-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Much Too Soon for Rate Cut, Hike Still Possible

- MNI INTERVIEW: Fed Not Restrictive, Might Need More Hikes-Levin

- MNI FED: Fed's Logan Says 'Much Too Soon' To Think About Rate Cuts

- MNI FED: Fed Gov Bowman Sees Chance Of More Rate Hikes

- MNI BOC WATCH: Macklem Seen Still Looking For Cut Conditions

- MNI US DATA: An All-Around Hawkish Establishment Survey Despite Some Minor Caveats

US

INTERVIEW (MNI): Fed Not Restrictive, Might Need More Hikes-Levin: U.S. inflation threatens to settle significantly above the Federal Reserve’s 2% target, making it premature for policymakers to even consider interest rate cuts and suggesting they might even need to consider additional rate increases, former Fed board economist Andrew Levin told MNI.

- Levin said monetary policy is not restrictive despite aggressive interest rate hikes because consumers' expectations of higher inflation have also become more entrenched.

- “I don’t think policy is restrictive, period. We have a pretty healthy economy, the unemployment rate is low, nominal wage growth is strong, nominal GDP has held up and housing actually seems like it’s recovering,” Levin said in an interview.

FED (MNI): Fed's Logan Says 'Much Too Soon' To Think About Rate Cuts: It's "much too soon" to consider lowering interest rates and monetary policy may not be as restrictive as many think, Federal Reserve Bank of Dallas President Lorie Logan said Friday, adding she's increasingly concerned about upside inflation risk.

- Her comments come on the heels of several Fed officials saying they're in no rush to cut after inflation reports came in firmer than expected in January and February.

- "It’s much too soon to think about cutting interest rates. I will need to see more of the uncertainty resolved about which economic path we’re on," Logan said in remarks prepared for a Duke University event in Durham, North Carolina. "And, as always, the FOMC should remain prepared to respond appropriately if inflation stops falling."

FED (MNI): Fed Gov Bowman Sees Chance Of More Rate Hikes: The Federal Reserve could need to keep interest rates on hold for longer than expected and even potentially raise them again if disinflation stalls or reverses, Governor Michelle Bowman said Friday.

- “While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse,” Bowman said in prepared remarks. (See MNI INTERVIEW: Fed Not Restrictive, Could Need To Hike More-Levin).

- Bowman said if progress on inflation resumes and looks sustainable then it may be appropriate to begin cutting interest rates at some point. But she doesn’t think conditions are in place yet and sees upside inflation risks such as geopolitics and housing.

NEWS

BOC WATCH (MNI): Macklem Seen Still Looking For Cut Conditions: Bank of Canada Governor Tiff Macklem is seen outlining that he wants durable evidence inflation is returning to target before officials can cut borrowing costs in a rate announcement Wednesday, and avoiding a direct commitment to the cut in June many investors predict as headline prices moderate.

US BIDEN (MNI): "Wages Are Going Up. Inflation Has Come Down Significantly": US President Joe Biden has issued a statement on today's jobs report, claiming that the report, "marks a milestone in America’s comeback."

US (MNI): East Coast Air Traffic Halted Following Earthquake In New Jersey: Several East Coast airports have temporarily grounded air traffic following a 4.8 magnitude earthquake at 10:23 ET 15:23 BST. The epicenter of the quake in Lebanon, New Jersey is roughly 50 miles west of Manhattan.

POLITICAL RISK (MNI): FT-US Warns Of Closer Sino-Russian Military-Industrial Links: (MNI) London - The FT is reporting that US Secretary of State Anthony Blinken has warned EU and NATO allies that China is deepening its military-industrial links with Russia, “at a concerning scale”, and providing “tools, inputs and technical expertise”. Senior US officials have ramped up communication on the issue this week.

ISRAEL (MNI): Ministry Of Justice Hit By 'Large-Scale' Cyberattack-INN: INN reportingthat the Israeli Justice Minsitry has confirmed that it has been targeted by a large-scale cyberattack. INN: "The Ministry of Justice stated that "the Ministry prepared ahead of time for this type of scenario and the matter was immediately reported to the relevant authorities.

SECURITY (MNI): Prospect Of Ceasefire Agreement Increases After Biden's 'Ultimatum': White House National Security Council spokesperson John Kirby has hinted to reporters that the US expects more positive developments from Hamas/Israel ceasefire talks in Cairo, Egypt this weekend.

MIDEAST (MNI): Iran Response Eyed After Funerals Of 7 IRGC Killed In Embassy Strike: The funerals of seven Islamic Revolutionary Guards Corps (IRGC) officers killed in a strike on the Iranian consulate in Damascus, Syria, have taken place in Tehran. Iran has laid the blame for the strike at Israel's feet, with the Israeli gov't neither confirming nor denying its involvement.

EU COMMISSION (MNI): Cabinet Chief's Move To VdL Campaign Signals Stasis Until EP Vote: The European Commission has confirmed that Head of Cabinet of the President of the European Commission Bjoern Seibert will take unpaid leave from his position in order to head Commission President Ursula von der Leyen's campaign for a second term in office.

SLOVAKIA (MNI): Presidential Election Comes Down To The Wire: The Slovakian presidential election is set to go down to the wire, with the final opinion polling ahead of the 6 April second round run-off showing former PM Peter Pellegrini and former Foreign Minister Ivan Korcok level-pegging.

US TSYS Back Near Post Jobs Low, Technical Support Holds

- Treasury futures gapped lower after higher than expected March employment data showed job surge of 303k vs. 214k est, 275k prior down revised to 270k.

- Balance of data: Private Payrolls (232k vs 170k est); Unemployment Rate (3.8% vs. 3.8% est vs. 3.9% prior), Average Hourly Earnings MoM (0.3% vs. 0.3% est), YoY (4.1% vs. 4.1% est), Labor Force Participation Rate (62.7% vs. 62.6% est).

- Jun'24 10Y futures gapped to a post-data low of 109-15 (-21; yield 4.3996% high) - near initial technical support of 109-09.5 (Apr 03 low). Futures dew short cover/position squaring support that saw TYM4 climb back to 109-30 in late morning trade before settling back near session lows after the Feb Consumer Credit came out lower than expected at $14.1B vs. $15B, prior down-revised to $17.684B from $19.495B.

- The strong jobs data sapped rate cut expectations in the near term: May 2024 at -5.7bp vs -9.8% pre-data w/ cumulative -1.4bp at 5.312%; June 2024 at -52.4% vs -59.6% earlier w/ cumulative rate cut -14.5bp at 5.181%. July'24 cumulative at -24.9bp vs -28.9bp earlier, Sep'24 cumulative -41.3bp vs. -45.1bp earlier.

- Slow start to next week, focus on CPI and March FOMC minutes on Wednesday, PPI on Thursday.

OVERNIGHT DATA

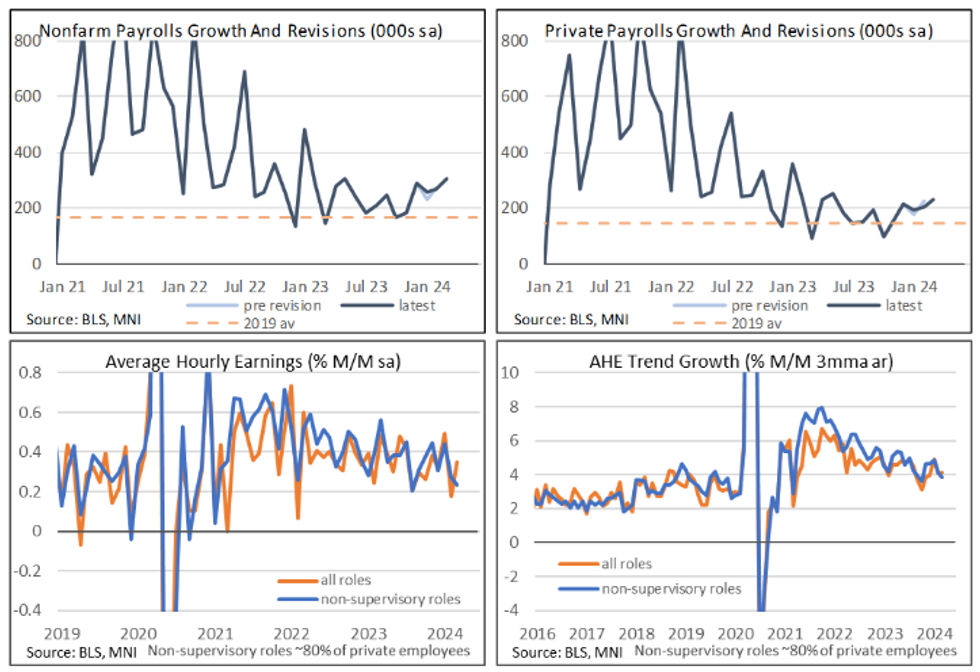

US DATA (MNI): An All-Around Hawkish Establishment Survey Despite Some Minor Caveats: Overall NFP growth far stronger than expected at 303k (cons 214k) in March along with a small net upward revision of 22k (-5k in Feb but +27k in Jan).

- The private data again take the gloss off the beat though, with a slightly smaller beat (232k vs cons 170k) and a two-month revision of only +3K including -16k for Feb.

- As above, AHE was on the strong side of expectations at 0.347% (cons 0.3) after an upward revised 0.174 (initial 0.145).

- That’s despite stronger than expected average hours worked at 34.4 (cons 34.3) even if the latter sticks to its 34.3-34.4 range seen in all but one month since Mar’23.

- The non-supervisory category was a little softer however at 0.24% after 0.27% M/M and sees a softer trend.

- Latest three-month trends 4.1% annualized for AHE, 3.8% for non-supervisory.

US DATA (MNI): AHE Unrounded - Mar'24: A 'high' 0.3% for AHE but non-supervisory lower

- Total AHE: M/M (SA): 0.347% in Mar (cons 0.3) from 0.174% in Feb (initial 0.145%)

- Y/Y (SA): 4.143% in Mar from 4.284% in Feb

- AHE Non-Supervisory: M/M (SA): 0.236% in Mar from 0.27% in Feb (initial 0.236%)

- Y/Y (SA): 4.234% in Mar from 4.574% in Feb

US DATA (MNI): Unemployment Rate As Expected As Rebounding Employment Met By Labor Force Surge: The u/e rate was very much as expected at 3.83% (cons median 3.8, av 3.83) in March having increased 0.2pps to 3.86% in Feb.

- Household employment volatile continues, surging 498k after three heavy monthly declines and most recently -184k in Feb.

- Labor force jumps another +469k after +150k in Feb in another sign of strong labor supply.

- Strong increase in the labor participation rate to 62.67 (cons 62.6) after 62.54%, but it remains below the recent highs of 62.8%.

CANADA DATA (MNI): Canada March unemployment +0.3 pp to 6.1% versus 5.9% expected as the labour force expanded by +57.7K. Employment -2.2K vs -20.4K expected with mild decreases in both full and part time jobs. Average hourly wages still elevated, rising +5.1% YOY after +5% in Feb.

- The employment rate fell by almost a percentage point from the year before and posted its 6th consecutive decrease. Employment growth has been outpaced by annual population growth of +3.2%, the fastest since 1957.

- The proportion of workers who were unemployed in the current month and the month before increased by +4.4 pp in March compared to Feb.

- Average hours worked were unchanged in March, but up +0.7 YOY.

- The Jobs Report is the last major release before the BoC's interest-rate decision on the 10th of April.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 307.77 points (0.8%) at 38906.52

- S&P E-Mini Future up 52 points (1%) at 5249.25

- Nasdaq up 182.6 points (1.1%) at 16231.83

- US 10-Yr yield is up 8.2 bps at 4.3916%

- US Jun 10-Yr futures are down 19/32 at 109-17

- EURUSD down 0.0003 (-0.03%) at 1.0834

- USDJPY up 0.27 (0.18%) at 151.61

- WTI Crude Oil (front-month) up $0.16 (0.18%) at $86.75

- Gold is up $30.21 (1.32%) at $2321.25

- European bourses closing levels:

- EuroStoxx 50 down 56.01 points (-1.1%) at 5014.75

- FTSE 100 down 64.73 points (-0.81%) at 7911.16

- German DAX down 228.09 points (-1.24%) at 18175.04

- French CAC 40 down 90.24 points (-1.11%) at 8061.31

US TREASURY FUTURES CLOSE

- 3M10Y +6.627, -99.187 (L: -109.084 / H: -97.421)

- 2Y10Y -1.251, -35.264 (L: -35.81 / H: -30.469)

- 2Y30Y -2.445, -20.032 (L: -20.763 / H: -15.587)

- 5Y30Y -1.708, 15.979 (L: 14.778 / H: 18.573)

- Current futures levels:

- Jun 2-Yr futures down 6.375/32 at 101-31.875 (L: 101-31.625 / H: 102-06.5)

- Jun 5-Yr futures down 13/32 at 106-8.5 (L: 106-07.75 / H: 106-22.25)

- Jun 10-Yr futures down 19/32 at 109-17 (L: 109-15 / H: 110-05.5)

- Jun 30-Yr futures down 33/32 at 117-12 (L: 117-01 / H: 118-15)

- Jun Ultra futures down 50/32 at 124-18 (L: 124-08 / H: 126-09)

US 10Y FUTURE TECHS: (M4) Trend Direction Remains Down

- RES 4: 111-24 High Mar 12

- RES 3: 111-10+ High Mar 13

- RES 2: 110-25+/31+ 50-day EMA / High Mar 27 and key resistance

- RES 1: 110-14 20-day EMA

- PRICE: 109-29+ @ 11:06 GMT Apr 05

- SUP 1: 109-09+ Low Apr 03

- SUP 2: 109-09 Lower 1.0% 10-dma envelope

- SUP 3: 109-00 Round number support

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

A bearish theme in Treasuries remains intact and signals scope for an extension lower near-term. The move through 109.24+, the Mar 18 low and a bear trigger has confirmed a resumption of this year's downtrend. Attention is on the 109-00 handle and a break of this level would open 108-25+, a Fibonacci projection level. Key short-term resistance has been defined at 110-31+, the Mar 27 high. First resistance is 110-15, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.055 at 94.830

- Sep 24 -0.075 at 95.070

- Dec 24 -0.095 at 95.325

- Mar 25 -0.110 at 95.560

- Red Pack (Jun 25-Mar 26) -0.135 to -0.12

- Green Pack (Jun 26-Mar 27) -0.11 to -0.085

- Blue Pack (Jun 27-Mar 28) -0.08 to -0.075

- Gold Pack (Jun 28-Mar 29) -0.07 to -0.07

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00306 to 5.31846 (-0.01028/wk)

- 3M -0.00845 to 5.29339 (-0.00484/wk)

- 6M -0.01858 to 5.22034 (+0.00253/wk)

- 12M -0.02836 to 5.03107 (+0.03125/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.974T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $710B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $697B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $256B

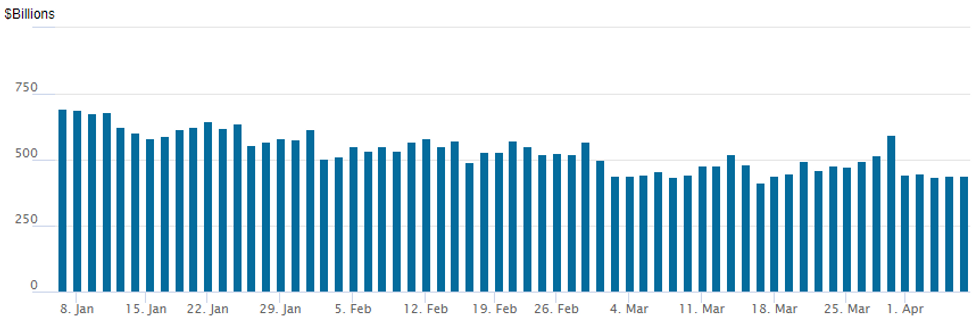

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches lower to $438.319B vs $438.764B on Thursday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 67 vs. 66 yesterday - lowest number of counterparties since July 7, 2021.

PIPELINE: $38.5B US$ Corporate Bond Issuance on the Week

$1.1B Priced Thursday, $38.5B/wk- Date $MM Issuer (Priced *, Launch #)

- 4/4 $600M #Brighthouse Financial Global 3Y +105

- 4/4 $500M #Development Bank of Kazakhstan (DBK) 3Y 5.6% (in conjunction with KZT500B 3Y yielding 13.25%)

EGBs-GILTS CASH CLOSE: Strong US Job Gains Seal Weekly Losses

European curves bear steepened Friday, with strong US payrolls data exacerbating weakness already evident earlier in the session.

- While global core FI was bid overnight on Israel-Iran tensions, Gilts and Bunds began retracing in morning European trade as the geopolitical risk premium faded.

- Stronger-than-expected US job gains alongside robust hourly earnings triggered a sharp sell-off in Treasuries that spilled over into Europe.

- Bunds outperformed Gilts, while EGB periphery spreads finished slightly wider of Bunds.

- 10Y Gilts saw their biggest weekly yield rise since early February (+13.6bp), while Bund yields were up 10.1bp on the week.

- In data, German factory orders were very weak, with industrial production mixed across France (soft) and Spain (strong). Meanwhile Eurozone retail sales posted a negative Y/Y outturn for the 17th consecutive month.

- Next week, the ECB meeting will take centre stage - with the communications ahead of the presumptive June rate cut decision looming large. MNI's Policy Team cited Eurosystem sources portraying an ECB divided over guidance as it nears the first cut.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 2.875%, 5-Yr is up 2.5bps at 2.39%, 10-Yr is up 3.8bps at 2.399%, and 30-Yr is up 3.9bps at 2.57%.

- UK: The 2-Yr yield is up 3.8bps at 4.224%, 5-Yr is up 4.4bps at 3.923%, 10-Yr is up 4.8bps at 4.069%, and 30-Yr is up 4.5bps at 4.577%.

- Italian BTP spread up 3.3bps at 141.8bps / Spanish up 0.6bps at 83.5bps

FOREX USD's NFP Surge Proves Short-Lived as NY Earthquake Undermines Yield Spike

- The USD surged in the initial response to the solid US jobs report, within which both the headline job gains and average hourly earnings topped market expectations.

- The market response was to shift back pricing of the first FOMC rate cut this year, which is now fully priced for the July meeting, and broadly 50/50 for the June decision. This pressed USD higher, keeping the USD/JPY pressure tilted to the upside, however the rally stopped short of any material test on the cycle high posted midweek at 151.95.

- Greenback strength was short-lived however, after the once-in-a-quarter century earthquake in New Jersey prompted buildings to shake across Manhattan and New York. The grounding of aircraft and concerns over infrastructure prompted a backtrack in US yields - weakening the dollar.

- Aggressive rhetoric from Hezbollah on possible retaliation toward Israel for the strikes on the Iranian consulate in Damascus aided the flight to quality, further buoying the bounce across the major pairs. EUR/USD and GBP/USD swiftly erased the post-NFP dips ahead of the London close.

- Focus in the coming week shifts to the ECB rate decision - at which the bank are expected to stand pat on policy as the governing council awaits more labour market and price data ahead of the more live meeting in June - toward which consensus has begun to look for a first rate cut of the cycle.

- Ahead of that decision, markets get March CPI numbers from the US, and another step lower for price pressures is expected. Y/Y Core CPI is seen slowing to 3.7% from 3.8%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2024 | 2301/0001 |  | UK | KPMG-REC Jobs Report | |

| 08/04/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 08/04/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/04/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 08/04/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 08/04/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/04/2024 | 1530/1630 |  | UK | BOE's Breeden Panellist at 'Towards the future of the monetary system' | |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.