-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Digesting Fed Speak in Aftermath of FOMC

- MNI BRIEF: Williams Says Fed Will Eventually Cut Rates

- MNI BRIEF: US Loan Officers See Tighter Credit, Weaker Demand

US

US FED (MNI): MNI BRIEF: Williams Says Fed Will Eventually Cut Rates: Federal Reserve Bank of New York President John Williams on Monday said the central bank will eventually lower rates but for the time being it is steady as she goes.

- The economy is moving back to better balance, "growing somewhat slower," and Friday's employment report showing employment increased by 175,000 in April "is consistent with what we've been seeing and what I think we need to see," said Williams at a Milken Institute conference noting real wage growth is also improving. "Eventually I think we'll have rate cuts," he said, noting interest rate policy will be based on the totality of the data.

US BRIEF (MNI): US Loan Officers See Tighter Credit, Weaker Demand. U.S. banks generally tightened lending standards for commercial and industrial loans in the first quarter and also reported weaker demand, citing a less favorable or more uncertain economic outlook, less tolerance for risk, and worsening of industry-specific problems, the Federal Reserve said in its April 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices, or SLOOS.

- Large banks said they left most lending standards and terms unchanged.

- The Fed survey also asked about commercial real estate loans in particular, and banks reported having tightened all queried lending policies, including the spread of loan rates over the cost of funds, maximum loan sizes, loan-to-value ratios, debt service coverage ratios, and interest-only payment periods, the survey said.

US TSYS Projected Rate Cut Pricing Already Starting to Recede

- Treasuries look to finish Monday's session steady to mixed, curves flatter with early session support in the short end evaporating as the session carried on. Quiet start to the week, lower volumes with Japan and London out for Spring holiday.

- Projected rate cut pricing looks steady to mildly cooler vs. this morning's levels: June 2024 steady at -10% w/ cumulative rate cut -2.5bp at 5.298%, July'24 at -24% w/ cumulative at -8.5bp at 5.238%, Sep'24 cumulative -20.7bp (-22.8bp earlier), Nov'24 cumulative -30.3bp (-32.8bp earlier). Dec'24 cumulative currently -43.7bp (-47.7bp earlier).

- Very little in the way of data all week, aside from today's Fed's Sr Loan Officer Opinion Survey on Bank Lending Practices, Initial and Continuing Jobless Claims report Thursday, UofM sentiment this Friday.

- SLOOS survey: U.S. banks generally tightened lending standards for commercial and industrial loans in the first quarter and also reported weaker demand, citing a less favorable or more uncertain economic outlook, less tolerance for risk, and worsening of industry-specific problems,

- Markets will be listening for Fed speakers, MN Fed Kashkari attends a fireside chat at the Milken Inst (text TBA, Q&A) Tuesday at 1130ET.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 176.22 points (0.46%) at 38845.2

- S&P E-Mini Future up 52 points (1.01%) at 5206.25

- Nasdaq up 193.6 points (1.2%) at 16346.76

- US 10-Yr yield is down 2 bps at 4.4874%

- US Jun 10-Yr futures are up 0.5/32 at 108-28

- EURUSD up 0.0006 (0.06%) at 1.0767

- USDJPY up 0.89 (0.58%) at 153.94

- WTI Crude Oil (front-month) up $0.46 (0.59%) at $78.57

- Gold is up $23.24 (1.01%) at $2325.02

- European bourses closing levels:

- EuroStoxx 50 up 35.48 points (0.72%) at 4956.96

- German DAX up 173.61 points (0.96%) at 18175.21

- French CAC 40 up 39.07 points (0.49%) at 7996.64

US TREASURY FUTURES CLOSE

- 3M10Y -1.745, -91.586 (L: -93.68 / H: -89.341)

- 2Y10Y -3.064, -34.317 (L: -34.73 / H: -30.79)

- 2Y30Y -3.385, -18.959 (L: -19.474 / H: -14.513)

- 5Y30Y -0.903, 15.435 (L: 15.101 / H: 17.934)

- Current futures levels:

- Jun 2-Yr futures down 1.5/32 at 101-22.75 (L: 101-22.625 / H: 101-25.37)

- Jun 5-Yr futures down 1/32 at 105-22.75 (L: 105-21 / H: 105-27.5)

- Jun 10-Yr futures up 0.5/32 at 108-28 (L: 108-23 / H: 109-01.5)

- Jun 30-Yr futures up 7/32 at 116-5 (L: 115-23 / H: 116-13)

- Jun Ultra futures up 11/32 at 122-16 (L: 121-25 / H: 122-25)

US 10Y FUTURE TECHS: (M4) Approaching Channel Resistance

- RES 4: 110-06 High Apr 4

- RES 3: 109-22+ 38.2% retracement of the Feb 1 - Apr 25 bear leg

- RES 2: 109-11 Channel top drawn from the Feb 1 low

- RES 1: 109-09/09+ 50-day EMA . High May 3

- PRICE: 109-00 @ 11:14 BST May 6

- SUP 1: 108-12 20-day EMA

- SUP 2: 107-04 Low Apr 25

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-09 Base of a bear channel drawn from the Feb 1 low

Treasuries rallied Friday and the contract is holding on to the bulk of its recent gains. The move higher strengthens a bullish short-term. The contract is through the 20-day EMA and has tested resistance at 109-09, the 50-day EMA. Price is also approaching 109-11, a channel top drawn from the Feb 1 high. Clearance of the 109-09/11 zone would strengthen a bullish theme. Initial support lies at 108-12, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.005 at 94.710

- Sep 24 -0.015 at 94.90

- Dec 24 -0.030 at 95.125

- Mar 25 -0.030 at 95.375

- Red Pack (Jun 25-Mar 26) -0.03 to -0.01

- Green Pack (Jun 26-Mar 27) -0.01 to +0.005

- Blue Pack (Jun 27-Mar 28) +0.010 to +0.020

- Gold Pack (Jun 28-Mar 29) +0.020 to +0.030

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00111 to 5.32130 (+0.00668 total last wk)

- 3M -0.00635 to 5.32120 (-0.00195 total last wk)

- 6M -0.02445 to 5.28248 (-0.00729 total last wk)

- 12M -0.07156 to 5.13716 (-0.03508 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.863T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $706B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $695B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

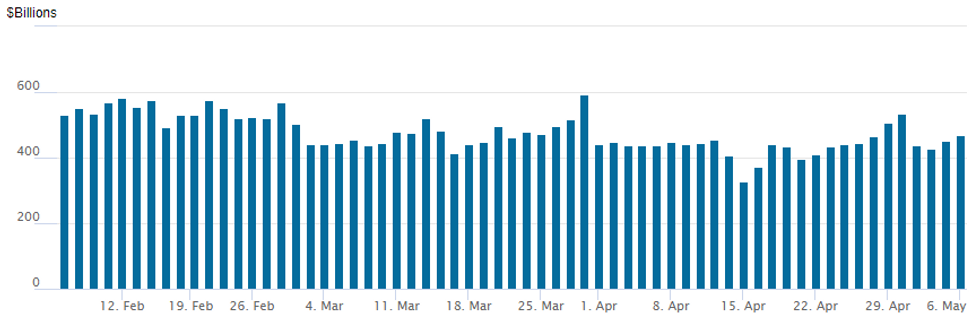

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rises to $468.970B vs. $450.168B last Friday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties slips to 67 from 70 prior.

PIPELINE: $3B Coca-Cola 3Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 5/6 $3B #Coca-Cola $1B 10Y +55, $1.1B 30Y +70, $900M 40Y +80

- 5/6 $2B #Dominion $1B 30.75NC5.5 6.875%, $1B 30NC9.75 7%

- 5/6 $1.6B #Athene Global $900M 2Y +80, $300M 2Y SOFR+85, $400M 5Y tap +112

- 5/6 $1.5B Block Inc 8NC3

- 5/6 $1.4B #Consolidated Edison $400M 10Y +90, $1B 30Y +110

- 5/6 $850M #Ares Capital +5Y +170

- 5/6 $750M #ICE (Intercontinental Exchange) 7Y +78

- 5/6 $750M #Southern California Edison 7Y +97

- 5/6 $500M Hilcorp Energy 10NC5

- 5/6 $Benchmark Ingersoll Rand investor calls

EGBS: Higher on the day, despite moving off the highs in the afternoon

- There have been little in the way of major talking points for EGBs today, but we have still seen an 89 tick range for Bund futures, which breached Friday's intraday high of 131.57 to trade as high as 131.63 before paring some of these gains as North Amercians got their desks, and Bund futures drifted lower with USTs to currently be trading around 131.30 at the time of writing.

- This range on futures saw 10-year Bund yields at one point 5.6bp below Friday's closing levels, before retracing around half of the early move to see 10-year Bund yields around 2.7bp lower going into the cash close. There has also been a flattening of the German curve with 2s10s around 1.6bp flatter on the day.

- Spreads across Europe have wideneed a little today - with French spreads only 0.4bp wider, most other semi-cores and peripheral spreads around 0.7-0.9bp wider on the day, with the exception of Spain where spreads are 1.4bp wider on the day at the time of writing.

- There have been no real major themes driving markets with some mixed-to-slightly positive Eurozone services PMIs this morning having no real market impact.

- Bund futures are up 0.43 today at 131.32 with 10y Bund yields down -2.7bp at 2.467% and Schatz yields down -1.1bp at 2.909%.

- BTP futures are up 0.31 today at 118.07 with 10y yields down -1.5bp at 3.794% and 2y yields down -0.3bp at 3.400%.

- OAT futures are up 0.40 today at 126.54 with 10y yields down -2.2bp at 2.950% and 2y yields down -1.0bp at 2.986%.

FOREX Weaker JPY The Main Feature of Holiday Thinned Monday Trade

- The market focus remained firmly on the Japanese Yen Monday, as holiday thinned trade prompted a fairly subdued session for G10 currencies.

- USDJPY rallied from a 152.78 low on the open to session highs of 154.01 ahead of the European open. Slightly lower core yields prompted a brief reversal to 153.42 as US trade began, however, USDJPY’s upside bias then took over for the remainder of the session, leaving the pair over half a percent stronger on the day.

- The pair has extended its post-NFP bounce, rallying well off the 50-dma - a key support tested Friday at 151.99, closely matching the multi-decade pivot level around 151.91-95, which garnered much attention earlier this year.

- The limited adjustment for US yields has kept the USD index unchanged Monday, with a higher USDJPY offset by a stronger AUD, EUR and GBP against the greenback, all benefitting from the buoyant price action for major equity indices.

- The firmer AUD comes before the RBA overnight, widely expected to leave rates at 4.35% at its May decision. AUDUSD traded firmly higher Friday and in the process breached resistance at 0.6587, the Apr 29 high. The break of this hurdle cancels a recent bearish threat and highlights a resumption of the bull leg that started Apr 19. This initially opens 0.6668, the Mar 8 high.

- Late headlines on Hamas potentially agreeing to a cease-fire placed downward pressure on USDILS, trading from around 3.74 to 3.70. The pair currently trades around 3.7150 as Israel are said to be studying the update proposal.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/05/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/05/2024 | 0030/1030 | *** |  | AU | Retail trade quarterly |

| 07/05/2024 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/05/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 07/05/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/05/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/05/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/05/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 07/05/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 07/05/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 07/05/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/05/2024 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/05/2024 | 1530/1130 |  | US | Minneapolis Fed's Neel Kashkari | |

| 07/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/05/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/05/2024 | 1900/1500 | * |  | US | Consumer Credit |

| 07/05/2024 | 1930/1530 |  | CA | BOC Sr Deputy Rogers at House Public Accounts committee (no text) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.