-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: Fed Mins, Not Letting Inflation Guard Down Yet

- MNI: Upside Inflation Risk Could Require More Tightening -Fed

- MNI Summary Points On FOMC Minutes

- MNI Building Permits Miss But Maintain Trend Of Relative Resilience

- MNI Atlanta Fed GDPNow Surges Further To 5.8% For Q3

- MNI IP Beats In July, Trend Still Soft But Relatively Resilient

US

FED: Most Federal Reserve officials are still worried that inflation pressures, while improving, are not yet fully under control and could call for additional monetary policy tightening, minutes from last month's meeting of the FOMC released Wednesday showed.

- Still, policymakers are hoping the cumulative weight of aggressive Fed interest rate hikes that have taken the federal funds rate more than a full 5 percentage points higher in just 18 months, to a 5.25%-5.5% range, is getting close to doing enough to soften demand and put a lid on a two-year surge of inflation.

- “Most participants continued to see upside risks to inflation, which could require further tightening of monetary policy,” the Fed minutes said. “A number of participants judged that, with the stance of monetary policy in restrictive territory, risks the achievement of Fed goals had become more two sided.” For more see MNI Policy main wire at 1411ET.

FED: The main hawkish angle relative to a dovish presser came from: “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy”

- However, two officials favored holding rates steady (or could have supported such a proposal) and “several” saw a need to consider the risk of overtightening financial conditions.

- “A number of participants judged that, with the stance of monetary policy in restrictive territory, risks the achievement of Fed goals had become more two sided.”

- Continued data dependency for September: “[participants] agreed that policy decisions at future meetings should depend on the totality of the incoming information and its implications for the economic outlook and inflation as well as for the balance of risks.”

- Supercore inflation developments: “several participants commented that significant disinflationary pressures had yet to become apparent in the prices of core services excluding housing.” Similar to June’s: “some participants remarked that core nonhousing services inflation had shown few signs of slowing in the past few months.”

- QT beyond rate cuts: "A number of participants noted that balance sheet runoff need not end when the Committee eventually begins to reduce the target range for the federal funds rate."

- Potential hints of downward revision to SEP u/e rate: staff “a small increase in the unemployment rate relative to its current level” as they “continued to expect that real GDP growth in 2024 and 2025 would run below their estimate of potential output”. The 4.1% forecast for 4Q23 looks increasingly incompatible with latest rate of 3.5%.

US TSYS: July Minutes More Hawkish Than Anticipated

- US rates markets finishing broadly lower/near lows as participants continued to digest the more hawkish than anticipated FOMC minutes as most policymakers see upside risk to inflation.

- “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy” However, two officials favored holding rates steady (or could have supported such a proposal) and “several” saw a need to consider the risk of overtightening financial conditions.

- Sporadic buying reported, however, while WSJ economist Timiraos writes "Some Fed Officials Are Turning Cautious about Raising Rates Too High".

- Treasury futures started the day on the back foot: see-sawing around pre-data lows, weaker Building Permits (1.442M vs. 1.468M est; MoM (0.1% vs. 1.5% est), stronger Housing Starts (1.452M vs 1.450M est; MoM (3.9% vs. 1.1% est). Treasury futures extend lows after strong IP driven by autos and utilities.

- Front month Sep'23 10Y futures mark 109-13.5 low (-11), near initial technical support at 109-11.5 (Low Aug 15), followed by 109-10.5 (Low Nov 4 2022, cont). Below that, major technical support at 108-26. (Low Oct 21 2022, cont).

- Curves maintain steeper profiles with short end rates outperforming, 3M10Y curve +6.382 at -118.489, 2Y10Y +3.566 at -71.193.

- Rate hike projections through year end are steady to mildly higher, Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.6bp at 5.435, December cumulative of 9.1bp at 5.420%. Fed terminal holds at 5.43% in Nov'23.

OVERNIGHT DATA

- US JUL INDUSTRIAL PROD +1.0%; CAP UTIL 79.3%

- US JUN IP REV TO -0.8%; CAP UTIL REV 78.6%

- US JUL MFG OUTPUT +0.5%

- Industrial production was stronger than expected in July, increasing 1.0% M/M (cons 0.3) after a partly offsetting downward revised -0.8% (initial -0.5%) in June.

- Utilities do exacerbate this trend, bouncing +5.4% after -3.0%, but there is a similar story for manufacturing production. The latter increased 0.5% M/M (cons 0.0) albeit after a downward revised -0.5% (initial -0.3) and with further downward revisions offsetting the July beat of consensus.

- The 3M/3M trend for both IP and manufacturing production has slowed, with both at -1% annualized from flat in June, yet they continue to hold up well considering the ISM manufacturing survey is in solid contraction territory at 46.4 as of July.

- US JUL HOUSING STARTS 1.452M; PERMITS 1.442M

- US JUN STARTS REVISED TO 1.398M; PERMITS 1.441M

- US JUL HOUSING COMPLETIONS 1.321M; JUN 1.498M (REV)

- Housing starts were close to expectations in July at 1452k (cons 1450k) with revisions further amplifying recent noise. Starts climbed 3.9% M/M in July (cons 1.1) after a downward revised -11.7% (initial -8.0%) in June and upward revised +17.4% (initial +15.7%) in May.

- Building permits as usual offer a relatively cleaner look at housing activity, and they disappointed slightly with 0.1% M/M (cons 1.5) after an unrevised -3.7% in June and +5.6% in May.

- Some of the recent noise in the latter has been driven by multi-unit projects, whilst single family permits saw their sixth consecutive monthly increase, albeit just 0.6% M/M in July after some strong gains.

- The report continues the recent discrepancy between single family and multi-unit permits, which in level terms is more a normalization back towards pre-pandemic levels.

Atlanta Fed GDPNow: Just a day on from yesterday’s significant upward revision, the Atlanta Fed GDPNow has been revised higher to 5.76% annualized for Q3 from 5.0% yesterday and 4.1% on Aug 8 after today’s housing starts and industrial production data.

- Real personal consumption expenditure growth was revised up from 4.4% to 4.8% and real gross private domestic investment growth was revised up from 8.8% to 11.4%.

- If accurate, it would follow the 2.2% averaged through 1H23 and, whilst still technically the strongest since 4Q21, when looking prior to the post-pandemic reopening period it was last stronger in 2003.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 154.49 points (-0.44%) at 34794.35

- S&P E-Mini Future down 29.5 points (-0.66%) at 4424.75

- Nasdaq down 132.3 points (-1%) at 13500.3

- US 10-Yr yield is up 5.1 bps at 4.2622%

- US Sep 10-Yr futures are down 8.5/32 at 109-16

- EURUSD down 0.0031 (-0.28%) at 1.0874

- USDJPY up 0.79 (0.54%) at 146.36

- WTI Crude Oil (front-month) down $1.78 (-2.2%) at $79.21

- Gold is down $9.42 (-0.5%) at $1892.59

- EuroStoxx 50 down 4.3 points (-0.1%) at 4284.27

- FTSE 100 down 32.76 points (-0.44%) at 7356.88

- German DAX up 22.17 points (0.14%) at 15789.45

- French CAC 40 down 7.45 points (-0.1%) at 7260.25

US TREASURY FUTURES CLOSE

- 3M10Y +5.988, -118.883 (L: -133.012 / H: -117.501)

- 2Y10Y +2.762, -71.997 (L: -74.727 / H: -70.847)

- 2Y30Y +2.153, -62.159 (L: -64.46 / H: -58.616)

- 5Y30Y +0.578, -5.475 (L: -6.275 / H: -0.571)

- Current futures levels:

- Sep 2-Yr futures down 1.625/32 at 101-9.75 (L: 101-09 / H: 101-14.625)

- Sep 5-Yr futures down 5/32 at 105-26.25 (L: 105-24.5 / H: 106-08.25)

- Sep 10-Yr futures down 8.5/32 at 109-16 (L: 109-13.5 / H: 110-05.5)

- Sep 30-Yr futures down 25/32 at 119-10 (L: 119-03 / H: 120-19)

- Sep Ultra futures down 1-01/32 at 124-26 (L: 124-17 / H: 126-07)

US 10Y FUTURE TECHS: (U3) Holds Close to Week’s Lows

- RES 4: 112-31 High Jul 20

- RES 3: 112-02+ 50-day EMA

- RES 2: 111-29 High Aug 10

- RES 1: 110-10/111-02+ High Aug 14 / 20-day EMA

- PRICE: 109-21 @ 1235 ET Aug 16

- SUP 1: 109-11+ Low Aug 15

- SUP 2: 109-10+ Low Nov 4 2022 (cont)

- SUP 3: 108-26+ Low Oct 21 2022 (cont) and a major support

- SUP 4: 108-15+ 2.0% 10-dma envelope

Treasuries remain bearish and the contract printed a new pullback low again Tuesday. Any recovery rally Wednesday was lacking, with prices holding within range of the week’s lows. Price has breached 109.24, Aug 4 low, to confirm a resumption of the bear cycle. This signals scope for a move towards 109-10+, the Nov 4 2022 low. Moving average studies are in a bear mode condition, highlighting current bearish sentiment. Resistance to watch is 111-02+, the 20-day EMA. The recovery from yesterday’s low is considered corrective - for now.

SOFR Futures Close

- Sep 23 -0.005 at 94.585

- Dec 23 -0.020 at 94.585

- Mar 24 -0.025 at 94.765

- Jun 24 -0.035 at 95.060

- Red Pack (Sep 24-Jun 25) -0.045 to -0.04

- Green Pack (Sep 25-Jun 26) -0.045 to -0.04

- Blue Pack (Sep 26-Jun 27) -0.05 to -0.045

- Gold Pack (Sep 27-Jun 28) -0.045 to -0.045

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00181 to 5.31195 (+.00147/k)

- 3M +0.00275 to 5.37923 (+0.01466/wk)

- 6M -0.00286 to 5.44186 (+0.02678/wk)

- 12M +0.00358 to 5.38554 (+0.07972/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $268B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.413T

- Broad General Collateral Rate (BGCR): 5.29%, $558B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $541B

- (rate, volume levels reflect prior session)

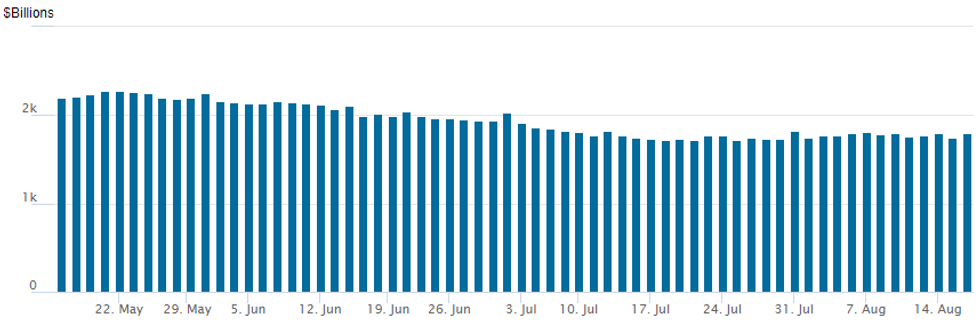

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operations continue to see-saw around 1.75-1.80T: the latest bounces to to $1,796.725B, w/105 counterparties, compared to $1,743.784B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Issuers Sidelined

No new corporate debt reported Wednesday, issuers sidelined ahead of the July FOMC minutes release.- $1.35B Priced Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 08/15 $750M *PNC Financial 11NC10 +173

- 08/15 $600M *Jacobs 5Y +200

EGBs-GILTS CASH CLOSE: More Hawkish UK Data Sees Gilts Underperform

Gilts weakened and underperformed global peers Wednesday - including Bunds, which strengthened. This followed another hawkish UK data release in the form of July inflation, as core CPI surprised to the upside driven by services prices.

- The immediate reaction wasn't as big as Tuesday's following strong wage data, but UK yields continued to drift higher for most of the session and closed on the highs (yesterday they lost momentum and closed near their open levels).

- In contrast to Gilts, Bund yields drifted lower all day, benefiting from a solid long-end auction, and taking a risk-off cue from Chinese economic concerns.

- The UK curve bear flattened overall, with slight bull steepening in Germany.

- Periphery spreads closed mostly wider, with BTPs again underperforming.

- A relatively quiet data schedule awaits Thursday with Dutch unemployment before the open and Eurozone trade. The Norges Bank decision will garner most attention in the morning, with French and Finnish bond supply later on.

- Germany: The 2-Yr yield is down 2.5bps at 3.085%, 5-Yr is down 2.4bps at 2.663%, 10-Yr is down 2.2bps at 2.65%, and 30-Yr is down 1.8bps at 2.729%.

- UK: The 2-Yr yield is up 6.6bps at 5.203%, 5-Yr is up 6.9bps at 4.664%, 10-Yr is up 5.7bps at 4.646%, and 30-Yr is up 5.6bps at 4.834%.

- Italian BTP spread up 1.8bps at 170.2bps / Spanish up 1.4bps at 105bps

FOREX USDJPY Extends Gains Above 146, EURGBP At Support

- The greenback staged a late rally on Wednesday ahead of the FOMC minutes, which was consolidated in the aftermath of the release which showed most Fed “participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy”. The USD index matched the weeks highs and resides close to six-week highs around 103.45 approaching the APAC crossover.

- USDJPY has breached the 146 handle and is extending the day’s gains to around 0.45% on the session amid the broader rebound for the USD index and ongoing Yen weakness.

- The overall uptrend for the pair resumed following the break of key resistance at 145.07, Jun 30 high. Moving average studies are in a bull mode condition, and the focus is now on 146.38, a Fibonacci projection. Above here, the notable target levels are 146.59, the Nov 10 2022 high, and 147.49, a Fibonacci projection level.

- Today’s resilient services CPI data in the UK has kept GBP moderately bid, with the most notable strength against both he Japanese yen and the Euro. EURGBP weakness has narrowed the gap to support at 0.8544, the Jul 27 low and clearance of this level would expose 0.8504, the Jul 11 low and a bear trigger.

- Australian employment data will be the focus overnight on Thursday before US jobless claims and Philly Fed manufacturing data later in the session.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/08/2023 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 17/08/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 17/08/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 17/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 17/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/08/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 17/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.