-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Ignore Fed Pushback of Dovish Data

- MNI US FED: Richmond Fed's Barkin: May CPI "Very Encouraging", To Learn A Lot More Over Coming Months

- MNI US FED: St Louis Fed's Musalem Appears To Be On Hawkish End Of FOMC Spectrum

- MNI US FISCAL: CBO Sees Even Larger Deficits Persisting Over Next Decade

- MNI US DATA: Retail Sales Rebound More Softly Than Expected In May:

US

US FED (MNI): Richmond Fed's Barkin: May CPI "Very Encouraging", To Learn A Lot More Over Coming Months

Richmond Fed President Barkin says at MNI's webinar that May's inflation report was "very encouraging", and overall, the economy appears to be "clearly" on the "back side" of inflation. Says that inflation in Jan/Feb/Mar "came in hot", though Apr / May were "less hot". "I certainly didn't get more confidence from the first quarter of the year...we'll see where we go."

- Inflation doesn't just go down to 2% in an instant, he says. He's looking for "sustainment" and "broadening" of disinflation (for example, the % of the PCE basket that is rising at 2% vs 3+%).

US FED (MNI): St Louis Fed's Musalem Appears To Be On Hawkish End Of FOMC Spectrum

St Louis Fed President Musalem's first public remarks on monetary policy since becoming St Louis Fed president (speech link here) appear to put him toward the hawkish end of the FOMC spectrum, particularly with this comment regarding his criteria for supporting rate cuts:

- "I will need to observe a period of favorable inflation, moderating demand and expanding supply before becoming confident that a reduction in the target range for the federal funds rate is appropriate. These conditions could take months, and more likely quarters to play out." Most other FOMC participants have spoken in terms of "few" or "several" "months" as their core view for the time horizon, not "quarters".

- And "should evidence of alternative inflation scenarios begin to materialize, I would support an additional firming of monetary policy."

NEWS

US FISCAL (MNI): CBO Sees Even Larger Deficits Persisting Over Next Decade

The Congressional Budget Office has increased its baseline expectation for nominal deficits over the 2025-34 period, to $22.1T in its June projections, vs $20.0T in its February projections (report here).

- The CBO attributes that largely ($1.6T) to legislative changes, including emergency supplemental appropriations seen earlier this year. It's also a reversal from the improved picture seen in February, in which the CBO lowered the cumulative deficit forecast through 2033 by $1.4T.

- This comes even against a stronger economic growth backdrop than had been seen in February, with the CBO citing a "surge in immigration" that started in 2021 and is assumed to continue through 2026.

FED BRIEF (MNI): US Inflation Falling, But No Victory Just Yet - Fed's Barkin

Inflation is clearly falling but it's too soon for policymakers to declare victory Richmond Fed President Tom Barkin told an MNI webcast Tuesday, as shelter and services price growth continue to run hotter than goods prices.

- "We are clearly on the backside of inflation," Barkin said but added quickly it is hard to know how long it will take to go all the way to target. However, he did note that goods price inflation was back around pre-Covid levels, helped by both monetary policy settings and supply chain easing.

UK (MNI): Betting Markets Give Reform Better Chance Of Majority Than Conservatives:

Data from Smarkets shows political betting markets giving a higher implied probability of the right-wing populist Reform UK winning an overall majority in the House of Commons that PM Rishi Sunak's centre-right Conservatives. Bettors assign an overwhelming likelihood (96.2%) that the centre-left Labour party wins an overall majority in the 4 July general election.

EU (MNI): EUCO Fails To Reach Agreement On Commission, Council, Parl't Presidents:

The informal meeting of European Union member state leaders on the evening of 17 June failed to reach an agreement on the next leaders of the EU's three political institutions and its foreign policy head. The division of positions among the various European political groups following the European Parliament elections can take some time to reach agreement as the various parties jostle for position and influence.

IRELAND (MNI): Ryan To Step Down As Greens Ldr, Unlikely To Affect Coalition Gov't:

Local press reporting that Eamon Ryan, leader of the environmentalist Green party and Minister for the Environment, Climate and Communications and Minister for Transport, is set to step down as party leader after 13 years in the role.

Tsys Gain After Soft Retail Sales, 20Y Bond Reopen Stops Through

- Two-part rally Tuesday as Treasuries gap higher after lower Retail Sales data and strong 20Y Bond auction reopen. Fed-speak push-back limited.

- Advance MoM (0.1% vs. 0.3% est, prior down revised to -0.2% from 0.0%), Ex Auto MoM (-0.1% vs. 0.2% est, prior down-revised to -0.1% from 0.2%), Ex Auto and Gas (0.1% vs. 0.4% est, prior revised to -0.3% from -0.1%). Retail Sales Control Group (0.4% vs. 0.5% est, prior revised to -0.5% from -0.3%).

- As the revisions imply, these figures are volatile and subject to reassessment in the months ahead, but control group retail sales in May remained a little under the March level, with ex-auto/gas struggling to move above December 2023 levels.

- Treasuries pared gains briefly as some Fed speakers pushed back on dovish expectations (Boston Fed Collins: "shouldn't overreact to a month or two of good inflation data"; StL Fed Musalem "could be 'quarters' before the first rate cut").

- Treasury futures extended highs (TYU4 110-28.5) after $13B 20Y bond auction reopen (912810UB2) stopped 2.1bp through: 4.452% high yield vs. 4.473% WI; 2.74x bid-to-cover vs. prior month's 2.51x (lowest since February). Indirect take-up at 77.89% vs. 70.76% last month; direct bidder take-up 16.35% vs. 19.81% prior; primary dealer take-up at 5.77% vs. 10.06% prior.

- Projected rate cut pricing regaining momentum (but still off Friday highs). Post-Retail Sales vs. pre-data: July'24 steady at -8% w/ cumulative at -2bp at 5.307%, Sep'24 cumulative -18.1bp (-16.1bp), Nov'24 cumulative -27.8bp (-25.3bp), Dec'24 -48.3bp (-44.5bp).

OVERNIGHT DATA

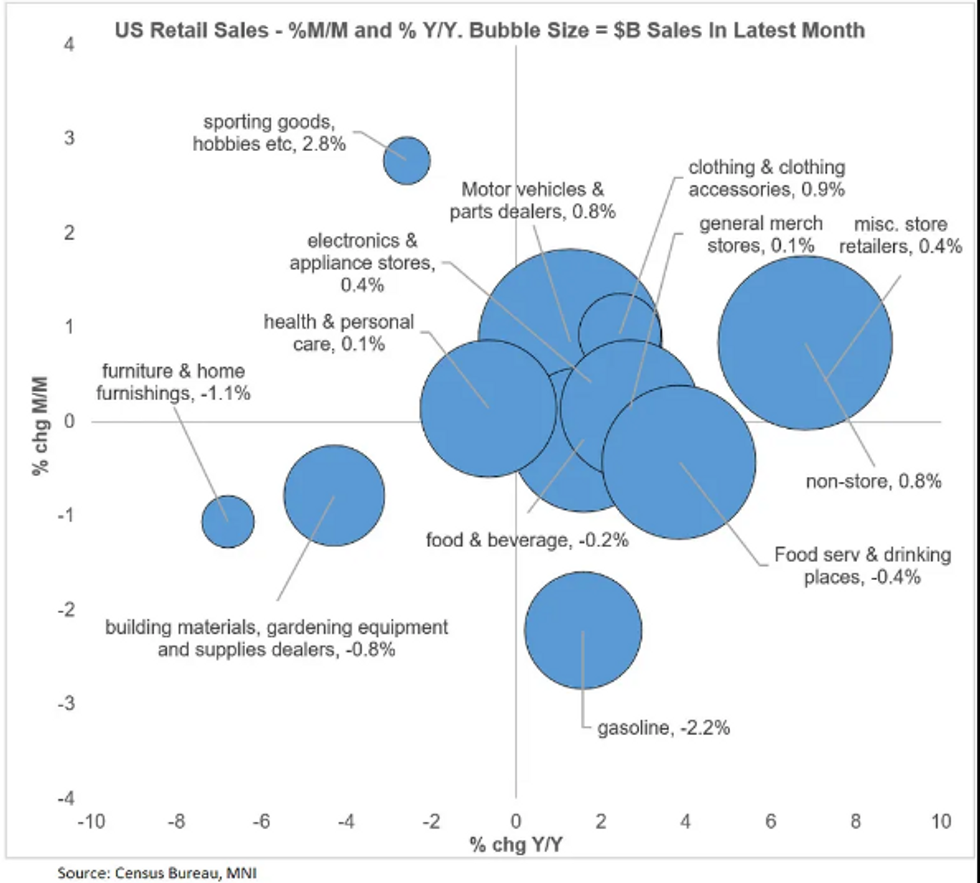

US DATA (MNI): Retail Sales Rebound More Softly Than Expected In May:

Retail sales bounced in May from a poor April, but by less than expected, exacerbated by downward revisions to data in the two prior months.

- Overall retail sales grew by just 0.1% M/M, vs 0.3% expected, with April's outturn revised down to -0.2% (vs 0.0% prelim) and March's to 0.5% (from 0.6%). Ex-Auto/Gas sales disappointed to an even greater degree, rising by just 0.1% M/M, vs 0.4% expected (and April's likewise was revised down 0.2pp, to -0.3%, with March's to 0.6% from 0.7%)).

- Most notably there was a miss for the key Control Group (GDP input) category at +0.4% (vs +0.5% expected), exacerbated by downward revisions to the prior two months (-0.3% to -0.5% for April, +1.0% to +0.9% for March).

- Growth across the biggest retail sales categories of motor vehicles, non-store retailers was around 0.8% apiece, with food services/drinking places (-0.4%), food and beverage (-0.2%), building material (-0.8%) and general merchandise (+0.1%) flat-to-negative.

- As the revisions imply, these figures are volatile and subject to reassessment in the months ahead, but control group retail sales in May remained a little under the March level, with ex-auto/gas struggling to move above December 2023 levels.

- Overall retail sales in May were up 2.3% Y/Y, with the control group up 3.1%, compared to overall CPI up 3.3%.

- The softer-than-expected control group reading could marginally downwardly impact the pre-release view for the Q2 GDP reading, but overall it's stabilizing on a 3M/3M annualized rate basis (1.9% vs 1.2% in Apr, 1.3% Mar) at a very low level.

US DATA (MNI): Nascent Pickup In Industrial Momentum:

Industrial production rose 0.9% M/M in May, well above the 0.3% expected and 0.0% (unrev) prior. Manufacturing production likewise rose 0.9% (-0.4% prior rev from -0.3%; March rev to -0.1% from +0.2%). Utilities jumped by 1.6% M/M (4.0% prior rev from 2.8%, though March was rev down sharply to -0.3% from the previous +1.6% estimate).

- Mining output rose 0.3% after two consecutive declines. Durable goods manufacturing rose 0.6%, while nondurables rose 1.1%.

- This was a solid report after a cumulatively flat several months (the level of industrial production is now back at an 8-month high). Indeed, beyond the month-to-month noise in areas such as utilities, industrial production is regaining momentum despite continued weakness in major surveys.

- The 1.8% 3M/3M annualized print in May was the highest since May 2023, with manufacturing's 2.3% rate the fastest since June 2022. Capacity utilization is now at its highest since November 2023.

- While IP contracted in Q1, as one of the quasi-official "recession indicators", the pickup in IP over the last couple of months confirms that there is little hard evidence of recession - industrial or otherwise - in the 2nd quarter.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 42.69 points (0.11%) at 38821.72

- S&P E-Mini Future up 10.5 points (0.19%) at 5557

- Nasdaq up 4 points (0%) at 17860.16

- US 10-Yr yield is down 6.6 bps at 4.2149%

- US Sep 10-Yr futures are up 11.5/32 at 110-24.5

- EURUSD up 0.0004 (0.04%) at 1.0738

- USDJPY up 0.09 (0.06%) at 157.83

- WTI Crude Oil (front-month) up $1.1 (1.37%) at $81.43

- Gold is up $11.11 (0.48%) at $2330.13

- European bourses closing levels:

- EuroStoxx 50 up 35.05 points (0.72%) at 4915.47

- FTSE 100 up 49.14 points (0.6%) at 8191.29

- German DAX up 63.76 points (0.35%) at 18131.97

- French CAC 40 up 57.23 points (0.76%) at 7628.8

US TREASURY FUTURES CLOSE

- 3M10Y -5.951, -117.175 (L: -118.14 / H: -108.119)

- 2Y10Y -0.612, -49.282 (L: -49.475 / H: -46.314)

- 2Y30Y +0.397, -35.811 (L: -36.933 / H: -31.912)

- 5Y30Y +1.297, 11.355 (L: 9.247 / H: 13.71)

- Current futures levels:

- Sep 2-Yr futures up 3/32 at 102-7.625 (L: 102-03 / H: 102-09)

- Sep 5-Yr futures up 8.25/32 at 106-31.75 (L: 106-19.75 / H: 107-02.25)

- Sep 10-Yr futures up 12/32 at 110-25 (L: 110-06.5 / H: 110-28.5)

- Sep 30-Yr futures up 27/32 at 120-13 (L: 119-09 / H: 120-17)

- Sep Ultra futures up 1-06/32 at 128-23 (L: 127-04 / H: 128-26)

US 10YR FUTURE TECHS: (U4) Bull Cycle Remains In Play

- RES 4: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-09 High Apr 1

- RES 1: 111-01 High Jun 14

- PRICE: 110-25 @ 1555 ET Jun 18

- SUP 1: 109-19+/109-00+ 50-day EMA / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-09+ Trendline drawn from the Apr low

- SUP 4: 107-31 Low May 29 and a key support

A bull cycle in Treasuries remains in play and the contract traded higher last week. Price has cleared resistance at 110-21, the Jun 7 high. The break confirms a resumption of the bull cycle that started Apr 25, and paves the way for an extension towards 111-17+, a Fibonacci projection. On the downside, key support to watch lies at 109-00+, the Jun 10 low. Clearance of this level is required to reinstate a bearish theme.

SOFR FUTURES CLOSE

- Jun 24 -0.003 at 94.643

- Sep 24 +0.010 at 94.850

- Dec 24 +0.035 at 95.175

- Mar 25 +0.055 at 95.485

- Red Pack (Jun 25-Mar 26) +0.065 to +0.075

- Green Pack (Jun 26-Mar 27) +0.065 to +0.070

- Blue Pack (Jun 27-Mar 28) +0.065 to +0.070

- Gold Pack (Jun 28-Mar 29) +0.060 to +0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00358 to 5.34225 (+0.01033/wk)

- 3M +0.00384 to 5.34741 (+0.00338/wk)

- 6M +0.01439 to 5.28331 (+0.00729/wk)

- 12M +0.03624 to 5.06444 (+0.01472/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.02), volume: $1.975T

- Broad General Collateral Rate (BGCR): 5.32% (+0.02), volume: $772B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.02), volume: $756B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $83B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $261B

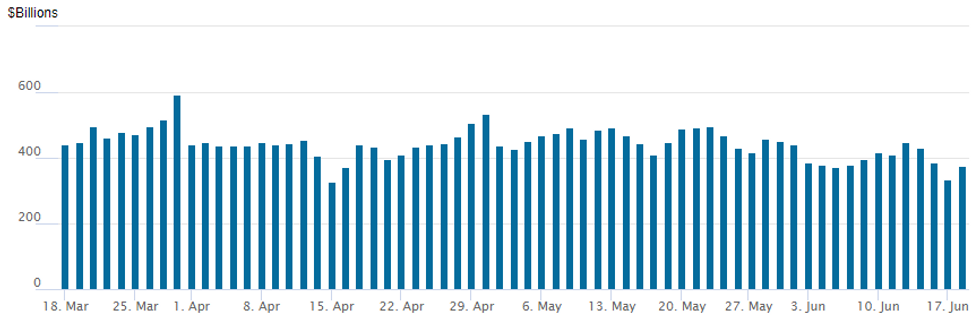

FED Reverse Repo Operation Rebound

NY Federal Reserve/MNI

- RRP usage bounces to $375.542B from Monday's near 3Y low of $333.429B; number of counterparties at 68. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $3.75B Hyundai 5Pt US$ Debt Launched

Well off Off Monday's $20.625B, Tuesday corporate bond issuance climbs to $11.8B:

- Date $MM Issuer (Priced *, Launch #)

- 6/18 $3.75B #Hyundai Capital $750M each: 2Y +78, 3Y +90, 3Y SOFR+104, 5Y +110, 7Y +120

- 6/18 $2B #Enel Finance $1.25B 5Y +115, $750M 10Y +150

- 6/18 $1.5B #Province of Alberta 5Y +51

- 6/18 $1.2B #Corebridge Global Funding $700M 2Y +67, $500M 5Y +100

- 6/18 $1B *KDB 3Y SOFR+56

- 6/18 $750M #Fairfax Financial $150M 10Y +140, $600M +30Y +177

- 6/18 $600M #Aviation Capital Group 5Y +130

- 6/18 $500M #American Homes 10Y +135

- 6/18 $500M #Allstate 5Y +85

EGBs-GILTS CASH CLOSE: Gilts Outperform Ahead Of UK CPI

European yields fell Tuesday, with Bunds partially unwinding Monday's weakness, and Gilts outperforming ahead of CPI data and the Bank of England decision.

- Modest weakness in early trade stemmed in part from a hawkish hold by the RBA overnight, but yields ultimately resolved lower, helped by a weaker-than-expected US retail sales report released in the European afternoon.

- Gilts easily outperformed Bunds on the day. The UK curve bull steepened through the 10Y segment, with 5Y outperforming after a solid auction today. Germany's curve bull flattened modestly.

- French 10Y spreads to Germany tightened for a 2nd day (-1.7bp) after last week's blow out. BTPs and GGBs outperformed in the EGB space once again, as periphery spreads narrowed for a 2nd consecutive session.

- While the BoE decision awaits Thursday, the main item on Wednesday's schedule is the UK inflation report - MNI's preview is here. MNI's Markets Team sees two-way risks to the services CPI print (median est 5.5% Y/Y), but with downside risks outweighing upside risks.

- Also of note, EU finance ministers are scheduled to meet Wednesday, with focus on the Excessive Deficit Procedure (and potential for France's inclusion therein).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at 2.803%, 5-Yr is down 0.9bps at 2.415%, 10-Yr is down 1.8bps at 2.396%, and 30-Yr is down 2.3bps at 2.548%.

- UK: The 2-Yr yield is down 6.8bps at 4.145%, 5-Yr is down 7.7bps at 3.917%, 10-Yr is down 6.7bps at 4.048%, and 30-Yr is down 7.4bps at 4.526%.

- Italian BTP spread down 3.4bps at 149.5bps / Greek down 3.6bps at 121.2bps

FOREX: Greenback Returns Lower Post US Retail Sales, CHF and AUD Outperform

- Despite trading with a bid tone early Tuesday, softer-than-expected US retail sales placed the greenback under pressure throughout US trading hours. While the USD index unwound the entirety of the Friday upswing, downside momentum waned amid prospects of a US holiday tomorrow.

- There are two clear standouts in G10, with both AUD and CHF notably outperforming on the session, both up around 0.65% against the dollar.

- For AUDUSD, the RBA statement overnight was a touch more hawkish, and this has likely underpinned the strength, which has been bolstered by a moderate risk-on tone across global markets. Price action narrows the gap to key resistance, defined at 0.6714, the May 16 high. Overall, the pair remains in a range with key support remaining at 0.6576, the Jun 10 and both price points representing key short-term directional triggers.

- CHF outperformance comes ahead of this Thursday's SNB rate decision, at which markets remain evenly split on expecting either a rate cut or hold - but today's further strength might provide more space for easier policy ahead. USDCHF is now 3.5% below the late-May highs following the hawkish remarks from SNB’s Jordan.

- EURJPY extended its strong recovery from the Friday lows, briefly trading within 9 pips of the 170.00 mark once more. Note that the cross did pierce a key support at 168.14, a key trendline drawn from the Dec 7 ‘23 low. The line remains intact, however, a clear breach of it would undermine a bullish theme and highlight a potential reversal.

- BOJ minutes will be published overnight before UK CPI takes the focus Wednesday. The Bank of Canada summary of deliberations will cross in what is expected to be a subdued Wednesday session, owing to the US Juneteenth holiday.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/06/2024 | 2301/0001 | * |  | UK | Brightmine pay deals for whole economy |

| 19/06/2024 | 2350/0850 | ** |  | JP | Trade |

| 19/06/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/06/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/06/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 19/06/2024 | 0800/1000 | ** |  | EU | Current Account |

| 19/06/2024 | 0900/1100 | ** |  | EU | Construction Production |

| 19/06/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/06/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 19/06/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 20/06/2024 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.