-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA OPEN: Powell Pushback on Easing Conditions Ignored

EXECUTIVE SUMMARY

US

FED: The Federal Reserve on Wednesday raised interest rates by half a percentage point to its highest level since 2007, and indicated further monetary tightening is in store, with policymakers raising their end of 2023 median funds rate estimate up to 5.1% from 4.6% in September.

- Officials raised their PCE inflation views for this year and next to 5.6% and 3.1% respectively, while downgrading their growth forecasts for 2023 to 0.5% from 1.2%.

- FOMC officials repeated in their post-meeting statement their expectation that "ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time."

- Fed Chair Jerome Powell will soon face questions from reporters about how convinced he is by the recent softening of inflation. The November CPI report showed a still-elevated headline inflation reading of 7.1% on the year, but that was down from a cycle peak of 9.1% in June.

- Some of this was the focus on a stepdown to 25bp hikes at the Feb meeting, and Powell's comfort that "our policy is getting into a pretty good place now". And some was the fact that Powell didn't change the apparently achievable goalposts on inflation he first mentioned at Brookings (goods, svcs, housing).

- Have seen some comments that Powell didn't push back forcefully on the recent easing of financial conditions, but the fact that including the following in his opening statement suggests otherwise: "Over the course of the year, financial conditions have tightened significantly in response to our policy actions. Financial conditions fluctuate in the short-term in response to many factors. But it is important that over time, they reflect the policy restraint that we're putting in place to return inflation to 2%."

- Yes, he said "our focus is not on short-term moves but persistent moves and many, many things of course move financial conditions over time", but that suggests that if financial conditions remain looser into next year, the Fed may push even more forcefully against it.

- There were some mixed takeaways from individual categories, but the main one is that all three major components of core (goods, shelter, and non-shelter services) moderated.

- In particular, after emphasis from Chair Powell, core services ex housing pointed to a further sequential moderation across different measures, although no official series adds to a risk of misinterpretation.

- The FOMC should still hike 50bp today but watch for a more dovish tilt plus the distribution of 2023 dots. Markets eagerly watch for a steer towards a further downshift in Feb but labor data could hold the key.

EUROPE:

EU: Talks on reforming the European Union’s rules on public borrowing and debt are in stalemate, raising the prospect of a temporary return to the old Stability and Growth Pact in 2024, EU officials told MNI.

- German Finance Minister Christian Lindner has been “extremely critical” of a European Commission Orientation Paper which had been meant to pave the way towards a joint legislative proposal on reform but which Berlin sees as too lenient with high-debt countries, officials said.

- “The finance ministers were still very far apart,” one official said, speaking after a recent meeting. Another official said: “Lindner objected to a number of things in the [Commission] paper, and then he left the meeting.” For more see MNI Policy main wire at 0937ET.

UK

BOE: The fall in UK inflation to 10.7% in November from 11.1% in October suggests the headline data may have peaked but signs of domestically-generated price increases and sticky service sector dynamics means there is little to change the outlook for more near-term Bank of England rate hikes, Resolution Foundation senior economist Jack Leslie told MNI.

- Leslie, a former Bank of England economist, said the string of upside inflation surprises now appear to be behind us and that it was encouraging that expectations for price increases had dipped, but services sector inflation was always going to be more persistent and the latest data would not prompt any fundamental reappraisal from the BOE’s Monetary Policy Committee, widely expected to hike by 50 basis points on Thursday.

- "I don't think it massively changes where they thought the economy would be at this point. I think it is consistent with there still (being) quite a lot of domestically-generated inflation pressure and that is why they are going to continue raising interest rates in the near-term," Leslie said.

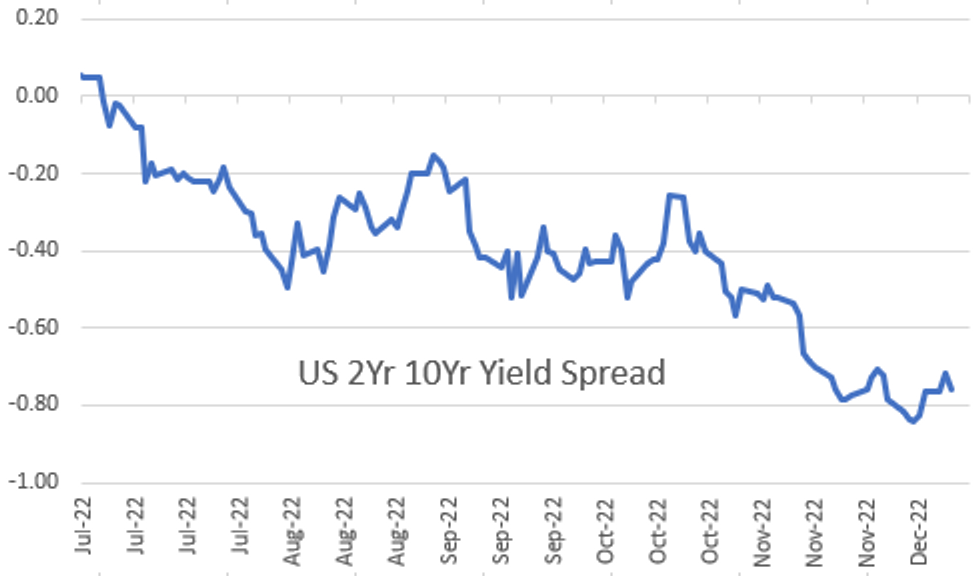

US TSYS: Bonds Extending Highs

Bonds leading Tsy futures higher after the bell, 30YY tapped 3.5154% low before bouncing to 3.5202% at the moment. Short end still lagging w/ yield curves flatter but off lows as Fed Chairman Powell ends his press conference Q&A session. 2s10s currently -2.576 at -74.909.- Bonds initially lead the bounce back above pre-FOMC levels as Fed Chairman Powell answered question over size and pace of future hikes to bring inflation back to 2%. After raising 425bp this year, Powell said "we're into restrictive territory, it's now not so important how fast we go. It's far more important to think what is the ultimate level and then at a certain point, the question will become how long do we remain restrictive."

- Trying to anticipate another step-down in rate hikes, pundits working themselves into knots over best estimate "as of today" comment as opening the door to a 25bp hike in early 2023 if inflation data continues to soften.

- Stocks slower to react, did rebound to mildly higher by the FI close are weaker, holding inside session range: ESH3 -40.0 at 4015.0.

OVERNIGHT DATA

- US NOV IMPORT PRICES -0.6%

- US NOV EXPORT PRICES -0.3%; NON-AG -0.6%; AGRICULTURE +2.3%

- CANADIAN OCT MANUFACTURING SALES +2.8% MOM

- CANADA OCT FACTORY INVENTORIES +0.3%; INVENTORY-SALES RATIO 1.68

MARKETS SNAPSHOT

Key late market levels:

- DJIA down 142.29 points (-0.42%) at 33987.93

- S&P E-Mini Future down 17.5 points (-0.43%) at 4033

- Nasdaq down 85.9 points (-0.8%) at 11176.21

- US 10-Yr yield is down 2.9 bps at 3.4719%

- US Mar 10Y are up 5.5/32 at 114-30.5

- EURUSD up 0.0051 (0.48%) at 1.0681

- USDJPY down 0.3 (-0.22%) at 135.21

- WTI Crude Oil (front-month) up $1.99 (2.64%) at $77.40

- Gold is down $2.89 (-0.16%) at $1806.69

- EuroStoxx 50 down 11.57 points (-0.29%) at 3975.26

- FTSE 100 down 6.96 points (-0.09%) at 7495.93

- German DAX down 37.69 points (-0.26%) at 14460.2

- French CAC 40 down 14.19 points (-0.21%) at 6730.79

US TSY FUTURES CLOSE

- 3M10Y -0.181, -87.768 (L: -98.936 / H: -82.129)

- 2Y10Y -3.359, -75.692 (L: -77.576 / H: -65.961)

- 2Y30Y -2.16, -71.382 (L: -75.785 / H: -59.826)

- 5Y30Y +0.889, -10.96 (L: -16.004 / H: -5.285)

- Current futures levels:

- Mar 2Y up 0.125/32 at 103-0.875 (L: 102-27.5 / H: 103-05.5)

- Mar 5Y up 3.25/32 at 109-15.25 (L: 109-01.75 / H: 109-19.75)

- Mar 10Y up 3.5/32 at 114-28.5 (L: 114-08 / H: 115-02)

- Mar 30Y up 5/32 at 131-12 (L: 130-10 / H: 131-22)

- Mar Ultra 30Y up 7/32 at 144-5 (L: 142-24 / H: 144-25)

US 10YR FUTURE TECHS: (H3) Trend Signal Still Bullish

- RES 4: 116-12 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-11+ High Dec 13

- PRICE: 114-25 @ 1200ET Dec 14

- SUP 1: 113-22+/113-08+ Low Dec 122 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures rallied Tuesday. The move higher resulted in a print above resistance at 115-06+, the Dec 7 high and the bull trigger. A clear break of this resistance would confirm a resumption of the current uptrend and pave the way for a climb towards 115-26, a Fibonacci projection. On the downside, key short-term support has been defined at 113-22+, the Dec 12 low. A reversal lower and a break of this level would threaten bullish conditions.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.005 at 95.260

- Mar 23 -0.010 at 94.955

- Jun 23 -0.020 at 94.930

- Sep 23 +0.010 at 95.120

- Red Pack (Dec 23-Sep 24) +0.030 to +0.040

- Green Pack (Dec 24-Sep 25) +0.040 to +0.050

- Blue Pack (Dec 25-Sep 26) +0.025 to +0.040

- Gold Pack (Dec 26-Sep 27) +0.015 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00200 to 3.81586% (-0.00214/wk)

- 1M +0.00843 to 4.32629% (+0.05600/wk)

- 3M -0.03271 to 4.73629% (+0.00315/wk)*/**

- 6M -0.08042 to 5.12529% (-0.01442/wk)

- 12M -0.14443 to 5.40686% (-0.09257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $100B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.051T

- Broad General Collateral Rate (BGCR): 3.76%, $412B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $391B

- (rate, volume levels reflect prior session)

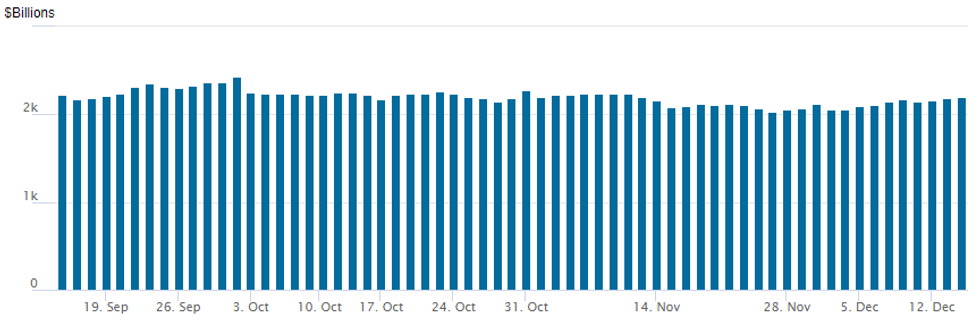

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,192.864B w/ 97 counterparties vs. $2,180.676B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE

High-grade corporate bond issuance remains absent ahead the final FOMC policy announcement of 2022.

EGBs-GILTS CASH CLOSE: UK Short End Gains With Central Bank Moves Eyed

German and UK yields were mostly lower Wednesday, though there was some weakness evident further down curves and in periphery EGBs ahead of multiple major central bank decisions.

- The UK short-end outperformed following weaker-than-expected CPI data this morning pull down terminal BoE rate hike pricing (4.56%, back to last Friday's levels pre-wage data).

- Periphery EGB spreads continue to widen from their knee-jerk post US-CPI narrowing, with one eye on Thursday's ECB decision that could include details on balance sheet runoff plans.

- Immediate post-cash close attention is on the US Fed decision; market pricing for the BoE and ECB rate hikes Thursday is firmly on 50bp increases.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at 2.133%, 5-Yr is down 1.1bps at 1.933%, 10-Yr is up 1.5bps at 1.94%, and 30-Yr is up 9.2bps at 1.844%.

- UK: The 2-Yr yield is down 6.8bps at 3.451%, 5-Yr is down 4.7bps at 3.297%, 10-Yr is up 1.4bps at 3.315%, and 30-Yr is down 2bps at 3.696%.

- Italian BTP spread up 5bps at 192.6bps / Spanish up 2.2bps at 103.2bps

FOREX: Initial Greenback Strength Reverses, USD Set To Extend Downtrend

- An initial reaction higher in US yields and lower equities boosted the greenback with the USD index surging back to unchanged on the day, rising roughly 0.4% upon the FOMC statement release. However, throughout the press conference, this early optimism was faded and the USD index (-0.48%) is making fresh lows as we approach the APAC crossover.

- It appears that Powell’s remarks were unable to deter market participants from the most recent USD weakening trend following yesterday’s weaker than expected US CPI report.

- Despite the roughly 100 pip bounce for USDJPY, Tuesday's move lower signalled the end of the recent corrective phase that started on Dec 2 and the subsequent reversal potentially bolsters the likelihood of a continuation lower, opening 133.63, the Dec 2 low and bear trigger.

- A break of this level would confirm a resumption of the current downtrend and pave the way for a move towards 132.56, the Aug 15 low. The 20-day EMA, at 138.31, remains the first key short-term resistance.

- There are no standout performers across G10, with EUR, GBP and CHF all rising around a half a percent with the focus immediately turning to important central bank decisions on Thursday, including the Norges Bank, the SNB, the BOE and the ECB.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/12/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 15/12/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/12/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/12/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/12/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/12/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/12/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 15/12/2022 | 0830/0930 |  | CH | SNB interest rate decision | |

| 15/12/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 15/12/2022 | - |  | IE | Ireland Prime Minister Transition | |

| 15/12/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 15/12/2022 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 15/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 15/12/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 15/12/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/12/2022 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 15/12/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/12/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 15/12/2022 | 1500/1000 | * |  | US | Business Inventories |

| 15/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/12/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 15/12/2022 | 2100/1600 | ** |  | US | TICS |

| 16/12/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.