-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI ASIA OPEN: Surprise Hawkish React to Weekly Claims

- MNI US: Betting Markets Slightly Favour Harris Over Trump

- MNI US: Labor Market Flows Further Cloud Interpretation Of Friday’s NFP Report

- MNI US DATA: Jobless Claims Lend Support To U/E Rate Rise Partly Being Down To Weather

US

US (MNI) Labor Market Flows Further Cloud Interpretation Of Friday’s NFP Report:

Much has been made of the surprise increase in the unemployment rate at Friday’s payrolls report, from 4.05% to 4.25% in July, but also how there were important caveats such as almost three quarters of the rise in unemployment coming from temporary layoffs (see the MNI Employment Insight).

- Digging into the status flows reveals some mixed signals:

- On the one hand, there was a strong increase in the seasonally adjusted flow from those who were previously employed to unemployed (from 1542k to 1834k, with the 292k increase being the largest change since Jan 2022).

- On the other hand, net flows between employment and unemployment pools were only 84k in July which meant it contributed just 0.05pp of the 0.20pp increase in the unemployment rate.

- The bulk of the increase in the unemployment rate instead came from net changes in those entering the labor force for work (0.15pps).

- We have seen some take this to downplay July’s rise in the unemployment rate as being down to the surge in immigration-driven population growth rather than an outright sign of economic weakness.

- We would however caution that when looking historically, this approach has only really seen large increases in net employment-unemployment flows in periods of deep recession (e.g. it had a material impact in 2008/09 but not 2001/02).

- Instead, we acknowledge that it was a surprisingly strong increase in the unemployment rate to a rate fractionally above the median FOMC participant’s long-term forecast (implying a modicum of slack is building) but with the above caveats that will be watched to see how much they unwind in the Aug payrolls report on Sep 6 before the FOMC meets on Sep 17-18.

NEWS

US (MNI): Betting Markets Slightly Favour Harris Over Trump

Betting and prediction markets are largely alignedin slightly favouring Vice President Kamala Harris over former President Donald Trump, following a successful reset of the Democratic Party presidential campaign.

- PredictIt currently shows the Harris with a relatively strong 10-point lead, but all the data, across the markets, falls comfortably within 'toss-up' range.

- Aggregator ElectionBettingOdds, shows a 12% swing to Harris in the past week, which may reflect Harris' preservation of party unity with her VP selection, Minnesota Governor Tim Walz (D-MN) and a faltering Trump campaign which has included several high-profile missteps and a shaky start for VP nominee JD Vance.

UKRAINE (MNI): Fighting In Russia's Kursk Continues Amid Major Ukrainian Incursion:

Despite the claims of Gen. Valery Gerasimov, chief of staff of the Russian Armed Forces, that the Russian army had halted Ukraine's surprise advance into the Kursk oblast of the Russian Federation, reports today suggest that fighting in the border region around the town of Sudzha remains intense.

UKRAINE (MNI): Intense Kursk Fighting Continues Amid Fog Of War:

Amid a thick 'fog of war' making confirmation of territorial gains or losses difficult to verify, it appears clear that intense fighting is ongoing in Russia's Kursk oblast for the third consecutive day. Initial reports on 6 August indicated that a small-scale operation was underway. However, through 7 and 8 August it has become apparent that rather than the initial 100 Ukrainian troops mentioned in reports, it would appear that a force of 1,000 or more have launched the largest incursion into Russian territory to date.

SPAIN (MNI): Exiled Catalan Leader Speaks In Barcelona, But No Sign Of Arrest Yet:

Former Catalan regional president Carles Puigdemont, who has been in self-imposed exile since 2017, spoke before a crowd in Barcelona earlier this morning ahead of the investiture of Salvador Illa as the next Catalan head of gov't. The investiture has been seen as a moment of high political tension, given that an arrest warrant remains in force against Puigdemont regarding allegations of embezzlement during the illegal 2017 independence referendum.

US Tsysy: Overreacting to Lower Than Expected Weekly Jobless Data

- Treasuries reversed early gains/gapped lower after weekly jobless claims came out lower than anticipated, continuing claims mildly higher -- tempered by down-revision of prior.

- A surprisingly large hawkish reaction to weekly jobless claims data that show little sign of an improvement in underlying terms, but do at least rule out a very latest deterioration for the labor market. Initial jobless claims were lower than expected in the week to Aug 3, at a seasonally adjusted 233k (cons 240k) as they retreated from a slightly upward revised 250k (initial 249k).

- Treasury futures remain near lows after Wholesale Trade Sales comes out lower than expected, Inventories in-line. Tsy Sep'24 10Y futures trade -8 at 112-20.5, vs. 112-16.5 low -- through technical support at 112-21 (Low Aug 2). Next support level well below at 111-30 (20D EMA). 10Y yield back over 4.0% to 4.0108% high. Eye on technical support at 112-21 Low Aug 2.

- Projected rate cut pricing into year end off early morning levels (*): Sep'24 cumulative -40.5bp (-44.8bp), Nov'24 cumulative -71.5bp (-77.6bp), Dec'24 -103.2bp (-109.3bp).

- Look ahead: No scheduled data, Fed speak or Tsy supply Friday. Next week sees PPI, CPI, Retail Sales, Home sales data and UofM inflation expectations.

OVERNIGHT DATA

US DATA (MNI): Jobless Claims Lend Support To U/E Rate Rise Partly Being Down To Weather

A surprisingly large hawkish reaction to weekly jobless claims data that show little sign of an improvement in underlying terms, but do at least rule out a very latest deterioration for the labor market. Initial jobless claims were lower than expected in the week to Aug 3, at a seasonally adjusted 233k (cons 240k) as they retreated from a slightly upward revised 250k (initial 249k).

- Markets have got very excited by the surprise lower but it’s important to not put too much weight on the individual weeks which can swing about. Instead, the four-week average has continued to trend higher to 241k (+3k) for a fresh high since Aug 2023.

- Texas continues to retrace its Hurricane Beryl hit, down another -4.8k but still slightly above cyclical norms – see chart.

- Continuing claims meanwhile were as expected at 1875k in the week to Jul 27 after a downward revised 1869k (initial 1877k).

- There’s not much new to say on the claims data, with their NSA values still right at the top of the range for pre-pandemic years but the market is reacting to no signs of further labor market deterioration here.

US DATA (MNI): US JUN WHOLESALE INV 0.2%; SALES -0.6%

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 638.78 points (1.65%) at 39402.95

- S&P E-Mini Future up 109.25 points (2.09%) at 5337.25

- Nasdaq up 419.5 points (2.6%) at 16615.71

- US 10-Yr yield is up 5 bps at 3.9935%

- US Sep 10-Yr futures are down 7/32 at 112-21.5

- EURUSD down 0.0007 (-0.06%) at 1.0915

- USDJPY up 0.46 (0.31%) at 147.15

- WTI Crude Oil (front-month) up $0.87 (1.16%) at $76.08

- Gold is up $39.7 (1.67%) at $2422.57

- European bourses closing levels:

- EuroStoxx 50 up 0.68 points (0.01%) at 4668.74

- FTSE 100 down 21.91 points (-0.27%) at 8144.97

- German DAX up 65.25 points (0.37%) at 17680.4

- French CAC 40 down 18.56 points (-0.26%) at 7247.45

US TREASURY FUTURES CLOSE

- 3M10Y +4.595, -123.636 (L: -135.14 / H: -120.942)

- 2Y10Y -2.753, -4.865 (L: -7.851 / H: -1.459)

- 2Y30Y -4.043, 24.17 (L: 20.956 / H: 30.293)

- 5Y30Y -2.977, 45.274 (L: 43.836 / H: 50.931)

- Current futures levels:

- Sep 2-Yr futures down 2.625/32 at 103-7.375 (L: 103-04.875 / H: 103-15.625)

- Sep 5-Yr futures down 4.75/32 at 108-21 (L: 108-16.75 / H: 109-06.25)

- Sep 10-Yr futures down 7/32 at 112-21.5 (L: 112-16.5 / H: 113-14)

- Sep 30-Yr futures down 12/32 at 122-2 (L: 121-17 / H: 123-12)

- Sep Ultra futures down 17/32 at 129-22 (L: 129-02 / H: 131-12)

US 10Y FUTURE TECHS: (U4) Corrective Pullback

- RES 4: 116-00 Round number resistance

- RES 3: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 114-03/115-03+ High Aug 6 / 5

- PRICE: 113-08 @ 11:28 BST Aug 8

- SUP 1: 112-21 Low Aug 2

- SUP 2: 111-30/00+ 11-00+ 20- and 50-day EMA values

- SUP 3: 110-18+ Low Jul 22

- SUP 4: 110-07 Low Jul 9

Treasuries traded sharply higher last week and a bullish theme is intact. Monday's gains have reinforced the current uptrend. Note that MA studies are in a bull-mode position too and the recent breach of 111-01, Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for 115-17, a Fibonacci projection. Initial support is 112-21, Aug 2 low. The contract has pulled back from Monday’s high, the move down is considered corrective.

SOFR FUTURES CLOSE

- Sep 24 -0.045 at 95.155

- Dec 24 -0.060 at 95.760

- Mar 25 -0.070 at 96.210

- Jun 25 -0.055 at 96.490

- Red Pack (Sep 25-Jun 26) -0.045 to -0.035

- Green Pack (Sep 26-Jun 27) -0.035 to -0.03

- Blue Pack (Sep 27-Jun 28) -0.03 to -0.025

- Gold Pack (Sep 28-Jun 29) -0.02 to -0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00165 to 5.32666 (-0.02538/wk)

- 3M -0.00133 to 5.10283 (-0.12490/wk)

- 6M +0.00011 to 4.78487 (-0.22276/wk)

- 12M +0.01322 to 4.32457 (-0.27151/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $2.042T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $809B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $789B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $231B

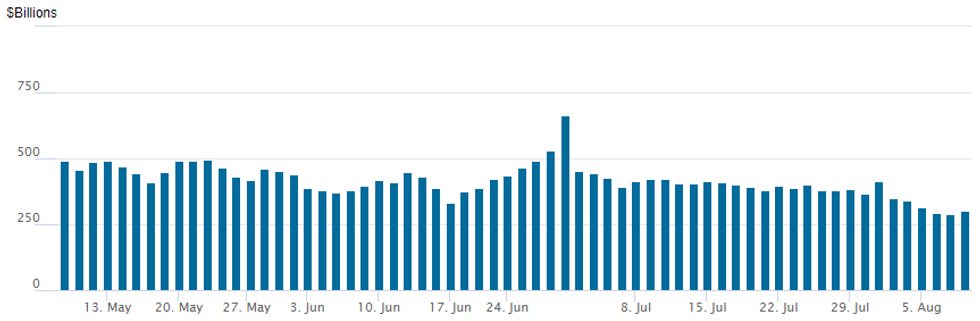

FED Reverse Repo Operation:

NY Federal Reserve/MNI

RRP usage rebounds back above $300B to $303.159B today, from $286.660B on Wednesday -- lowest since mid-May 2021. Number of counterparties climbs to 58 from 52 prior.

PIPELINE: $8B Corporate Bond Issuance to Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 8/8 $1.5B #William Cos $450M +5Y +100, $300M 10Y +127, $750M +30Y +150

- 8/8 $1.5B #Marriott Int $500M +5Y +102, $1B +10Y +142

- 8/8 $1.2B Post Holdings 8.5NC3 6.25%

- 8/8 $1B DaVita 8NC3 6.875%a

- 8/8 $700M #Zimmer Biomet 10Y +120

- 8/8 $600M *Southern California Gas WNG 10Y +110

- 8/8 $500M *Howmet Aerospace 7Y +100

- 8/8 $500M *Essential Utilities 3Y +90

- 8/8 $500M *Prologis 10Y +132

- 8/8 $Benchmark Tennessee Valley Authority 10Y +55a

FOREX: Solid Session for Equities Weighs on EURAUD

- The strong performance for major equity benchmarks on Thursday has further supported a reversal of the sharp risk off moves in currency markets earlier in the week. As such the risk sensitive AUD has outperformed, bolstered by early hawkish rhetoric from RBA Governor Bullock.

- As such, AUDUSD stands 0.90% in the green and moderate pressure on the single currency sees EURAUD slide over 1%. As a reminder, this cross reached the highest level since H1 2020 on Monday and has swiftly reversed 3.6% since this peak. Price action was underpinned by a hawkish tilt to the RBA Governor’s comments earlier in the session, indicating the committee won’t “hesitate” to hike if needed.

- In similar vein, MXNJPY has risen 1.23% on Thursday and continues to be the most sensitive currency pair to adjustments in risk sentiment, owing to the severe carry trade unwind in recent weeks. USDMXN is down 0.90% ahead of this evening’s Banxico decision, which remains a close call.

- Elsewhere, lower-than-expected initial jobless claims in the US provided USDJPY with a firm boost. Markets have grabbed onto the faintest signs of strength (233k vs 240k exp) in the labour market to further undo the sharp moves in the aftermath of last week’s unemployment report.

- USDJPY gapped higher on the release, rising from just above the 146.00 mark to print as high as 147.54. The first topside level is at 147.90 before initial resistance is found at 149.77, the Aug 2 high.

- Risk-on also weighed further on the Swiss Franc with both EURCHF and USDCHF rising around 0.5%.

- China CPI/PPI will be in focus overnight before Canada employment data caps off the event risk this week.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2024 | 0130/0930 | *** |  | CN | CPI |

| 09/08/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/08/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 09/08/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 09/08/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 09/08/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 09/08/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.