged incrementally to fresh post-Jun lows.

- There were almost no macro catalysts of note during the session, with the highlight being a jump in 1Y consumer inflation expectations in the ECB's CES survey that brought core FI down from morning highs.

- Central bank speakers attempted to push back on recent rate cut talk, including ECB's Makhlouf ('far too early in my view' to discuss cuts) and Nagel (the 'last mile' may well be the hardest), as well as BoE's Bailey ('really too early to be talking about cutting rates'). but this had little discernable impact.

- Instead it was a continued march lower in oil prices, a pullback in equities, and a general resumption of the trend begun last week post-US Fed decision / jobs report that saw long-end European FI rally.

- Periphery spreads tightened, led by Italy, while PGBs lagged as political uncertainty continued to drag.

- Following on from the US 10Y Treasury auction after the cash close Wednesday, a limited docket awaits Thursday, with the ECB's economic bulletin and multiple speakers (Villeroy, Lane, Lagarde, BoE's Pill) ahead.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.1bps at 3.015%, 5-Yr is down 0.8bps at 2.569%, 10-Yr is down 4.1bps at 2.617%, and 30-Yr is down 8.1bps at 2.813%.

- UK: The 2-Yr yield is down 1.2bps at 4.62%, 5-Yr is down 0.2bps at 4.242%, 10-Yr is down 3bps at 4.24%, and 30-Yr is down 4.6bps at 4.691%.

- Italian BTP spread down 2.9bps at 186.3bps / Portuguese up 1.1bps at 74.5bps

FOREX EURJPY Rises 0.45%, Extending To Multi-Year Highs Above 161.00

- Early greenback strength saw the USD index rise around 0.35%, briefly reversing the entirety of the post-NFP sell-off. However, the move lower for US yields in a flattening move prompted some renewed dollar weakness which has seen the USD index slip into negative territory approaching the APAC crossover.

- However, further weakness for crude futures amid a bearish demand outlook has continued to weigh on the likes of AUD and NZD, the clear underperformers in G10 alongside the Japanese Yen.

- USDJPY has been steadily grinding higher over the course of the session, with the pair probing the 1.51 handle heading into late US trade. The trend needle in USDJPY continues to point north. Last week’s gains resulted in a breach of 150.78, the Oct 26 high. This confirmed a resumption of the uptrend and has opened 152.20, a Fibonacci projection. Moving average studies are in a bull-mode position, reflecting the market's positive sentiment. Indeed, a solid bounce for the Euro across US hours has seen EURJPY extend the long-standing uptrend, gaining momentum above 161.00 and continuing to eat in to the steep 2008 sell-off. 161.52, a Fibonacci projection, has been pierced today which paves the way for further strength to 162.00 and 162.80, the 1.00 projection of the Jul 28 - Aug 30 - Oct 3 price swing.

- EURUSD found support once more around 1.0660 on Wednesday. The low today was just 4-pips shy of pre-NFP levels at 1.0655, before the pair registered a not-insignificant recovery that brings the pair back above 1.0700. The current bullish condition in EURUSD remains intact and this week’s pullback is considered technically corrective.

- Commodity weakness provided a more notable decline for some emerging market currencies on Wednesday, with punchy moves for the likes of USDCLP (+1.90%) and USDCOP (+1.60%) and a 0.80% advance for USDZAR.

- Chinese CPI/PPI overnight marks the highlight for the APAC session where the market consensus is for headline CPI to dip back into negative territory. US Jobless claims and central bank speakers will dominate the rest of Thursday’s calendar.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/11/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/11/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/11/2023 | 0810/0910 |  | EU | ECB's Lane remarks at ECB conference | |

| 09/11/2023 | 0830/0830 |  | UK | BOE's Pill speaks at ICAEW UK Regions Economic Summit | |

| 09/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 09/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/11/2023 | 1430/0930 |  | US | Fed's Raphael Bostic and Tom Barkin | |

| 09/11/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/11/2023 | 1600/1100 |  | US | MNI Webcast with Fed's Tom Barkin | |

| 09/11/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/11/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/11/2023 | 1645/1145 |  | CA | BOC Sr Deputy Rogers speech | |

| 09/11/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/11/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/11/2023 | 1900/1400 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.