-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Tsys Off Cycle Lows Ahead Friday NFP

- MNI INTERVIEW: US Services Firm But Topping Out Into Q4 - ISM

- MNI INTERVIEW: BOC Could Hike Once Or Twice More, Dodge Says

- MNI: Central Banks Need 3 Years To Rebalance Inflation- IMF

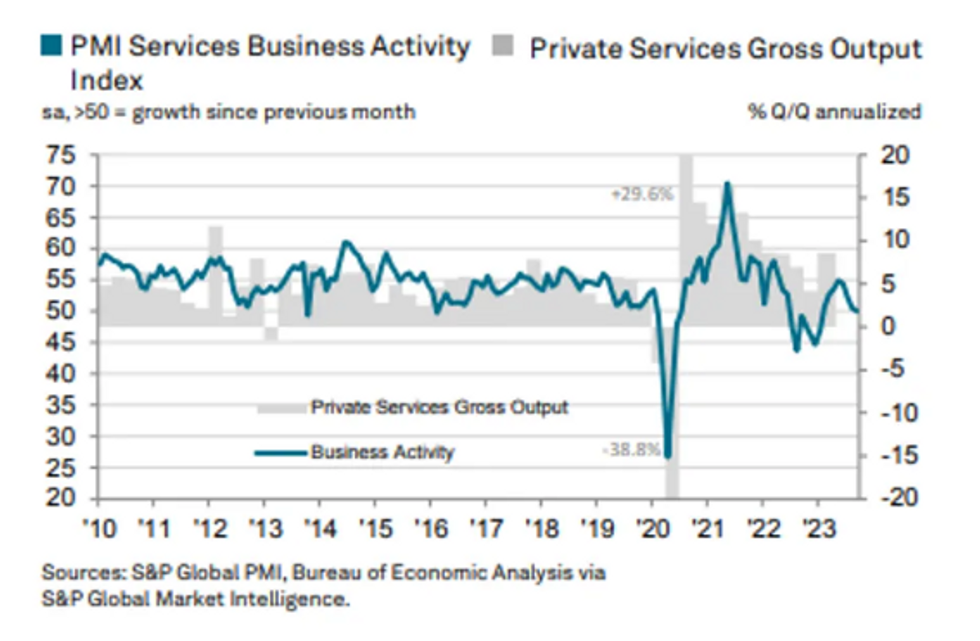

- MNI US DATA: Services PMI Shows Further Price Pressures

US

US DATA: The U.S. service sector is likely to see further growth in coming months as employment remains strong and consumer demand persists, though growth could top out at a lower level than previously envisioned, Institute for Supply Management Chair Anthony Nieves told MNI Wednesday.

- The ISM services index decreased 0.9pp to 53.6 in September, a smidge better than expectations and a ninth month above the 50-mark that separates growth from contraction. "I think we're going to stay right around here. We might pop up to 55 or 56 tops. I don't expect it to have a huge spike going in towards the end of the year," said Nieves, who in prior months had shown more confidence the PMI could rebound to the mid-50s for a sustainable period. The new orders sub-index fell 5.7pps to 51.8, the ninth consecutive month showing growth but the lowest this year. Nieves said the monthly decrease was driven mostly by technical factors and that some optimism would rebound in coming months. For more see MNI Policy main wire at 1312ET.

CANADA

BOC: The Bank of Canada and Federal Reserve could easily raise interest rates another quarter or half percentage point, former BOC Governor David Dodge told MNI, citing surprising job market strength and evidence of sticky wages and prices.

- “We’ve been consistently learning over the past year that it’s just not having as much impact, and so we probably need a bit higher number,” Dodge said about higher rates. “I wouldn’t be at all surprised if the Fed and our Bank were to have to raise rates by another quarter, or even another half. It’s highly debatable if you need that and they are debating that themselves.”

- Current BOC Governor Tiff Macklem boosted rates 10 times to the highest since 2001 at 5%, which is still below a benchmark closer to 6% when Dodge began his tenure in 2001, while the Fed has moved its policy rate to a range of 5.25%-5.5%.

- “It may well be that everything below four, four-and-a-half percent was actually accommodative and we just haven’t applied the amount of restriction that is needed to open up that gap where supply would exceed demand,” said Dodge, now an adviser at the Bennett Jones law firm.

EUROPE

EU: International Monetary Fund researchers said Wednesday that central banks likely need three years following recent inflation shocks to slow price gains back to target, calling the risk of embedded price expectations a "specter" hanging over policymakers. (See: MNI INTERVIEW: Higher Rates Finally Begin To Bite US Firms)

- The delay is linked to a large share of people with backward-looking price expectations and officials can boost the chances of a soft landing with improved communication that makes people more forward-looking. That's according to a paper by IMF economists Silvia Albrizio and John Bluedorn published as a chapter of the fund's World Economic Outlook.

- Inflation peaked across many economies in 2022 as a result of the Covid pandemic and the Ukraine invasion, and after lagging the inflation surge many central banks took on the most aggressive tightening campaign in decades. More recently officials at the Fed and ECB have started to focus on keeping rates high for long and downplayed the prospect of rate cuts, noting stubborn core inflation.

US TSYS: Markets Roundup: Lower ADP Kindles Hops For Softer Policy

- A risk-on tone held in late trade (stocks bouncing late) after markets latched onto this morning's lower than expected ADP private employment vs. ISM Services PMI that pointed to slower albeit strong growth.

- While there isn't a strong correlation, lower private jobs gain ahead Friday's NFP is a potential setup for softer policy expectations that have been weighing on rates and stocks the last four weeks.

- Initially following EGBs, Treasury futures continue to reject overnight cycle lows (TYZ3 106-03.5, 10Y yield 4.8799% high) then extended the rally after ADP Employment Change comes in much lower than expected +81k vs.150k est, +177k prior.

- Following mixed EU servicer PMI overnight, US services PMI was 50.1 (vs 50.2 flash; 50.5 prior), the composite print was 50.2 (vs 50.1 flash; 50.2 prior). "September data indicated a continued decline in new business at service sector firms"…"lower new orders were reportedly linked to weak domestic and foreign client demand".

- Dec'23 10Y futures topped 107-00 to 107-05 high in the first half, while yield slipped to 4.7246% low. Technical resistance focus on 107-14 (High Oct 3).

- Cross asset summary: Greenback softer (DXY -.195 at 106.805), Gold weaker (-3.98 at 1819.04), crude broadly weaker (WTI -4.67 at 84.56). Stocks back near midday highs with S&P E-Mini futures up 28.75 points (0.67%) at 4293.25, DJIA up 86.46 points (0.26%) at 33088.8, Nasdaq up 164 points (1.3%) at 13223.73.

- Thursday Data Calendar: Weekly Claims, Trade Balance, and various Fed speakers: Cleveland Fed Mester, MN Fed Kashkari, Richmond Fed Barkin, SF Fed Daly and Fed Vice Chair Barr.

OVERNIGHT DATA

ADP Employment Change comes in much lower than expected +81k vs.150k est, +177k prior.

US Sept. US services PMI was 50.1 (vs 50.2 flash; 50.5 prior). The composite print was 50.2 (vs 50.1 flash; 50.2 prior). Key notes from the release are:

- "September data indicated a continued decline in new business at service sector firms"…"lower new orders were reportedly linked to weak domestic and foreign client demand".

- "Alongside efforts to clear backlogs, firms noted that greater workforce numbers on the month were often due to the replacement of previous voluntary leavers".

- "Input costs rose at a further marked pace, with the rate of inflation similar to that seen in August"…"higher energy, fuel, wage and food costs drove the latest increase in business expenses".

- "In line with another substantial uptick in cost burdens, service providers hiked their selling prices in September".

- "Service sector businesses expressed positive expectations regarding the outlook for output over the coming year".

- US ISM SEP SERVICES COMPOSITE INDEX 53.6

- US ISM SEP SERVICES BUSINESS INDEX 58.8

- US ISM SEP SERVICES PRICES 58.9

- US ISM SEP SERVICES EMPLOYMENT INDEX 53.4

- US ISM SEP SERVICES NEW ORDERS 51.8

- US AUG FACTORY ORDERS +1.2%; EX-TRANSPORT NEW ORDERS +1.4%

- US AUG DURABLE ORDERS +0.1%

- US AUG NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.9%

- US MBA: MARKET COMPOSITE -6.0% SA THRU SEP 29 WK

- US MBA: APPLICATIONS LOWEST SINCE 1996, PURCH LOWEST SINCE '95

- US MBA: REFIS -7% SA; PURCH INDEX -6% SA THRU SEP 29 WK

- US MBA: UNADJ PURCHASE INDEX -22% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.53% VS 7.41% PREV

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 19.59 points (-0.06%) at 32983.25

- S&P E-Mini Future up 13 points (0.3%) at 4277.75

- Nasdaq up 111.6 points (0.9%) at 13170.88

- US 10-Yr yield is down 6.1 bps at 4.735%

- US Dec 10-Yr futures are up 14.5/32 at 107-3

- EURUSD up 0.0036 (0.34%) at 1.0503

- USDJPY up 0.07 (0.05%) at 149.09

- WTI Crude Oil (front-month) down $4.76 (-5.33%) at $84.49

- Gold is down $5.07 (-0.28%) at $1817.94

- European bourses closing levels:

- EuroStoxx 50 up 4.26 points (0.1%) at 4099.85

- FTSE 100 down 57.71 points (-0.77%) at 7412.45

- German DAX up 14.71 points (0.1%) at 15099.92

- French CAC 40 down 0.32 points (0%) at 6996.73

US TREASURY FUTURES CLOSE

- 3M10Y -5.439, -77.348 (L: -78.39 / H: -62.86)

- 2Y10Y +4.419, -31.473 (L: -37.554 / H: -29.979)

- 2Y30Y +5.853, -17.284 (L: -25.873 / H: -16.828)

- 5Y30Y +3.236, 15.435 (L: 9.27 / H: 15.654)

- Current futures levels:

- Dec 2-Yr futures up 6/32 at 101-10.875 (L: 101-02.875 / H: 101-11)

- Dec 5-Yr futures up 10.75/32 at 104-28.75 (L: 104-08.5 / H: 104-29.75)

- Dec 10-Yr futures up 14.5/32 at 107-3 (L: 106-03.5 / H: 107-05)

- Dec 30-Yr futures up 26/32 at 111-15 (L: 109-20 / H: 111-27)

- Dec Ultra futures up 1-05/32 at 115-14 (L: 112-29 / H: 115-26)

US 10Y FUTURE TECHS: (Z3) Bear Leg Extends

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-03+ High Sep19

- RES 2: 108-20+ 20-day EMA

- RES 1: 107-14 High Oct 3

- PRICE: 107-03 @ 1505 ET Oct 4

- SUP 1: 106-00 Round number support

- SUP 2: 105-27+ 3.0% Lower Bollinger Band

- SUP 3: 105-27 2.0% lower 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

A bear trend in Treasuries remains intact and the contract has traded to a fresh cycle low today. The extension confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Support at 107-07, the Sep 28 low, has been cleared this week signalling scope for the 106-00 handle next. Initial firm resistance is seen at 108-20+, the 20-day EMA. Short-term gains are considered corrective.

SOFR FUTURES CLOSE

- Dec 23 +0.045 at 94.555

- Mar 24 +0.090 at 94.670

- Jun 24 +0.110 at 94.865

- Sep 24 +0.115 at 95.115

- Red Pack (Dec 24-Sep 25) +0.080 to +0.120

- Green Pack (Dec 25-Sep 26) +0.055 to +0.070

- Blue Pack (Dec 26-Sep 27) +0.055 to +0.055

- Gold Pack (Dec 27-Sep 28) +0.050 to +0.050

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00289 to 5.33040 (+0.01141/wk)

- 3M +0.00811 to 5.42240 (+0.02690/wk)

- 6M +0.00759 to 5.49332 (+0.02605/wk)

- 12M +0.00599 to 5.48366 (+0.01740/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $245B

- Secured Overnight Financing Rate (SOFR): 5.33%, $1.498T

- Broad General Collateral Rate (BGCR): 5.30%, $539B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $533B

- (rate, volume levels reflect prior session)

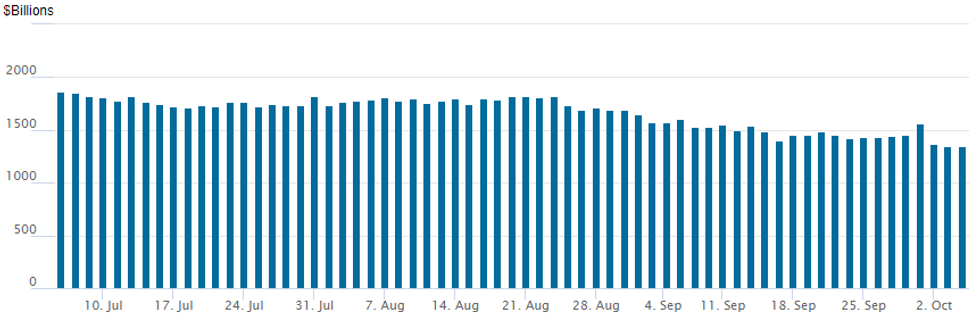

US FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation usage slips to $1,342.031B - lowest since early November 2021 w/96 counterparties vs. $1,348.465B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.25B Kommuninvest +2Y SOFR Priced; Dominion, Darden Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/04 $1.25B *Kommuninvest +2Y SOFR+31

- 10/04 $500M #Dominion Energy South Carolina WNG 30Y +140

- 10/04 $500M #Darden WNG 10Y +165

- Expected to Price Thursday

- 10/05 $Benchmark MuniFin +3Y SOFR+40a

EGBs Bund Retracement From 3.00% Extends Further

Bunds continue to grind away from session lows, with the benchmark futures contract +15, a little shy of recent session highs.

- Recent flow has seen a 6.6K block in bund futures, price action points to a buy, although it’s harder to be sure when looking at quoted levels at the time that the trade was registered.

- German cash benchmarks sit 1.0-6.5bp richer on the day as the curve bull flattens, with bears failing to solidify this morning’s brief and limited showing above 3.00% in 10-Year yields.

- Softer than expected eurozone retail sales data wouldn’t have harmed the bid, while positive revisions to final Eurozone services & composite PMIs did little to hinder the rally.

- German 2s10s tick away from the multi-month highs registered this morning, while 5s30s move off YtD steeps registered early today.

- EGBs run a touch wider vs. Bunds on the day, although the move is contained.

- BTPs were not sensitive to a RTRS sources piece noting that “Italy risks collecting minimal proceeds from a windfall tax on banks after it gave lenders the option to set aside money instead of paying the levy.”

- 10-Year PGBs are incrementally wider on the day after a couple of sessions of compression (with the latter related to a sovereign rating upgrade and reduced issuance requirements for the remainder of ’23).

FOREX USD Rally Falters as Yields Roll Off Highs

- Early gains for the USD accompanied another surge higher for longer-end US yields, as the 10y and 30y yields crested at new cycle highs, steepening the curve in the process. The 30y yields managed to show north of 5% for the first time this cycle, a move that initially helped pressure the likes of EUR/USD and GBP/USD into the NY crossover.

- Nonetheless, the momentum soon faded, allowing beleaguered USD pairs to recover some of this week's sharp losses. As a result, the USD was mixed through the European close, allowing GBP, EUR and CHF to trade among the best performers in developed markets. Nonetheless, the medium-term USD uptrend drawn off the July low remains intact, meaning this price action could be consolidative, rather than the beginning of any major reversal for the greenback.

- Lastly, a pullback in oil prices worked against oil-tied currencies to leave the NOK and CAD among the poorest performers in G10. Oil prices slipped sharply to partially reverse the solid gains posted across August and September, as demand concerns peaked amid Saudi Arabia and Russia's plans to continue their policy of reduced output. The OPEC JMMC meeting came and went with little consequence.

- Focus Thursday remains on the US labour market, as the Challenger job cuts and weekly jobless claims data provide the last look at jobs sentiment ahead of Friday's Nonfarm Payrolls. Markets look for the US to have added around 170k jobs over the month of September, with the UAW strike and the conclusion of the actors strike seen having minimal impact.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/10/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 05/10/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/10/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/10/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/10/2023 | 0830/0930 |  | UK | BOE DMP Survey | |

| 05/10/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/10/2023 | 0945/1145 |  | EU | ECB's Lane, BOE Broadbent and Riksbank Breman at ECB MP Conference | |

| 05/10/2023 | 0945/1045 |  | UK | BoE's Broadbent speaks at ECB conference | |

| 05/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 05/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 05/10/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/10/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2023 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 05/10/2023 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/10/2023 | 1400/1600 |  | EU | ECB's de Guindos speaks at ECB MP Conference | |

| 05/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 05/10/2023 | 1440/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/10/2023 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 05/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 05/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 05/10/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2023 | 1615/1215 |  | US | Fed Vice Chair Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.