-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: Long-Term Inflation Expectations Anchored

- MNI POLITICAL RISK - Elections Weekly: Harris Leads In Polls

- MNI MIDEAST: Biden-'We're Closer To Deal'; Hamas: We Won't Accept 'New Conditions

- MNI US DATA: State Labor Data Offer Arguably Hawkish Takeaways

- MNI US DATA: U.Mich Long-Term Inflation Expectations Remain Anchored Around 3%

US

POLITICAL RISK (MNI) - Elections Weekly: Harris Leads In Polls

- Vice President Kamala Harris continues to ride the enthusiasm surge that accompanied President Joe Biden’s withdrawal from the race and Harris’ lightning-quick consolidation of the Democrat nomination.

- It remains to be seen if her strategy, centered on scripted public events rather than press conferences that could risk missteps, can maintain momentum through November. But the Democratic Party National Convention, which gets underway on Monday, should keep positive Democrat vibes high while Trump struggles to alight on a coherent strategy for countering Harris.

NEWS

MIDEAST (MNI): Biden-'We're Closer To Deal'; Hamas: We Won't Accept 'New Conditions':

Continuing the flurry of back-and-forth headlines regarding the Gaza ceasefire talks, in what could prove a major dampener to the positive mood surrounding the joint statement from negotiators, AFP reportthat Hamas has rejected the 'new conditions' in the proposed deal.

ISRAEL (MNI): Kan-Israeli Delegation To Return Home After Today's Ceasefire Talks:

Amichai Stein at Kan reports that the Israeli delegation to the talks in Doha regarding a potential ceasefire in Gaza is set to return home from Qatar after the conclusion of today's negotiations.

SECURITY (MNI): US Sec State Blinken To Travel To Israel On Aug 17

US Secretary of State Antony Blinken will travel to Israel on August 17 to, "continue diplomatic efforts to conclude a deal for a ceasefire and the release of hostages in Gaza," according to a statement from the US State Department. The trip, which was initially scheduled for earlier this week, comes amid optimism that a ceasefire deal for Gaza could be closer than at any point in recent months, following two-days of talks in Doha, Qatar.

MIDEAST (MNI): WaPo-Qatar Warns Iran Against Israel Strike During Gaza Talks: John Hudson at WaPo:

"Qatar’s prime minister cautioned Iran's leaders to hold off on their expected assault of Israel to avoid scuttling the real progress in the negotiations in Doha. That was relayed in a phone call to Tehran following the first day of talks, per diplomats familiar."

GERMANY (MNI): Gov't Agrees On Plugging Budget Gap, But Coalition Tensions Remain:

Gov't spokesperson Steffen Hebestreit confirms the coalition has agreed on plans to narrow the EUR17bn gap in the 2025 federal budget.

FRANCE (MNI): Macron To Meet Party Leaders 23 Aug-AFP:

AFP reporting that according to the Elysee Palace, President Emmaneul Macron will meet with party heads on Friday 23 August. The meetings come amid renewed disagreement between the president and the centrist Ensemble bloc in the National Assembly aligned with Macron, and the leftist New Popular Front (NFP) over who should lead the next gov't.

RUSSIA (MNI): Putin Aide Claims West Involved In Planning Kursk Offensive:

Senior aide to President Vladimir Putin, Nikolai Patrushev, has claimed that the West and NATO were directly involved in the planning of Ukraine's ongoing offensive into the Kursk oblast of the Russian Federation.

US TSYS Firmer/Inside Range, Build Permits Miss, UofM Expectations Firmer

- Treasuries are holding modestly higher after the bell, inside the early session range after some modest data driven volatility. Rates held near early highs after Building permits disappointed in July at 1396k (cons 1425k) after a mildly upward revised 1454k (1446k).

- Tsys ratcheted lower into/after University of Michigan inflation expectations were a tenth stronger than expected for both 1Y and 5-10Y measures but remain in recent ranges.

- Meanwhile, the BLS state household survey data showed another decline in the share of states that have triggered the Sahm Rule threshold, down to 30% in July from 34% in June and 42% in May.

- Tsy Sep'24 10Y futures gained slightly on the week, currently at 113-04 (+5.5/day) vs. last Friday's 112-30.5 settle. Curves mildly steeper, 2s10s +.795 at -17.611, 5s30s +.370 at 38.171.

- As such, short end rebound underpinned projected rate cuts into year end vs. this mornings pre-data levels (*): Sep'24 cumulative -33.8bp (-33.8bp), Nov'24 cumulative -64.2bp (-62.0bp), Dec'24 -96.8bp (-93.5bp).

- The KC Fed hosted Jackson Hole economic symposium "Reassessing the Effectiveness and Transmission of Monetary Policy," will be held Aug. 22-24, Fed Chairman Powell speaking 1000ET Friday Morning.

OVERNIGHT DATA

US DATA (MNI): U.Mich Long-Term Inflation Expectations Remain Anchored Around 3%

Inflation expectations were a tenth stronger than expected for both 1Y and 5-10Y measures but remain in recent ranges.

- 1Y: 2.9% (cons 2.8) for no change from the 2.9% in the finalized July print.

- 5-10Y: 3.0% (cons 2.9) for no change from the 3.0% in the finalized July print.

- Whilst the 5-10Y measure remains firmly within its 2.9-3.1% range seen in most months since mid-2021, it goes against the recent softening seen in slightly shorter term measures in the NY Fed’s consumer survey.

US DATA (MNI): State Labor Data Offer Arguably Hawkish Takeaways

The state household survey data showed another decline in the share of states that have triggered the Sahm Rule threshold, down to 30% in July from 34% in June and 42% in May. There are issues with looking at this metric beyond a national level, not least as different states receive differing levels of immigration with differing impacts on labor supply, but it nevertheless receives attention. You can see how this mostly labor supply driven increase in the unemployment rate has differed to prior recessions in the chart below:

US DATA (MNI): Building Permits And Starts Slip To Post-Pandemic Lows

Building permits disappointed in July at 1396k (cons 1425k) after a mildly upward revised 1454k (1446k). It left them down 4% M/M after a 3.9% increase in June, led by a sharp pullback in multi-units after a spike (-11% after 16%) whilst single family units held onto prior declines (-0.1% after -1.8%).

- The June increase remains somewhat of an anomaly – the only increase in the past five months – during which permits have fallen 11% for post-pandemic lows.

- It sees the overall level of starts back almost exactly in line with the 2019 average although this won’t help alleviate housing pressures from stronger population growth since then.

- Noisier housing starts data were more disappointing again with -6.8% M/M (cons -1.5) after a downward revised 1.1% increase (initial 3.0%).

- Starts saw the polar opposite compositional story though, with single unit dwellings tumbling -14% vs multi-units +14.5%.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 123.8 points (0.31%) at 40685.97

- S&P E-Mini Future up 11 points (0.2%) at 5578

- Nasdaq up 38.3 points (0.2%) at 17632.11

- US 10-Yr yield is down 2.3 bps at 3.8902%

- US Sep 10-Yr futures are up 5/32 at 113-3.5

- EURUSD up 0.0047 (0.43%) at 1.1019

- USDJPY down 1.59 (-1.07%) at 147.69

- WTI Crude Oil (front-month) down $1.52 (-1.94%) at $76.64

- Gold is up $46.5 (1.89%) at $2503.31

- European bourses closing levels:

- EuroStoxx 50 up 32.75 points (0.68%) at 4840.52

- FTSE 100 down 35.94 points (-0.43%) at 8311.41

- German DAX up 139.16 points (0.77%) at 18322.4

- French CAC 40 up 26.33 points (0.35%) at 7449.7

US TREASURY FUTURES CLOSE

- 3M10Y -1.545, -132.96 (L: -135.292 / H: -129.458)

- 2Y10Y +0.985, -17.421 (L: -20.264 / H: -15.949)

- 2Y30Y +1.366, 8.67 (L: 4.321 / H: 11.239)

- 5Y30Y +0.558, 38.359 (L: 35.727 / H: 41.095)

- Current futures levels:

- Sep 2-Yr futures up 1.625/32 at 103-4.25 (L: 103-01.875 / H: 103-06.625)

- Sep 5-Yr futures up 3.5/32 at 108-24.25 (L: 108-19.25 / H: 108-29.75)

- Sep 10-Yr futures up 5/32 at 113-3.5 (L: 112-28.5 / H: 113-12)

- Sep 30-Yr futures up 12/32 at 123-21 (L: 123-09 / H: 124-04)

- Sep Ultra futures up 14/32 at 132-0 (L: 131-18 / H: 132-22)

US 10YR FUTURE TECHS: (U4) Bullish Theme

- RES 4: 116-00 Round number resistance

- RES 3: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 114-03/115-03+ High Aug 6 / 5 and the bull trigger

- PRICE: 113-02 @ 15:13 BST Aug 16

- SUP 1: 112-11 20-day EMA

- SUP 2: 111-10+ 50-day EMA values

- SUP 3: 110-18+ Low Jul 22

- SUP 4: 110-07 Low Jul 9

A bullish theme in Treasuries remains intact, evident in the recovery off the post-data lows on Thursday. The outlook follows recent gains and this week’s early recovery is seen as a positive development. Moving average studies are in a bull-mode position and the recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for 115-17, a Fibonacci projection. The recent move down is considered corrective. Initial support to watch is 112-11, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.005 at 95.055

- Dec 24 +0.020 at 95.670

- Mar 25 +0.030 at 96.135

- Jun 25 +0.035 at 96.430

- Red Pack (Sep 25-Jun 26) +0.030 to +0.030

- Green Pack (Sep 26-Jun 27) +0.030 to +0.030

- Blue Pack (Sep 27-Jun 28) +0.025 to +0.030

- Gold Pack (Sep 28-Jun 29) +0.035 to +0.040

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00589 to 5.33568 (+0.00216/wk)

- 3M +0.02686 to 5.12841 (+0.01572/wk)

- 6M +0.05907 to 4.83969 (+0.03372/wk)

- 12M +0.10199 to 4.38660 (+0.03252/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.02), volume: $2.118T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $817B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $797B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

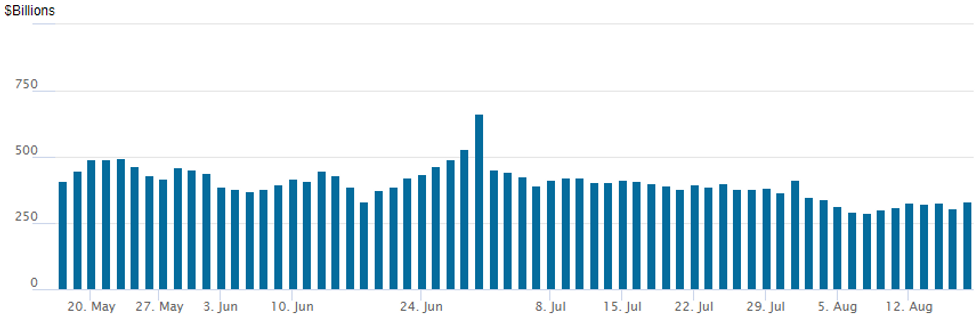

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage rebounds to $330.317B from $307.141B Thursday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties steady at 63.

EGBs-GILTS CASH CLOSE: Yields End Week On Flat Note

Bunds and Gilts surrendered early session strength by Friday's close, leaving yields relatively flat for the week.

- Core yields fell through the European morning, helped in large part by weaker oil prices diminishing inflation risk premia.

- But after bottoming out in early afternoon, Bund and Gilt yields turned higher as the week's cash trade reached a conclusion, closing the session near the highs.

- Contributing factors in the reversal included a rebound in oil and equities from session lows and stronger-than-expected US consumer sentiment data (UMichigan).

- The German curve bull steepened slightly on the day, with the UK's twist flattening.

- Periphery EGB spreads widened modestly.

- Next week's schedule includes August flash PMIs Thursday, with central bank speakers including BoE's Bailey and ECB's Lane appearing at the Fed's Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at 2.433%, 5-Yr is down 2.1bps at 2.174%, 10-Yr is down 1.6bps at 2.247%, and 30-Yr is down 1.5bps at 2.467%.

- UK: The 2-Yr yield is up 2.7bps at 3.68%, 5-Yr is up 1.8bps at 3.736%, 10-Yr is up 0.3bps at 3.926%, and 30-Yr is down 1.1bps at 4.469%.

- Italian BTP spread up 1.7bps at 138.6bps / Spanish up 1.6bps at 84.3bps

FOREX: DXY Erases Thursday’s Data Inspired Boost, USDJPY Back Below 148.00

- The US dollar slowly backtracked on the prior session gains that had been prompted by a set of firmer US retail sales and initial jobless claims data. The ongoing strength of the major equity benchmarks recovery weighed consistently on the greenback, and slightly lower US yields, added to this pessimism. The DXY is down half a percent approaching the close.

- Amid this dynamic, USDJPY retreated 1.10% on Friday, slipping back below 148 having bridged the gap to the pre-NFP levels yesterday. Overall, the bearish condition remains intact, leaving this week’s recovery as corrective in nature. Note that the downtrend remains oversold, and the latest recovery is allowing this set-up to unwind. Resistance to watch is 149.99, the 20-day EMA.

- Also capitalising on the firmer risk sentiment and pressure on the greenback was kiwi, with NZDUSD extending gains to 1.15% on the session, unwinding a large portion of the dovish RBNZ inspired decline seen Wednesday.

- Also standing out is GBP, breaking above the initial resistance at 1.2899 (a retracement level for the downleg off the cycle high), helping trigger some decent volumes via futures markets. UK retail sales was not the trigger for this morning's GBP strength (particularly as BoE pricing holds the recent range), with the currency more closely correlated to risk sentiment and global equity futures. Cross-selling via EUR/GBP also evident, as the price continues to unwind the overbought condition that resulted from the run-up to 0.8625. The 100-dma undercuts as support at 0.8511.

- FOMC Member Waller speaks Monday, however, the focus next week will be later in the week as central bankers gather at the Jackson Hole Symposium. Also, there are a host of emerging market central bank decisions.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 19/08/2024 | - |  SE SE | Riksbank Meeting | |

| 19/08/2024 | 2350/0850 | * |  JP JP | Machinery orders |

| 19/08/2024 | - |  GB GB | DMO to hold quarterly consultation investors / GEMM consultation | |

| 19/08/2024 | 1315/0915 |  US US | Fed Governor Christopher Waller | |

| 19/08/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 26 Week Bill |

| 19/08/2024 | 1530/1130 | * |  US US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.