-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Corporate Issuance Adds to Tsy Consolidation

- MNI FED: Chairman Powell Semi-Annual Congressional Testimony Set For 2nd Week Of July

- MNI FED: Philly Fed Harker Sees One Rate Cut By Year-End

- MNI US: Biden Campaign To Target Trump Legal Issues In Risky Swing State Ad Strategy

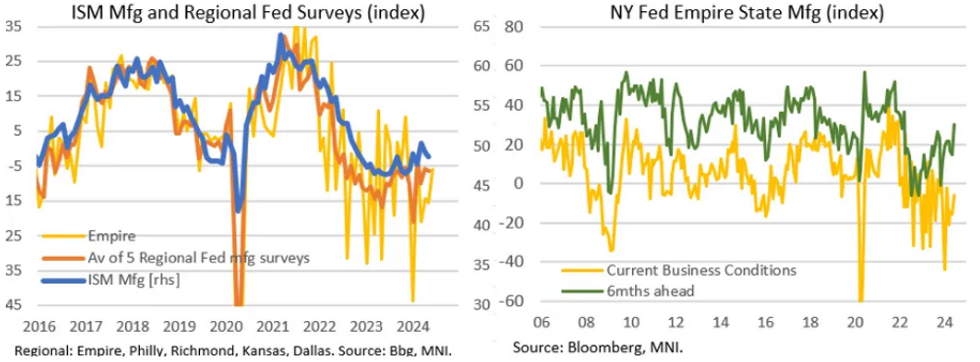

- MNI US DATA: Empire Survey Shows Improving Manufacturing Optimism At End-Q2The NY Fed's Empire State

US TSYS Corporate Supply Weighs, Projected Yr End Rate Cuts Ease

- Treasury futures looked to finish lower/near midday lows Monday, initial weakness tied to cooling French political uncertainty over the weekend.

- Rates broke through a narrow overnight range amid word Home Depot would issue corporate debt over 9 tranches. Speculative selling added to rate lock hedging well before the $10B 9pt launched, lion's share of just over $20B total issuance on the day.

- Average Treasury futures volumes (TYU4<1.3M), with the Sep'24 10Y contract currently trading -15.5 at 110-11.5 vs. 110-09 low. Despite the decline, a bull cycle remains in play after the contract traded higher Friday, clearing resistance at 110-21, the Jun 7 high. Focus on 111-01 initial resistance - last Friday's high, followed by 111-09, April 1 high. Key support well below at 109-00+, the Jun 10 low.

- Short end selling sees rate cut projections cooling vs. late Friday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -17.5bp (20bp), Nov'24 cumulative -26.6bp (-29.9bp), Dec'24 -46.1bp (-50.5bp).

- Cash yields are running mildly higher: 5s +.0649 at 4.3032%, 10s +.0561 at 4.2770%, 30s +.0586 at 4.4074%, while curves reversed early steepening to mildly flatter: 2s10s -0.476 at -49.041, 5s30s -.722 at 10.150.

- Look ahead: economic data surge Tuesday with Retail Sales, IP/Cap-U and TIC Flows, Several Fed speakers on tap as well.

US

US FED (MNI): Chairman Powell Semi-Annual Congressional Testimony Set For 2nd Week Of July

Fed Chair Powell will deliver semi-annual monetary policy testimony to the Senate Banking committee on Tues July 9, Reuters reports. These testimonies usually run Tues-Weds or Weds-Thu so we would anticipate the House Financial Services committee testimony will be Weds July 10, though we await official confirmation.

- Looking at the calendar, Powell will be testifying just after the next nonfarm payrolls report (Jul 5), but before the next CPI reading (Jul 11).

- His next scheduled appearance is speaking on a panel at the ECB's annual Sintra symposium on July 2, with the congressional testimony to be followed by the Economic Club of Washington D.C. event on July 15. The July FOMC decision on July 31.

US FED (MNI): Philly Fed Harker Sees One Rate Cut By Year-End

Federal Reserve Bank of Philadelphia President Patrick Harker said Monday he expects one interest rate cut by year-end if data meet his forecasts, calling the latest inflation report "quite promising" in signaling that progress on disinflation has resumed.

- "I have a forecast for inflation, employment, and economic activity: slowing but above trend growth, a modest rise in the unemployment rate, and a long glide back to target for inflation," he said in remarks prepared for a Global Interdependence Center conference in Philadelphia.

NEWS

US (MNI): Biden Campaign To Target Trump Legal Issues In Risky Swing State Ad Strategy

US President Joe Biden's re-election campaign is out with a new USD$50 million ad buy for June which will focus on Trump’s character, explicitly referencing Trump’s Manhattan ‘hush money’ criminal conviction and the two other civil suits that found him liable in a defamation case and a USD$355 million fraud case against his business.

US (MNI): Treasury Announces Measures To Close Tax Loophole, Raise USD$50B New Revenue

The US Treasury Department and the IRS has announced measures to close a, “major tax loophole exploited by large, complex partnerships,” which they claim will raise more than USD$50 billion in new revenue over the next 10 years.

FRANCE (MNI): National Rally Retains Polling Lead Despite Left-Wing Alliance

The National Rally (RN) party of Marine Le Pen and Jordan Bardella retains a polling lead ahead of French legislative elections on June 30 despite the formation of the Nouveau Front Populaire [New Popular Front] a new left-wing alliance designed to present a unified left-wing resistance to the RN.

RUSSIA (MNI): Putin To Travel To DPRK June 19, Vietnam, June 20

Russian wires reporting official confirmation that Russian President Vladimir Putin will travel to North Korea on June 18-19 and Vietnam on June 19-20. It will be Putin’s first trip to the DPRK since 2000 and his first to Vietnam since 2017.

OVERNIGHT DATA

US DATA (MNI): Empire Survey Shows Improving Manufacturing Optimism At End-Q2The NY Fed's Empire State

Empire Survey Shows Improving Manufacturing Optimism At End-Q2The NY Fed's Empire State Manufacturing index came in a little stronger than expected in June at -6.0 (-10.0 expected, -15.6 prior). This was the biggest monthly increase since November 2023, to the least-negative reading since February 2024.

- The Empire survey, while historically volatile, on balance represented a positive start to June's round of regional Fed manufacturing readings. While activity continues to contract, the survey provided signals that pronounced 2Q weakness may have represented a trough in activity in New York State for now.

- The positive signals included: Prices Paid slipped to the lowest since January (24.5) after four relatively elevated months, with prices received dipping slightly, suggesting softening inflation pressures. New Orders jumped by 15.5 points to -1.0, the best reading since July 2023, Shipments turned positive after 3 months of contractions, and expectations for activity 6 months ahead rose by 15.6 points to 30.1, the highest since March 2022.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 228.37 points (0.59%) at 38815.81

- S&P E-Mini Future up 54.75 points (1%) at 5556.75

- Nasdaq up 219.6 points (1.2%) at 17907.71

- US 10-Yr yield is up 5.2 bps at 4.2731%

- US Sep 10-Yr futures are down 14/32 at 110-13

- EURUSD up 0.003 (0.28%) at 1.0733

- USDJPY up 0.33 (0.21%) at 157.73

- WTI Crude Oil (front-month) up $2.11 (2.69%) at $80.56

- Gold is down $12.91 (-0.55%) at $2320.13

- European bourses closing levels:

- EuroStoxx 50 up 41.28 points (0.85%) at 4880.42

- FTSE 100 down 4.71 points (-0.06%) at 8142.15

- German DAX up 66.19 points (0.37%) at 18068.21

- French CAC 40 up 68.3 points (0.91%) at 7571.57

US TREASURY FUTURES CLOSE

- 3M10Y +5.304, -111.74 (L: -117.879 / H: -109.797)

- 2Y10Y -0.459, -49.024 (L: -49.447 / H: -45.564)

- 2Y30Y -0.379, -36.152 (L: -36.604 / H: -31.318)

- 5Y30Y -0.478, 10.394 (L: 9.782 / H: 13.409)

- Current futures levels:

- Sep 2-Yr futures down 5.125/32 at 102-4.375 (L: 102-04 / H: 102-08.25)

- Sep 5-Yr futures down 10.5/32 at 106-23.5 (L: 106-22.75 / H: 107-00)

- Sep 10-Yr futures down 14/32 at 110-13 (L: 110-09 / H: 110-24)

- Sep 30-Yr futures down 27/32 at 119-19 (L: 119-07 / H: 120-10)

- Sep Ultra futures down 1-5/32 at 127-20 (L: 126-31 / H: 128-21)

US 10Y FUTURE TECHS: (U4) Bull Cycle Remains In Play

- RES 4: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-09 High Apr 1

- RES 1: 111-01 High Jun 14

- PRICE: 110-12 @ 1515 ET Jun 17

- SUP 1: 109-19+/109-00+ 50-day EMA / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-09+ Trendline drawn from the Apr low

- SUP 4: 107-31 Low May 29 and a key support

A bull cycle in Treasuries remains in play and the contract traded higher last week. Price has cleared resistance at 110-21, the Jun 7 high. The break confirms a resumption of the bull cycle that started Apr 25, and paves the way for an extension towards 111-17+, a Fibonacci projection. On the downside, key support to watch lies at 109-00+, the Jun 10 low. Clearance of this level is required to reinstate a bearish theme.

SOFR FUTURES CLOSE

- Jun 24 -0.013 at 94.640

- Sep 24 -0.040 at 94.835

- Dec 24 -0.075 at 95.135

- Mar 25 -0.10 at 95.425

- Red Pack (Jun 25-Mar 26) -0.11 to -0.10

- Green Pack (Jun 26-Mar 27) -0.095 to -0.08

- Blue Pack (Jun 27-Mar 28) -0.08 to -0.07

- Gold Pack (Jun 28-Mar 29) -0.075 to -0.07

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00675 to 5.33867 (+0.00428 total last wk)

- 3M -0.00046 to 5.34357 (+0.01004 total last wk)

- 6M -0.00710 to 5.26892 (+0.00473 total last wk)

- 12M -0.02152 to 5.02820 (-0.02238 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.855T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $785B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $771B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

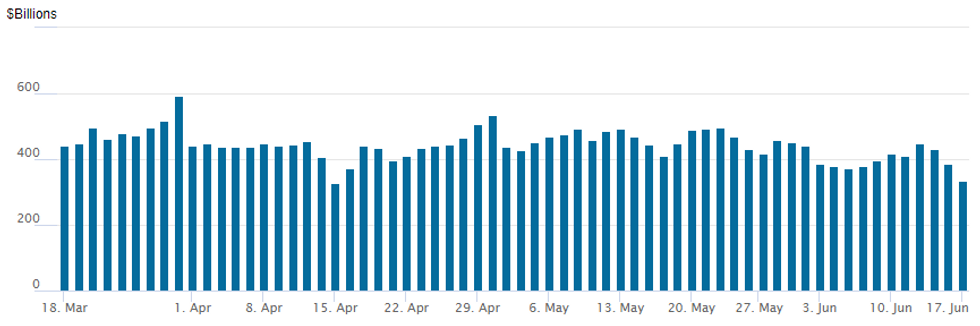

FED Reverse Repo Operation

NY Federal Reserve/MNI

- Nearing three year lows RRP usage falls to $333.429B from $386.885B prior; number of counterparties down to 66 from 68 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $10B Home Depot 9Pt Jumbo Leads Monday's $20.625B Total Issuance

- Date $MM Issuer (Priced *, Launch #)

- 6/17 $10B #Home Depot 9pt jumbo: $900M 1.5Y +40, $600M 1.5Y SOFR+33, $1.5B 2Y +45, $1B 3Y +50, $1.25B 5Y +60, $1B 7Y +70, $1.75B 10Y +80, $1.5B 30Y +100, $500M 40Y +110

- 6/17 $2B #Daimler Truck $600M 3Y +75, $350M 3Y SOFR+96, $550M +5Y +90, $500M 10Y +112

- 6/17 $1B #American Electric Power $400M 30.5NC5.25 7.05%, $600M 30.5NC10.25 6.95%

- 6/17 $1.25B #National Securities Clearing $625M 2Y +40, $625M 5Y +65

- 6/17 $1.2B #Air Lease $200M 2Y +77, $600M 7Y +122

- 6/17 $1B# Nutrien $400M 3Y +70, $600M 10Y +117

- 6/17 $900M #Republic Services $400M +5Y +75, $500M +10Y +97

- 6/17 $750M #Oncor Electric WNG 30Y +115

- 6/17 $650M #Plains All American Pipeline 10Y +143

- 6/17 $650M #Brookfield Finance $450M 10Y +140, $200M 2054 tap +145

- 6/17 $625M #Ameren Illinois WNG 30Y +115

- 6/17 $600M #NiSource 5Y +95

- Expected to issuance Tuesday:

- 6/18 $Benchmark Province of Alberta 5Y +54a

EGBs-GILTS CASH CLOSE: Modest Political Risk Relief

Yields rose across European curves Monday, with EGB periphery spreads narrowing.

- With weekend developments on the French political front helping soothe market concerns to some degree (e.g. Le Pen saying if victorious in the upcoming election she would work with Pres Macron), some of last week's jump in related risk premia softened.

- This saw Bunds underperform among EGBs with some bear steepening in the German curve. France/Germany 10Y spreads tightened 2.8bp from last week's 7-year wides.

- Weakness extended in the European afternoon amid heavy US corporate issuance.

- Friday's periphery underperformers, BTPs and GGBs, were Monday's outperformers.

- Gilts were weighed down by a poor BoE APF sale of longer-dated instruments. BoE implied cuts were relatively unchanged on the day, with attention on UK CPI Wednesday and the MPC decision Thursday.

- On the Eurozone docket Tuesday, we get German ZEW and final Euro CPI, along with multiple ECB speakers (starting with Knot and Vujcic in the morning).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.1bps at 2.814%, 5-Yr is up 5.1bps at 2.424%, 10-Yr is up 5.4bps at 2.414%, and 30-Yr is up 5.9bps at 2.571%.

- UK: The 2-Yr yield is up 4.2bps at 4.213%, 5-Yr is up 4.9bps at 3.994%, 10-Yr is up 5.9bps at 4.115%, and 30-Yr is up 6.1bps at 4.6%.

- Italian BTP spread down 4.1bps at 152.9bps / Greek down 4.3bps at 124.8bps

FOREX Euro Crosses Moderately Reverse Higher as Political Risks Stabilise

- The single currency has traded on a better footing Monday as markets were given a degree of reassurance surrounding the political risk uncertainties in France. A moderate compression of EGB spreads has helped the Euro trade higher against the majority of its G10 counterparts, although ranges across the FX majors remain subdued overall.

- EURUSD has edged from 1.0700 to 1.0725 across the US session, and has also been assisted by more optimistic price action in equity markets. More notable has been the solid bounce for the EURJPY, which matches the likes of EURAUD and EURNZD which all look set to close around 0.5% in the green Monday.

- For EURJPY, despite piercing a key support at 16803, a trendline drawn from the Dec 7 ‘23 low, the trend structure remains bullish, and the recent move lower appears to be a correction. A clear breach of this line would undermine the bullish theme and highlight a potential reversal. Initial firm resistance is at 170.14, the Jun 13 high.

- The largest net shifts in positioning last week see the NZD and GBP net longs improve, while the EUR and MXN net longs were trimmed, and the AUD and CAD net shorts extended. Meanwhile, the CAD net position slips to a new series low, with the net short now amounting to 42.1% of open interest - a fresh 52 week low.

- Immediate attention shifts to Tuesday’s RBA decision & press conference before US retail sales and industrial production take focus later in the session.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/06/2024 | 0100/2100 |  | US | Fed Governor Lisa Cook | |

| 18/06/2024 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 18/06/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/06/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/06/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/06/2024 | 1200/1400 |  | EU | ECB's Cipollone chairing session on market supervision | |

| 18/06/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 18/06/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/06/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 18/06/2024 | 1330/1530 |  | EU | ECB's De Guindos at EC and ECB joint conference | |

| 18/06/2024 | 1400/1000 | * |  | US | Business Inventories |

| 18/06/2024 | 1400/1000 |  | US | MNI Webcast with Richmond Fed's Tom Barkin | |

| 18/06/2024 | 1540/1140 |  | US | Boston Fed's Susan Collins | |

| 18/06/2024 | 1700/1300 |  | US | Fed Governor Adriana Kugler | |

| 18/06/2024 | 1700/1300 |  | US | Dallas Fed's Lorie Logan | |

| 18/06/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/06/2024 | 1720/1320 |  | US | St. Louis Fed's Alberto Musalem | |

| 18/06/2024 | 1800/1400 |  | US | Chicago Fed's Austan Goolsbee | |

| 18/06/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.