-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Pushback on Projected Rate Cuts

- MNI BRIEF: Fed's Daly: 'Premature' To Say Rate Cuts Close

- MNI FED: Fed’s Goolsbee-Too Soon To Commit To Timing Of Cuts

- MNI US: Biden Signs Government Funding Continuing Resolution

- MNI INTERVIEW: StatsCan Likely Keeping Flash GDP Estimates

- MNI DATA: A Small Miss For Existing Home Sales, Rebalancing Continues

- MNI DATA: Consumer Confidence Rises As Inflation Expectations Surprisingly Soften Further

US

FED (MNI): Fed's Daly: 'Premature' To Say Rate Cuts Close

Federal Reserve Bank of San Francisco President Mary Daly on Friday pushed back against market expectations for interest rate cuts soon, saying she needs to see more evidence that inflation is sustainably headed toward 2% before adjusting rates. Her comments come soon after Chicago Fed chief Austan Goolsbee also indicated rate cuts aren't yet imminent.

FED (MNI): MNI FED: Fed’s Goolsbee-Too Soon To Commit To Timing Of Cuts

The Federal Reserve could cut interest rates sooner than later if inflation falls faster than expected, but policymakers should not commit to any timing of cuts before they have more data at hand, Chicago Fed President Austan Gooslbee said Friday.

NEWS

US (MNI): Biden Signs Government Funding Continuing Resolution

The White House has confirmed in a statement that President Biden has signed into law the Continuing Resolution to fund the government through two new deadlines in March. With the CR in place, there is now roughly 40 days to draft and legislate all 12 spending bills for Fiscal Year 2024.

US (MNI): House Committee Meeting Shortly To Mark Up Bipartisan Tax Bill

The House of Representatives Ways and Means Committee is due to convene shortly to markup a bipartisan and bicameral USD$78 billion tax deal which will extend child tax credits in return for business tax cuts.

SECURITY (MNI): Biden And Netanyahu Hold First Call Since Before Holidays

Peter Baker at the New York Times reports on X that, according to the White House, President Biden has spoken with Israeli Prime Minister Benjamin Netanyahu, "to discuss the latest developments in Israel and Gaza," for the first time since before the holidays.

MIDEAST/US (MNI): Houthi Spox Says Saudi & UAE Not Targets, But Warns Of Co-op w/US

Speaking to Reuters, spox for the Houthi rebels in Yemen, Mohammed Abdulsalam, says that as long as regional powers Saudi Arabia and the UAE do not become actively involved in efforts to counter Houthi strikes on Red Sea shipping then they themselves will not become targets.

IRAN/PAKISTAN (MNI) Geo TV: Cabinet Decides To End Standoff w/Iran

Pakistani outlet Geo TV reporting that according to its sources, the Cabinet 'Has decided to end the standoff with Iran', and 'Endorsed a move to re-establish full diplomatic relations with Iran'. This comes after a call between Pakistani interim Foreign Minister Jalil Jalani and his Iranian counterpart Hossein Amirabdollahian that sought to dampen down tensions.

CANADA (MNI): StatsCan Likely Keeping Flash GDP Estimates

Statistics Canada will likely continue producing flash GDP estimates rolled out during the pandemic, so long as the data remains credible and people want the faster rough data, the head of the federal statistics agency told MNI.

US TSYS

- US treasury futures are drifting off lows despite headlines from SF Fed President Mary Daly on Fox Business in late trade. Leaning toward the hawkish side of balanced, Daly's comments strike a familiar refrain for the week:

- PREMATURE TO THINK RATE CUTS AROUND THE CORNER

- WE HAVE A LOT OF WORK LEFT TO DO ON INFLATION

- NEED MORE EVIDENCE TO FEEL CONFIDENT TO ADJUST POLICY RATE

- ANY EARLY SIGNS THAT LABOR MARKET COULD FALTER COULD ALSO TRIGGER POLICY ADJUSTMENT

- Mar'24 10Y futures climbed back to 111-06 (-.5) before settling back in at 111-04, well inside technical ranges: initial support of 110-26 Intraday low, resistance above at 111-28+/112-26+ (20-day EMA / High Jan 12). 10Y yield remains well above 4% at 4.1437% (0.17) vs. 4.1957% session high.

- Reminder, SF Fed Daly will attend a fireside chat/economic roundtable with Q&A at 1615ET.

- Fast two-way in Treasury futures reported after the UofM data came out much higher than expected, but quickly reversed course to session low (TYH4 110-26).

- U. of Mich. Sentiment (78.8 vs. 70.1 est, 69.7 prior)

- Expectations (75.9 vs. 67.0 est, 67.4 prior)

- Current Conditions (83.3 vs. 73.0 est, 73.3 prior)

- Inflation expectation dip slightly:

- 1 Yr Inflation (2.9% vs. 3.1% est, 3.1% prior)

- 5-10 Yr Inflation (2.8% vs. 3.0% est, 2.9% prior)

- Meanwhile, Existing Home Sales lower than expected (3.78M vs. 3.83M est), MoM (-1.0% vs. 0.3% est, 0.8% prior).

- Trading desks tied the post-data sell-off to ongoing rate cut unwinds, but took a stab at buying the dip.

OVERNIGHT DATA

US DATA: UofM Consumer Confidence Rises As Inflation Expectations Surprisingly Soften Further

- 1Y: 2.9% (cons 3.1) in Jan prelim vs 3.1% in Dec and 4.5% in Nov – lowest since Dec’20.

- 5-10Y: 2.8% (cons 3.0) in Jan prelim vs 2.9% in Dec and 3.2% in Nov – cycle low remains 2.7% in Sep’22.

- Long-term expectations have mostly kept to the 2.9-3.1% range seen since Aug’21, although have recently breached it both to the downside (2.8 in Sep) and upside (3.2 in Nov – highest since 2011). The findings start to echo progress made in NY Fed equivalent readings.

- Consumer sentiment meanwhile is notably stronger than expected at 78.8 (con 70.1) after 69.7, with strong increases in both expectations and current conditions. It’s the highest since mid-2021 but still compares with pre-pandemic readings in the 90-100 range.

US DATA: A Small Miss For Existing Home Sales, Rebalancing Continues

- Existing home sales were softer than expected in Dec at 3.78m (cons 3.83m) after an unrevised November.

- It left sales falling -1.0% M/M (cons 0.3) after the +0.8% M/M in Nov had marked the first increase since May.

- There was continued regional dispersion: declines were led by the largest regions of the south (-2.8%) and midwest (-4.3%), offsetting a bounce in the west (7.8%).

- With inventory pulling back sharply as is the seasonal norm, months of supply fell from 3.5 to 3.2 months. This is however relatively high by recent December standards, and is above the 3.1 in both 2017 and 2019 as the housing market continues to re-balance after post-pandemic tightness.

- Despite the rebalancing, median prices still increased 4.4% Y/Y.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 380.07 points (1.01%) at 37848.67

- S&P E-Mini Future up 54.25 points (1.13%) at 4865.5

- Nasdaq up 228.4 points (1.5%) at 15284.18

- US 10-Yr yield is up 0.4 bps at 4.1456%

- US Mar 10-Yr futures are down 2/32 at 111-4.5

- EURUSD up 0.0015 (0.14%) at 1.0891

- USDJPY down 0.01 (-0.01%) at 148.15

- WTI Crude Oil (front-month) down $0.24 (-0.32%) at $73.84

- Gold is up $5.07 (0.25%) at $2028.35

- European bourses closing levels:

- EuroStoxx 50 down 4.22 points (-0.09%) at 4448.83

- FTSE 100 up 2.84 points (0.04%) at 7461.93

- German DAX down 12.22 points (-0.07%) at 16555.13

- French CAC 40 down 29.71 points (-0.4%) at 7371.64

US TREASURY FUTURES CLOSE

- 3M10Y +0.596, -122.92 (L: -127.462 / H: -117.062)

- 2Y10Y -4.769, -26.231 (L: -27.103 / H: -19.572)

- 2Y30Y -6.484, -5.614 (L: -6.824 / H: 3.158)

- 5Y30Y -3.526, 28.156 (L: 26.998 / H: 33.091)

- Current futures levels:

- Mar 2-Yr futures down 3.375/32 at 102-18.5 (L: 102-17.5 / H: 102-22.5)

- Mar 5-Yr futures down 4/32 at 107-21.75 (L: 107-16.5 / H: 107-27)

- Mar 10-Yr futures down 2/32 at 111-4.5 (L: 110-26 / H: 111-09.5)

- Mar 30-Yr futures up 2/32 at 119-31 (L: 119-10 / H: 120-08)

- Mar Ultra futures up 11/32 at 126-1 (L: 125-01 / H: 126-08)

US 10Y FUTURE TECHS: (H4) Challenging Support

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-28+/112-26+ 20-day EMA / High Jan 12

- PRICE: 111-04+ @ 1515 ET Jan 19

- SUP 1: 110-26 Intraday low

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries have extended this week’s bearish move and the contract has traded to a fresh weekly low today. Price has pierced the 50-day EMA, at 111-0 and support at 111-06+, the Jan 5 low. A clear break of both levels would undermine the recent bullish theme and signal scope for a deeper pullback, opening 110-16, the Dec 13 low. Initial firm resistance has been defined at 112-26+, the Jan 12 high. A break would be a bullish development.

SOFR FUTURES CLOSE

- Mar 24 -0.035 at 94.860

- Jun 24 -0.070 at 95.270

- Sep 24 -0.085 at 95.665

- Dec 24 -0.080 at 96.020

- Red Pack (Mar 25-Dec 25) -0.07 to -0.04

- Green Pack (Mar 26-Dec 26) -0.03 to -0.015

- Blue Pack (Mar 27-Dec 27) -0.015 to -0.005

- Gold Pack (Mar 28-Dec 28) -0.005 to +0.005

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00072 to 5.33594 (-0.00204/wk)

- 3M -0.00201 to 5.31580 (-0.00073/wk)

- 6M -0.00430 to 5.15933 (+0.00586/wk)

- 12M -0.00421 to 4.79849 (+0.00871/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.746T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $659B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $87B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $260B

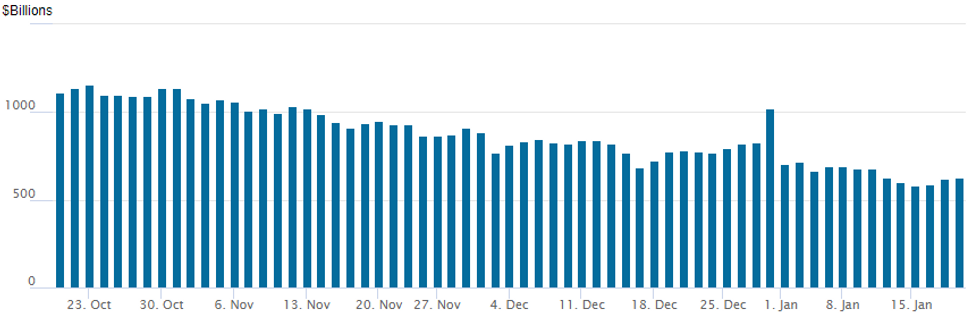

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $625.182B vs. $618.234B Thursday. Compares to $583.103B on Tuesday - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties recedes to 79 from 81 on Thursday (65 Tuesday, the lowest since July 7, 2021)

PIPELINE

No new corporate or supra-sovereign issuance Friday after total of $70.75B priced on the shortened week, $216.85B running total for the month so far. That compares to total of $231.425B for all of January 2023.

FOREX Equities Rally Weighs Modestly On Greenback, USD Index Remains +0.85% on Week

- A significant shift higher for US yields this week sees the USD index set to close 0.85% in the green. A mid-week dip in equity sentiment briefly prompted the DXY to extends the week’s advance to 1.2%, although the more stable backdrop has prompted a moderate paring of gains over the past two sessions. With yield differentials the key focus, the greenback’s advance has been most notable against the Japanese Yen, with USDJPY up a further 2.3% this week.

- This week’s USDJPY gains resulted in a break of 146.41, the Jan 11 high, confirming a resumption of the bull cycle. The move higher opens 149.16 next, a Fibonacci retracement. On the downside, a key short-term support has been defined at 144.36, the Jan 12 low. Clearance of this level is required to signal a top. Initial support moves up to 147.08, the Jan 17 low.

- Ahead of the ECB next week, it is worth noting that EURUSD maintains a short-term weaker tone. The week’s move lower has resulted in the break of a trendline drawn from the Nov 1 low, signalling scope for a continuation of the corrective cycle. Note that key support at 1.0877, the Jan 5 low, has been pierced. A clear breach would further reinforce bearish conditions and open 1.0793, a Fibonacci retracement. Resistance is at 1.0998, Jan 5 high. A break would signal a reversal.

- After a subdued couple of sessions for G10 FX overall, markets will be paying attention to the Bank of Japan decision and New Zealand CPI on Tuesday. Focus then quickly turns to European flash PMIs and the BOC on Wednesday. The action continues on Thursday with the European central bank decision and press conference, as well as the advanced reading of Q4 US GDP, which will include an estimate of Dec core PCE.

MONDAY/TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2024 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 23/01/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 23/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/01/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 23/01/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 23/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.