-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI BRIEF: Aussie Q3 GDP Prints At 0.3% Q/Q

MNI ASIA OPEN: Tsy Ylds Recede Ahead Mid-Week CPI

- MNI: Fed's Mester-Mistake To Declare Victory On CPI This Week

- MNI: FED'S DALY SEES A COUPLE MORE RATE HIKES THIS YEAR

- MNI BRIEF: Fed Barr Proposes Raising Bank Capital Requirements

- MNI BRIEF: Fed Has More Work To Do But Close to End -Barr

- MNI BOC WATCH: Macklem Seen Hiking Rate To Fresh 2001 High

- MNI BoC Preview, Jul'23: A Second Hike Before Assessing

US

FED: It would be a mistake to think that inflation is on a sustainable path toward 2% even if the CPI readings for June fall this week, Federal Reserve Bank of Cleveland President Loretta Mester said Monday, adding at least two more quarter-point interest rate increases are needed this year to cool the economy.

- "Theexpectationisthatwecouldgetalow reading thisweek,butwe'llsee," she told reporters after giving a talk to University of California San Diego. "Inflationhasbeenparticularlystubborn,anditwouldbeamistakegivenalltheworkwe'vedonesofar tobasicallydeclarevictoryandthenitturnsoutthatactuallyinflationis heading up more, andthenwehavetogoback in."

- "There are costs of prematurely declaring that inflation is on that sustainable downward path and so that's why I lean towards thinking that we're going to have to do some more," she said. The Labor Department's June CPI report Wednesday is expected to show headline CPI falling to 3.1% from 4.0% a month earlier and core CPI dipping three-tenths to 5.0%. For more see MNI Policy main wire at 1334ET.

FED: Cleveland Fed President Loretta Mester on Monday called for a "slightly higher" policy interest rate to balance the risk of persistent inflation against a hard landing, adding the U.S. economy has shown more underlying strength than anticipated.

- "A somewhat tighter policy stance will help achieve a better balance between the risks of tightening too much against the risks of tightening too little," she said in remarks prepared for a University of California San Diego roundtable.

- "Tightening too much would slow the economy more than necessary and entail higher costs than needed to get inflation back to our goal. Tightening too little would allow high inflation to persist, with short- and long-run consequences, and necessitate a much more costly journey back to price stability."

FED: Federal Reserve Governor Michael Barr said Monday U.S. inflation remains far too high and the central bank has more work to do though it is getting close to ending its rate hiking cycle.

- "We're quite attentive to bringing inflation down to our target of 2%. We've made a lot of progress in monetary policy," he said in Q&A after a speech on bank capital at the Bipartisan Policy Center in Washington. "At the last meeting, we skipped a meeting, and that's all part of -- as we get closer and closer to what we think is a sufficiently restrictive level -- that's part of positioning ourselves so that we can try and get to that target level in a careful way."

- "We're close but I think you saw from our last meeting that many participants believe we need to do more," he said, referring to the FOMC's quarterly projections that showed the median policymaker saw the need for two more quarter-point rate hikes this year. "We're going to be very data-dependent, meeting by meeting looking at the data as it comes in. I would say we're close but we still have a bit of work to do."

FED: Federal Reserve Vice Chair for Supervision Michael Barr Monday proposed strengthened capital standards for large banks over USD100 million in assets, arguing it would significantly strengthen the financial system and prepare it for emerging and unanticipated risks.

- For a firm’s lending activities, the proposed rules would end the practice of relying on banks’ own individual estimates of their own risk and instead use a consistent approach, and for a firm’s trading activities the proposed rules would adjust the way that the firm measures market risk, he said. "These changes would raise market risk capital requirements by correcting for gaps in the current rules," Barr said.

- Importantly, the proposed adjustments would require banks with assets of USD100billion or more to account for unrealized losses and gains in their available-for-sale(AFS) securities when calculating their regulatory capital, he said. Barr added that he would recommend to the Fed's Board that it activate a buffer under the CCyB framework "if macroeconomic conditions suggested that it would be appropriate."

CANADA

BOC: The Bank of Canada looks set to deliver another quarter point interest rate hike Wednesday after recognizing last month that inflation was persistent enough to warrant a resumption of rate increases after a two-meeting pause.

- There's almost no way the BOC ended its rate pause last month for a one-off hike. Twenty economists surveyed by MNI see the target rate for overnight loans between commercial banks rising another quarter point to 5%, the highest since 2001 and the 10th rate tightening in this cycle. (See MNI INTERVIEW: BOC Hike Is A Precusor For More)

- Governor Tiff Macklem's emphasis on upside risks to inflation have since been corroborated by a string of robust data. CIBC and JP Morgan switched to call for a hike Friday after employment rose 59,900 last month to triple the consensus forecast, leaving just two economists predicting unchanged rates. For more see MNI Policy main wire at 1420ET.

BOC: The BoC is widely, but not unanimously, expected to hike 25bp for the second meeting after coming off the sidelines five weeks ago. 17 of 23 analysts expect such a move, OIS suggests 19bps is priced.

- A hike should see a hawkish initial reaction but a pivot to possibly more neutral language after recent data were more nuanced and open-ended guidance could see the edge taken off this move.

- Along with consensus, we also expect the 25bp hike to 5% to then assess data over an almost two-month period, but as always with the BoC see non-trivial risk of a surprise, this time from a hawkish hold.

US TSYS: Tsys Near Highs, Projected Rate Hike Holds Steady

- Tsy futures drifting near session highs over the last couple hours after headlines from Fed Daly, Mester and Barr leaned toward the dovish side of balanced: Barr "more work to do but close to the end" earlier while Daly said "risks becoming less unbalanced, fed decisions getting harder, more data reliant".

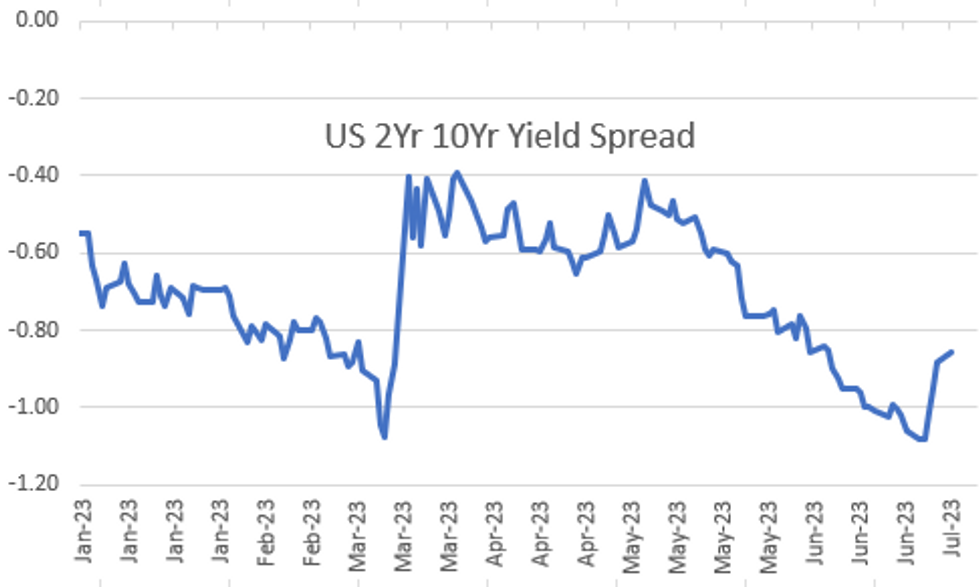

- Curves mixed but generally steeper after the bell, 2s10s currently +2.823 at -86.228, despite over 20,000 TUU3 block sales at various prices this morning.

- Currently, Sep'23 10Y futures are +15.5 at 111-05 vs. 111-08 high, initial technical resistance at 111-15, July 6 high.

- Projected rate hike expectations holding slightly higher to this mornings levels: July 26 FOMC is 89% w/ implied rate of +22.2bp to 5.298%. September fully pricing hike w/ cumulative of +29bp at 5.365%, November cumulative of 34.4bp at 5.42%, December cumulative 29bp at 5.366%. Fed terminal holding at 5.415% in Nov'23.

- Little in the way of data and scheduled Fed speakers Tuesday, focus remains on Wednesday's CPI release.

OVERNIGHT DATA

Final May reading of Wholesale Inventories is 0.0% MoM vs. -0.1%

No substantive data on tap for Tuesday, focus squarely on June CPI data at 0830ET Wednesday.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 165.43 points (0.49%) at 33910.91

- S&P E-Mini Future up 3.25 points (0.07%) at 4439.75

- Nasdaq up 6.4 points (0%) at 13676.28

- US 10-Yr yield is down 5.4 bps at 4.0078%

- US Sep 10-Yr futures are up 14/32 at 111-3.5

- EURUSD up 0.0031 (0.28%) at 1.0999

- USDJPY down 0.9 (-0.63%) at 141.29

- WTI Crude Oil (front-month) down $0.82 (-1.11%) at $73.02

- Gold is up $0.15 (0.01%) at $1926.32

- EuroStoxx 50 up 19.91 points (0.47%) at 4256.51

- FTSE 100 up 16.85 points (0.23%) at 7273.79

- German DAX up 69.76 points (0.45%) at 15673.16

- French CAC 40 up 31.81 points (0.45%) at 7143.69

US TREASURY FUTURES CLOSE

- 3M10Y -4.328, -137.497 (L: -140.41 / H: -129.222)

- 2Y10Y +3.011, -86.04 (L: -88.285 / H: -84.656)

- 2Y30Y +8.009, -82.473 (L: -89.758 / H: -82.338)

- 5Y30Y +11.073, -20.723 (L: -31.114 / H: -20.465)

- Current futures levels:

- Sep 2-Yr futures up 3.75/32 at 101-21 (L: 101-15.625 / H: 101-21.875)

- Sep 5-Yr futures up 12/32 at 106-21 (L: 106-04 / H: 106-23.75)

- Sep 10-Yr futures up 14.5/32 at 111-4 (L: 110-13 / H: 111-08)

- Sep 30-Yr futures up 8/32 at 124-0 (L: 122-30 / H: 124-11)

- Sep Ultra futures down 5/32 at 131-26 (L: 130-28 / H: 132-10)

(U3) Bear Threat Remains Present

- RES 4: 113-19 50-day EMA

- RES 3: 112-17 20-day EMA

- RES 2: 112-12+ Low Jun 14

- RES 1: 111-15 High Jul 6

- PRICE: 111-01+ @ 1200ET Jul 10

- SUP 1: 110-05 Low Jul 6

- SUP 2: 110-00 Low Nov 9 2022 (cont)

- SUP 3: 109-14 Low Nov 8 2022 (cont)

- SUP 4: 109-10+ Low Nov 4 2022 (cont)

Treasury futures remain above last week’s low of 110-05 (Jun 6). The trend outlook is bearish following last week’s extension lower. The break lower confirmed a resumption of the downtrend and, note that moving average studies are in a bear mode position, highlighting current conditions. The focus is on the 110-00 handle next. Initial firm resistance is seen at 112-12+, the Jun 14 low. First resistance is at 111-15, the Jul 6 high.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.585

- Dec 23 +0.015 at 94.630

- Mar 24 +0.050 at 94.880

- Jun 24 +0.085 at 95.255

- Red Pack (Sep 24-Jun 25) +0.110 to +0.125

- Green Pack (Sep 25-Jun 26) +0.120 to +0.130

- Blue Pack (Sep 26-Jun 27) +0.090 to +0.110

- Gold Pack (Sep 27-Jun 28) +0.050 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01685 to 5.19386 (+.03623 total last wk)

- 3M +0.00103 to 5.29950 (+.03011 total last wk)

- 6M -0.01161 to 5.40339 (+.03354 total last wk)

- 12M -0.04585 to 5.40860 (+.05763 total last wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $127B

- Daily Overnight Bank Funding Rate: 5.07% volume: $268B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.547T

- Broad General Collateral Rate (BGCR): 5.04%, $590B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $578B

- (rate, volume levels reflect prior session)

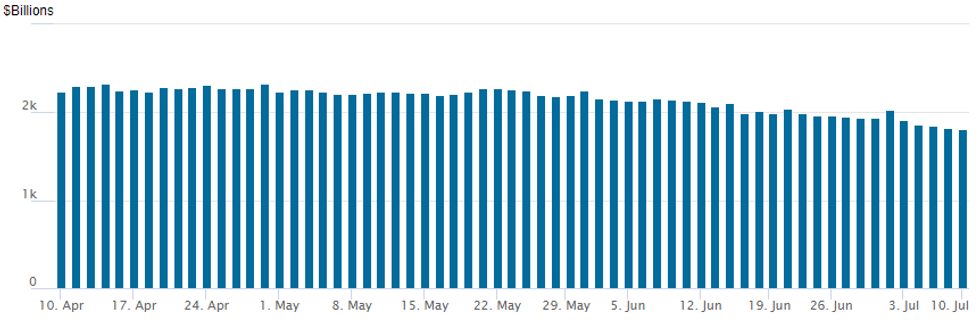

FED Reverse Repo Operation

NY Federal Reserve/MNI

Latest operation shows $1,811.981B, lowest since early May'22, w/ 102 counterparties, compared to $1,822.303B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3.5B TD Bank 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/10 $3.5B #TD Bank $1.8B 3Y +98, $450M 3Y SOFR+108, $1.25B 5Y+128

- 07/10 $1B #MetLife 10Y +145

- 07/10 $Benchmark KFW 10Y SOFR+47a

- 07/10 $Benchmark Korea Hydro/Nuclear Power investor calls

- 07/10 $Benchmark JBIC (Japanese Bank for Int Cooperation) 5Y +70a - expected Tuesday

EGBs-GILTS CASH CLOSE: Greece Spread Widening Stands Out

Gilts easily outperformed Bunds to start the week, with cheapening Greek paper representing the most notable move in the EGB space Monday.

- Germany's curve twist flattened with Schatz yields 4+bp wider on the day as ECB terminal hike pricing likewise firmed 4bp (peak depo rates seen at 4.05%, within 1bp of June's high) after Villeroy's comments over the weekend that he saw policy rates higher for longer.

- Conversely the UK curve leaned bull steeper, with few catalysts on the day - BoE Gov Bailey's Mansion House speech brought little new, and Gilts/terminal BoE pricing remained steady.

- News of a Greek 15Y bond syndication (alongside a switch/tender offer) induced a sharp selloff in GGBs that saw the spread close nearly 11bp wider, and well off the tights below 120bp seen last month.

- Tuesday morning kicks off with UK jobs data and final German inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.3bps at 3.296%, 5-Yr is up 1.8bps at 2.757%, 10-Yr is up 0.1bps at 2.638%, and 30-Yr is down 0.3bps at 2.644%.

- UK: The 2-Yr yield is down 2.3bps at 5.37%, 5-Yr is down 0.6bps at 4.845%, 10-Yr is down 1.2bps at 4.638%, and 30-Yr is down 1.1bps at 4.676%.

- Italian BTP spread up 2.8bps at 174.7bps / Greek up 10.7bps at 144.5bps

FOREX: Greenback Maintains Downward Bias, NOK Tops G10 Leaderboard

- Markets latched on to the latest US inflation headlines to continue selling the greenback on Monday. Used-car prices in the US fell 4.2% in June, their biggest monthly drop since the early days of the pandemic, bolstering hopes for further downside surprises this week in the June US CPI figures. Despite registering early moderate gains on Monday, the USD index has declined 0.25% across the session, hovering just above the 102 mark as we approach the APAC crossover.

- NOK tops the G10 FX table following higher-than-expected CPI for June: core CPI accelerated sharply to 7.0% vs. Exp. 6.6% to print another cycle high and provide another headache for the Norges Bank, who likely now have to consider faster policy action at the August rate decision. USD/NOK has dropped over 1% and looks set to test the June lows at 10.4682.

- The Japanese Yen has posted an impressive reversal amid the downtick for US yields, with USDJPY declining around 160 pips from the early 143.01 highs. The move extends the sharp move lower seen late last week after the pair met strong pivot resistance around the 145 handle. The pair now looks set to close below 142.24, the former bull channel top. A sustained break would signal scope for a deeper correction and opens 140.30, the 50-day EMA.

- Price action for cable has been reinforcing bullish trend conditions and following the strong 100 pip bounce of today’s lows, attention is once again on key resistance at 1.2849, a Fibonacci projection and Friday’s intraday high. A clear break of this level would confirm a resumption of the uptrend and open 1.2877, the Apr 25 2022 high.

- Tuesday morning kicks off with UK jobs data, final German inflation and German ZEW figures. The focus will then quickly turn to a busy Wednesday which includes US CPI data, the Bank of Canada and RBNZ rate decisions.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/07/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/07/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/07/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 11/07/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 11/07/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/07/2023 | 1500/1100 |  | US | New York Fed's John Williams | |

| 11/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 11/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 11/07/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.