-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Red Wave Hopes Tempered After Biden Exit

- MNI WHITE HOUSE: Betting Markets Shift Slightly Towards Dems As Biden Exits Race

- MNI WHITE HOUSE: Key Democrats Endorse Harris For Nomination

US TSys Off Late Morning Lows, Curves Steeper

- Treasuries look to finish weaker after a firmer start Monday, rather subdued trade in the aftermath of President Biden's Sunday annc he would drop out of the 2024 presidential race.

- Treasury futures held a narrow range for much of the first half, gapped lower heading into the London close. Sell-stops were triggered, adding to the speed of the move as Sep'24 10Y futures breached initial technical support at 110-21.5 (20-day EMA) to 110-18.5 low. Focus turned next support at 110-08 (50-day EMA values).

- No obvious headline driver or block for the move, some desks cited incoming Treasury coupon supply (2s, 5s, 7s and 2Y FRN) or possibly some hedging of election risk that had not been addressed as soon as markets opened late Sunday.

- Another driver for the unexplained sell-off could be the ongoing theme were Tsys sell-off going into the London close and gradually reverse in the second half.

- Focus turns to Tuesday's Regional Fed and Existing Home Sales data, Tsy $70B 42D CMB Bill and $69B 2Y Note auctions.

NEWS

WHITE HOUSE (MNI): Betting Markets Shift Slightly Towards Dems As Biden Exits Race:

The withdrawal of President Joe Biden from the election race, announced on 21 July, has seen a small shift in political betting markets. The seemingly likelihood (but not a guarantee) that Vice President Kamala Harris will be the Democratic party nominee has seen the implied probability for Republican nominee former President Donald Trump fall from 65.1% on 21 July prior to Biden's announcement to 62.5% at the time of writing. The implied probability of the Democrats retaining the White House has risen from 34.5% to 37.1% according to data from electionbettingodds.com.

WHITE HOUSE (MNI): Harris Praises Biden In First Comments Since President's Withdrawal:

Vice President Kamala Harris has been speaking at a reception for NCAA athletes on the White House South Lawn. Following President Joe Biden's withdrawal from the election race on 21 July and his subsequent endorsement of Harris for the Democratic nomination, all public comments from the veep will be pored over in the run up to November.

WHITE HOUSE (MNI): Key Democrats Endorse Harris For Nomination

A number of key Democratic party figures have announced their endorsement of Vice President Kamala Harris for the party's presidential nomination, with her eventual confirmation looking more and more likely. Illinois Governor JB Pritzker and Michigan Governor Gretchen Whitmer - speculated as potentially mulling runs themselves - are the most recent to offertheirendorsements.

US (MNI): Trump Leads Harris By 2% In Latest Poll:

In the latest omnibus opinion poll from Echelon Insights, former President Donald Trump leads Vice President Kamala Harris by 2pp. The fieldwork for this poll took place 19-21 July, with Echelon stating that the poll was conducted "after the RNC and before Joe Biden dropped out of the race". Republican candidate Trump wins the overall backing of 49% of respondents, compared to 47% backing Democratic frontrunner Harris. Four per cent of respondents were unsure.

WHITE HOUSE (MNI): Sen Manchin-I Will Not Be A Candidate For President:

A short time after teasing that he was being pushed for a presidential run, Senator Joe Manchin (I-WV) has said to CBS that "I'm not running for office", adding “I’m not going to be a candidate for president… I don’t need that in my life.”

US-RUSSIA (MNI): Kremlin-Biden Withdrawal 'Not A Priority Issue For Russia':

Wires carrying comments from the Kremlin spox Dmitry Peskov regarding US President Joe Biden's withdrawal from the election race. Peskov claims that 'this is a priority issue for US voters but not a priority issue for Russia,' adding that 'relations with the US have gone through the worst period in history', but that 'the future of relations with the US is very important'.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 130.34 points (0.32%) at 40420.95

- S&P E-Mini Future up 58.5 points (1.05%) at 5612.75

- Nasdaq up 304.7 points (1.7%) at 18032.66

- US 10-Yr yield is up 1.8 bps at 4.2564%

- US Sep 10-Yr futures are down 3/32 at 110-23.5

- EURUSD up 0.0006 (0.06%) at 1.0888

- USDJPY down 0.38 (-0.24%) at 157.1

- WTI Crude Oil (front-month) down $0.35 (-0.44%) at $79.78

- Gold is down $2.87 (-0.12%) at $2397.96

- European bourses closing levels:

- EuroStoxx 50 up 70.2 points (1.45%) at 4897.44

- FTSE 100 up 43.06 points (0.53%) at 8198.78

- German DAX up 235.14 points (1.29%) at 18407.07

- French CAC 40 up 87.5 points (1.16%) at 7622.02

US TREASURY FUTURES CLOSE

- 3M10Y +1.636, -108.405 (L: -117.838 / H: -106.386)

- 2Y10Y +0.729, -26.893 (L: -30.774 / H: -26.29)

- 2Y30Y +2.068, -4.767 (L: -10.423 / H: -4.342)

- 5Y30Y +2.198, 29.876 (L: 26.066 / H: 30.146)

- Current futures levels:

- Sep 2-Yr futures down 1.125/32 at 102-14 (L: 102-12.75 / H: 102-16.25)

- Sep 5-Yr futures down 2.5/32 at 107-6.5 (L: 107-03.25 / H: 107-11.5)

- Sep 10-Yr futures down 3/32 at 110-23.5 (L: 110-18.5 / H: 111-01)

- Sep 30-Yr futures down 10/32 at 118-26 (L: 118-15 / H: 119-24)

- Sep Ultra futures down 18/32 at 125-18 (L: 125-07 / H: 127-02)

US 10YR FUTURE TECHS: (U4) Pullback Persists, But Bullish Backdrop Remains

- RES 4: 112-25 High Mar 8

- RES 3: 112-10 1.50 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 111-13+/17+ High Jul 16 / 1.382 of Apr 25-May 16-29 swing

- PRICE: 110-25 @ 16:29 BST Jul 22

- SUP 1: 110-21+/110-08 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-25+ Trendline drawn from the Apr 25 low

A bullish theme in Treasuries remains intact despite a fade in prices through late last week and into Monday morning. Short-term pullbacks are proving to be corrective at this stage. The contract has traded through resistance at 111-10+, the Jul 8 high. This confirms a resumption of the bull cycle and has opened 111-17+ and 111-31, the 1.236 and 1.382 projection of the Apr 25 - May 16 - 29 price swing. Initial support is 110-21+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.020 at 94.915

- Dec 24 -0.020 at 95.30

- Mar 25 -0.020 at 95.660

- Jun 25 -0.025 at 95.940

- Red Pack (Sep 25-Jun 26) -0.02 to -0.01

- Green Pack (Sep 26-Jun 27) -0.01 to -0.005

- Blue Pack (Sep 27-Jun 28) -0.01 to -0.005

- Gold Pack (Sep 28-Jun 29) -0.01 to -0.01

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00275 to 5.34950 (+0.01895 total last wk)

- 3M +0.00037 to 5.28336 (-0.00508 total last wk)

- 6M +0.00455 to 5.13923 (-0.03012 total last wk)

- 12M +0.02119 to 4.82145 (-0.06528 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $1.992T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $791B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $770B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $79B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $223B

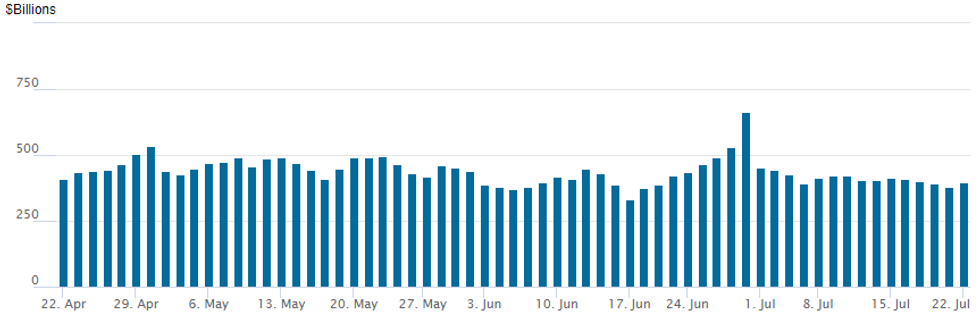

FED Reverse Repo Operation

RRP usage rebounds to $395.901B from $379.801B on Friday. Number of counterparties at 77 from 67 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE: $3.4B American Express 3Pt US$ Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 7/22 $3.4B #American Express $1.2B 4NC3 +75, $500M 4NC3 SOFR+93, $1.7B 11NC10 +103

- 7/22 $1.25B #Kinder Morgan $500M 5Y +95, $750M 30Y +150

- 7/22 $1B #Nationwide BS 5Y +95

- 7/22 $750M #Ally Financial 11NC10 +192

- 7/22 $500M *Korea Hydro & Nuclear Power 5Y +70

- Expected later in the week:

- 7/24 $500M Wilsonart 8NC3

- 7/?? $Benchmark PG&E Recovery Fund

EGBs-GILTS CASH CLOSE: Gilts Underperform As Solid Start Fades

European curves closed Monday bear flatter, with Gilts underperforming Bunds.

- Core FI got off to a solid start, following an unanticipated rate cut overnight by the Chinese central bank.

- That gave way to weakness led by Treasuries as the session progressed, with some pointing to US political uncertainty after Pres Biden withdrew from the presidential election. European core FI yields closed near the highs.

- Gilts underperformed, in part due to new Chancellor Reeves' indications of above-inflation pay rises for UK public sector workers.

- Periphery spreads tightened, led by BTPs and GGBs, mirroring a strong bounce in equities.

- Tuesday's docket is limited, with an appearance by ECB Chief Economist Lane and preliminary Eurozone consumer confidence the highlights.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.5bps at 2.829%, 5-Yr is up 3.9bps at 2.46%, 10-Yr is up 2.8bps at 2.495%, and 30-Yr is up 1.5bps at 2.679%.

- UK: The 2-Yr yield is up 6bps at 4.063%, 5-Yr is up 5.2bps at 3.98%, 10-Yr is up 3.8bps at 4.161%, and 30-Yr is up 3.3bps at 4.669%.

- Italian BTP spread down 3.3bps at 127.9bps / Greek down 2.9bps at 95.4bps

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/07/2024 | 0700/0900 |  | EU | ECB's Lane at ECB/IMF conference in Frankfurt | |

| 23/07/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/07/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 23/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/07/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/07/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 23/07/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/07/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.