-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: SLOOS Survey Credit Tightening Eases

- MNI BRIEF: Cook Hopeful Fed Has Done Enough, Staying Vigilant

- MNI INTERVIEW: Productivity Curbs BOC Cut Enthusiasm-Ex Adviser

- MNI INTERVIEW: EU Lacks Focus For Trade Deals - EP's Winkler

- MNI US DATA: Only Slight Let Up In The Pace Of Credit Tightening

US

FED: Federal Reserve Governor Lisa Cook on Monday indicated a bias toward leaving the Fed's policy rate steady, while also suggesting the recent rise in long-term U.S. bond yields does not seem to have been driven by investor expectations of further interest rate increases.

- "We hope that this will be restrictive enough such that we can return to our 2% target over time, but we will continue to be vigilant," she said in Q&A after a speech on financial stability at Duke University. "We have to be data dependent and we have to be careful in assessing the data we have and aware of the data we don't have in real-time." (See: MNI: Yield Spike Cuts Chance Of Fed Dec Hike, Q1 Still In Play)

- "We're looking for this soft landing. We're looking for the Goldilocks scenario. We're trying to balance these two-sided risks," Cook said. In her prepared remarks, Cook said an expectation of higher near-term policy rates does not appear to be causing the increase in longer-term rates.

CANADA

BOC: The Bank of Canada’s scope for lowering interest rates is limited by sagging productivity and it will take until the second half of next year for policymakers to start easing monetary policy, former BOC adviser Andrew Spence told MNI.

- Canadian companies spend only about 60 cents for every dollar American peers invest on gear which makes workers more effective, Spence said, grinding down the pace the economy can grow without adding to inflation. That adds another layer of doubt about whether prices are returning to the Bank's 2% target said the former special adviser now with Validus Risk Management in Toronto.

- Governor Tiff Macklem raised borrowing costs to the highest since 2001 at 5% and has left them unchanged at the last two meetings, continuing to warn he may hike again even if inflation remains sticky. Officials also say talk of rate cuts is premature, arguing that inflation risks have risen alongside higher crude oil prices and recent wage gains of 5% are inconsistent with price stability. Dismal productivity dictates that even as the economy slows there will be less drag on prices, Spence said. For more see MNI Policy main wire at 1118ET.

EUROPE

EU: The surprise failure of talks for an EU-Australia Free Trade Agreement should be a wake-up call for European Commission which has lost its focus on securing trade deals, the Vice-Chair of the European Parliament’s International Trade Committee told MNI, pointing to the need for a dedicated trade commissioner.

- A tough position from Agriculture Commissioner Janusz Wojciechowski, who had taken flak over surging Ukraine grain imports into Eastern Europe, and the failure to appoint a dedicated trade commissioner following the resignation of Phil Hogan in 2019 were factors behind the setback, Iuliu Winkler said in an interview.

- The Commission has blamed Australia for going back on an earlier agreement on farm quotas, an accusation rejected by Australia.

- “Our whole economic security strategy is based on international cooperation so if we don’t find the global partners for that we will be in a very difficult position,” said Winkler, noting that the EU depends on international partners to implement policies such as its recently-announced Carbon Border Adjustment Mechanism, which would penalise imports from carbon-intensive producers. For more see MNI Policy main wire at 0826ET.

US TSYS Unwinding Post-NFP Rally, SLOOS Credit Less Tight Than Estimated

- Treasury futures are holding just above late session lows after both Tsy and SOFR futures nearly unwound all of Friday's post-NFP rally.

- A confluence of less tighter credit conditions reported by the Fed's latest Sr Loan Advisor Survey (SLOOS) for Q3, and heavy corporate supply at nearly $27B weighed on rates due to rate lock hedges after $6B RTX Corp 5-tranche and $5.5 Roche 5-tranche issuance surprised to the upside.

- The SLOOS report has had little impact on pricing for near-term FOMC meetings (which are still seen with essentially an end to the hiking cycle) but has trimmed cuts later into 2024.

- Fed Funds futures still show the first cut in June but with a cumulative 33bp of cuts vs 36bp pre SLOOS (and 27bps before payrolls), building to a cumulative 91bp of cuts by end-2024 vs 94bp pre SLOOS (and 84bp before payrolls).

- Cross asset: Stocks are having a mildly rocky morning, S&P Eminis bounced off marginal lows at the same time as Tsys, have since scaled back support to near steady at 4376.00.

- Tuesday Data Calendar: Multiple Fed Speakers and 3Y Note Sale

OVERNIGHT DATA:

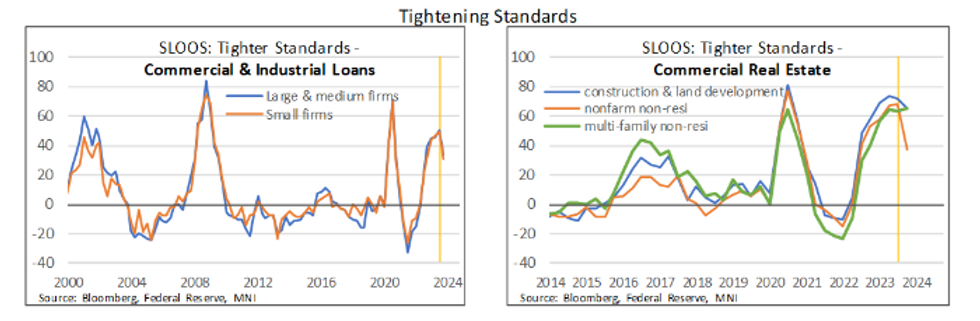

- “Significant net shares of banks reported having tightened standards on C&I loans to firms of all sizes”

- “Major net shares of banks reported tightening standards for all types of CRE loans. Such tightening was more widely reported by other banks than by large banks.”

- The pace in the tightening of standards for residential mortgage loans on balance looks similar to or slightly larger than the prior July, whilst consumer loans were on balance at a similar pace to the fastest rate of tightening seen in the pandemic and before that the GFC.

- Summary lending standards charts below

US DATA: SLOOS Helps Trim Rate Cut Expectations The SLOOS report has had little impact on pricing for near-term FOMC meetings (which are still seen with essentially an end to the hiking cycle) but has trimmed cuts later into 2024.

- Fed Funds futures still show the first cut in June but with a cumulative 33bp of cuts vs 36bp pre SLOOS (and 27bps before payrolls), building to a cumulative 91bp of cuts by end-2024 vs 94bp pre SLOOS (and 84bp before payrolls).

- See table for latest run vs prior levels.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 21.24 points (0.06%) at 34083.18

- S&P E-Mini Future up 3 points (0.07%) at 4379.5

- Nasdaq up 24.1 points (0.2%) at 13503.19

- US 10-Yr yield is up 8.5 bps at 4.6577%

- US Dec 10-Yr futures are down 24/32 at 107-19.5

- EURUSD down 0.0009 (-0.08%) at 1.0722

- USDJPY up 0.6 (0.4%) at 149.99

- WTI Crude Oil (front-month) up $0.59 (0.73%) at $81.09

- Gold is down $12.83 (-0.64%) at $1979.83

- European bourses closing levels:

- EuroStoxx 50 down 16.03 points (-0.38%) at 4158.64

- FTSE 100 up 0.03 points (0%) at 7417.76

- German DAX down 53.28 points (-0.35%) at 15135.97

- French CAC 40 down 33.77 points (-0.48%) at 7013.73

US TREASURY FUTURES CLOSE

- 3M10Y +8.348, -77.11 (L: -87.076 / H: -76.015)

- 2Y10Y -1.058, -28.101 (L: -29.723 / H: -25.374)

- 2Y30Y -3.894, -11.51 (L: -11.834 / H: -6.808)

- 5Y30Y -4.298, 21.832 (L: 21.332 / H: 26.215)

- Current futures levels:

- Dec 2-Yr futures down 6.625/32 at 101-14.375 (L: 101-14 / H: 101-20.5)

- Dec 5-Yr futures down 16/32 at 105-9.25 (L: 105-08.25 / H: 105-23.5)

- Dec 10-Yr futures down 24/32 at 107-19.5 (L: 107-18 / H: 108-07.5)

- Dec 30-Yr futures down 1-04/32 at 112-17 (L: 112-12 / H: 113-14)

- Dec Ultra futures down 1-18/32 at 116-1 (L: 115-26 / H: 117-09)

US TREASURY FUTURES CLOSE: (Z3) Resistance Remains Exposed

- RES 4: 110-07+ High Sep 14

- RES 3: 110-00 Round number resistance

- RES 2: 109-20 High Sep 19

- RES 1: 108-25+ High Sep 25

- PRICE: 107-23 @ 1210 ET Nov 3

- SUP 1: 106-31 20-day EMA

- SUP 2: 105-27+/105-10+ Low Nov 1 / Low Oct 19 and bear trigger

- SUP 3: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 104-16 2.0% 10-dma envelope

Treasuries maintain a firmer short-term tone and are trading closer to their recent highs. Last Friday’s rally resulted in the break of the 50-day EMA, at 108-01+ and delivered a print above 108-16, the Oct 12 high and a key resistance. A clear break of this 108-16 hurdle would strengthen a bullish case and signal scope for a climb towards 109-20, the Sep 19 high. Initial support lies at 106-31, the 20-day EMA.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.005 at 94.615

- Mar 24 -0.045 at 94.730

- Jun 24 -0.090 at 94.975

- Sep 24 -0.130 at 95.260

- Red Pack (Dec 24-Sep 25) -0.15 to -0.14

- Green Pack (Dec 25-Sep 26) -0.13 to -0.12

- Blue Pack (Dec 26-Sep 27) -0.12 to -0.105

- Gold Pack (Dec 27-Sep 28) -0.11 to -0.105

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00168 to 5.32344 (-0.00236 total last wk)

- 3M -0.01211 to 5.36806 (-0.00304 total last wk)

- 6M -0.02770 to 5.39819 (-0.01744 total last wk)

- 12M -0.06312 to 5.26278 (-0.04705 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $246B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.579T

- Broad General Collateral Rate (BGCR): 5.30%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $575B

- (rate, volume levels reflect prior session)

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage inches up to $1,062.878B w/101 counterparties vs. $1,071.139B in the prior session, compares to $1,054,986B on November 2 -- lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Near $27B High Grade Corporate Debt Issued Monday

RTX Corp and Roche Lead Monday's issuance volume, just under $12B, total of $26.9B on the day.

- Date $MM Issuer (Priced *, Launch #)

- 11/06 $6B #RTX Corp $1.25B 3Y +105, $500M 5Y +115, $1B 7Y +135, $1.5B 10Y +147, $1.75B 30Y +160

- 11/06 $5.5B #Roche $1.1B 3Y +55, $300M 3Y SOFR+74, $1.25B 5Y +75, $1.25B 7Y +85, $1.6B 10Y +95

- 11/06 $3.5B #Enbridge $750M 3Y +117, $750M 5Y +142, $750M 7Y +157, $1.25M 30Y +187

- 11/06 $2B #Targa Resources Partners $1B +5Y +160, $1B +10Y +185

- 11/06 $2B #HSBC 11NC10 +275

- 11/06 $1.5B #Costa Rica 31Y 7.75% yield

- 11/06 $1.5B #Nationwide Building Society 3Y SOFR+75

- 11/06 $1.3B #Duke Energy Florida $600M 10Y +125, $700M 30Y +142

- 11/06 $1B #Simon Property Group $500M 10Y +172, $500M 30Y +190

- 11/06 $1B *Sysco Corp $500M 5Y +120, $500M 10Y +147

- 11/06 $800M #PG&E +10Y +233

- 11/06 $800M *Korea National Oil Corp $300M 3Y +80, $500M 3Y SOFR+108

- 11/06 $Benchmark Santander 8NC7 +300

- 11/06 $Benchmark Rep of Turkiye 5Y Sukuk

- Rolled to Tuesday:

- 11/07 $Benchmark British Columbia 5Y SOFR+55a

- 11/07 $Benchmark Denmark 2Y +12a

EGBs-GILTS CASH CLOSE: Yields Close Near The Highs

Core European FI retreated sharply Monday following last week's rally, with both the UK and German curves bear steepening.

- In a session light on data flow, fixed income markets appeared to reassess Friday's post-US employment gains, with steady losses throughout most of the day for both Bunds and Gilts.

- Yields closed on the highs as the US dollar regained ground and equities pulled back in the European afternoon, with 10Y Bund breaching Friday's pre-payrolls levels, with Gilt finishing just below.

- Periphery spreads widened, with BTPs underperforming - 10Y/Bund spreads erased the post-payrolls tightening and then some but closed about 0.5bp narrower vs last Friday's open.

- BoE's Pill said after the cash close that inflation may have fallen sharply below 5% in October (data's out next week).

- On the data front, Services PMIs were mixed (mostly Finals, little market reaction), while September German factory orders surprised to the upside, but the details and downward revisions made for a weak report ahead of Tuesday's industrial production data.

- Among other releases Tuesday we get Spanish industrial production data, along with an appearance by ECB's Nagel (who is also due to speak after hours Monday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 3.023%, 5-Yr is up 8.5bps at 2.627%, 10-Yr is up 9.4bps at 2.739%, and 30-Yr is up 8.7bps at 3.006%.

- UK: The 2-Yr yield is up 4.4bps at 4.721%, 5-Yr is up 6.5bps at 4.329%, 10-Yr is up 8.9bps at 4.377%, and 30-Yr is up 8bps at 4.852%.

- Italian BTP spread up 3.7bps at 190.5bps / Spanish up 1.9bps at 105.8bps

FOREX Greenback On Slightly Firmer Footing As Treasury Yields Reverse Higher

- Ongoing pressure on treasuries throughout Monday’s session has provided a late relief bid for the USD on Monday. While US yields have reversed almost the entirety of the post-NFP move, the greenback has only moderately recovered, with the USD index still way off the pre-data levels from Friday.

- Marginal downward pressure for equities leaves AUD and NZD as two of the worst performers, pulling back just under half a percent on the session. Additionally, the Japanese Yen has struggled, prompting USDJPY to pull higher towards 150.00 once more.

- To emphasise the narrow ranges for G10 FX on Monday, EURUSD has traded within a thirty-pip range and although a touch lower to start the week, the pair is broadly consolidating last week’s impressive move higher, back above the 1.07 handle.

- Key short-term resistance at 1.0694, the Oct 24 high has been cleared. The break of this hurdle strengthens a bullish case and signals scope for a stronger short-term correction. Attention is on 1.0764, a Fibonacci retracement. Initial support is at 1.0652, the 50-day EMA.

- As noted earlier, an overnight AUD/USD straddle breaks even on a 45pip (vs. 3m average ~20-25pips) swing in the pair ahead of the RBA rate decision in APAC on Tuesday. This is the widest break-even pricing for the pair since Sep13 as markets awaited the August Australian jobs report. Such a move in the pair might bring expiries layered between 0.6460-80 into play, across which A$584mln is set to roll off.

- Additionally on Tuesday, markets will receive the latest trade data from China. Over the weekend, China Premier Li Qiang stated that the authorities will expand market access and boost imports, which have fallen this year.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/11/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 07/11/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2023 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/11/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/11/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2023 | 0835/0935 |  | EU | ECB's de Guindos fireside organised by Deloitte | |

| 07/11/2023 | 1000/1100 | ** |  | EU | PPI |

| 07/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/11/2023 | - | *** |  | CN | Trade |

| 07/11/2023 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/11/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/11/2023 | 1345/0845 |  | CA | BOC Governor Macklem conference opening remarks | |

| 07/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/11/2023 | 1415/0915 |  | US | Fed Vice Chair Michael Barr | |

| 07/11/2023 | 1450/0950 |  | US | Kansas City Fed's Jeff Schmid | |

| 07/11/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/11/2023 | 1500/1000 |  | US | Fed Governor Christopher Waller | |

| 07/11/2023 | 1600/1100 |  | CA | BOC Deputy Kozicki opening remarks for lecture by IMF's Pierre-Olivier Gourinchas | |

| 07/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 07/11/2023 | 1700/1200 |  | US | New York Fed's John Williams | |

| 07/11/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/11/2023 | 1825/1325 |  | US | Dallas Fed's Lorie Logan | |

| 07/11/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.