-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Projected Rate Cuts Gain Momentum

- MNI US BRIEF: Treasury's Yellen: Inflation Moving To Fed's Target

- MNI US DATA: Jobless Claims Allay Last Week's Concerns

- MNI US DATA: Aircraft-Led Durables Collapse Masks Rebound In Core Orders

- MNI US DATA: Sizeable Beat For Q2 GDP With Firm Underlying Details

US TSYS Off Early Highs, Short End Underperforms, Rate Cut Odds Still Supported

- Treasury futures look to finish mixed Thursday, well off early session highs with the short end mildly weaker after the bell. Curves unwound a portion of yesterday's steepening with 2s10s -3.763 at -18.867. Sep'24 10Y futures neared initial technical resistance of 111-13+ (July 16 high) before finishing at 110-26 (+4.5).

- Tsys climbed past yesterday's early highs on a variety of dovish/risk off factors (20bp medium-term lending facility rate cut by PBOC, soft EU data and carry-over weakness in global equities after Wed's rout). In turn, projected rate cut pricing into year end surged briefly with almost three 25bp cuts priced in by December.

- Treasuries pared gains after higher than expected GDP, weekly/continuing jobless slightly lower than expected, while durable goods orders decline. Real GDP growth: 2.84% annualized in Q2 (cons 2.0, Atlanta Fed’s GDPNow 2.7) after 1.4% in Q1 and the average 4.1% in 2H23. Initial jobless claims pulled back slightly more than expected to a seasonally adjusted 235k (cons 238k) in the week to Jul 20 after an upward revised 245k (initial 243k).

- Headline durable goods orders unexpectedly collapsed in June, falling the most (-6.6% M/M vs +0.3% expected, +0.1% prior) since the start of the Covid pandemic (April 2020 -20.0%). The seasonally-adjusted level of durable goods orders thus fell back to levels not seen since November 2021.

- Cross asset roundup: US$ receded, stocks bounced after Wednesday's rout, Gold sold off while crude prices rebounded.

- Focus turns to Friday's personal income & spending data and UofM inflation sentiment.

US

US BRIEF (MNI): Treasury's Yellen: Inflation Moving To Fed's Target

U.S. inflation remains higher than preferred but is set to keep heading lower over time to the Federal Reserve's 2% target, Treasury Secretary Janet Yellen said on Thursday. "Inflation is down significantly from its peak, trending towards the Federal Reserve’s target," Yellen said in prepared remarks to a G20 press conference in Rio de Janeiro. "New data from just this morning shows growth of 2.8% in the second quarter of this year, affirming the path we’re on to steady growth and declining inflation," while "unemployment rate remains historically low." (See: MNI INTERVIEW: Fed To Open Door To Sept Cut Next Week - English)

NEWS

US (MNI): Trump Leads In 4/5 Swing States, But Harris Narrows Gap Compared To Biden:

In Emerson College's latestswing state opinion polling, Republican candidate, former President Donald Trump, leads Vice President Kamala Harris in four of the five states surveyed. According to the poll, carried out 22-23 July following President Joe Biden's withdrawal from the presidential race, Trump holds a lead in Arizona, Georgia, Michigan and Pennsylvania, and is tied with Harris in Wisconsin.

CHINA-RUSSIA (MNI): Joint Air Patrols Skirt Alaska After US Warns Of Arctic Co-op:

Chinese and Russian defense ministries have both confirmed that joint patrols took place between the nations' air forces in the Chukchi and Bering Seas close to the Alaskan coast. The Chinese Defense Ministry says that 'The patrols deepened strategic mutual trust and coordination between the two militaries', and claimed that they 'did not target any third parties' and 'have nothing to do with the current international situation'.

CHINA BRIEF (MNI): China State Planner To Increase Trade-in Support

China will allocate CNY300 billion ultra-long special treasury bonds towards supporting large-scale equipment renewals and consumer good replacement projects, Zhao Chenxin, Deputy Director at the National Development and Reform Commission said on Thursday. Speaking to reporters, Zhao said the government would also increase interest rate subsidies for bank loans supporting equipment renewals from 1 percentage point to 1.5pp for a period of 2 years and up to CNY20 billion.

MIDEAST (MNI): Kremlin Could Host Erdogan-Assad Meeting In Aug:

Russian state outlet RIA reporting that following a meeting between Russian President Vladimir Putin and his Syrian counterpart Bashar al-Assad in Moscow, that there is the prospect of "a possible meeting between Assad and Turkish leader Recep Erdogan, which, as reported, could take place in Moscow in August. The Kremlin said that Russia , like other countries, is interested in improving relations between Turkey and Syria."

OVERNIGHT DATA

US DATA (MNI): Sizeable Beat For Q2 GDP With Firm Underlying Details: Real GDP growth: 2.84% annualized in Q2 (cons 2.0, Atlanta Fed’s GDPNow 2.7) after 1.4% in Q1 and the average 4.1% in 2H23.

- Personal consumption growth: 2.3% (cons 2.0, Atlanta Fed’s GDPNow 2.2) after 1.5% in Q1 and the average 3.2% in 2H23. It left a 1.6pp contribution after the 1.0pp in Q1 and 2.2pp in 2H24.

- Changes in inventories did indeed act as a large sequential driver on the quarter (swing from -0.4pps to +0.8pp with Atl Fed’s GDPNow particularly close there), but the details shown encouraging signs for domestic demand:

- Final sales to domestic purchasers added 2.74pp to GDP growth after 2.5pp in Q1 for only limited moderation after the strong 3.6pp averaged through 2H23.

- Net trade is another large drag but it’s a further sign of domestic demand strength as imports dragging a heavy -0.9pp from GDP growth after -0.8pp as they increased nearly 7% on the quarter.

- You have to look hard for any softer signs. Government spending accelerated (3.1%, adding 0.53pp on the quarter) which helped exaggerate private sector strength but that’s about it considering non-residential investment also increased 5.2%.

- The softer than expected GDP deflator (2.3% vs cons 2.6) only partly accounted for the upside surprise.

- What’s more, core PCE inflation was notably stronger than expected at 2.89% annualized in Q2 (cons 2.7). The rounded 2.9% figure was above any analyst estimate in the Bloomberg survey.

US DATA (MNI): Jobless Claims Allay Last Week's Concerns: Initial jobless claims pulled back slightly more than expected to a seasonally adjusted 235k (cons 238k) in the week to Jul 20 after an upward revised 245k (initial 243k).

- The prior upward revision meant the four-week average still ticked 1k higher to 236k, just off the 239k as of late June that was the highest since Aug 2023.

- The NSA data sticks to a familiar pattern, -56k after the +38k increase the week prior, whilst the fact that Texas was the only large state with an uncharacteristic increase helps bolster last week’s argument about Hurricane Beryl impact (with claims rising a further +6.4k after a particularly sharp +11.9k).

- The next largest weekly increase was the 0.8k in Tennessee, the only other state that didn’t see a decline in NSA initial claims.

- Continuing claims also came in lower than expected, falling to a seasonally adjusted 1851k (cons 1868k) after a downward revised 1860k (initial 1867k) to pull back off fresh highs since Nov 2021.

- The NSA data importantly didn’t push any higher relative to prior years, seeing as they’re already right at the high end of recent years excluding immediate pandemic fallout.

- The latest data point to a trend where prior labor market deterioration appears to have temporarily stalled but with the level of claims still clearly higher than those during past periods of labor market tightness.

US DATA (MNI): Aircraft-Led Durables Collapse Masks Rebound In Core Orders: June's advance durable goods report was extremely mixed, with the more important (and less volatile) core readings offsetting severe weakness in overall orders.

- Headline durable goods orders unexpectedly collapsed in June, falling the most (-6.6% M/M vs +0.3% expected, +0.1% prior) since the start of the Covid pandemic (April 2020 -20.0%). The seasonally-adjusted level of durable goods orders thus fell back to levels not seen since November 2021.

- However, this was largely non-core driven: nondefense aircraft and parts came in at -127% M/M, with the level of net orders negative for the first time since July 2020. Note that, separately, per various industry publications, Boeing reported sharply negative net aircraft orders in June, which this may reflect. Excluding transportation, new orders rose 0.5%, which was actually above the 0.2% expected (and -0.1% prior).

- The key nondefense capital goods orders excluding aircraft category saw 1.0% growth, vs 0.2% expected (and reversing May's -0.9% decline, rev from -0.6%). That was the fastest growth rate since January 2023, pushing the series to an all-time high (on a SA basis), though the 3M/3M annualized rate merely steadied out at 0.0% (-0.8% prior).

- In terms of ongoing activity, core shipments bounced back in June to +0.1% from -0.7% in May (rev from -0.5%), though the 3M/3M annualized rate fell further negative, to -2.3% - lowest since July 2020.

- Overall, when stripping out the volatile components, this report suggests flat sequential business investment at the end of Q2, though the overall outlook remains soft.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 189.43 points (0.48%) at 40050.66

- S&P E-Mini Future down 10 points (-0.18%) at 5462.5

- Nasdaq down 66.9 points (-0.4%) at 17278.88

- US 10-Yr yield is down 2.9 bps at 4.2544%

- US Sep 10-Yr futures are up 4.5/32 at 110-26

- EURUSD up 0.0008 (0.07%) at 1.0848

- USDJPY down 0.05 (-0.03%) at 153.85

- WTI Crude Oil (front-month) up $0.78 (1.01%) at $78.37

- Gold is down $34.96 (-1.46%) at $2362.73

- European bourses closing levels:

- EuroStoxx 50 down 50.59 points (-1.04%) at 4811.28

- FTSE 100 up 32.66 points (0.4%) at 8186.35

- German DAX down 88.74 points (-0.48%) at 18298.72

- French CAC 40 down 86.71 points (-1.15%) at 7427.02

US TREASURY FUTURES CLOSE

- 3M10Y -2.34, -105.604 (L: -111.382 / H: -104.106)

- 2Y10Y -3.557, -18.661 (L: -19.134 / H: -11.301)

- 2Y30Y -4.98, 5.729 (L: 5.015 / H: 16.854)

- 5Y30Y -1.166, 35.513 (L: 34.798 / H: 43.323)

- Current futures levels:

- Sep 2-Yr futures down 1.75/32 at 102-16.125 (L: 102-15.5 / H: 102-22.5)

- Sep 5-Yr futures up 0.25/32 at 107-9.75 (L: 107-08 / H: 107-20.5)

- Sep 10-Yr futures up 4.5/32 at 110-26 (L: 110-20.5 / H: 111-08.5)

- Sep 30-Yr futures up 20/32 at 118-21 (L: 118-00 / H: 119-13)

- Sep Ultra futures up 1-02/32 at 125-5 (L: 124-04 / H: 126-00)

US 10YR FUTURE TECHS: (U4) Clears Wednesday High Comfortably

- RES 4: 112-25 High Mar 8

- RES 3: 112-10 1.50 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 111-13+/17+ High Jul 16 / 1.382 of Apr 25-May 16-29 swing

- PRICE: 110-26 @ 1535 ET Jul 25

- SUP 1: 110-21+/110-09 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-25+ Trendline drawn from the Apr 25 low

The bull theme in Treasuries holds, with markets making light work of the Wednesday high ahead of the US open. Treasures are seemingly building a base at the weekly low of 110-18+, going someway to correcting the pullback off last week’s high, but further progress higher is needed before historic resistance at 111-10+ gives way again. Clearance here would confirm a resumption of the bull cycle and open 111-17+ and 111-31, the 1.236 and 1.382 projection of the Apr 25 - May 16 - 29 price swing. Initial support is 110-21+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.005 at 94.945

- Dec 24 -0.005 at 95.340

- Mar 25 -0.020 at 95.710

- Jun 25 -0.035 at 95.990

- Red Pack (Sep 25-Jun 26) -0.035 to -0.015

- Green Pack (Sep 26-Jun 27) -0.005 to +0.015

- Blue Pack (Sep 27-Jun 28) +0.025 to +0.035

- Gold Pack (Sep 28-Jun 29) +0.035 to +0.045

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00214 to 5.34712 (+0.00069/wk)

- 3M -0.01565 to 5.26356 (-0.01943/wk)

- 6M -0.03153 to 5.10750 (-0.02718/wk)

- 12M -0.04955 to 4.76862 (-0.03164/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.083T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $799B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $778B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $219B

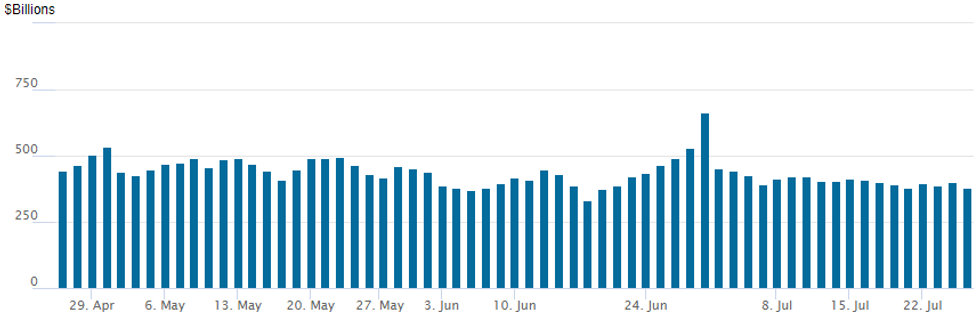

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $377.433B from $399.121B on Wednesday. Number of counterparties falls to 69 from 75 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE: $1B IADB 5Y SOFR Debt Priced

- Date $MM Issuer (Priced *, Launch #)

- 7/25 $1B *IADB 5Y SOFR+37

- $5.45B Priced Wednesday, $30.85B/wk

- 7/24 $2B *Capital One 6NC5 $1B +130, $1B 11NC10 +160

- 7/24 $1.85B *Whistler Pipeline $400M $5Y +125, $500M 7Y +150, $825M 10Y +170

- 7/24 $1B *Export Development Canada 4Y SOFR+33

- 7/24 $600M *Empresa Del Petroleo 10Y +187

EGBs-GILTS CASH CLOSE: Gains Fade, But UK Short-End Rally Stands Out

Gilts and core EGBs strengthened Thursday, with periphery spreads mostly wider.

- The session began with a risk-off tone in a resumption of the previous day's price action. Gilts and Bunds both gained, helped by an unexpected PBOC rate cut overnight, soft German IFO data, and weak corporate earnings reports - each of which underlined global growth concerns.

- Price action shifted negative in the afternoon following stronger-than-expected US GDP data, though Bund and Gilt futures partially recovered and closed higher on the day.

- The German curve bull flattened, with the UK's bull steepening.

- UK short-end outperformance was notable, with 2Y yields seeing their lowest close since May 2023 as BoE rate cut probabilities crept higher.

- Having widened in early trade, periphery EGB spreads regained ground over the course of the session as equities found their footing. BTPs underperformed, closing wider to Bunds, with PGBs outperforming.

- Looking ahead, Friday's docket includes more Eurozone consumer confidence surveys, and ECB inflation expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 2.634%, 5-Yr is down 2.2bps at 2.348%, 10-Yr is down 2.7bps at 2.417%, and 30-Yr is down 3.2bps at 2.629%.

- UK: The 2-Yr yield is down 4.1bps at 3.948%, 5-Yr is down 2.5bps at 3.917%, 10-Yr is down 2.6bps at 4.13%, and 30-Yr is down 0.3bps at 4.67%.

- Italian BTP spread up 1.1bps at 136.1bps / Portuguese down 1.2bps at 64.1bps

FOREX JPY Rally Slows, But Trend Direction is Still Higher

- The week's JPY rally persisted well through the European morning, pressing USD/JPY through the Y152.00 handle for the first time since early May, marking a total correction off the cycle highs of 1,000 pips. The aggressive short covering-triggered rally pressured EUR/JPY, NZD/JPY and AUD/JPY to new pullback lows.

- A strong set of US growth numbers briefly interrupted the one-way traffic in the JPY, as advanced GDP data for Q2 came in ahead of expectations. The stabilization above the lows allows the near-term oversold condition in USD/JPY to unwind.

- Outside of JPY, CHF has extended recent outperformance, as soft global equities and JPY volatility undermines the carry trade dynamics that have dominated across the first half of 2024. USD/CHF broke to a new low and through the 0.88 handle in the process.

- Focus for Friday turns to Tokyo CPI for July - one of the last looks at inflation momentum in Japan ahead of next week's BoJ decision - at which markets continue to speculate over the possibility of a further rate hike from the Bank of Japan. A 10bps hike from 0.1% is more than 50% priced by markets, but a hot CPI print for Tokyo could help bed in this pricing further. The ECB's inflation expectations survey is also due, ahead of June personal income/spending and PCE price index numbers from the US.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/07/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 26/07/2024 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/07/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/07/2024 | 0800/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 26/07/2024 | - |  | EU | ECB's Cipollone at Rio de Janeiro G20 Fin min/central bank meeting | |

| 26/07/2024 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/07/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 26/07/2024 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/07/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.