-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Through First Support

MNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI ASIA OPEN: Corporate Supply Tempers Post-2Y Support

- MNI US FED: Going Into July Meeting, FOMC Participants Reluctant To Identify Cut Timing

- MNI US: Harris Effectively Securing Dem Nom Does Little To Shift Betting Markets

- MNI US DATA: Philly Non-Mfg Prices Received Offer A More Measured Trend

- MNI US DATA: Existing Home Sales Disappoint Whilst Relative Supply Is Back At Pre-Pandemic Levels

US

US FED (MNI): Going Into July Meeting, FOMC Participants Reluctant To Identify Cut Timing

FOMC participants’ commentary between the June meeting and the soft June CPI release on July 11 mostly reinforced the main theme from the June meeting: despite the more encouraging inflation data of late, policymakers are not in a rush to cut rates (details in our FedSpeak PDF here).

- Participants said that while they were cautiously optimistic that inflation would sustainably converge with the 2% target, it was too soon to make a determination on when rate cuts can begin. As Powell put it on July 2, “we have the ability to take our time and get this right. And that’s what we’re planning to do.”

- There were two notable shifts in July, though. The first came from Powell who said in his Congressional testimony in the second week of July that the labor market appeared to be fully back in balance, an observation that highlights mounting upside risks to unemployment and thus potential for rate cuts to come sooner rather than later. The second shift came after the June inflation release: Powell said that while 1st quarter CPI/PCE data warranted caution, “three [inflation] readings in the second quarter, including the one from last week, do add to that confidence” that inflation is converging to the 2% target sustainably.

NEWS

US (MNI): Harris Effectively Securing Dem Nom Does Little To Shift Betting Markets

An AP report claiming that Vice President Kamala Harris has won over enough Democratic National Convention delegates to effectively secure the party's presidential nomination, combined with news that the Harris For President campaign has seen a major influx of donations in the past 24hrs, has done little to move political betting markets regarding the outcome of November's election.

ISRAEL (MNI): Axios-Israel, US & UAE Held Gaza 'Day After' Meeting On 18 July:

Axios reporting that Israel, the United States, and the United Arab Emirates (UAE) held a meeting in Abu Dhabi on 18 July to discuss the plans for Gaza after the war. As Axios notes the meeting could suggest that Israeli PM Benjamin Netanyahu "...is beginning to recognize the need for a realistic plan for how Gaza might be governed after the Israel-Hamas war."

EU-RUSSIA (MNI): Response To EU Seizing Tranche Of Russian Assets 'Will Be Harsh':

Russian state media carrying comments from Foreign Ministry spox Maria Zakharova. Says that should the EU seize any tranche of Russian assets currently held frozen in European accounts or platforms, then 'the Russian Frederation will respond very harshly'.

US TSYS Corporate Debt Issuance Hedging Tempers Post 2Y Auction Support

- Treasuries look to finish mildly higher Tuesday, near the middle of a generally narrow session range. Tsys extended highs briefly (TYU4 tapped 111-00) after the $69B 2Y Note auction stopped 2.1bp through (4.434% high yld vs. 4.455% WI).

- Tsy futures quickly reversed amid comparatively heavy rate lock hedging vs. corporate issuance: $12B United Health over 8 tranches, and $5B Occidental Petroleum over 5 tranches.

- Tsys gained earlier after weaker than expected existing home sales: 3.89m (cons 3.99m) after an unrevised 4.11m in May. It sees sales fall -5.4% M/M and a fourth consecutive monthly decline worth a cumulative -11% which has more than offset the 9.5% jump back in Feb.

- Tsy Sep'24 10Y futures are currently trading 110-26 (+3), above initial technical support of 110-21+, the 20-day EMA. Otherwise bullish theme in Treasuries remains intact despite a fade in prices through late last week and into Monday morning. Short-term pullbacks are proving to be corrective at this stage. The contract has traded through resistance at 111-10+, the Jul 8 high.

- Focus turns to Wednesday's Wholesale/Retail Inventories, Flash PMIs and New Home Sales; Tsy supply includes $30B 2Y FRN Note and $70B 5Y Notes.

- Early Wednesday equity earnings from: Tenet Healthcare, Evercore, AT&T, Amphenol, CME Group, Old Dominion Freight Line, Blackstone Mortgage Trust, International Paper, Boston Scientific, Applied Digital, Lennox International, Fiserv, General Dynamics, Thermo Fisher Scientific, NextEra Energy, Otis Worldwide, Stifel Financial and NextEra Energy.

OVERNIGHT DATA

US DATA (MNI): Existing Home Sales Disappoint Whilst Relative Supply Is Back At Pre-Pandemic Levels

Existing home sales were weaker than expected in June at 3.89m (cons 3.99m) after an unrevised 4.11m in May. It sees sales fall -5.4% M/M and a fourth consecutive monthly decline worth a cumulative -11% which has more than offset the 9.5% jump back in Feb. The trend better reflects the continued weakness seen in pending home sales which hit a new series low in May for data going back to 2001. Latest existing home sale declines were relatively broad-based, ranging from -2% (northeast) to -8% (midwest) and with the largest region, the south, falling -6%.

- A further uplift in the outright level of inventories meant that the months of supply increased strongly to 4.1 from 3.7 in May. This non-seasonally adjusted figure compares with 3.1 in Jun’23 and 2.9 in Jun ’22, and is essentially back to pre-pandemic averages (4.2 average in 2017-19 June readings). That compares with last month’s 3.7 vs a 2017-19 average also of 4.2. Impressively considering the further increase in relative supply, median price growth slowed but only from 5.2% to 4.1% Y/Y.

US DATA (MNI): Philly Non-Mfg Prices Received Offer A More Measured Trend

The Philly Fed’s non-manufacturing index saw a sharp decline in July, falling from 2.9 to -19.1 for its lowest since Dec’20. Notably, it didn’t reflect the second strong increase seen for prices received in the latest manufacturing survey: “Price indicator readings suggest continued increases in input prices and prices for the firms’ own goods and services this month. Both price indexes were near their long-run averages.”

- Softer employment: “The full-time employment index fell 20 points to -4.9 this month, its first negative reading since June 2023. […] The part-time employment index declined from 13.1 to 4.0.”

- Modestly smaller expected wage increases in special question: “Although the firms now expect somewhat lower increases in costs for wages, intermediate goods, and non-health benefits than when asked in April, expectations for increases in total compensation (wages plus benefits) costs remained at a median of 4 to 5 percent.”

MARKETS SNAPSHOT

- DJIA down 12.81 points (-0.03%) at 40402.93

- S&P E-Mini Future down 5.25 points (-0.09%) at 5605.5

- Nasdaq up 8.9 points (0%) at 18017.09

- US 10-Yr yield is down 0.4 bps at 4.2486%

- US Sep 10-Yr futures are up 3/32 at 110-26

- EURUSD down 0.004 (-0.37%) at 1.0851

- USDJPY down 1.39 (-0.89%) at 155.65

- Gold is up $12.15 (0.51%) at $2408.92

- European bourses closing levels:

- EuroStoxx 50 up 19.36 points (0.4%) at 4916.8

- FTSE 100 down 31.41 points (-0.38%) at 8167.37

- German DAX up 150.63 points (0.82%) at 18557.7

- French CAC 40 down 23.39 points (-0.31%) at 7598.63

US TREASURY FUTURES CLOSE:

- 3M10Y +1.481, -106.339 (L: -112.24 / H: -106.339)

- 2Y10Y +2.392, -24.272 (L: -28.562 / H: -24.025)

- 2Y30Y +3.628, -1.089 (L: -6.822 / H: -0.688)

- 5Y30Y +2.166, 31.937 (L: 28.58 / H: 32.35)

- Current futures levels:

- Sep 2-Yr futures up 1.75/32 at 102-15.75 (L: 102-13.875 / H: 102-16.875)

- Sep 5-Yr futures up 2.75/32 at 107-9 (L: 107-06.25 / H: 107-12.5)

- Sep 10-Yr futures up 2.5/32 at 110-25.5 (L: 110-23 / H: 111-00)

- Sep 30-Yr futures up 2/32 at 118-27 (L: 118-26 / H: 119-11)

- Sep Ultra futures up 1/32 at 125-19 (L: 125-13 / H: 126-09)

US 10YR FUTURE TECHS: (U4) Pullback Persists, But Bullish Backdrop Remains

- RES 4: 112-25 High Mar 8

- RES 3: 112-10 1.50 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 111-13+/17+ High Jul 16 / 1.382 of Apr 25-May 16-29 swing

- PRICE: 110-28+ @ 16:05 BST Jul 23

- SUP 1: 110-21+/110-08 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-25+ Trendline drawn from the Apr 25 low

A bullish theme in Treasuries remains intact despite a fade in prices through late last week and into Monday morning. Short-term pullbacks are proving to be corrective at this stage. The contract has traded through resistance at 111-10+, the Jul 8 high. This confirms a resumption of the bull cycle and has opened 111-17+ and 111-31, the 1.236 and 1.382 projection of the Apr 25 - May 16 - 29 price swing. Initial support is 110-21+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.005 at 94.920

- Dec 24 +0.020 at 95.315

- Mar 25 +0.035 at 95.690

- Jun 25 +0.030 at 95.970

- Red Pack (Sep 25-Jun 26) +0.025 to +0.030

- Green Pack (Sep 26-Jun 27) +0.015 to +0.025

- Blue Pack (Sep 27-Jun 28) +0.005 to +0.015

- Gold Pack (Sep 28-Jun 29) -0.005 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00008 to 5.34958 (+0.00283/wk)

- 3M +0.00124 to 5.28460 (+0.00161/wk)

- 6M +0.00485 to 5.14408 (+0.00940/wk)

- 12M +0.01590 to 4.83735 (+0.03709/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.120T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $792B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $769B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $84B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $226B

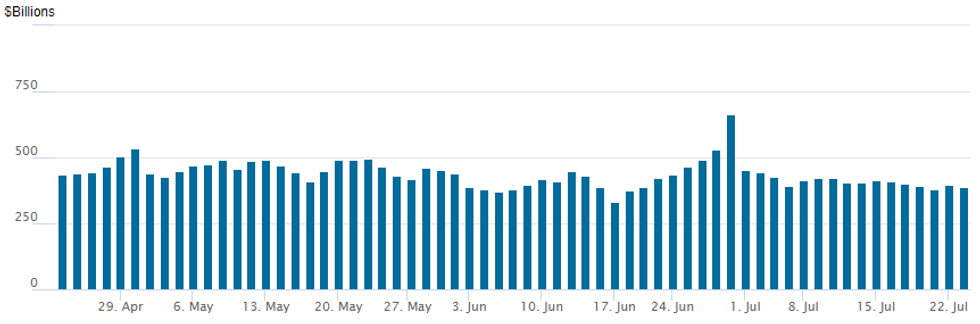

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $389.837B from $395.901B on Monday. Number of counterparties falls to 64 from 77 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.PIPELINE $12B United Health 8Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 7/23 $12B #United Health $650M 2Y +35, $500M 2Y FRN+50, $1.25B 5Y +65, $1.5B 7Y +80, $2B 10Y +90, $1.5B 20Y +100, $2.75B 30Y +115, $1.85B 40Y +13

- 7/23 $5B #Occidental Petroleum $600M 3Y +75, $1.2B 5Y +105, $1B 7Y +120, $1.2B 10Y +135, $1B 30Y +160

- 7/23 $1.5B #Citigroup PerpNC10 7%

- Expected later in the week:

- 7/24 $Benchmark Export Development Canada 4Y SOFR+34a

- 7/24 $500M Wilsonart 8NC3

- 7/?? $Benchmark PG&E Recovery Fund

EGBs-GILTS CASH CLOSE: Semi-Core, Periphery EGB Spreads Widen

Core EGBs outperformed Gilts Tuesday, with periphery/semi-core spreads widening.

- Gilts underperformed Bunds early in the session in a continuation of Monday's price action as next week's BoE decision remained in focus, with little impact on the day from speakers (ECB's de Guindos, Lane) or supply (Gilt linker, Schatz).

- Early in the afternoon session, OAT spreads widened sharply with no apparent headline trigger, with a broader flight-to-safety move seeing equities fall, Bunds strengthen and periphery EGB spreads also widen. Some desks pointed to much earlier headlines that leftists planned to take take measures to scrap French pension reforms.

- 10Y OAT/Bund widened almost 4bps on the day to close at 69.6bps, highest since early July.

- The German curve bull steepened, with UK yields down 3-4bp across the curve. Gilts' underperformance meant the 10Y spread to Bunds hit the widest levels since mid-June.

- Wednesday's main focus will be flash July PMI data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 5-Yr yield is down 6.4bps at 2.397%, 10-Yr is down 5.6bps at 2.439%, and 30-Yr is down 4.5bps at 2.634%.

- UK: The 2-Yr yield is down 3.7bps at 4.025%, 5-Yr is down 4bps at 3.94%, 10-Yr is down 3.7bps at 4.124%, and 30-Yr is down 3.3bps at 4.636%.

- Italian BTP spread up 3bps at 130.8bps / Greek up 4.6bps at 99.9bps

FOREX EUR/JPY Cracks Key Support, Opens Next Leg Lower

- JPY remains a market highlight, as the currency is the strongest performer in G10 for another session - helping tip AUD/JPY over 5% off the cycle high posted pre-intervention. Critically, EUR/JPY has also broken below major psychological support at the Y170.00 mark and looks to secure a close below the 50-dma - hard-worn support that successfully contained weakness on several occasions over the past few months. Clustered support at 167.53-75 could be key on the next downleg.

- Global growth dynamics remain key, with concerns around the Chinese economy weighing heavily on industrial metals and energy products through the Tuesday session, dragging growth-, risk- and commodity-tied currencies lower in the process. As a result, NOK, AUD and NZD traded poorly into the close.

- Focus Wednesday turns to pivotal prelim PMI data from the Eurozone, UK and US. The UK numbers could take particular focus given it's the last look at economic data ahead of the August Bank of England decision on Thursday next week - for which markets are priced on a knife edge, split between unchanged, and a first 25bps rate cut of the cycle.

- Outside of the data, the Bank of Canada decision is also due. Markets are speculating over the potential for a back-to-back rate cut, however some signs of resilience in certain inflation metrics could contain the BoC at this stage.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/07/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/07/2024 | 2301/0001 | * |  | UK | Brightmine pay deals for whole economy |

| 24/07/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/07/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/07/2024 | 0645/0845 |  | EU | ECB's de Guindos at ECB/IMF conference | |

| 24/07/2024 | 0700/0900 | ** |  | ES | PPI |

| 24/07/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/07/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/07/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 24/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/07/2024 | 1200/1400 |  | EU | ECB's Lane at ECB/IMF conference | |

| 24/07/2024 | 1345/0945 |  | CA | BOC Monetary Policy Report | |

| 24/07/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 24/07/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 24/07/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 24/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/07/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 24/07/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.