MNI ASIA OPEN: Flash PMIs Price Pressure/Soft Employ

- MNI FED BRIEF: Bostic Echoes Powell’s Press Conference Tone

- MNI FED BRIEF: Kashkari - Monetary Policy Remains Tight After 50bp Cut

- MNI SECURITY: US To Send Additional Troops To Region Amid Israel/Hezb'h Escalation

- MNI US DATA: Flash PMIs Show Renewed Price Pressures But Softer Employment

US

FED BRIEF (MNI): Bostic Echoes Powell’s Press Conference Tone

Bostic’s (’24 voter) prepared remarks appear very much in keeping with the tone from Powell’s press conference, somewhat of note for someone who had been on the more hawkish end of the FOMC spectrum.

- “Bostic emphasizes that the reduction in the federal funds rate does not lock in a cadence for further moves.”

- Optionality around rate moves ahead: "Policy remains in the restrictive range, so if my optimism about inflation is unsatisfied, then the Committee can slow or even halt the pace of further reductions. Should labor markets prove substantially less healthy than they appear at the moment, the 0.5 percentage point reduction puts us in a better position to adjust than a more modest cut would have,"

- "Any further evidence of material weakening in the labor market over the next month or so will definitely change my view on how aggressive policy adjustment needs to be."

FED BRIEF (MNI): Kashkari - Monetary Policy Remains Tight After 50bp Cut

Kashkari (non-voter) has published an essay on "Why I Supported Cutting Rates Last Week": Unclear just how tight policy is: “While there remain mixed signals about the underlying strength of the U.S. economy and I remain uncertain just how tight policy is, I do believe policy remains tight today.”

- But still tight after 50bps cut: “Given both the significant progress we’ve made in reducing inflation and also the softening of many labor market indicators, in my judgment the balance of risks has now shifted away from higher inflation toward higher unemployment. This could potentially jeopardize achievement of maximum employment. This risk assessment led me to support the FOMC’s decision last week to reduce the federal funds rate by 50 basis points. […E]ven after the 50 basis-point cut, I believe the overall stance of monetary policy remains tight.”

- He reveals in in the below chart that his dots where exactly in line with the median participant this month.

NEWS

SECURITY (MNI): US To Send Additional Troops To Region Amid Israel/Hezb'h Escalation

Newswires reporting that the US will send additional troops to the Middle East amid an escalation of hostilities between Israel and Hezbollah in Lebanon, according to a Pentagon statement.

- The report comes amid a flurry of headlines on the conflict, including claims that an IDF strike in Beirut may have killed high-ranking Hezbollah southern front commander, Ali Karaki.

- Regional expert Charles Lister notes: "If Ali Karaki was just killed in Beirut, Israel will have crippled Hezbollah's military leadership -- leaving only (1) Hassan Nasrallah & (2) Abu Ali Rida still alive. Devastating intelligence penetration."

SECURITY (MNI): Israel Will Launch "Large Scale" Attack Across Rural Lebanon - Ynet

Israeli news outlet Ynet News reporting that, according to IDF sources, Israel's conflict with Hezbollah in Lebanon could intensify in the coming days and weeks, following "operations have been planned by the IDF for years."

- Ynet: "The attack’s peak may still be ahead. A security official told Ynet on Monday the military will launch a “large-scale” attack across rural areas of Lebanon. According to him, Hezbollah’s possible response could include expanding its range of fire, possibly targeting “selected sites in Tel Aviv.”"

- Comes as Reuters reports that the IDF said it is now, "targetting Beirut": "An Israeli strike hit Beirut's southern suburbs on Monday evening, a security source told Reuters, but said it was not immediately clear what type of strike was used or what was hit."

ISRAEL (MNI): IDF Launches New Wave Of Airstrikes On Hezbollah In Lebanon:

Tensions in the Levant remain extremely high amid the risk of a regional escalation. The Israeli Defence Forces (IDF) have confirmed a new wave of airstrikes against Hezbollah targets in southern Lebanon. This follows a weekend of Israeli airstrikes and Hezbollah rocket launches into northern Israel. The IDF has publicly warned Lebanese citizens to move away from buildings or civilian homes linked to Hezbollah, claiming that these buildings will be targets for airstrikes.

GERMANY (MNI): SPD Denies AfD Brandenburg Win, But Problems Not Over For Federal Gov't:

The centre-left Social Democrats (SPD) were able to hold off the challenge from the far-right Alternative for Germany (AfD) in state elections in Brandenburg held on 22 September. Opinion polling had shown a surge in support for the SPD in the last days of the campaign, as supporters of other moderate parties shifted to the SPD in an effort to stop the AfD coming in first.

US TSYS: Off Flash PMI Lows, Safe Haven Bid As US To Send Troops to Middle East

- Treasuries still look to finish weaker, but well off Monday morning lows as late London unwinds segued to safe haven buying on Middle East headlines: Israel Will Launch "Large Scale" Attack Across Rural Lebanon - Ynet, followed by Newswires reporting that the US will send additional troops to the Middle East amid an escalation of hostilities between Israel and Hezbollah in Lebanon, according to a Pentagon statement.

- Treasuries gapped lower/extended lows after this morning's Flash PMIs showed renewed price pressures but softer employment. Manufacturing: 47.0 (cons 48.6) in Sept prelim after 47.9 in Aug; Services: 55.4 (cons 55.2) after 55.7; Composite: 54.4 (cons 54.3) after 54.6.

- Dec'24 10Y Tsy futures are currently -3.5 at 114-23.5 vs. 114-11.5 low -- breaching 114-23 support (20-day EMA) briefly. Curves bear steepened, 2s10s +1.494 at 16.105, 5s30s +0.190 at 58.393.

- Projected rate cuts into early 2025 rebound, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -38.5bp (-36.5bp), Dec'24 -75.9bp (-72.8bp), Jan'25 -110.0bp (-107.0bp).

- Focus turns to House Price index data tomorrow including Consumer Confidence and regional Fed mfg data. US Tsy to auction $69B 2Y notes as well as $60B 42D CMB bills.

OVERNIGHT DATA

US DATA (MNI): Flash PMIs Show Renewed Price Pressures But Softer Employment

The S&P Global US flash PMIs held up much better than was the case in this morning’s European results, with a composite slightly higher than expected and only easing marginally on the month (EZ composite at 48.9 vs cons 50.5 after 51.0, UK composite at 52.9 vs cons 53.5 after 53.8). See the full press release here. Manufacturing: 47.0 (cons 48.6) in Sept prelim after 47.9 in Aug; Services: 55.4 (cons 55.2) after 55.7; Composite: 54.4 (cons 54.3) after 54.6.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 65.98 points (0.16%) at 42130.6

- S&P E-Mini Future up 14 points (0.24%) at 5776

- Nasdaq up 26.8 points (0.1%) at 17973.72

- US 10-Yr yield is up 0.4 bps at 3.7451%

- US Dec 10-Yr futures are down 4.5/32 at 114-22.5

- EURUSD down 0.0047 (-0.42%) at 1.1115

- USDJPY down 0.36 (-0.25%) at 143.49

- WTI Crude Oil (front-month) down $0.53 (-0.75%) at $70.46

- Gold is up $4.74 (0.18%) at $2626.61

- European bourses closing levels:

- EuroStoxx 50 up 14.03 points (0.29%) at 4885.57

- FTSE 100 up 29.72 points (0.36%) at 8259.71

- German DAX up 126.78 points (0.68%) at 18846.79

- French CAC 40 up 7.82 points (0.1%) at 7508.08

US TREASURY FUTURES CLOSE

- 3M10Y +4.321, -88.77 (L: -98.188 / H: -88)

- 2Y10Y +1.031, 15.642 (L: 14.779 / H: 17.935)

- 2Y30Y +1.369, 50.176 (L: 49.32 / H: 52.816)

- 5Y30Y +0.201, 58.404 (L: 57.432 / H: 60.499)

- Current futures levels:

- Dec 2-Yr futures down 0.75/32 at 104-10.5 (L: 104-07.875 / H: 104-12)

- Dec 5-Yr futures down 3/32 at 110-7.5 (L: 110-00.5 / H: 110-10.75)

- Dec 10-Yr futures down 4.5/32 at 114-22.5 (L: 114-11.5 / H: 114-26.5)

- Dec 30-Yr futures down 7/32 at 125-1 (L: 124-08 / H: 125-10)

- Dec Ultra futures down 12/32 at 134-2 (L: 133-01 / H: 134-16)

US 10YR FUTURE TECHS: (Z4) Tests Support At The 20-Day EMA

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-02+/23+ High Sep 19 / 11 and the bull trigger

- PRICE: 114-24+ @ 1450 ET Sep 23

- SUP 1: 114-23/11+ 20-day EMA / Intraday low

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-22 50-day EMA

- SUP 4: 113-12 Low Sep 3

Treasuries maintain a bullish theme and the latest pullback appears to be a correction - for now. Firm support is seen at 114-23, the 20-day EMA. This average has been pierced but for now, remains intact. A clear break of it would signal scope for a deeper retracement towards 113-22, the 50-day EMA. For bulls, a resumption of gains would refocus attention on 115-23+, the Sep 11 high and a bull trigger. A break would resume the uptrend.

SOFR FUTURES CLOSE

- Dec 24 +0.010 at 96.045

- Mar 25 -0.005 at 96.620

- Jun 25 -0.010 at 96.930

- Sep 25 -0.010 at 97.060

- Red Pack (Dec 25-Sep 26) -0.02 to -0.01

- Green Pack (Dec 26-Sep 27) -0.025 to -0.02

- Blue Pack (Dec 27-Sep 28) -0.03 to -0.025

- Gold Pack (Dec 28-Sep 29) -0.025 to -0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00244 to 4.85478 (-0.22551 total last wk)

- 3M -0.02330 to 4.66795 (-0.24993 total last wk)

- 6M -0.01770 to 4.33369 (-0.22753 total last wk)

- 12M -0.00799 to 3.82350 (-0.16036 total last wk)

- Secured Overnight Financing Rate (SOFR): 4.83% (+0.01), volume: $2.147T

- Broad General Collateral Rate (BGCR): 4.81% (+0.00), volume: $824B

- Tri-Party General Collateral Rate (TGCR): 4.81% (+0.00), volume: $789B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $284B

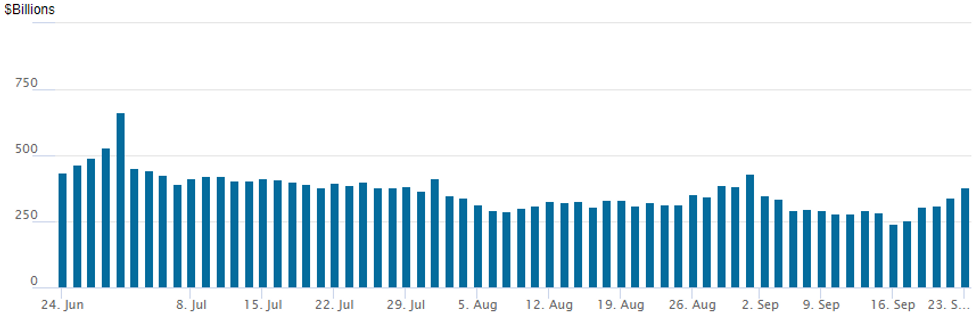

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $380.372B this afternoon from $339.316B Friday. Compares to $239.386B last Monday -- the lowest level since early May 2021. Number of counterparties at 71 from 65 prior.

PIPELINE: $2.75B Hyundai 4Pt Launched

- $12.3B total corporate debt to price Monday

- Date $MM Issuer (Priced *, Launch #)

- 9/23 $2.75B #Hyundai $900M 3Y +85, $500M 3Y SOFR+103, $$850M 5Y +105, $500M 7Y +115

- 9/23 $2.5B #T-Mobile $700M 5Y +75, $900M +10Y +98, $900M +30Y +118

- 9/23 $2.5B #ANZ $750M 3Y +45, $500M 3Y SOFR+65, $1.25B 11NC10 +147

- 9/23 $1.25B #AIA $500M 10.5Y +125, $750M 30Y +135

- 9/23 $1B #Simon Property 10Y +110

- 9/23 $800M *IBK $300M 3Y SOFR+62, $500M 5Y +57

- 9/23 $500M #Invitation Homes +10Y +128

- 9/23 $500M #Guardian Life 5Y +68

- 9/23 $500M *REC 5Y +127.5

- 9/23 $Benchmark Shriram investor calls

- Later this week:

- 9/24 $Benchmark Kommunalbanken 5Y SOFR+50a

- 9/24 $Benchmark BNG 2Y

BONDS: EGBs-GILTS CASH CLOSE: German 2s10s Disinverts As PMIs Come In Weak

European curves steepened Monday as weak PMIs showed a pullback in regional economic momentum.

- Eurozone (incl each of France and Germany) and UK flash September PMIs came in below expectations across the board on both Manufacturing and Services, adding further impetus to near-term ECB and BoE rate cut expectations.

- An October ECB is now priced at 10bp (40% prob of 25bp), vs 5bp prior.

- Against this backdrop, the German curve bull steepened, with 2s10s disinverting for the first time since Aug 2022. The UK's twist steepened.

- OATS underperformed again (10Y/Bund +2.5bp), weighed down by continued political uncertainty and an FT report that France has requested a further delay in submitting its budget plans to the EC.

- Periphery EGB spreads widened modestly, having reversed early session wides. Note that futures rallied through the cash close.

- Tuesday's schedule includes September German IFO data and appearances by ECB's Muller, Nagel, and Escriva.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.1bps at 2.149%, 5-Yr is down 6.7bps at 2%, 10-Yr is down 5.2bps at 2.156%, and 30-Yr is down 2.8bps at 2.481%.

- UK: The 2-Yr yield is down 1bps at 3.915%, 5-Yr is up 1bps at 3.754%, 10-Yr is up 2bps at 3.923%, and 30-Yr is up 2.6bps at 4.496%.

- Italian BTP spread up 0.5bps at 135.2bps / Spanish up 0.8bps at 79.7bps

FOREX: EUR Weaker Post PMIs, Volatile Yen Swings Persist

- The Euro remains lower on the session following a weaker set of flash PMI data for the Eurozone. In particular, the resilience for major equity benchmarks has weighed substantially on the likes of EURAUD, EURNZD and EURCAD, all falling around 0.85% on Monday.

- EURUSD is also lower but was unable to garner any momentum below the 1.1100 handle as the early greenback optimism lost steam. The pair currently resides around 1.1125 as we approach the APAC crossover.

- EURJPY is also 0.7% lower on Monday, however, the ongoing volatile swings for the Japanese yen persist, creating some tricky price action for EURJPY bears to navigate. The early weakness saw a print as low as 159.05, however, the two-way action for US yields saw a punchy recovery to 160.53 before then reverting lower once more. Moving average studies are in a bear-mode position and this continues to highlight a dominant downtrend. An extension lower would refocus attention on the key support at 154.42, the Aug 5 low.

- It's been a similar story for USDJPY, where a cluster of highs appear to be forming between 144.35/50, which will remain the short-term technical point of note.

- Today’s AUD outperformance is notable as we approach the overnight RBA decision and Wednesday’s CPI data. Key resistance at 0.6824, the Aug 29 high, has been breached. A clear break of this hurdle would confirm a resumption of the bull cycle that started Aug 5 and pave the way for a climb towards 0.6900, the Jun 16 ‘23 high. First support is 0.6726, the 20-day EMA.

- There may also be comments from BOJ’s Ueda on Tuesday, before US consumer confidence headlines the data calendar.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/09/2024 | 0030/0930 | ** |  JP JP | Jibun Bank Flash Japan PMI |

| 24/09/2024 | 0430/1430 | *** |  AU AU | RBA Rate Decision |

| 24/09/2024 | 0800/1000 | *** |  DE DE | IFO Business Climate Index |

| 24/09/2024 | 0900/1000 | * |  GB GB | Index Linked Gilt Outright Auction Result |

| 24/09/2024 | 1230/0830 | ** |  US US | Philadelphia Fed Nonmanufacturing Index |

| 24/09/2024 | 1255/0855 | ** |  US US | Redbook Retail Sales Index |

| 24/09/2024 | 1300/0900 | ** |  US US | S&P Case-Shiller Home Price Index |

| 24/09/2024 | 1300/0900 | ** |  US US | FHFA Home Price Index |

| 24/09/2024 | 1300/1500 | ** |  BE BE | BNB Business Sentiment |

| 24/09/2024 | 1400/1000 | *** |  US US | Conference Board Consumer Confidence |

| 24/09/2024 | 1400/1000 | ** |  US US | Richmond Fed Survey |

| 24/09/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for Cash Management Bill |

| 24/09/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 2 Year Note |

| 24/09/2024 | 1710/1310 |  CA CA | BOC Governor Macklem fireside chat on "Growth During Uncertainty" | |

| 24/09/2024 | 2210/1810 |  US US | New York Fed's Roberto Perli |