-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Dovish Minutes, Concern Over Falling Behind?

- MNI FED: July Minutes Suggest Rising Concern Over Falling Behind Cut Curve

- MNI US: RFK Withdrawal Could Boost Trump In Swing States

- MNI US DATA: Large Downward Preliminary Benchmark Revision For Payrolls

US

FED (MNI): July Minutes Suggest Rising Concern Over Falling Behind Cut Curve

As expected, the July FOMC minutes (link) signalled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July. There weren't many clues in the minutes on future monetary policy beyond that, with no mention for example of a potential >25bp cut.

- In keeping with the change of focus in the statement toward employment risks, though, the July Minutes suggest that cautionary voices on cuts were outnumbered by those who highlighted risks of cutting too little, too late. (Note in Fedspeak, "Many" is typically interpreted to be more participants than "some" which is more than "several").

- The minutes note "a majority of participants remarked that the risks to the employment goal had increased, and many participants noted that the risks to the inflation goal had decreased",

- On risks of falling behind the curve: "Some participants noted the risk that a further gradual easing in labor market conditions could transition to a more serious deterioration. Many participants noted that reducing policy restraint too late or too little could risk unduly weakening economic activity or employment. A couple participants highlighted in particular the costs and challenges of addressing such a weakening once it is fully under way."

- On the more cautionary side, and keeping in mind there may be some overlap with the previous group here, "several participants remarked that reducing policy restraint too soon or too much could risk a resurgence in aggregate demand and a reversal of the progress on inflation."

NEWS

SECURITY (MNI): Biden To Press Netanyahu For More Flexibility In Ceasefire Talks

Barak Ravid at Axios reporting that US President Joe Biden is expected to speak with Israeli Prime Minister Benjamin Netanyahu this evening to, "urge him to show more flexibility so a hostage-release and ceasefire deal can be reached in Gaza." According to Ravid, Biden wants Netanyahu to soften his stance on this deploying IDF forces along the entire Philadelphia axis on the Egypt-Gaza border to prevent arms smuggling to Hamas, a demand that was not part of the original three-phase proposal outlined by Biden on May 31.

US (MNI): RFK Withdrawal Could Boost Trump In Swing States

The implied probability of independent presidential candidate Robert F. Kennedy Jr. withdrawing from the presidential race has spiked on comments from running mate Nicole Shanahan appearing to flirt with a Trump endorsement. According to Polymarket, the implied probability of RFK withdrawing before November is currently 83%. The implied probability of RFK endorsing Trump is a similar 78%.

ISRAEL (US): Fatah Official Killed In Strike In Lebanon Had IRGC Links-Reports:

An Israeli airstrike on a car in the southern Lebanon city of Sidon has killed Khalil Al-Maqdah, a senior official in Fatah, the rival political movement to Hamas that controls the West Bank under the umbrella of the Palestinian Authority. Unconfirmed reports in Israeli media claim that al-Maqdah was linked to the foreign ops. branch of Iran's Islamic Revolutionary Guards Corps (IRGC), the Quds Force.

US TSYS Lrg BLS March Job Down Revision, Dovish July FOMC Minutes Weigh on Tsys

- Treasuries saw a moderately volatile session following the delayed BLS prelim annual payrolls benchmark down revision of 818k jobs to the Mar'24 statistics.

- After taking more than 30 minutes for official public confirmation, the BLS reports that the preliminary benchmark payrolls revision is a very large -818k. It implies seasonally adjusted average monthly payrolls growth through the twelve months to Mar 2024 was closer to 174k rather than 242k seen in the current vintage.

- Futures pared back gains after see-sawing higher into the dovish July FOMC minutes, Sep'24 10Y futures +8 at 113-26 vs. 114-01 high, 10Y yield at 3.7897% vs. 3.7595% low.

- As expected, the July FOMC minutes (link) signalled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July. There weren't many clues in the minutes on future monetary policy beyond that, with no mention for example of a potential >25bp cut.

- Projected rate cuts through year end gained vs. early Wednesday levels (*): Sep'24 cumulative -33.6bp (-33.3bp), Nov'24 cumulative -65.7bp (-64.4bp), Dec'24 -101.3bp (-98.3bp).

- Focus turns to the KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday morning.

OVERNIGHT DATA

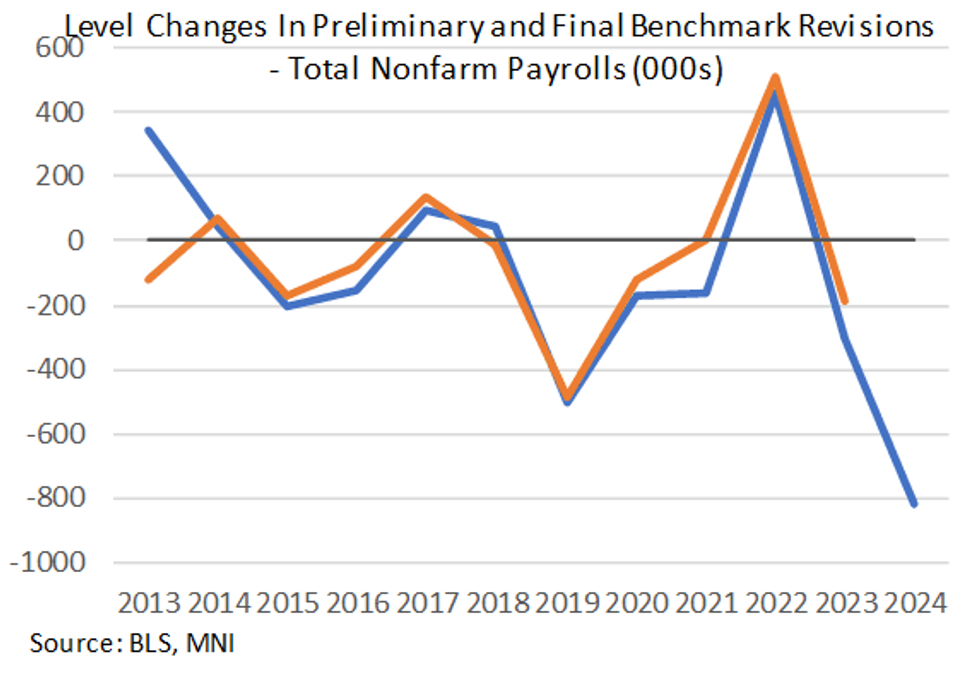

US DATA (MNI): Large Downward Preliminary Benchmark Revision For Payrolls

After taking more than 30 minutes for official public confirmation, the BLS reports that the preliminary benchmark payrolls revision is a very large -818k. It implies seasonally adjusted average monthly payrolls growth through the twelve months to Mar 2024 was closer to 174k rather than 242k seen in the current vintage.

- Analyst estimates we had seen prior had centered around -600k. GS had a range of -600k to -1m but thought it could exaggerate a downward revision by 300-500k.

- Preliminary benchmark estimates undershot the final estimates (which will be known in Feb 2025 for the Jan NFP report) by an average 110k through 2021-23 but that still leaves it on track for a historically large downward revision.

- Nevertheless, questions remain as to the amount that undocumented workers might be reflected in payrolls vs QCEW which is based on unemployment insurance records.

US DATA (MNI): Atlanta Businesses Expect Faster Price Increases

Atlanta Fed Business Inflation Expectations for one year ahead saw a 0.2pp moderation to 2.2%. That’s a joint recent low with Jan’24 on a rounded basis for a rate last previously seen in early 2021, although it remains above the 1.9% averaged both in 2019 and over the longer-term. This series specifically asks expectations to changes in unit costs.

- The quarterly question does however show some renewed price pressures compared to May. Firms reported an average price rise of 5.6% over the past twelve months (4.5% in May) and an average expected price rise of 4.0% over the next twelve months (3.4% in May, highest since Dec’22).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 33.84 points (0.08%) at 40864.89

- S&P E-Mini Future up 13.75 points (0.24%) at 5632.75

- Nasdaq up 55.8 points (0.3%) at 17871.02

- US 10-Yr yield is down 1.9 bps at 3.7878%

- US Sep 10-Yr futures are up 8.5/32 at 113-26.5

- EURUSD up 0.0023 (0.21%) at 1.1153

- USDJPY down 0.28 (-0.19%) at 144.96

- Gold is up $0.7 (0.03%) at $2514.69

- European bourses closing levels:

- EuroStoxx 50 up 27.7 points (0.57%) at 4885.28

- FTSE 100 up 10.11 points (0.12%) at 8283.43

- German DAX up 91.43 points (0.5%) at 18448.95

- French CAC 40 up 38.99 points (0.52%) at 7524.72

US TREASURY FUTURES CLOSE

- 3M10Y +0.783, -136.477 (L: -139.823 / H: -133.548)

- 2Y10Y +4.047, -14.067 (L: -18.995 / H: -13.348)

- 2Y30Y +6.114, 13.396 (L: 6.111 / H: 15.073)

- 5Y30Y +4.341, 41.48 (L: 36.452 / H: 43.078)

- Current futures levels:

- Sep 2-Yr futures up 4.125/32 at 103-12 (L: 103-07 / H: 103-14.125)

- Sep 5-Yr futures up 7.25/32 at 109-8.25 (L: 108-31 / H: 109-13)

- Sep 10-Yr futures up 8/32 at 113-26 (L: 113-14.5 / H: 114-01)

- Sep 30-Yr futures up 9/32 at 125-5 (L: 124-17 / H: 125-18)

- Sep Ultra futures up 7/32 at 133-29 (L: 133-02 / H: 134-15)

US 10YR FUTURE TECHS: (U4) Bullish Structure

- RES 4: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-03+ High Aug 5 and the bull trigger

- RES 1: 114-03/114-16 High Aug 6 / 76.4% of the Aug 5 - 8 pullback

- PRICE: 113-28 @ 1455 ET Aug 21

- SUP 1: 112-23 20-day EMA

- SUP 2: 111-22 50-day EMA values

- SUP 3: 111-06+ Low Jul 29

- SUP 4: 110-18+ Low Jul 22

A bullish theme in Treasuries remains intact and the contract continues to trade above support. Note that moving average studies are in a bull-mode position and this continues to highlight bullish sentiment. The recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for a climb towards 115-17, a Fibonacci projection. The recent move down is considered corrective. Support to watch is 112-23, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.045 at 95.113

- Dec 24 +0.075 at 95.790

- Mar 25 +0.090 at 96.30

- Jun 25 +0.090 at 96.60

- Red Pack (Sep 25-Jun 26) +0.060 to +0.080

- Green Pack (Sep 26-Jun 27) +0.025 to +0.055

- Blue Pack (Sep 27-Jun 28) +0.010 to +0.020

- Gold Pack (Sep 28-Jun 29) +0.010 to +0.010

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00287 to 5.30858 (-0.02710/wk)

- 3M -0.01932 to 5.10176 (-0.02665/wk)

- 6M -0.01759 to 4.81009 (-0.02960/wk)

- 12M -0.03949 to 4.33885 (-0.04975/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $2.101T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $784B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $765B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $90B

- Daily Overnight Bank Funding Rate: 5.33% (+0.00), volume: $257B

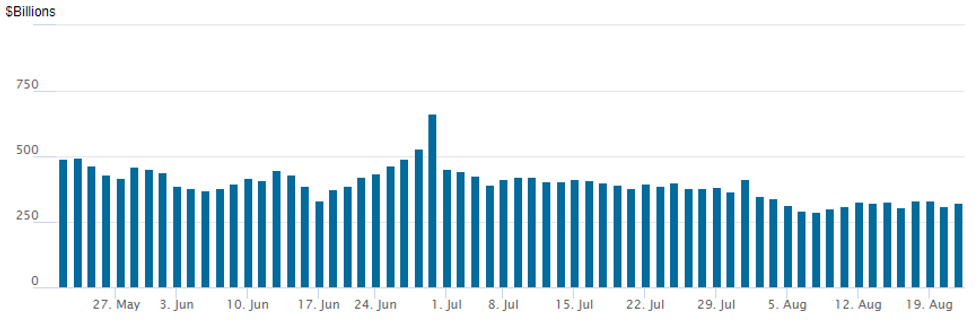

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage rebounds to $321.329B from $310.819B Tuesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties slips to 66 from 77 prior.

PIPELINE $1.25B Rabobank 2Pt Launched, $3.5B ADB SOFR Priced

- Date $MM Issuer (Priced *, Launch #)

- 8/21 $3.5B *ADB SOFR+38

- 8/21 $1.25B #Rabobank $500M 2Y +43, $750M 2Y SOFR+62

- Expected Thursday:

- 8/22 $Benchmark IFC 4Y SOFR+32a

BONDS: EGBs-GILTS CASH CLOSE: Core Yields Edge Lower For Third Day

Core European yields closed lower Wednesday for the third day this week.

- After a modestly constructive start on limited data and newsflow, Bund and Gilt yields fluctuated in mid-afternoon as the release of US payroll revisions proved messy.

- Ultimately core FI gained going into the European cash close, as the delayed data release showed downward revisions on the high end of expectations.

- ECB's Panetta noted that a "phase of loosening" likely laid ahead, while the UK saw higher-than-expected public sector net borrowing. Neither had much tangible market impact.

- The German and UK curves leaned bull steeper, while EGB periphery spreads tightened modestly.

- The main focus for the week continues to be on Thurs/Fri, which bring August flash PMIs, Eurozone national accounts/negotiated wages, and the Fed's Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 2.357%, 5-Yr is down 3.6bps at 2.106%, 10-Yr is down 2.4bps at 2.191%, and 30-Yr is down 0.8bps at 2.429%.

- UK: The 2-Yr yield is down 2.7bps at 3.664%, 5-Yr is down 3.2bps at 3.701%, 10-Yr is down 2.4bps at 3.891%, and 30-Yr is down 1.3bps at 4.441%.

- Italian BTP spread down 1.1bps at 136.7bps / Spanish down 1.4bps at 81.3bps

FOREX Greenback Continues Downward Trend, USD Index at Year’s Lows

- A volatile session for currencies in which a chaotic release of the BLS payrolls benchmark revisions provided only a momentary hiccup for an otherwise steady session of greenback selling. As expected, the July FOMC minutes signalled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July, which has paved the way for an extension of dollar weakness as we approach the APAC crossover.

- As such, the USD index (-0.49%) trades at fresh yearly lows, having extended below 101.00 in recent trade, significantly narrowing the gap to the Dec 2023 lows of 100.62. GBP stands out as one of the key beneficiaries in G10, with the ongoing bid for equities providing further optimism to higher beta currencies.

- A close at current or higher levels would be the firmest close for GBPUSD since July last year, and brings the pair within striking distance of the 1.3142 bull trigger. While USD weakness has certainly played a part so far this week, today stands out on the GBP strength more broadly, with EURGBP testing 100-dma support at 0.8510 and looking vulnerable on any break of 0.8504, the 50% retracement for the upleg off the mid-July low.

- Moving in tandem, EUR/USD shows through the mid-December, extending to a high of 1.1175 at typing. Underlying drivers here remain the broad USD weakness (especially given the single currency’s weighting in the usd index) this week as well as the bullish underlying techs in the pair: moving average studies remain in a bull-mode set-up, highlighting a rising trend. 1.1201 is the next objective for the move, the 1.50 projection of the Jun 26 - Jul 17 - Aug 1 price swing.

- The next test for the Euro’s outperformance will be Thursday’s release of Eurozone PMI’s, where markets will look for the continuation of the dynamic highlighted by President Lagarde in the ECB's July meeting press conference, with services driving the Eurozone’s gradual recovery in economic activity. Jobless claims and existing home sales highlight the US calendar.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 22/08/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 22/08/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/08/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2024 | 1130/1330 |  | EU | Account of ECB MonPol meeting in July | |

| 22/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 22/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/08/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/08/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/08/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/08/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.