-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI European Closing FI Analysis: Bear Steepening To End The Week

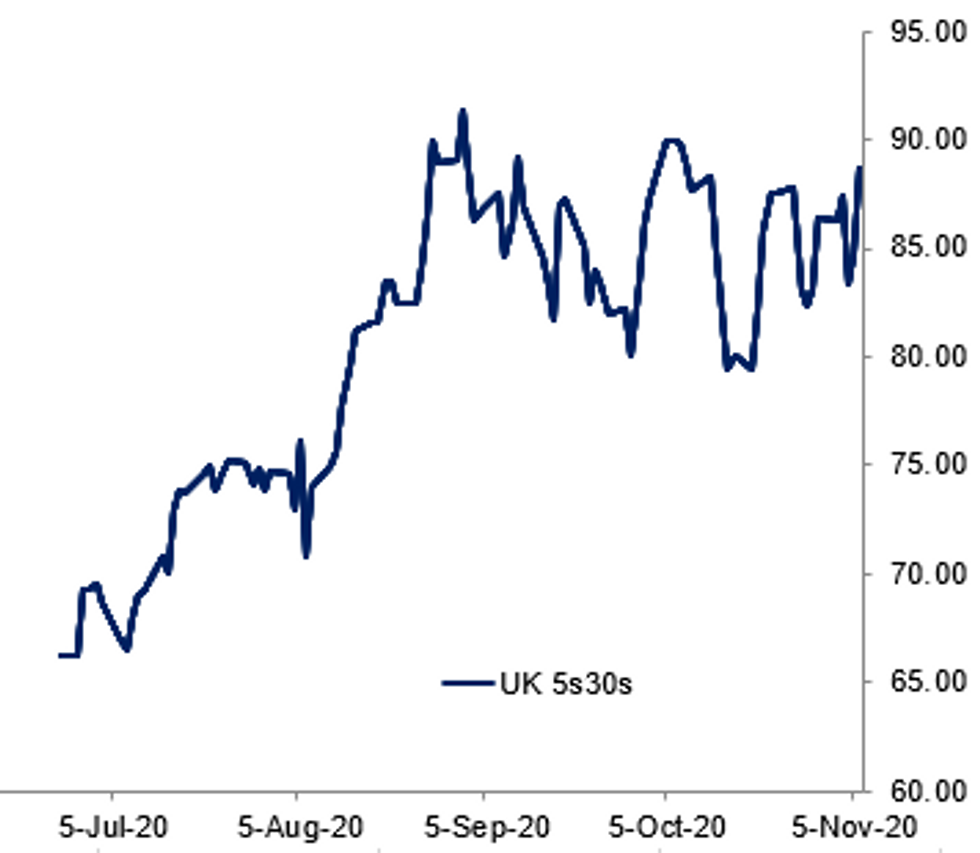

Fig. 1: Gilt Curve Bear Steepens

BBG, MNI

BBG, MNI

EGB SUMMARY: Lower on stronger US data and election polling numbers

EGBs have taken their leads from the US treasuries this afternoon, and pushed lower US treasuries and Germany continued to bear steepen, with the long end underperforming

- The Move was US led, post the strong NFP beat.

- Then some continuation from the latest US election polling, pushing Biden ahead in PA and the final Wholesale Inventories beat, have all helped to keep Govies heavy.

- Germany 5/30s test high of the session

- Peripheral are tighter on the day, after Italy 10 yr yields tested record low earlier today.

- Greece leads at 4.8bps tighter.

- Regarding US election nothing validated or official despite the noise in the street

- Dec Bund futures (RX) down 42 ticks at 175.91 (L: 175.86 / H: 176.49)

- Germany: The 2-Yr yield is up 1bps at -0.774%, 5-Yr is up 2bps at -0.792%, 10-Yr is up 2.8bps at -0.609%, and 30-Yr is up 3.4bps at -0.193%.

- Dec BTP futures (IK) up 12 ticks at 150.66 (L: 150.51 / H: 150.95)Italy / German 10-Yr spread 4bps tighter at 126.5bpsDec OAT futures (OA) down 28 ticks at 170.13 (L: 170.08 / H: 170.6)

GILT SUMMARY: Sharp Bear Steepening

Gilts started off the session on a relatively quiet note, before selling off sharply from late morning.

- The curve has bear steepened with the long-end under performing the EGB space. While yesterday's announcement from the BoE on expanding QE is positive for gilts, a potential slowdown in the pace of purchases coupled with the furlough scheme extension unveiled by Rishi Sunak, are offsetting dynamics

- Cash yields are now 2-8bp higher on the day with the 2s30s spread 4bp wider. Last yields: 2-year -0.0356%, 5-year -0.0321%, 10-year 0.2756%, 30-year 0.86%.

- The Dec-20 gilt future trades at 135.50, towards the bottom end of the day's range (L: 135.38 / H: 136.24)

- The short sterling futures strip has steepened with greens/blues down 1.0-3.5 ticks.

- Looking ahead, there is a packed data calendar next week. Jobless claims data for October and earnings/employment data for September will be published on Tuesday, preliminary Q3 GDP is out on Thursday alongside the September prints for industrial production, construction output, the index of services and international trade data.

DEBT FUTURES/OPTIONS:

- LH1 99.87c sold at 12.25 in 3k

- LM1 100.12/100.25cs vs 100.00p, sold the put at 3.5 in 4k (ref 100.02, -60 del)

- RXF1 173/174/178.5/179.5 iron condor, sold at 50 in 1k

- RXZ0 174/174.50/175/175.5 c condor, sold at 7 in 1k

- RXF1 181 c, sold at 21 and 21.5 in 2.5k

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.