-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: Projected Rate Cut Pricing Recedes

- MNI INTERVIEW: Fed To Cut Once Or Twice At Most In 2024 -Pakko

- MNI US DATA: Mixed Consumer Inflation and Labor Market Expectations In March

US

INTERVIEW (MNI): Fed To Cut Once Or Twice At Most In 2024 -Pakko: The window is narrowing for the Federal Reserve to live up to its March forecast for three rate cuts by the end of this year, and the central bank is likely to deliver at most one or two reductions, former St. Louis Fed economist Michael Pakko told MNI.

- While inflation is heading in the right direction, price pressures tend to be sticky and slow to dissipate, so it will take time for policymakers to gain full confidence that consumer price growth is headed back to the 2% target, Pakko said in an interview.

- “I wouldn’t be surprised to see one or two cuts but probably not three this year,” he said. “I’ve expected all along given the sluggish dynamics of inflation that it’s going to be a while before it goes from 3% to 2%. It’s definitely trending in the right direction.”

NEWS

SECURITY (MNI): WH: Ceasefire Proposal Presented To Hamas, No Rafah Operation Imminent: Wires carrying comments from White House National Security Council spokesperson John Kirby briefing reporters on the Middle East. Kirby says that the latest ceasefire/hostage exchange proposal, brokered in Cairo over the weekend with assistance by CIA Director Bill Burns, has been presented to Hamas and is "awaiting a response."

US (MNI): Biden Admin Teases More Major CHIPS Investments After TSMC Announcement: Taiwan Semiconductor Manufacturing Company (TSMC) has agreed to boost investment in the US by more than 60% - to over USD$65 billion – and build leading-edge 2-nanometer semiconductors in the US for the first time.

SECURITY (MNI): AUKUS: "We Are Considering Cooperation With Japan On AUKUS Pillar II": US Defence Secretary Lloyd Austin, Australian Defence Minister Richard Marles and UK Defence Minister Grant Shapps - have released ajoint statementsignalling that Japan will likely be invited to join "Pillar 2" of the AUKUS security pact.

10Y Yield Taps Mid-Nov High, Focus on Wed's CPI, Fed Minutes

- Treasury futures finished weaker but off lows Monday, 10Y yield marking the highest level since mid-November at 4.4621%.

- The NY Fed’s consumer inflation expectations were mixed in March. Full report here. Otherwise, limited data to speak of for the next two sessions, focus on Wednesday's CPI and March FOMC minutes, PPI on Thursday.

- Projected rate cut pricing continued to ebb: May 2024 at -4.7bp w/ cumulative -1.2bp at 5.317%; June 2024 at -48.8% w/ cumulative rate cut -13.4bp at 5.195%. July'24 cumulative at -22.1bp, Sep'24 cumulative -38.2bp.

- A downtrend in Treasuries remains intact and today’s move lower marks a bearish start to the week. The contract has breached support at 109-09+, the Apr 3 low to confirm a resumption of this year's downtrend. The break lower opens the 109-00 handle and 108-25+, a Fibonacci projection level. Key short-term resistance has been defined at 110-31+, the Mar 27 high. First resistance to watch is 110-06, the Apr 4 high.

OVERNIGHT DATA

US DATA (MNI): Mixed Consumer Inflation and Labor Market Expectations In March: The NY Fed’s consumer inflation expectations were mixed in March. Full report here.

- The 1Y held at 3%, where it’s been for four months now.

- The 3Y rose from 2.7% to 2.9%, the highest since Nov.

- The 5Y fell from 2.9% to 2.6% to reverse most of the 0.4pps step higher in Feb.

- The latest decline in the long-term measure comes with the U.Mich 5-10Y measure falling a tenth to 2.8% in the final March reading for a rare print outside of its sticky 2.9-3.1% range.

Separately: "Labor market expectations were also mixed. While expectations about earnings growth and the mean probability that the U.S. unemployment rate will be higher one year from now remained essentially unchanged, respondents’ perceived probability of finding a job decreased to 51.2% in March from 52.5% in February, the lowest reading in almost three years."

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 34.62 points (0.09%) at 38936.55

- S&P E-Mini Future up 4.5 points (0.09%) at 5257.5

- Nasdaq up 20.2 points (0.1%) at 16268.46

- US 10-Yr yield is up 1.6 bps at 4.4178%

- US Jun 10-Yr futures are down 12/32 at 109-9

- EURUSD up 0.0021 (0.19%) at 1.0858

- USDJPY up 0.18 (0.12%) at 151.8

- WTI Crude Oil (front-month) down $0.31 (-0.36%) at $86.60

- Gold is up $9.84 (0.42%) at $2339.58

- European bourses closing levels:

- EuroStoxx 50 up 31.3 points (0.62%) at 5046.05

- FTSE 100 up 32.31 points (0.41%) at 7943.47

- German DAX up 143.93 points (0.79%) at 18318.97

- French CAC 40 up 57.99 points (0.72%) at 8119.3

US TREASURY FUTURES CLOSE

- 3M10Y +1.435, -96.747 (L: -101.969 / H: -92.511)

- 2Y10Y -1.772, -36.871 (L: -37.091 / H: -32.644)

- 2Y30Y -3.888, -23.662 (L: -24.182 / H: -18.302)

- 5Y30Y -3.711, 12.121 (L: 11.366 / H: 15.943)

- Current futures levels:

- Jun 2-Yr futures down 3.375/32 at 101-29.125 (L: 101-28.625 / H: 101-31)

- Jun 5-Yr futures down 8.75/32 at 106-1.75 (L: 105-30.75 / H: 106-06.245)

- Jun 10-Yr futures down 12/32 at 109-9 (L: 109-02 / H: 109-13.5)

- Jun 30-Yr futures down 11/32 at 117-6 (L: 116-11 / H: 117-10)

- Jun Ultra futures down 11/32 at 124-16 (L: 123-11 / H: 124-22)

US 10Y FUTURE TECHS: (M4) Resumes Its Downtrend

- RES 4: 111-24 High Mar 12

- RES 3: 111-10+ High Mar 13

- RES 2: 110-24+/31+ 50-day EMA / High Mar 27 and key resistance

- RES 1: 110-06 High Apr 4

- PRICE: 109-06 @ 11:09 BST Apr 08

- SUP 1: 109-00 Round number support

- SUP 2: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 3: 108-06 2.236 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-00 Round number support

A downtrend in Treasuries remains intact and today’s move lower marks a bearish start to the week. The contract has breached support at 109-09+, the Apr 3 low to confirm a resumption of this year's downtrend. The break lower opens the 109-00 handle and 108-25+, a Fibonacci projection level. Key short-term resistance has been defined at 110-31+, the Mar 27 high. First resistance to watch is 110-06, the Apr 4 high.

SOFR FUTURES CLOSE

- Jun 24 -0.020 at 94.815

- Sep 24 -0.035 at 95.040

- Dec 24 -0.045 at 95.290

- Mar 25 -0.055 at 95.515

- Red Pack (Jun 25-Mar 26) -0.09 to -0.07

- Green Pack (Jun 26-Mar 27) -0.085 to -0.07

- Blue Pack (Jun 27-Mar 28) -0.065 to -0.045

- Gold Pack (Jun 28-Mar 29) -0.045 to -0.04

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00104 to 5.31742 (-0.01028 total last wk)

- 3M +0.00384 to 5.29723 (-0.00484 total last wk)

- 6M +0.01052 to 5.23086 (+0.00253 total last wk)

- 12M +0.02147 to 5.05254 (+0.03125 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.898T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $705B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $695B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $247B

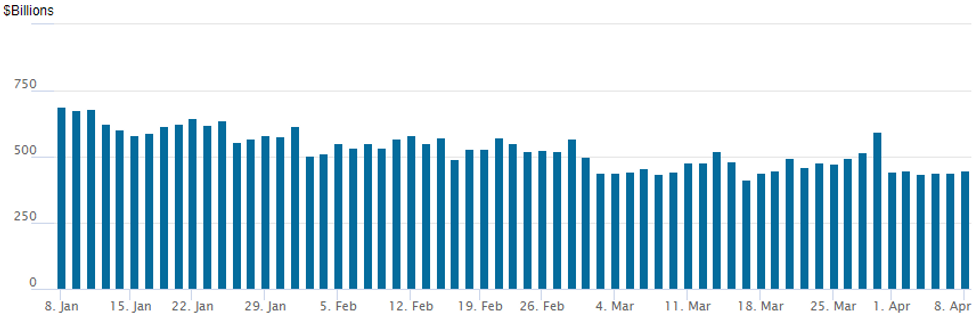

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches bounces to $448.597B vs $438.319B on Friday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 74 vs. 67 Friday (near the lowest number of counterparties since July 7, 2021).

PIPELINE: $2.5B MUFG 2Pt Launched

$5.75B Corporate debt to price Monday:

- Date $MM Issuer (Priced *, Launch #)

- 4/8 $2.5B #MUFG $900M 6NC5 +82, $1.6B 11NC10 +100

- 4/8 $1.25B #Nuveen $500M +5Y +115, $750M 10Y +145

- 4/8 $1B #John Deere Capital 10Y +70

- 4/8 $500M #Met Tower Global 5Y +87

- 4/8 $500M *Shinhan Bank 10Y +140

- Rolled to Tuesday's session:

- 4/9 $Benchmark JBIC 10Y SPFR+73

- Investor calls:

- 4/8 $1.25B Endo Finance Holdings 7NC3

- 4/8 $Benchmark Nippon Life 30NC10

- 4/8 $Benchmark Aegon 3Y

- 4/8 $Benchmark RWE 10Y/30Y

- 4/8 $Benchmark Goodman Group

- 4/9 $Benchmark LG Electronics 3Y/5Y

EGBs-GILTS CASH CLOSE: Caught Between US Data Points, Bunds Underperform

The German curve bear flattened Monday, with the belly underperforming on the UK curve.

- Stronger-than-expected German industrial production data continued the negative tone for European core FI set after Friday's robust US jobs data. While there was little otherwise in the way of newsflow or macro developments Monday, focus was firmly on hawkish risks from the upcoming US CPI reading on Wednesday.

- Bunds underperformed Gilts, with notable underperformance of the German short end (though ECB cut pricing was little changed on the day).

- Periphery EGB spreads closed tighter, as equities clawed back some of Friday's losses.

- Our latest Europe Pi showed broad short-setting across the futures space last week, with BTP structural positioning moving into short territory.

- MNI's preview of Thursday's ECB meeting was published today (PDF). With limited expectations of the ECB changing tack ahead of a presumptive June cut, any adjustment to the official communication this week would represent a minor surprise.

- Overnight we get UK BRC retail sales, while Tuesday brings the ECB Bank Lending Survey, and supply from Austria, Belgium, and Germany.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.2bps at 2.927%, 5-Yr is up 5.1bps at 2.441%, 10-Yr is up 3.6bps at 2.435%, and 30-Yr is up 1.6bps at 2.586%.

- UK: The 2-Yr yield is up 1bps at 4.234%, 5-Yr is up 2.3bps at 3.946%, 10-Yr is up 1.6bps at 4.085%, and 30-Yr is up 1.4bps at 4.591%.

- Italian BTP spread down 2.4bps at 139.4bps / Spanish bond spread down 1.8bps at 81.7bps

FOREX Renewed CHF Weakness, Antipodeans & Scandies Outperform

- The greenback was little phased by rising US yields on Monday, with the USD index marginally in the red, down 0.11% at typing. This coincides with latest indicative positioning data which shows the USD Index net position has consolidated at lows, with outright position now short of 1,896 contracts, the lowest since 2021.

- CHF remains the poorest performer on the session, a move that's keeping the uptrend in EUR/CHF underpinned. Cycle highs at 0.9849 remain the bull trigger, a break above which puts the cross at the best levels since April last year.

- Interestingly, UBS noted that while the CHF may continue to depreciate a little in the short-term, the expected tightening of the ECB/SNB and Fed/SNB policy rate spread will likely raise the risk of CHF appreciation in the longer-term.

- With equity markets consolidating the post-payrolls bounce, AUD and NZD are rising around 0.4%. The recent bounce in AUDUSD has resulted in a break of resistance around the 50-day EMA. This marks a bullish development and suggests the recent bout of weakness between Mar 8 - Apr 1 has been a correction

- In similar vein, Scandi currencies are among the session's best performers, with NOK shrugging off the pullback in oil prices. EUR/NOK trades close to last week's lows, with the striking of a sizeable wage deal with labour unions adding to domestic inflationary pressure and possibly restricting the Norges Bank's space with which to ease policy this year.

- USDJPY has traded in a narrow 151.70-90 range, with 152.00 continuing to cap the topside, a level that continues to dominate the focus ahead of this week’s US CPI release and the ongoing threat of possible MOF intervention.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/04/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/04/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/04/2024 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/04/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.