-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Powell Threads Policy Needle, Focus on Thu CPI

- MNI FED BRIEF: Fed's Powell: Looking For More Good Inflation Data To Cut

- MNI FED BRIEF: Fed's Powell: Further Rate Hikes Unlikely As Job Market Cools

- MNI US CPI Preview: More “Modest” Progress Within Wider Tails

US

US FED BRIEF (MNI): Fed's Powell -- Looking For More Good Inflation Data To Cut

The Federal Reserve will gain the confidence needed to start cutting interest rates if it sees more good inflation data, Chair Jerome Powell said Tuesday, boosting hopes that the U.S. central bank will lowering borrowing costs soon.

- "The Committee has stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2%.

- "Incoming data for the first quarter of this year did not support such greater confidence. The most recent inflation readings, however, have shown some modest further progress, and more good data would strengthen our confidence that inflation is moving sustainably toward 2%," Powell said in remarks prepared for his semiannual testimony to the U.S. Senate.

US FED BRIEF (MNI): Fed's Powell: Further Rate Hikes Unlikely As Job Market Cools

U.S. interest rates are likely to fall from here as the labor market has cooled, Federal Reserve Chair Jerome Powell said Tuesday, all but ruling out further rate hikes.

- "It doesn't seem likely that the next policy move would be a rate increase," he told the Senate Banking Committee. "We don't take things like that off the table, but that does not seem the likely direction. The likely direction does seem to be: as we make more progress in inflation, and as a labor market remains strong, we begin to loosen policy at the right moment."

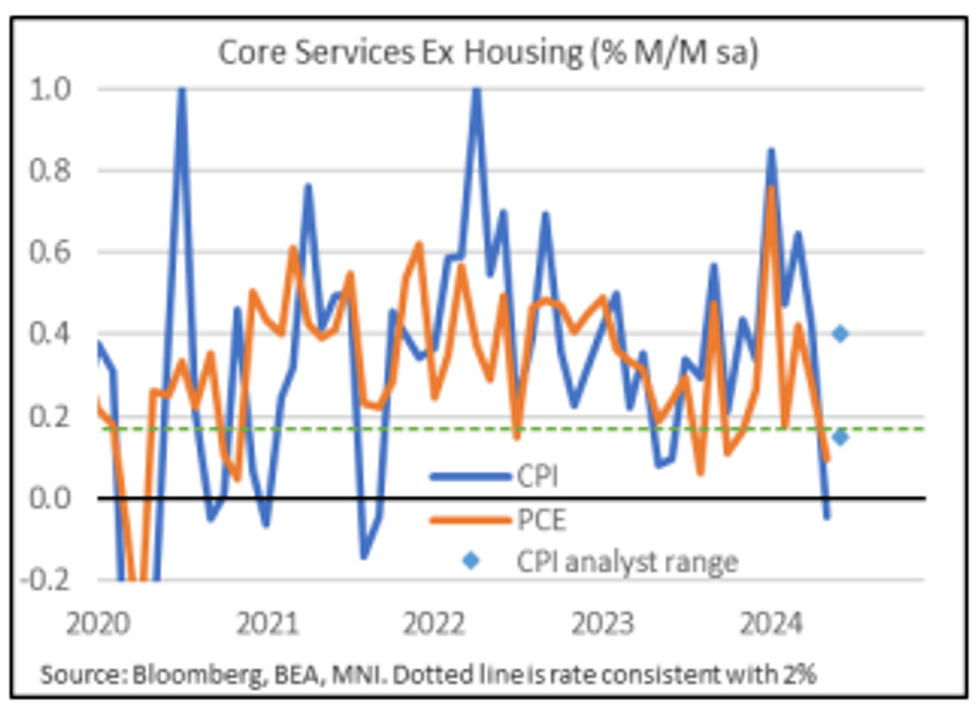

US CPI DATA VIEW (MNI): More “Modest” Progress Within Wider Tails

Consensus sees core CPI at 0.2% M/M in June after the softer than expected 0.16% M/M in May (vs cons 0.3), with a mild skew toward a “high” 0.2%, per MNI’s compilation of sell-side previews.

- But there is an unusually wide range of estimates for core this month. Uncertainty over some categories (eg auto insurance) means that a surprise reading in either direction should be interpreted with caution.

- That may prove especially true for the “supercore’ reading, which is expected to bounce from May’s slightly negative M/M print, to 0.27% (MNI sell-side average), but with a wide range of estimates

NEWS

US NSA Sullivan (MNI): Every NATO Ally To Strengthen Industrial Capacity

Wires carrying comments from White House National Security Advisor Jake Sullivan stating that, "every NATO ally [will] pledge to develop plans to strengthen their industrial capacity," during this week's NATO leaders' summit in Washington, D.C. Sullivan says that NATO is, "committed to standing with Ukraine in the long term," and notes that Russian President Vladimir Putin, "cannot divide us, he cannot outlast us or weaken us."

RUSSIA (MNI): INDIA-Modi/Putin Talks 'Constructive': Kremlin:

State-run RIA carrying comments following Russian President Vladimir Putin's meeting with Indian PM Narendra Modi in Moscow. Kremlin spox Dmitry Peskov says the two leaders 'had constructive discussions on Ukraine', adding that 'Modi does not intend to take on a mediating role in resolving the situation in Ukraine; everyone is exchanging opinions, and new ideas emerged as a result of the discussion.'

ISRAEL (MNI): Gov't Risks Splits As Def Sec. To Start Haredi Draft Next Month:

Defence Minister Yoav Gallant has confirmed that the Israeli Defence Forces (IDF) will begin drafting eligible men from the ultra-Orthodox Haredi community from next month. This follows a ruling from the High Court in June that ordered the universal draft of previously-exempt Haredi men and the withdrawal of funds from institutions that do not obey the Court's order.

IRAN (MNI): Pezeshkian Election Unlikely To Radically Alter Iran's Policy Stances:

The election of reformist candidate Masoud Pezeshkian as Iran's next president has seen a flurry of speculation about the potential impact a change in leadership could have on Iran's political landscape, its foreign relations, and the broader regional outlook.

US Tsys Hold Range as Chair Powell Threads Policy Needle at Testimony

- Treasury futures look to finish near where they started Tuesday's session, mildly weaker after some brief volatility tied to Fed Chairman Powell's semi-annual monetary policy report to the Senate (testimony to the House tomorrow).

- Futures initially gapped higher (TYU4 up to 110-18) in reaction to more dovish comments: "It doesn't seem likely that the next policy move would be a rate increase," he told the Senate Banking Committee. "We don't take things like that off the table, but that does not seem the likely direction. The likely direction does seem to be: as we make more progress in inflation, and as a labor market remains strong, we begin to loosen policy at the right moment."

- Support quickly evaporated as Powell stated the "Committee has stated that we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2%."

- Treasuries extended session lows by midmorning but traded back near opening levels after the London close.

- Treasury 10Y futures pare losses slightly (TYU4 110-12, -7) after $58B 3Y note auction (91282CKZ3) stops .6bp through: 4.399% high yield vs. 4.405% WI; 2.67x bid-to-cover vs. 2.43x prior.

OVERNIGHT DATA

US REDBOOK: JUL STORE SALES +5.7% V YR AGO MO

US REDBOOK: STORE SALES +6.3% WK ENDED JUL 06 V YR AGO WK

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 52.82 points (-0.13%) at 39291.97

- S&P E-Mini Future up 6.5 points (0.12%) at 5631.75

- Nasdaq up 25.6 points (0.1%) at 18429.29

- US 10-Yr yield is up 1.6 bps at 4.2939%

- US Sep 10-Yr futures are down 4.5/32 at 110-14.5

- EURUSD down 0.0009 (-0.08%) at 1.0815

- USDJPY up 0.45 (0.28%) at 161.27

- WTI Crude Oil (front-month) down $0.76 (-0.92%) at $81.58

- Gold is up $5.88 (0.25%) at $2365.03

- European bourses closing levels:

- EuroStoxx 50 down 66.21 points (-1.33%) at 4903.62

- FTSE 100 down 53.68 points (-0.66%) at 8139.81

- German DAX down 235.86 points (-1.28%) at 18236.19

- French CAC 40 down 118.79 points (-1.56%) at 7508.66

US TREASURY FUTURES CLOSE

- 3M10Y +2.296, -107.794 (L: -112.5 / H: -103.685)

- 2Y10Y +2.612, -32.826 (L: -35.424 / H: -31.903)

- 2Y30Y +3.49, -13.317 (L: -16.971 / H: -12.459)

- 5Y30Y +2.616, 24.807 (L: 22.167 / H: 25.447)

- Current futures levels:

- Sep 2-Yr futures down 0.375/32 at 102-9.25 (L: 102-07.125 / H: 102-09.625)

- Sep 5-Yr futures down 2.25/32 at 106-30 (L: 106-25 / H: 106-31.75)

- Sep 10-Yr futures down 4.5/32 at 110-14.5 (L: 110-07 / H: 110-18)

- Sep 30-Yr futures down 16/32 at 118-16 (L: 118-01 / H: 118-30)

- Sep Ultra futures down 24/32 at 125-15 (L: 124-27 / H: 126-05)

US 10Y FUTURE TECHS: (U4) Trading Below Key Short-Term Resistance

- RES 4: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-13 High Mar 25

- RES 2: 111-01 High Jun 14 and the bull trigger

- RES 1: 110-20+ High Jul 08

- PRICE: 110-13.5 @ 1545 ET Jul 9

- SUP 1: 109-28 50-day EMA

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-20+ Trendline drawn from the Apr 25 low

Treasuries are trading closer to their recent highs, however, key short-term resistance at 111-01 - the June 14th high, remains intact for now. A bear threat is present while this resistance holds. A resumption of weakness would refocus attention on 109-02+, the Jul 1 low, ahead of 109-00+, the Jun 10 low. For bulls, clearance of 111-01 would instead resume the uptrend that started Apr 25.

SOFR FUTURES CLOSE

- Sep 24 -0.010 at 94.870

- Dec 24 -0.010 at 95.20

- Mar 25 -0.005 at 95.530

- Jun 25 -0.005 at 95.805

- Red Pack (Sep 25-Jun 26) -0.005 to steady

- Green Pack (Sep 26-Jun 27) -0.015 to -0.01

- Blue Pack (Sep 27-Jun 28) -0.03 to -0.02

- Gold Pack (Sep 28-Jun 29) -0.035 to -0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00006 to 5.32637 (-0.00106/wk)

- 3M -0.00059 to 5.30404 (-0.00285/wk)

- 6M -0.00596 to 5.20850 (-0.01797/wk)

- 12M -0.01535 to 4.95593 (-0.04956/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $2.090T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $772B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $758B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $80B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $252B

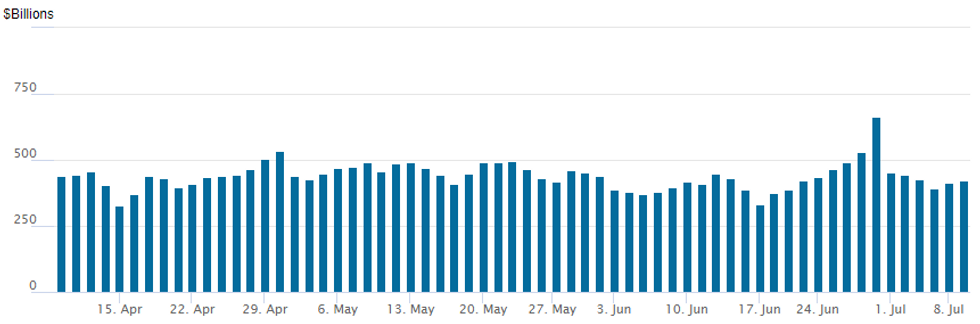

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $423.152B from $415.257B Monday. Number of counterparties to 73 from 72 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $750M Bank of Montreal 60NC10 Launched

- Date $MM Issuer (Priced *, Launch #)

- 7/9 $2.5B *IADB 10Y SOFR+56

- 7/9 $1.5B #Turkiye 8Y 7.3%

- 7/9 $1.5B #JBIC 3Y SOFR+44

- 7/9 $1B *CCB HK 3Y SOFR+55

- 7/9 $750M #Bank of Montreal 60NC10 7.3%

- 7/9 $Benchmark TD Bank 3Y SOFR+63a

- 7/8 $500M #Panasonic 10Y +100

- 7/8 $Benchmark Saudi Aramco 10Y, 30Y, 40Y investor calls

EGBs-GILTS CASH CLOSE: Weaker, With France Leading Spread Widening

European yields rose Tuesday, with risk spreads widening.

- While we heard from a few ECB speakers, including Centeno and Nagel, commentary didn't move markets, and there was little in the way of relevant macro data. Supply potentially weighed on the space, including syndications of E9bln of EU Bond and GBP4.5bln of Gilt linker.

- Both the German and UK curves bear steepened on the day, with Gilts modestly underperforming Bunds at the longer end of the curve.

- With French fiscal/political risk concerns appearing to re-emerge after Monday's post-election relief rally, OAT/Bund spreads are back at last Thursday's closing level after widening over 4bp.

- That led overall EGB spread widening, with periphery spreads up 1-2bp.

- Wednesday's calendar is highlighted by BoE speakers Pill and Mann, with the week's primary focus being Thursday's US CPI release (preceded by UK GDP).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.8bps at 2.924%, 5-Yr is up 3.5bps at 2.562%, 10-Yr is up 4bps at 2.58%, and 30-Yr is up 4.2bps at 2.74%.

- UK: The 2-Yr yield is up 0.3bps at 4.128%, 5-Yr is up 3.5bps at 4%, 10-Yr is up 4.6bps at 4.159%, and 30-Yr is up 4.7bps at 4.664%.

- Italian BTP spread up 1.4bps at 136.2bps / Spanish up 1.4bps at 77.7bps

FOREX Greenback Edges Higher Post Powell, Focus on CPI Thursday

- Fed Chair Powell's semiannual testimony provided little really new information versus last week's communications. The recent rise in the unemployment rate has not met the FOMC's cutting "test" of unexpected weakness in the labour market and this may have provided a moderate boost to the greenback on Tuesday. As such, the USD index is up 0.15% approaching the close, however, G10 ranges overall have remained subdued.

- Price action did allow USDJPY to edge higher and is the best performing major pair. USDJPY briefly rose above 161.40 - the Friday high and further progress through here will confirm the pullback off the multi-decade high as corrective in nature, and bring new cycle highs and Japanese intervention back into question.

- JPY selling in the crosses helped to add to the move, with EUR/JPY falling just shy of fresh multi decade highs, adding extra pressure to the JPY trade-weighted index.

- AUD net positioning continued to rise in the latest CFTC report, reducing the AUD net short to 8% of open interest, the smallest net short in a year. Indeed, AUDUSD bullish conditions remain intact following the recent break of key short-term resistance at 0.6714, the May 16 high. This highlights a significant range breakout and confirms a resumption of the bull leg that started Apr 19. A continuation higher would open 0.6771 next, the Jan 3 high and 0.6839, the Jan 02 high.

- Given the proximity to tomorrow’s RBNZ meeting, AUDNZD will be in focus, a cross that has garnered more attention in recent sessions as we rise back above 1.10 once again. We note the move has been assisted by rate differentials, with the AU-NZ 2yr swap spread now 46bps above the May lows at -48bps. This represents the highest levels since August 2022.

- Having struggled to maintain momentum above this 1.10 mark over the past 12 months, closes above 1.1031 and 1.1056 will be crucial for the cross going forward. A break above 1.1088 would place the cross at the highest level since October 2022.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/07/2024 | 0130/0930 | *** |  | CN | CPI |

| 10/07/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/07/2024 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 10/07/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 10/07/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 10/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/07/2024 | - | *** |  | CN | Money Supply |

| 10/07/2024 | - | *** |  | CN | New Loans |

| 10/07/2024 | - | *** |  | CN | Social Financing |

| 10/07/2024 | 1330/1430 |  | UK | BoE Pill At Asia House | |

| 10/07/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/07/2024 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 10/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/07/2024 | 1530/1630 |  | UK | BOE's Mann Panellist on UK Business investment | |

| 10/07/2024 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/07/2024 | 1830/1430 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.