-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys at 6Mo Highs Ahead July Employ Data

- MNI Fed Review: July 2024 Analyst Views

- MNI BOE: BOE Cuts Rates By 25bps, But Decision Finely Balanced

- MNI US Payrolls Preview: Hurricane Beryl To Add A Layer Of Confusion

- MNI US DATA: Jobless Claims Surprise Higher, Potential Beryl Impact Only Slowly Dissipating

US

Fed Review (MNI): July 2024 Analyst Views:

While there have been no changes to pre-meeting analyst views on the first rate cut timing or magnitude of future cuts, focus is already mostly turning to what happens beyond a September easing. A couple of analysts still see the first cut only in December. We’ve collated from reviews of Wednesday’s Fed decision some of the more interesting views on what is to come – below in alphabetical order by analyst.

US Payrolls Preview (MNI): Hurricane Beryl To Add A Layer Of Confusion

Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months.

- Hurricane Beryl is likely to have the largest impact on the establishment survey, clouding the underlying trends with expected negative impacts on payrolls and hours worked but some upside for AHE growth.

- This hurricane impact adds asymmetrical risk to reaction in payrolls surprises: a 20-30k miss could easily be faded whilst a beat would be an outright positive surprise. Revisions will be particularly important.

- The unemployment rate is seen rounding to 4.1% for a second month in July but it can easily round down to 4.0% after the 4.05% in June.

- A 4.10% reading would leave the u/e rate fractionally short of triggering the Sahm rule, although Powell looked to play this down on Wednesday.

UK

BOE (MNI): BOE Cuts Rates By 25bps, But Decision Finely Balanced

The BOE MPC voted 5-4 to reduce Bank Rate to 5.00%, though the decision was "finely balanced" for some of the members electing to ease policy.

- Chief Economist Pill voted with Greene, Haskel and Mann in voting to hold rates, with these members requiring stronger evidence that upside pressures to inflation would not materialise.

- The Monetary Policy Summary guidance was little changed, with rates still needing to "remain restrictive for sufficiently long" and the MPC needing to "monitor closely the risks of inflation persistence".

- Although the Summary highlighted that "there has been some progress in moderating risks of persistence in inflation", there remains a risk that "inflationary pressures from second-round effects will prove more enduring in the medium term"

NEWS

WHITE HOUSE (MNI): Harris Overtakes Trump In PredictIt Election Odds:

Political share-trading site PredictIt shows Vice President and likely Democratic presidential nominee overtaking Republican nominee former President Donald Trump for the first time as nationwide swing-state polling has indicated increasing support for Harris (albeit with the outcome still too-close-to-call).

US-RUSSIA (MNI): Major Prisoner Swap Does Not Point To Closer Links:

Reports of a 'large-scale prisoner swap' between the United States and Russia, which is rumoured (but not confirmed) to include WSJ journalist Evan Gershkovich, former Marine Paul Whelan, and anti-Putin activist Vladimir Kara-Murza, is unlikely to prove a signal of new lines of communication or a notable improvement in relations between Washington, D.C., and Moscow.

UKRAINE (MNI): Russia Claims Jets 'Won't Influence Battlefield' As First F-16s Arrive:

Kremlin spox Dmitry Peskov has claimed that F-16 fighter jets sent to Ukraine 'will be shot down' and 'will not influence the battlefield'. Adds that 'rewards for shooting them down have already been offered I believe.'

LATAM (MNI): Pressure Ratchets Up On Venezuela's Maduro Amid Election Fraud Claims:

Venezuelan President Nicolas Maduro remains under significant domestic and international pressure regarding the outcome of the 28 July presidential election. Maduro and his far-left United Socialist Party of Venezuela (PSUV) have claimed victory, citing official returns from the National Electoral Council (seen as under gov't control).

MIDEAST (MNI): Hezbollah Leader-Battle w/Israel 'Has Entered New Phase':

Wires carrying comments from Hezbollah leader Hassan Nasrallah amid heightened tensions in the Middle East. Says that the 'battle with Israel has entered a new phase', and that Israel 'does not know who what extent it has crossed the red lines'. Nasrallah says that the Israeli response to any Hezbollah attack will determine if war escalates.

MIDEAST (MNI): NYT-Iran Orders Strike On Israel Following Haniyeh Killing:

The New York Times is reporting that according to Iranian officials briefed on the matter, Supreme Leader Ayatollah Ali Khamenei "has issued an order for Iran to strike Israel directly, in retaliation for the killing in Tehran of Hamas’s leader, Ismail Haniyeh,". Israel has not commented on the killing of Haniyeh, neither confirming nor denying its involvement.

US TSYS 10Y Yield Falls Below 4% Heading Into Friday's July Jobs Data

- Treasury futures continued to climb higher Thursday, Sep'24 10Y back at early February levels (112-26, +1-00) while 10Y yield fell below 4% to 3.9627% low for the same period.

- Weaker economic data followed the midweek dovish hold from the FOMC, while continued geopolitical risk in the Middle East provided additional safe haven support.

- Initial jobless claims were notably higher than expected in the week to Jul 27, at a seasonally adjusted 249k (cons 236k) after an unrevised 235k.

- Building on dovish implications from yesterday’s softer than expected employment cost growth, labor productivity was also stronger than expected as it increased 2.3% annualized (cons 1.8) in preliminary Q2 data

- The S&P Global US manufacturing PMI was revised only 0.1pt higher as expected in the final July print to 49.6 (initial 49.5) as it held the sizeable drop from the 51.6 in June.

- Heavy short end buying helped curves bull steepen on the day: 2s10s +4.526 at -18.466, 5s30s +3.515 at 42.398. in turn, projected rate cut pricing into year end have gained slightly vs. late Wednesday levels (*): Sep'24 cumulative -29.0bp (-28.4bp), Nov'24 cumulative -47.9bp (-46.9bp), Dec'24 -73.2bp (-72.4bp).

- Focus turns to Friday's employment report for July. Nonfarm payrolls are expected to moderate further in July after the slight beat in June was more than offset by large negative revisions to the prior two months. • Hurricane Beryl is likely to have the largest impact on the establishment survey, clouding the underlying trends with expected negative impacts on payrolls and hours worked but some upside for AHE growth.

OVERNIGHT DATA

US DATA (MNI): Jobless Claims Surprise Higher, Potential Beryl Impact Only Slowly Dissipating

Initial jobless claims were notably higher than expected in the week to Jul 27, at a seasonally adjusted 249k (cons 236k) after an unrevised 235k. It pushes the four-week average up another 2k to 238k, just shy of late June's 239k for what was the highest since Sep 2023 for a further gap to the 2019 average of 218k.

- At a non-seasonally adjusted 25.5k, Texas claims continue to see impact from Hurricane Beryl but have at least dropped. The -6.2k helped drive the -10k for national claims.

- Continuing claims were also higher than expected at a seasonally adjusted 1877k (cons 1855k) in the week to Jul 20. It’s for a fresh high since Nov 2021, with the latest increase extended by a marginally downward revised 1844k (initial 1851k) in the prior week covering a payrolls reference period.

US DATA (MNI): Surprisingly Strong Productivity Growth Further Dampens Unit Labor Costs

Building on dovish implications from yesterday’s softer than expected employment cost growth, labor productivity was also stronger than expected as it increased 2.3% annualized (cons 1.8) in preliminary Q2 data. Revisions to productivity were marginal, up to 0.4% annualized in Q1 vs the initial 0.2%, in a quarter that still represented payback after a particularly strong 4.0% in 2H23.

- In broader trend terms, productivity growth remained robust at 2.7% Y/Y. The stronger than expected productivity growth saw unit labor costs come in more tepid than expected in Q2 at just 0.9% annualized (cons 1.7%).

- The quarterly ULC trend has been mixed of late, with 3.8% in Q1 after -2.8% in Q4, but year-ago growth of 0.5% Y/Y is clearly beneficial for cooling wage-related components of inflation.

- Recall Powell at yesterday’s FOMC press conference: Today's ECI reading was softer than expected. That's a good reading. It shows that wage increases are still at a strong level, but that that level continues to come down to more sustainable levels over time. That's exactly the pattern that we want to be seeing.”

US DATA (MNI): Final Mfg PMI Confirms July Drop, Softest Output Inflation In A Year

The S&P Global US manufacturing PMI was revised only 0.1pt higher as expected in the final July print to 49.6 (initial 49.5) as it held the sizeable drop from the 51.6 in June.

US DATA (MNI): Challenger Job Cuts Extend Broad Stabilization But Hiring Particularly Anaemic

- Challenger job cut announcements fell to a non-seasonally adjusted 25.9k in July from 48.8k in June, with the relative decline matching that seen last year in a move that limited the increase to only 9% Y/Y.

- The tech sector is back to accounting for the largest share of job cuts, with the 6.0k marking a 27% Y/Y increase as we increasingly move away from large base effects.

- The report doesn’t materially change a trend where overall job cut announcements have broadly levelled out this year after large increases in 2023 (cuts have averaged -1% Y/Y in 2024 ytd vs an average 160% Y/Y in 2023.

- Hiring announcements meanwhile offer a more dovish reading as they fell to 3.7k in July after a brief pop higher to 19.1k.

- This is the second lowest monthly increase in the series history back to 2004 and the three lowest have all come in the past eight months (3.0k in Dec’23 being the lowest).

- Being non-seasonally adjusted data, September still tends to be by far the more important month for hiring announcements but the data continue to show a reluctance to hire even if cuts have stabilized.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 621.58 points (-1.52%) at 40215.32

- S&P E-Mini Future down 92.5 points (-1.66%) at 5466.25

- Nasdaq down 462.2 points (-2.6%) at 17138.82

- US 10-Yr yield is down 5 bps at 3.9798%

- US Sep 10-Yr futures are up 28/32 at 112-22

- EURUSD down 0.0033 (-0.3%) at 1.0793

- USDJPY down 0.34 (-0.23%) at 149.64

- WTI Crude Oil (front-month) down $1.04 (-1.33%) at $76.87

- Gold is down $4.87 (-0.2%) at $2442.75

- European bourses closing levels:

- EuroStoxx 50 down 107.22 points (-2.2%) at 4765.72

- FTSE 100 down 84.62 points (-1.01%) at 8283.36

- German DAX down 425.6 points (-2.3%) at 18083.05

- French CAC 40 down 161.04 points (-2.14%) at 7370.45

US TREASURY FUTURES CLOSE

- 3M10Y -3.599, -129.562 (L: -132.32 / H: -122.371)

- 2Y10Y +4.717, -18.275 (L: -24.463 / H: -17.864)

- 2Y30Y +6.73, 11.149 (L: 1.967 / H: 11.381)

- 5Y30Y +3.789, 42.672 (L: 36.772 / H: 43.082)

- Current futures levels:

- Sep 2-Yr futures up 11/32 at 103-0.875 (L: 102-24.25 / H: 103-01.5)

- Sep 5-Yr futures up 20.75/32 at 108-17.25 (L: 108-02.25 / H: 108-19.25)

- Sep 10-Yr futures up 28/32 at 112-22 (L: 112-01.5 / H: 112-26)

- Sep 30-Yr futures up 1-22/32 at 122-15 (L: 121-10 / H: 122-26)

- Sep Ultra futures up 2-01/32 at 130-0 (L: 128-20 / H: 130-15)

US 10Y FUTURE TECHS: (U4) Bull Cycle Remains In Play

- RES 4: 113-02 1.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 113-00 Psychological round number

- RES 2: 112-20+ 1.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 112-10+ High Jul 31

- PRICE: 112-05 @ 11:31 BST Aug 1

- SUP 1: 111-15 High Jul 17

- SUP 2: 110-30+/110-15 20- and 50-day EMA values

- SUP 3: 109-17+ Low Jul 5

- SUP 4: 109-02+ Trendline drawn from the Apr 25 low

Treasuries rallied Wednesday, touching a high of 112-10+. The extension higher this week reinforces the current bullish theme. Moving average studies are in a bull-mode position too and the recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend that started Apr 25. Scope is seen for a climb towards 112-20+, a Fibonacci projection. Support is at 111-15, the Jul 17 high, and 110-30+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.090 at 95.055

- Dec 24 +0.170 at 95.565

- Mar 25 +0.220 at 96.020

- Jun 25 +0.235 at 96.335

- Red Pack (Sep 25-Jun 26) +0.170 to +0.220

- Green Pack (Sep 26-Jun 27) +0.125 to +0.150

- Blue Pack (Sep 27-Jun 28) +0.105 to +0.120

- Gold Pack (Sep 28-Jun 29) +0.090 to +0.10

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00770 to 5.35025 (+0.00355/wk)

- 3M +0.00102 to 5.24212 (-0.01315/wk)

- 6M -0.00901 to 5.06657 (-0.02488/wk)

- 12M -0.02027 to 4.71520 (-0.03770/wk)

- Secured Overnight Financing Rate (SOFR): 5.38% (+0.05), volume: $2.185T

- Broad General Collateral Rate (BGCR): 5.34% (+0.02), volume: $820B

- Tri-Party General Collateral Rate (TGCR): 5.34% (+0.02), volume: $797B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $220B

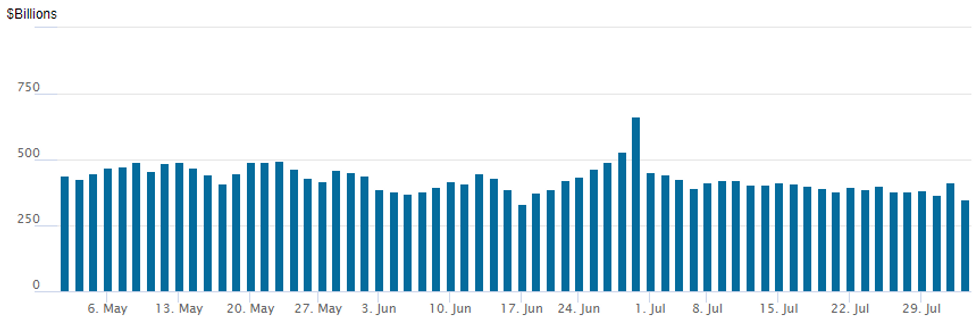

FED Reverse Repo Operation

NY Federal Reserve/MNI

Reversing course at the start of the new month, RRP usage falls back to $348.885B from $413.200B on Wednesday. Number of counterparties steady at 66. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE August Corporate Debt Issuance Kicks Off With $11.825B

- Date $MM Issuer (Priced *, Launch #)

- 8/1 $3B #Peru $1.25B +10Y +140, $1.75B +30Y +165

- 8/1 $2.5B #Enterprise Products $1.1B +10Y +105, $1.4B +30Y +130

- 8/1 $1.75B #Fiserv $850M +5Y +95, $900M 10Y +120

- 8/1 $1.25B #Crown Castle $550M 5Y +110, $700M 10Y +130

- 8/1 $1.1B #PSE&G $600M 10Y +90, $500M 30Y +105

- 8/1 $1B #Truist Financial8NC7 +127

- 8/1 $700M *PACCAR 3Y +50

- 8/1 $525M #NY State Electric 10Y +135

- 8/1 $Benchmark DR Horton investor calls

EGBs-GILTS CASH CLOSE: UK Short-End Leads Gains As BoE Narrowly Cuts

Core European yields closed sharply lower Thursday, as the BoE delivered a rate cut and data spurred concern over slowing growth.

- Following on from the dovish impulse from Wednesday's Fed press conference, 2Y UK yields saw their 3rd biggest daily drop of the year Thursday with the BoE opting by a 5-4 vote to cut rates by 25bp. The UK and German curves both bull steepened.

- Soft data was a theme all day: German unemployment unexpectedly ticked higher, while US initial jobless claims pushed higher and the ISM Manufacturing report was weaker than expected, particularly in the employment component - all of which is in increased focus ahead of Friday's US payrolls report.

- Safe-haven bonds gained for most of the session as equities dropped in the European afternoon, with the evaporation in risk appetite seeing periphery EGB spreads move wider.

- Apart from US nonfarm payrolls which is the main global event, Friday's data schedule includes Euro national industrial production and retail sales prints, while BoE Chief Economist Pill makes an appearance.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.456%, 5-Yr is down 6.7bps at 2.165%, 10-Yr is down 5.8bps at 2.246%, and 30-Yr is down 4.7bps at 2.467%.

- UK: The 2-Yr yield is down 10.4bps at 3.722%, 5-Yr is down 9.6bps at 3.669%, 10-Yr is down 8.7bps at 3.883%, and 30-Yr is down 5.6bps at 4.48%.

- Italian BTP spread up 5.5bps at 140.1bps / Spanish up 3.6bps at 84.8bps

FOREX Weakness for Equities Boosts Greenback, GBP Pressured Post BOE Cut

- A particularly soft ISM manufacturing report in the US prompted an extension lower for US yields and notable pressure on risk/equities across Thursday’s session. The employment complement saw a very substantial miss: 43.4 (cons 49.2) after 49.3, the lowest since Jul 2020. Pre-pandemic, that’s the lowest since 2009 and has likely exacerbated the risk off flows.

- Despite the impressive moves in rates and equities, the USD index stands just 0.25% in the green, with the Swiss Franc outperforming on the safe haven demand. EURCHF sits 0.90% in the red at the lowest level since February, just ahead of the 0.94 handle.

- The Yen’s daily price adjustment is masked by an extremely volatile overnight session, where the pair fell to a four-month low of 148.51, closely matching touted support, the 61.8% retracement of the Dec 28 ‘23 - Jul 3 upleg.

- Subsequently the pair bounced very firmly, rising as high as 150.89 and so the soft US data and late equity weakness has only brought the pair back to flat, residing just below 1.5000 ahead of the APAC crossover.

- GBP sits lower on the session, consolidating an early move lower ahead of the Bank of England. The BOE's Monetary Policy Committee delivered a 25 basis point rate cut at its August meeting on the narrowest of margins, a five-to-four vote in favour, with even some of those who voted for it saying that their decision was "finely balanced."

- Despite price action remaining choppy for sterling in the aftermath of the decision, GBPUSD sits 0.70% lower on the session, with the poorer risk sentiment likely weighing.

- Note that support has been established just below the 50-day EMA - at 1.2792 - and a trendline at 1.2752, drawn from the Apr 22 low. A clear break of these points would suggest scope for an extension towards the 1.2700. Initial resistance to watch is at 1.2863, today’s high.

- For the cross, EURGBP (+0.40%) has narrowed in on firm resistance which is seen at 0.8458, the 50-day EMA.

- All focus turns to Friday’s US employment report where nonfarm payrolls are expected to moderate further in July. Swiss CPI will also cross during the European session.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2024 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 02/08/2024 | 0630/0830 | *** |  | CH | CPI |

| 02/08/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 02/08/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 02/08/2024 | 0900/1100 | * |  | IT | Retail Sales |

| 02/08/2024 | 1115/1215 |  | UK | BOE's Pill at National MPC Agency Briefing | |

| 02/08/2024 | 1230/0830 | *** |  | US | Employment Report |

| 02/08/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/08/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 02/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.