-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Projected Rate Cuts Recede Ahead Dec NFP Data

- MNI US Payrolls Preview: Household Survey Seasonal Revisions Add Uncertainty

- MNI FED: St. Louis Fed Picks Alberto Musalem As New President

- MNI US DATA: Initial Claims Four Week Average Nears Lowest Readings Of 2023

- MNI US DATA: No Sign Of Labor Market Stress In Challenger Job Cuts

- MNI US DATA: Service PMI Cements Highest Reading Since July

- MNI US DATA: ADP Employment Beats In December But Shouldn’t Move Payrolls Needle

US

US PAYROLLS PREVIEW (MNI): Bloomberg consensus sees nonfarm payrolls growth of 171k in December after November’s 199k was boosted by 38k workers returning from strikes.

- The public sector is expected to see further above-average job creation with private sector focus on health & social assistance as well as retail.

- Both AHE and the unemployment rate are seen marginally dovish vs November, but exaggerated by rounding and with primary dealer analysts tilted to a small hawkish surprise across both categories.

- The household survey (i.e. including the unemployment rate) will see historical revisions to seasonally adjusted figures, zero sum over the year but potentially altering recent trends.

- We see two-sided sensitivity after the recent trimming in Fed rate cut expectations.

NEWS

BRIEF (MNI): US Labor Market 'Very Stable' To End 2023 -ADP

The U.S. labor market ended 2023 on a strong note with private sector hiring rebounding in December and pay growth returning to normal levels without boosting inflation, ADP chief economist Nela Richardson said Thursday. "Wage growth was never the direct driver, but it did keep inflation elevated," she told reporters after the release of the ADP National Employment Report showed private employers adding 164,000 jobs in the last month of 2023, up from around 100,000 in November and October.

FED (MNI): St. Louis Fed Picks Alberto Musalem As New President

The Federal Reserve Bank of St. Louis on Thursday named Evince Asset Management CEO Alberto Musalem to be its next president effective April 2, making him the first Latino to lead the regional Fed bank. He will be a voting member of the FOMC in 2025.

IRAN (MNI): Islamic State Claims Responsibility For Kerman Bombings

Islamic State has claimed responsibility for the two terrorist combings in the Iranian city of Kerman on 3 Jan that killed nearly 100 and injured many more. The group posed on its affiliate Telegram channels that two suicide bombers carried out the attacks against 'rejectionist polytheists'.

IRELAND (MNI): Fin Min Outlines Surplus But Warns Of Risks w/Election On Horizon

The Irish Department of Finance has released a statementoutlining the gov'ts fiscal balance and receipts for 2023. Following the increase in Ireland's rate of corporation tax from 12.5% to 15%, to come into line with the minimum rate agreed to by 135+ nations nationwide, Finance Minister Michael McGrath states that he "does not expect a cash benefit to the state from the new global 15% tax base until 2026."

SECURITY (MNI): Blinken Departs Today On Fourth Mideast Trip Since Outbreak Of War

US State Department Spokesperson Matthew Miller has confirmed that US Secretary of State Antony Blinken will depart today on his fourth Middle East trip since the start of the Israel-Hamas war in October.

SECURITY (MNI): US Unveils New Intelligence On Russia/DPRK/Iran Military Cooperation

White House National Security Council Spokesperson John Kirby has unveiled new intelligence suggesting that Russia and North Korea (DPRK) have increased military cooperation in recent months, with DPRK providing Russia with, "ballistic missile launchers and several ballistic missiles."

US (MNI) Partisan Divides Impact Approval Polling On Govt Officials

A new surveyfrom Gallup has illustrated the deep partisan fissures on approval of key government officials. The survey results are largely unsurprising but indicate an important underlying dynamic to note which may impact the reliability of approval polling ahead of the 2024 general election.

US TSYS 10Y Yield Hovers Near 4% Ahead Key December Employment Data

- Treasury futures still weaker, holding narrow range near lows since this morning as markets await Friday's headline employment data. Tsy futures extended lows after this morning's higher than expected ADP Employment Change data (164k vs 125k est), and again after lower than expected Initial Jobless Claims (202k vs. 216k est) and Continuing Claims (1.855M vs 1.881M est).

- Treasury 10Y futures tested initial technical support, TYH4 tapped 111-27.5 low (-21), 112-00 last, 10Y yield did briefly top 4% in the second half is currently at 3.9931%.

- Bloomberg consensus sees nonfarm payrolls growth of 175k in December after November’s 199k was boosted by 38k workers returning from strikes. The public sector is expected to see further above-average job creation with private sector focus on health & social assistance as well as retail.

- Both AHE and the unemployment rate are seen marginally dovish vs November, but exaggerated by rounding and with primary dealer analysts tilted to a small hawkish surprise across both categories.

- Projected rate cuts for early 2024 continue to cool after surging higher post Dec'23 FOMC: January 2024 cumulative -1.6bp at 5.313%, March 2024 chance of rate cut -63% vs. 66.8% this morning (-84.3% last Friday) w/ cumulative of -17.4bp at 5.155%, May 2024 chance of cut -83.7% vs. -86% this morning, cumulative -38.3bp at 4.946%. Fed terminal at 5.33% in Jan'24.

OVERNIGHT DATA

US DATA: ADP employment increased by more than expected in December, at 164k (cons 125k) from a marginally downward revised 101k (initial 103k).

- Gains were mostly solid across a range of firms except for the second-largest category of 250-499 employees.

- Analyst consensus for private payrolls in tomorrow’s release stands at 130k, unlikely to altered by this ADP beat after weak correlation between the two -- comparing latest vintages, ADP undershot private payrolls by an average -45k through Sep-Nov having overshot by an average 200k in Jun-Aug owing to a particularly large 369k overshooting in June.

- ADP’s Nela Richardson: "We're returning to a labor market that's very much aligned with pre-pandemic hiring. While wages didn't drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared."

US DATA: Initial jobless claims surprisingly fell to a seasonally adjusted 202k (cons 216k) in the week to Dec 30 after a slightly upward revised 220k (initial 218k).

- The four-week moving average fell 5k to 207k, its lowest since mid-Oct and before that February.

- For context, initial claims averaged 218k in 2019 and saw a low that year of 197k.

- Continuing claims were also lower than expected, falling to 1855k (cons 1881k) in the week to Dec 23 from an upward revised 1886k (initial 1875k).

- Continuing claims remain elevated by the past year's standards on a seasonally adjusted basis.

US DATA: Challenger job cuts amounted to 34.8k in December for a -20% Y/Y reduction. It leaves jobs cuts growth averaging -17% Y/Y in Q4 after 106% in Q3 and 163% in Q2.

- As with November’s reading, these Y/Y figures are being biased lower as we lap the spike in technology job cut announcements from this time last year (tech cuts were 4.5k in Dec’23 vs 16.2k in Dec’22, and will have a more favorable base effect next month vs tech cuts of 41.8k from Jan’23).

- Job cuts ex-tech still looked healthy in December though, rising only 11% Y/Y for one of the smallest readings of 2023. It leaves ex-tech job cuts up 35% Y/Y in Q4 from 142% in Q3 and 130% in Q2.

- Looking at other sector, retail job cuts fell sharply to just 110 after spiking to 6.5k in Nov, with job cuts instead led by financial and automotive roles.

US DATA: S&P Global US services PMI was revised a tenth higher to 51.4 (initial 51.3) in the final December print, from 50.8 in Nov to cement its highest reading since July.

- The press release notes stronger hiring (pace of job creation joint-fastest since June) and sharper cost burdens (most marked increased for three months), but softer increases in selling prices (pace eased to one of the slowest in over three years). See more here.

- The PMI services index has seen some notably different readings to ISM services over the past two years, although ISM has recently been running higher including 52.7 in November.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 127.45 points (0.34%) at 37555.37

- S&P E-Mini Future down 1.75 points (-0.04%) at 4744.5

- Nasdaq down 36.3 points (-0.2%) at 14555.08

- US 10-Yr yield is up 7.1 bps at 3.9874%

- US Mar 10-Yr futures are down 17.5/32 at 111-31

- EURUSD up 0.0027 (0.25%) at 1.0948

- USDJPY up 1.28 (0.89%) at 144.58

- WTI Crude Oil (front-month) down $0.45 (-0.62%) at $72.26

- Gold is up $3.22 (0.16%) at $2044.61

- European bourses closing levels:

- EuroStoxx 50 up 25.88 points (0.58%) at 4474.01

- FTSE 100 up 40.74 points (0.53%) at 7723.07

- German DAX up 78.9 points (0.48%) at 16617.29

- French CAC 40 up 38.77 points (0.52%) at 7450.63

US TREASURY FUTURES CLOSE

- 3M10Y +6.425, -141.583 (L: -153.276 / H: -139.363)

- 2Y10Y +1.724, -39.919 (L: -41.395 / H: -37.879)

- 2Y30Y +0.86, -25.066 (L: -26.262 / H: -21.794)

- 5Y30Y -0.656, 16.127 (L: 15.436 / H: 18.965)

- Current futures levels:

- Mar 2-Yr futures down 4.5/32 at 102-21.5 (L: 102-20.625 / H: 102-27.125)

- Mar 5-Yr futures down 11.25/32 at 108-3.75 (L: 108-01.75 / H: 108-17)

- Mar 10-Yr futures down 17/32 at 111-31.5 (L: 111-27.5 / H: 112-19)

- Mar 30-Yr futures down 41/32 at 122-27 (L: 122-18 / H: 124-05)

- Mar Ultra futures down 56/32 at 130-28 (L: 130-14 / H: 132-18)

US 10Y FUTURE TECHS: (H4) Corrective Pullback Finds First Support

- RES 4: 115-00+ 2.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 114-00 Round number resistance

- RES 1: 113-12+ 1.764 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- PRICE: 112-07+ @ 11:07 GMT Jan 04

- SUP 1: 111-31+/28 20-day EMA / Low Jan 03

- SUP 2: 111-09+ High Dec 7

- SUP 3: 109-31+ Low Dec 11 and key short-term support

- SUP 4: 110-24+ 50-day EMA

The corrective pullback in Treasuries found its first support Wednesday, with prices steadying at the 20-day EMA of 111-31+. The level slowed any further decline and has allowed for a modest recovery ahead of the Thursday crossover. Nonetheless, prices are again fading, raising the focus on that key support. More broadly, the technical picture remains positive following the price sequence of higher highs and higher lows into December-end. Sights are on 113-12+, a Fibonacci projection point.

SOFR FUTURES CLOSE

- Current White pack (Mar 24-Dec 24):

- Mar 24 -0.030 at 94.910

- Jun 24 -0.060 at 95.320

- Sep 24 -0.075 at 95.720

- Dec 24 -0.090 at 96.075

- Red Pack (Mar 25-Dec 25) -0.115 to -0.105

- Green Pack (Mar 26-Dec 26) -0.115 to -0.105

- Blue Pack (Mar 27-Dec 27) -0.11 to -0.105

- Gold Pack (Mar 28-Dec 28) -0.10 to -0.10

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00160 to 5.34371 (-0.01001/wk)

- 3M -0.00087 to 5.32931 (-0.00209/wk)

- 6M +0.00996 to 5.17808 (+0.02036/wk)

- 12M +0.02137 to 4.81929 (+0.04831/wk)

- Secured Overnight Financing Rate (SOFR): 5.39% (-0.01), volume: $1.832T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $672B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $657B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $226B

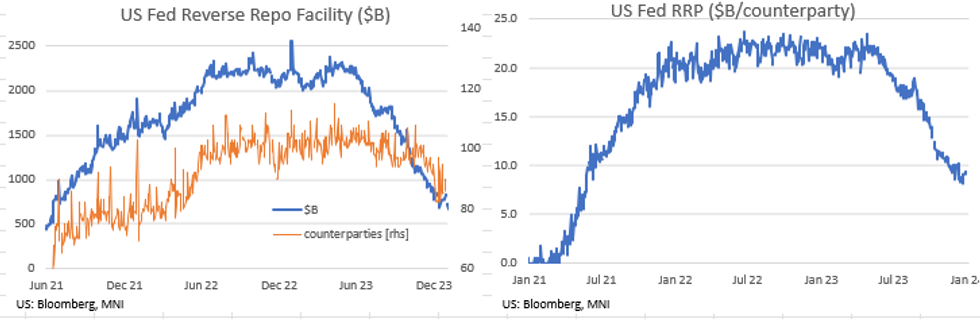

REVERSE REPO OPERATION: Resumes Collapse

- RRP usage falls to $664.899B vs. $719.897B yesterday. The latest level not seen since mid-June 2021 compares to last Friday's move over $1T: $1,018.483B.

- The number of counterparties slips to 78 - lowest since April 2022.

PIPELINE $20B Corporate Debt to Price, Off Last Years Pace

$20B high grade corporate debt expected to price today, total for the week at $80.6B -- healthy, but well off the $94.775B priced in the first week of 2023.

- Date $MM Issuer (Priced *, Launch #)

- 1/4 $5B #EIB 5Y SOFR+44

- 1/4 $5B *Asia Development Bank (ADP) 3Y SOFR+35, 10Y SOFR+59

- 1/4 $2.25B #BP Capital $1.25B +5Y +73, $1B +10Y +100

- 1/4 $1.5B #AerCap $800M 5Y +140, $700M 10Y +160

- 1/4 $1.5B #Standard Chartered 11NC10 +210

- 1/4 $1.25B #Bimbo Bakeries $450M 2029 Tap +115, $800M 12Y +150

- 1/4 $1B #New York Life 10Y +100

- 1/4 $750M #Athene 5Y +160

- 1/4 $750M #Bank of Nova Scotia 60NC5 8%

- 1/4 $500M #Columbia Pipelines WNG 10Y +168

- 1/4 $500M #Sun Communities 5Y +155

- 1/4 $Benchmark Essential Utilities 10Y +145

EGBs-GILTS CASH CLOSE: Sell-Off As Rate Cut Expectations Pull Back

European core FI fell sharply Thursday despite apparently softer-than-expected inflation data continuing to trickle through.

- After some richening early in the session, Bunds and Gilts resumed the theme of the week: a reversal of late 2023 bullishness. Today's negative price action brushed off in-line French and German inflation data, eyeing fairly heavy supply (Spain/France/Portugal/UK) with stronger than expected US labor market data helping extend the sell-off in the afternoon.

- There are now just 151bp in ECB cuts priced in 2024 (with March no better than a 50/50 chance of a 1st hike) vs 166bp Wednesday, with the first BoE cut seen in June and 132bp of cuts in 2024 (vs 147bp Wednesday).

- The curve sell-off was led by curve bellies (5Y Germany +12bp, 5Y UK +10bp), with German instruments slightly underperforming overall.

- Periphery spreads widened in another risk-off session, led by Greece.

- Looking ahead to Friday, US payrolls will be the highlight, but Eurozone / Italian inflation data will take focus in the morning.

- Given the data so far (which represents over 60% of the Euro area basket), headline HICP looks set to come in slightly lower than the consensus coming into the week of 3.0% Y/Y, with the core expectation of 3.4% looking roughly correct at this point.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 11.9bps at 2.533%, 5-Yr is up 12.1bps at 2.064%, 10-Yr is up 10bps at 2.124%, and 30-Yr is up 7.2bps at 2.35%.

- UK: The 2-Yr yield is up 9.3bps at 4.196%, 5-Yr is up 10.7bps at 3.687%, 10-Yr is up 8.8bps at 3.727%, and 30-Yr is up 6.8bps at 4.362%.

- Italian BTP spread up 1.3bps at 169.1bps / Greek up 5.4bps at 113.3bps

FOREX Higher Core Yields Prompt Further JPY Weakness As NFP Approaches

- A mixture of stronger than expected US jobs data and general sentiment saw US yields rise once again on Thursday, prompting a further extension of Japanese Yen weakness, which stands out as the notable underperformer in today’s session.

- USDJPY rises another 0.90%, narrowing the gap substantially with previously significant pivot resistance around the 145.00 handle, printing a high of 144.85, an impressive 199 pips off the overnight lows. This extends the 2024 bounce to roughly 2.5% as we approach tomorrow’s important US employment data.

- 144.96, the Dec 19 high remains the immediate technical point of note, before the 50-day EMA which now intersects at 145.35. EURJPY has outpaced the move, with the single currency outperforming the greenback on Thursday, and the pair has substantially narrowed the gap to 158.67, the Dec 12 high and key short-term resistance.

- Antipodean FX has underperformed with major equity indices consolidating the week’s declines, with a notable uptick for the likes of EURAUD and EURNZD, rising 0.66% and 0.57% respectively. In similar vein, EURCHF has strengthened by half a percent, although the pair continues to consolidate the most recent break below 0.9400 that prompted some sharp weakness towards 0.9250 late last week.

- Tomorrow’s data highlights will be Eurozone inflation figures and the US employment report. Additionally, German retail sales, UK construction PMI and Canada jobs data are all scheduled.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/01/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 05/01/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/01/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/01/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 05/01/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/01/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 05/01/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 05/01/2024 | 1330/0830 | *** |  | US | Employment Report |

| 05/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/01/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/01/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 05/01/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 05/01/2024 | 1830/1330 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.