-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Bunds And Gilts Extend Losses

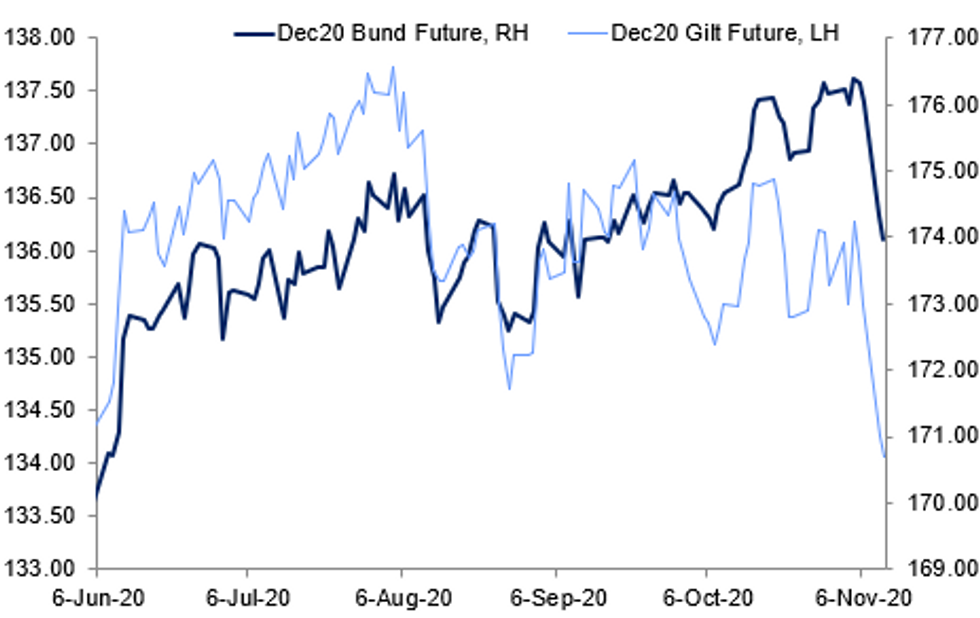

Fig.1: Core FI Down Again

BBG, MNI

BBG, MNI

EGB SUMMARY: Bunds continue their descent as spreads tighten further

Bunds remain lower beta than both Treasuries and gilts but were the first of the three core bond markets to fall below yesterday's lows today. The move has accelerated slightly on the news that the EU parliament had finally signed off on the stimulus deal that EU leaders announced back in July. In a generally risk-on day (as markets continue to digest yesterday's Pfizer vaccine success news), peripheral spreads have also tightened.

- The focus for Bunds now turns to the Oct 7 low of 173.93.

- Bund futures are down -0.38 today at 173.98 with 10y Bund yields up 2.7bp at -0.484% and Schatz yields up 1.6bp at -0.719%.

- BTP futures are down -0.12 today at 149.34 with 10y yields up 0.7bp at 0.763% and 2y yields down -0.8bp at -0.374%.

- OAT futures are down -0.23 today at 168.53 with 10y yields up 1.7bp at -0.239% and 2y yields up 0.1bp at -0.672%.

GILT SUMMARY: Extending Yesterday's Losses

Gilts have traded weaker today and have extended yesterday's sell-off.

- Cash yields are 1-2bp higher on the day with the curve 1bp steeper. Last yields: 2-year -0.0053%, 5-year 0.0402%, 10-year 0.3967%, 30-year 0.9804%.

- The Dec-20 gilt future trades at 134.08, towards the bottom end of the day's range (L: 133.93 / H: 134.48).

- Tomorrow the DMO will offer GBP800mn of the 0.125% Nov-36 linker.

- The DMO indicated that the 0.125% Aug-28 linker auction will delayed from Nov 25 to Dec 2 so that the sale will not clash with the Chancellor of the Exchequer's 2020 Spending Review.

- Labour market data published earlier this morning showed a worse than expected employment change estimate for Setember (-164k 3m/3m vs -150k survey), while the unemployment rate increased in line with consensus to 4.8% from 4.5% the previous month.

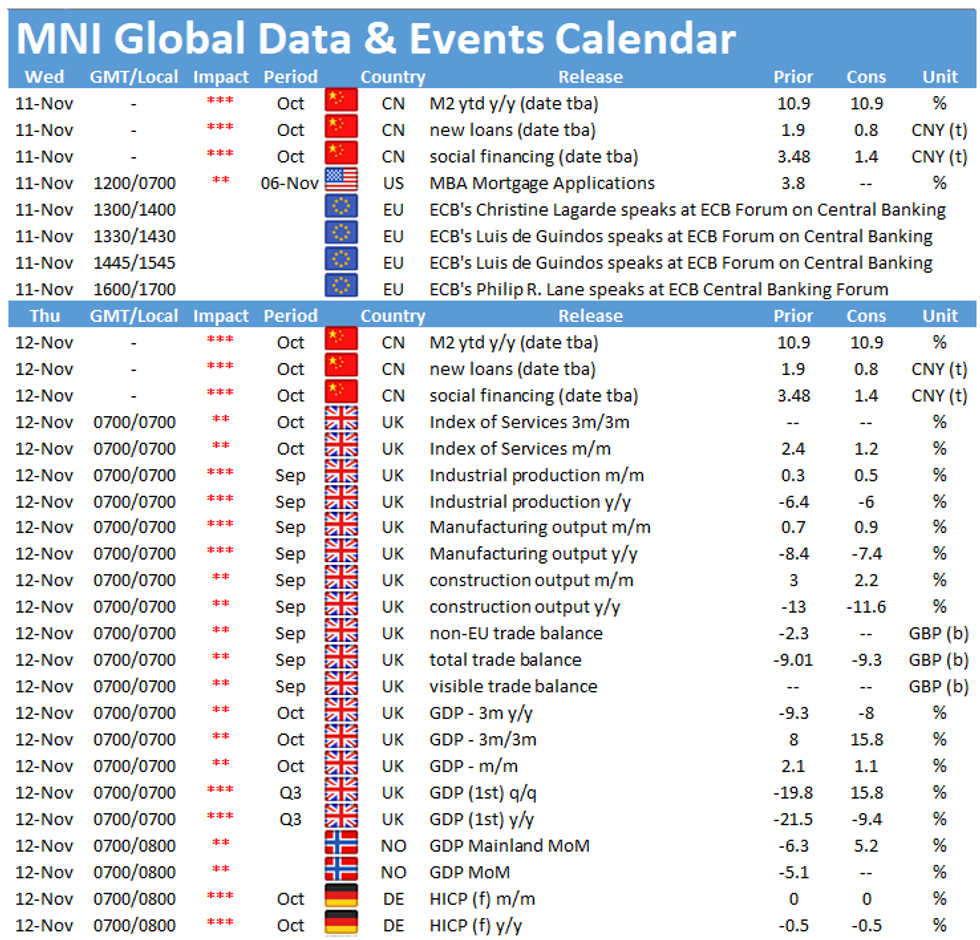

- Looking ahead, preliminary third quarter GDP data will be published on Thursday alongside September estimates for industrial production, construction output, the index of services and international trade.

DEBT FUTURES/OPTIONS:

- IKZ0 146/148cs 1x2, sold between 13 and 20 in 1.7k

- IKZ0 149p, sold at 50 in 1.5k

- DUG1 112.30/20ps 1X2, bought for flat in 5k

- DUZ0 112.40/30/20p fly, sold at 4 in 2k

- DUZ0 112.30/20/10p fly, sold at 2.5 in 1k

- RXZ0 175.50/175.00/174.50/174.00 p condor, sold atr 16 in 1k

- ERZ1 100.25/100.00ps, bought for 1 in 20k

- LH1 100.00c, sold at 3 in 6.5k

- 0LH1 100./100.125cs, bought for 2 in 2.5k

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.